Today we’re taking a dive into the world of hospital and health system financials, specifically looking at total revenue and patient revenue. I’ve painstakingly sifted through hundreds of audits and quarterly reports to comprise this information as of the most recently available full calendar year – so all of these financials, save for a few health systems who don’t report partial year periods, are current as of Calendar Year ended December 31, 2024.

Let’s dive into the top health systems by total revenue and patient revenue

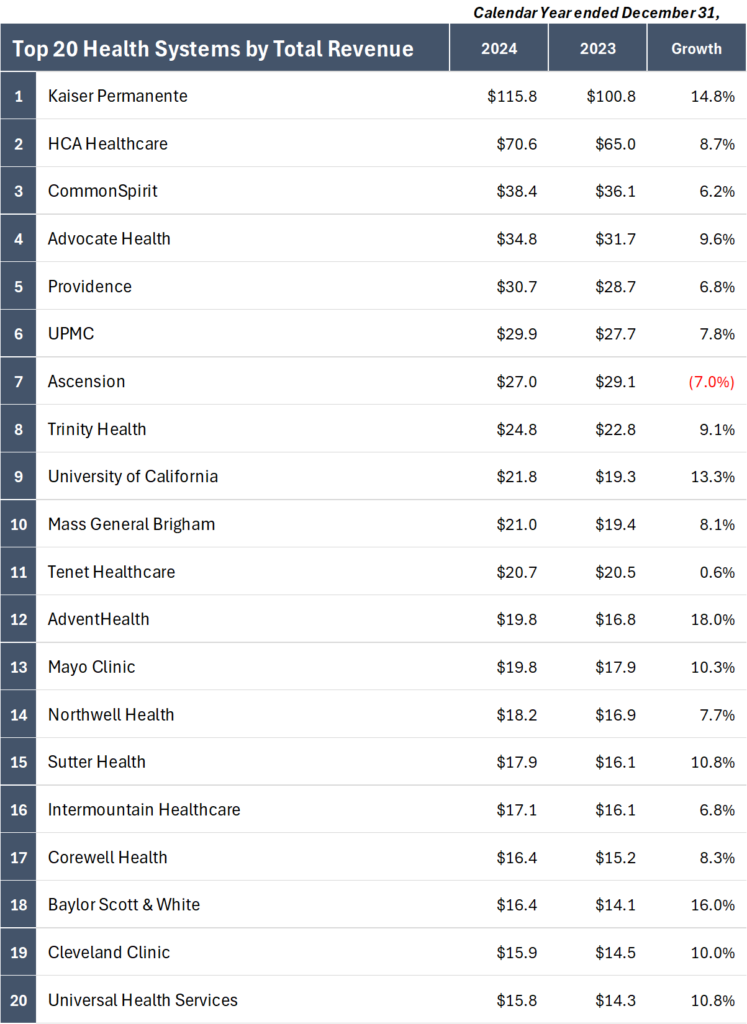

Top 20 Health Systems by 2024 Total Revenue

Of course given its status as an integrated health plan, Kaiser takes the total revenue crown. But if you’re looking at mostly patient services revenue (the next table), HCA reigns supreme by a wide margin over its nonprofit and for-profit counterparts.

Top 20 Health Systems by 2024 Total Revenue

- Kaiser Permanente: $115.8 billion — 14.8%

- HCA Healthcare: $70.6 billion — 8.7%

- CommonSpirit: $38.4 billion — 6.2%

- Advocate Health: $34.8 billion — 9.6%

- Providence: $30.7 billion — 6.8%

- UPMC: $29.9 billion — 7.8%

- Ascension: $27.0 billion — –7.0%

- Trinity Health: $24.8 billion — 9.1%

- University of California: $21.8 billion — 13.3%

- Mass General Brigham: $21.0 billion — 8.1%

- Tenet Healthcare: $20.7 billion — 0.6%

- AdventHealth: $19.8 billion — 18.0%

- Mayo Clinic: $19.8 billion — 10.3%

- Northwell Health: $18.6 billion — 10.3%

- Sutter Health: $18.2 billion — 12.9%

- Intermountain Healthcare: $17.1 billion — 6.8%

- Corewell Health: $16.4 billion — 8.3%

- Baylor Scott & White: $16.4 billion — 16.0%

- Cleveland Clinic: $15.9 billion — 10.0%

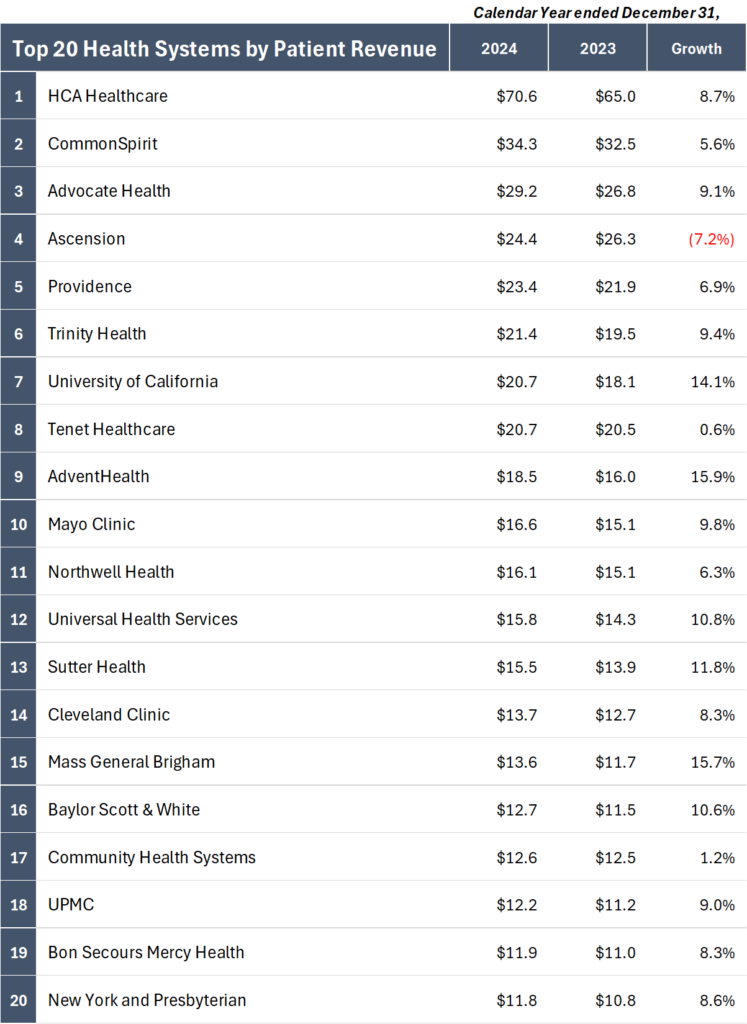

Top 20 Health Systems by 2024 Patient Revenue

You can see all of the typical names here on the patient revenue side (excluding Kaiser, which hasn’t completed its audit, nor do I think they break out the patient revenue generated on the provider side of the business). Advocate has secured its spot in the top 3 given its recent merger with Atrium and the second year of combined financials. Ascension slid into 4th given its asset sales, and so on.

Top 20 Health Systems by 2024 Patient Revenue

- HCA Healthcare: $70.6 billion — 8.7%

- CommonSpirit: $34.3 billion — 5.6%

- Advocate Health: $29.2 billion — 9.1%

- Providence: $23.4 billion — 6.9%

- UPMC: $12.2 billion — 9.0%

- Ascension: $24.4 billion — –7.2%

- Trinity Health: $21.4 billion — 9.4%

- University of California: $20.7 billion — 14.1%

- Mass General Brigham: $13.6 billion — 15.7%

- Tenet Healthcare: $20.7 billion — 0.6%

- AdventHealth: $18.5 billion — 15.9%

- Mayo Clinic: $16.6 billion — 9.8%

- Northwell Health: $16.5 billion — 9.1%

- Sutter Health: $15.8 billion — 14.0%

- Intermountain Healthcare: $10.1 billion — 6.6%

- Corewell Health: $9.1 billion — 10.5%

- Baylor Scott & White: $12.7 billion — 10.6%

- Cleveland Clinic: $13.7 billion — 8.3%

- Universal Health Services: $15.8 billion — 10.8%

- Banner Health: $10.4 billion — 8.2%

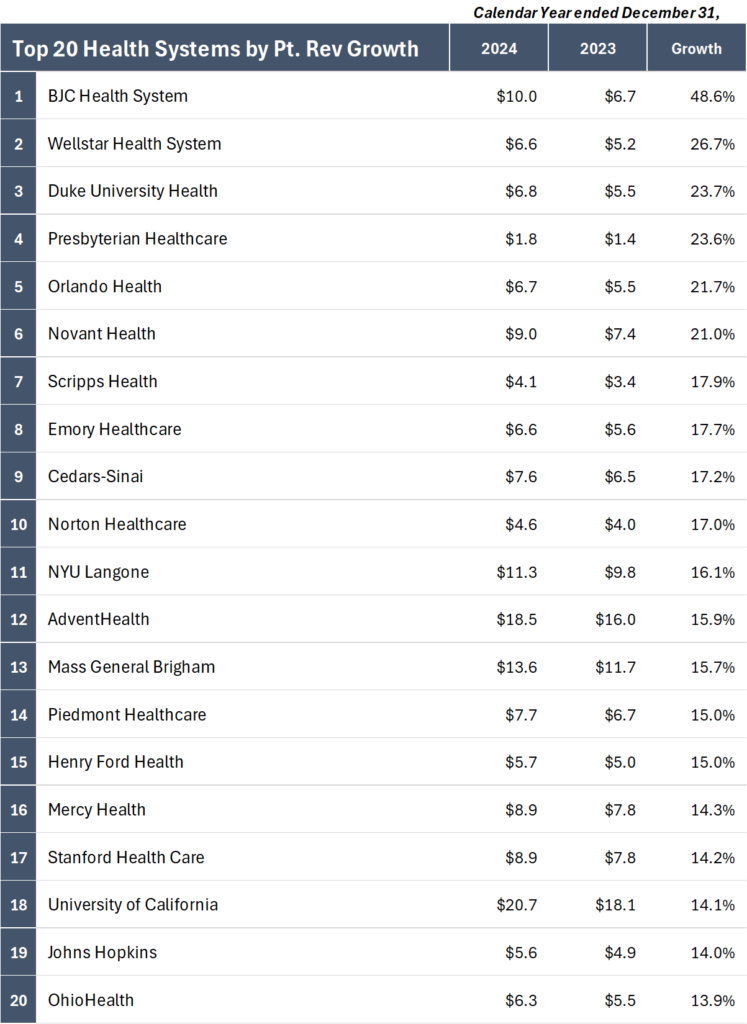

Top 20 Health Systems by Patient Revenue Growth

Several names on the list saw spikes or drops in revenues from divestitures or portfolio add-ons. Novant Health comes to mind here in tacking on several Tenet hospitals. BJC just merged with Saint Luke’s. Wellstar merged with August University Health System. On the other side of the growth equation, Tenet and Ascension come to mind as notable players who either saw no revenue growth, or declines in patient revenue growth stemming from hospital divestitures for portfolio realignment purposes. Health systems like Henry Ford and Prime Healthcare picked up a material amount of Ascension’s book of business. I covered Ascension’s whole 2024 portfolio realignment here.

Top 20 Health Systems by 2024 Patient Revenue Growth

- BJC Health System: 48.6%

- Henry Ford Health: 31.5%

- Wellstar Health System: 26.7%

- Duke University Health: 23.7%

- Presbyterian Healthcare: 23.6%

- Orlando Health: 21.7%

- Novant Health: 21.0%

- Scripps Health: 17.9%

- Emory Healthcare: 17.7%

- Cedars-Sinai: 17.2%

- NYU Langone: 16.1%

- AdventHealth: 15.9%

- Mass General Brigham: 15.7%

- Piedmont Healthcare: 15.0%

- Mercy Health: 14.3%

- Stanford Health Care: 14.2%

- Sutter Health: 14.0%

- Johns Hopkins: 14.0%

- UCHealth (Colorado): 13.9%

- OhioHealth: 13.9%

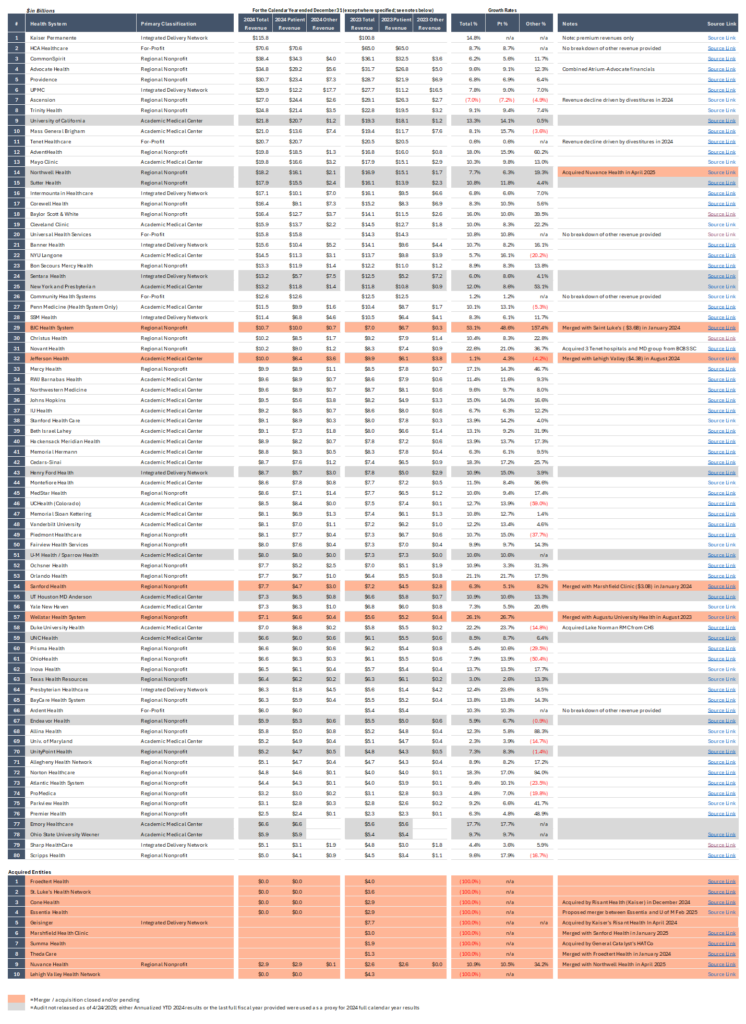

The Top 80 Health Systems by Total Revenue and Revenue Growth as of calendar year ended December 31, 2024

Top 80 Health Systems by 2024 Total Revenue; 2024 year over year total revenue growth

- Kaiser Permanente: $115.8 billion — 14.8%

- HCA Healthcare: $70.6 billion — 8.7%

- CommonSpirit: $38.4 billion — 6.2%

- Advocate Health: $34.8 billion — 9.6%

- Providence: $30.7 billion — 6.8%

- UPMC: $29.9 billion — 7.8%

- Ascension: $27.0 billion — –7.0%

- Trinity Health: $24.8 billion — 9.1%

- University of California: $21.8 billion — 13.3%

- Mass General Brigham: $21.0 billion — 8.1%

- Tenet Healthcare: $20.7 billion — 0.6%

- AdventHealth: $19.8 billion — 18.0%

- Mayo Clinic: $19.8 billion — 10.3%

- Northwell Health: $18.6 billion — 10.3%

- Sutter Health: $18.2 billion — 12.9%

- Intermountain Healthcare: $17.1 billion — 6.8%

- Corewell Health: $16.4 billion — 8.3%

- Baylor Scott & White: $16.4 billion — 16.0%

- Cleveland Clinic: $15.9 billion — 10.0%

- Universal Health Services: $15.8 billion — 10.8%

- Banner Health: $15.6 billion — 10.7%

- NYU Langone: $14.5 billion — 5.7%

- Bon Secours Mercy Health: $13.3 billion — 8.9%

- Sentara Health: $13.2 billion — 6.0%

- New York & Presbyterian: $13.2 billion — 12.0%

- Community Health Systems: $12.6 billion — 1.2%

- Penn Medicine: $11.5 billion — 10.1%

- SSM Health: $11.4 billion — 8.3%

- BJC Health System: $10.7 billion — 53.1%

- Christus Health: $10.2 billion — 10.4%

- Novant Health: $10.2 billion — 22.6%

- Jefferson Health: $10.0 billion — 1.1%

- Mercy Health: $9.9 billion — 17.1%

- RWJ Barnabas Health: $9.6 billion — 11.4%

- Northwestern Medicine: $9.6 billion — 9.6%

- Johns Hopkins: $9.5 billion — 15.0%

- IU Health: $9.2 billion — 6.7%

- Stanford Health Care: $9.1 billion — 13.9%

- Beth Israel Lahey: $9.1 billion — 13.1%

- Hackensack Meridian Health: $8.9 billion — 13.9%

- Memorial Hermann: $8.8 billion — 6.3%

- Cedars-Sinai: $8.7 billion — 18.3%

- Henry Ford Health: $9.6 billion — 22.6%

- Montefiore Health: $8.6 billion — 11.5%

- MedStar Health: $8.6 billion — 10.6%

- UCHealth (Colorado): $8.5 billion — 12.7%

- Memorial Sloan Kettering: $8.1 billion — 10.8%

- Vanderbilt University: $8.1 billion — 12.2%

- Piedmont Healthcare: $8.1 billion — 10.7%

- Fairview Health Services: $8.0 billion — 9.9%

- U-M Health / Sparrow Health: $8.0 billion — 10.6%

- Ochsner Health: $7.7 billion — 10.9%

- Orlando Health: $7.7 billion — 21.1%

- Sanford Health: $7.7 billion — 6.3%

- UT Houston MD Anderson: $7.3 billion — 10.9%

- Yale New Haven: $7.3 billion — 7.3%

- Wellstar Health System: $7.1 billion — 26.1%

- Duke University Health: $7.0 billion — 22.2%

- UNC Health: $6.6 billion — 8.5%

- Prisma Health: $6.6 billion — 5.4%

- OhioHealth: $6.6 billion — 7.9%

- Inova Health: $6.5 billion — 13.7%

- Texas Health Resources: $6.6 billion — 6.2%

- Presbyterian Healthcare: $6.3 billion — 12.4%

- BayCare Health System: $6.3 billion — 13.8%

- Ardent Health: $6.0 billion — 10.3%

- Endeavor Health: $5.9 billion — 6.2%

- Allina Health: $5.8 billion — 12.3%

- University of Maryland: $5.2 billion — 2.3%

- UnityPoint Health: $5.3 billion — 10.0%

- Allegheny Health Network: $5.1 billion — 8.9%

- Norton Healthcare: $4.8 billion — 18.3%

- Atlantic Health System: $4.4 billion — 9.4%

- ProMedica: $3.2 billion — 4.8%

- Parkview Health: $3.1 billion — 9.2%

- Premier Health: $2.5 billion — 6.3%

- Emory Healthcare: $6.6 billion — 17.7%

- Ohio State University Wexner: $5.9 billion — 9.7%

- Sharp HealthCare: $5.1 billion — 4.4%

- Scripps Health: $5.0 billion — 9.6%

The Top 80 Health Systems by Patient Revenue and Patient Revenue Growth as of calendar year ended December 31, 2024

Top 80 Health Systems by 2024 Patient Revenue; 2024 year over year Patient revenue growth

- HCA Healthcare: $70.6 billion — 8.7%

- CommonSpirit: $34.3 billion — 5.6%

- Advocate Health: $29.2 billion — 9.1%

- Providence: $23.4 billion — 6.9%

- UPMC: $12.2 billion — 9.0%

- Ascension: $24.4 billion — –7.2%

- Trinity Health: $21.4 billion — 9.4%

- University of California: $20.7 billion — 14.1%

- Mass General Brigham: $13.6 billion — 15.7%

- Tenet Healthcare: $20.7 billion — 0.6%

- AdventHealth: $18.5 billion — 15.9%

- Mayo Clinic: $16.6 billion — 9.8%

- Northwell Health: $16.5 billion — 9.1%

- Sutter Health: $15.8 billion — 14.0%

- Intermountain Healthcare: $10.1 billion — 6.6%

- Corewell Health: $9.1 billion — 10.5%

- Baylor Scott & White: $12.7 billion — 10.6%

- Cleveland Clinic: $13.7 billion — 8.3%

- Universal Health Services: $15.8 billion — 10.8%

- Banner Health: $10.4 billion — 8.2%

- NYU Langone: $11.3 billion — 16.1%

- Bon Secours Mercy Health: $11.9 billion — 8.3%

- Sentara Health: $5.7 billion — 8.6%

- New York & Presbyterian: $11.8 billion — 8.6%

- Community Health Systems: $12.6 billion — 1.2%

- Penn Medicine: $9.9 billion — 13.1%

- SSM Health: $6.8 billion — 6.1%

- BJC Health System: $10.0 billion — 48.6%

- Christus Health: $8.5 billion — 8.3%

- Novant Health: $9.0 billion — 21.0%

- Jefferson Health: $6.4 billion — 4.3%

- Mercy Health: $8.9 billion — 14.3%

- RWJ Barnabas Health: $8.9 billion — 11.6%

- Northwestern Medicine: $8.9 billion — 9.7%

- Johns Hopkins: $5.6 billion — 14.0%

- IU Health: $8.5 billion — 6.3%

- Stanford Health Care: $8.9 billion — 14.2%

- Beth Israel Lahey: $7.3 billion — 9.2%

- Hackensack Meridian Health: $8.2 billion — 13.7%

- Memorial Hermann: $8.3 billion — 6.1%

- Cedars-Sinai: $7.6 billion — 17.2%

- Henry Ford Health: $6.5 billion — 31.5%

- Montefiore Health: $7.8 billion — 8.4%

- MedStar Health: $7.1 billion — 9.4%

- UCHealth (Colorado): $8.4 billion — 13.9%

- Memorial Sloan Kettering: $6.9 billion — 12.7%

- Vanderbilt University: $7.0 billion — 13.4%

- Piedmont Healthcare: $7.7 billion — 15.0%

- Fairview Health Services: $7.6 billion — 9.7%

- U-M Health / Sparrow Health: $8.0 billion — 10.6%

- Ochsner Health: $5.2 billion — 3.3%

- Orlando Health: $6.7 billion — 21.7%

- Sanford Health: $4.7 billion — 5.1%

- UT Houston MD Anderson: $6.5 billion — 10.6%

- Yale New Haven: $6.3 billion — 5.5%

- Wellstar Health System: $6.6 billion — 26.7%

- Duke University Health: $6.8 billion — 23.7%

- UNC Health: $6.0 billion — 8.7%

- Prisma Health: $6.0 billion — 10.6%

- OhioHealth: $6.3 billion — 13.9%

- Inova Health: $6.1 billion — 13.5%

- Texas Health Resources: $6.4 billion — 5.7%

- Presbyterian Healthcare: $1.8 billion — 23.6%

- BayCare Health System: $5.9 billion — 13.8%

- Ardent Health: $6.0 billion — 10.3%

- Endeavor Health: $5.4 billion — 8.5%

- Allina Health: $5.0 billion — 5.8%

- University of Maryland: $4.9 billion — 3.9%

- UnityPoint Health: $4.8 billion — 10.6%

- Allegheny Health Network: $4.7 billion — 8.2%

- Norton Healthcare: $4.6 billion — 17.0%

- Atlantic Health System: $4.3 billion — 10.1%

- ProMedica: $3.0 billion — 7.0%

- Parkview Health: $2.8 billion — 6.6%

- Premier Health: $2.4 billion — 4.8%

- Emory Healthcare: $6.6 billion — 17.7%

- Ohio State University Wexner: $5.9 billion — 9.7%

- Sharp HealthCare: $3.1 billion — 3.6%

- Scripps Health: $4.1 billion — 17.9%

The Full List

Here’s the full list of 80 or so health system names updated through calendar year 2024. The names highlighted in orange either just announced a significant merger, or closed on in recent years. For instance, Northwell-Nuvance, BJC-Saint Luke’s, Sanford-Marshfield, and Kaiser/Risant-Cone-Geisinger as a few examples.

An Excel file with links to source data has been made available to Hospitalogy plus and pro subscribers as of today!

Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.