Last week I talked about the dynamics facing hospitals and how the current model and way of thinking is unsustainable.

This week, I’m diving into what changes will likely need to happen in order for health systems to find a sustainable future!

If you’re new here, welcome! Hospitalogy hits your inbox every Tuesday (news roundup) and Thursday (deep dive).

Let’s dive in!

Join 9,800+ thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Key Takeaways

Here’s my thinking: As mentioned in Part 1, the hospital industrial complex focused on fee-for-service growth and market power will decline as margins shrink and local mergers are killed by antitrust review.

Further, assuming the tough operating environment continues, my guess is that hospitals will move toward risk-based contracting (AKA, revenue diversification), especially as payors build out their clinical service assets (United-Optum, Humana-Centerwell, Elevance-Carelon, and Cigna-Evernorth).

This move toward risk and cost management will ALSO incentivize hospitals to focus efforts on more creative ways to reduce costs and improve care, an identified $1T+ opportunity across healthcare.

‘Peak’ hospital is past its prime like Jordan on the Wizards. The hospital is not dying and never will – but it WILL be forced to adapt to the changing environment – hopefully to the benefit of clinicians and patients. Physician-led alignment will be key.

Health systems will look to copy their model and outsource / partner a lot more in the coming years with a focus on professional service orgs.

P.S. / disclaimer once again – This is a thought experiment piece and a newsletter, a much more informal medium to express ideas on healthcare. I welcome any and all opinions as always, but given that the healthcare system is unbelievably massive, I’m sure to miss plenty! All I ask is that you be respectful.

The Future of the Hospital.

So what needs to change? Here are some of my thoughts on potential steps health systems can take.

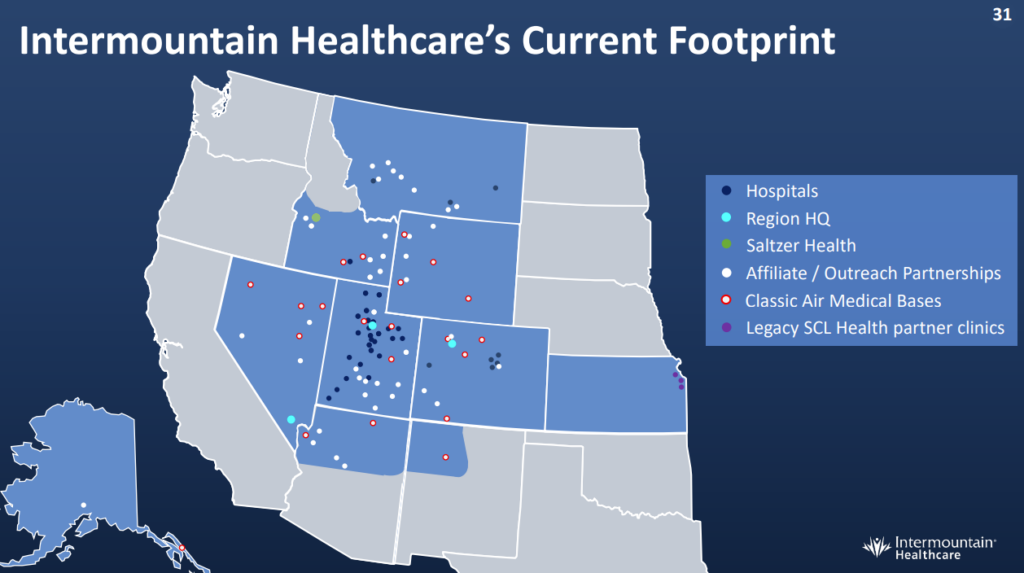

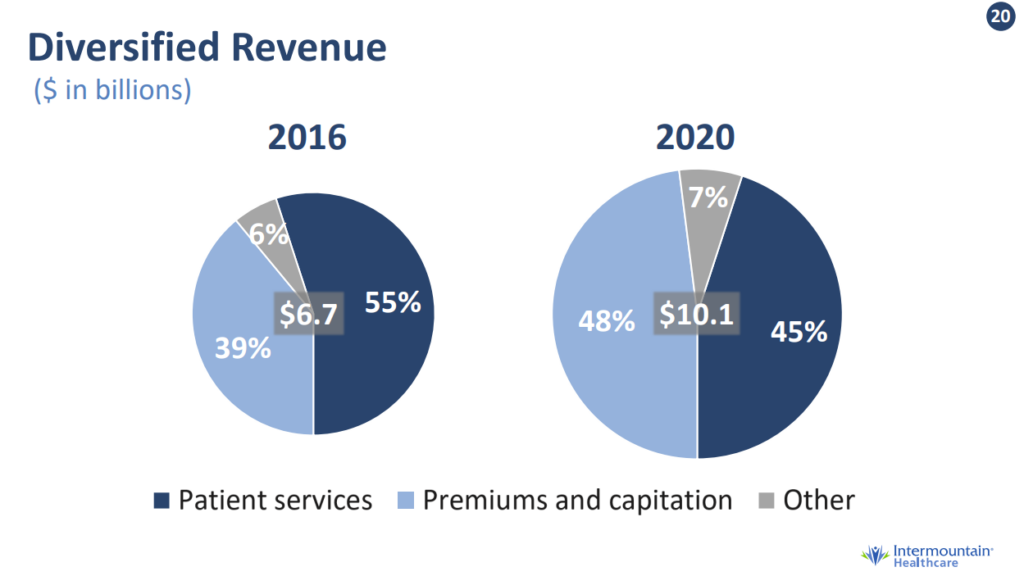

Go Risk On; Follow Intermountain: Intermountain Healthcare, a health system based in Utah, is the poster child for the future of integrated care. Intermountain has long set out a goal to generate at least 50% of its revenue from risk-based contracting and continues to work down that path. In 2018, Intermountain bought Healthcare Partners Nevada, a key acquisition to align with a large physician base. Intermountain’s focus on value has led to a decrease in insurance premiums (AKA, costs) over the past 3 years in Utah and better operating performance during the pandemic. It’s a stark contrast to most traditional organizations who struggled.

In addition, Intermountain holds the best financial ratings in healthcare from Moody’s and S&P. Its insurance product SelectHealth now holds over 1 million members as of March 2022. This growth will continue to increase after Intermountain’s merger with SCL Health.

Finally, Intermountain’s “Reimagining Primary Care” model around population health and value-based payment success has decreased MA admissions by 60%, commercial admissions by 25%, and reduced PMPM costs by 20%. Seems like a win-win! Patients/employers get lower costs and better outcomes while Intermountain achieves financial success.

Partner where necessary: I get it – hospitals are slow-moving and it’s hard to build new models on their own with limited capital ready for acquisitions. Luckily, health systems have a lot of help these days. There are plenty of companies that can help hospital organizations unlock value through joint ventures. It’s less risky when a specialized operator is involved. These partnerships often provide value to health systems since they involve outsourcing a service line to a more efficient operator. Here are some specific examples:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Population Health: Having a partner to help hospitals manage ACO functions will help hospitals transition to value-based care. Players like agilon and Privia are big in this space and have seen financial success. They’ll continue to have conversations with health systems about how they can help the transition toward population health management. Recent announcements include agilon’s partnership with MaineHealth and Privia’s partnership with OhioHealth. On a related note, Aledade partnered with Elevance to offer its technology services and care offerings to independent PCPs in Elevance’s network.

- Ambulatory Surgery Centers: The ASC is a huge point of emphasis for hospitals and health systems. Tenet bought USPI in 2015 and SurgCenter Development in late 2021. Optum bought Surgical Care Affiliates in 2017. Envision merged with AmSurg in 2016. HCA operates 120+ ASCs. Along with the business incentives, ASCs are much more convenient and accessible for patients and a much more preferable setting for payors (high-value fee-for-service). Creating an outpatient footprint of ASCs along with your partnered physicians and a player like USPI or SCA (or another management company) is a no-brainer.

- Post-Acute Care: In 2020, Rush University Medical Center in Chicago partnered with Select Medical, a specialized operator of post-acute facilities like inpatient rehab, skilled nursing, and physical therapy. This JV gave RUSH access to a new IRF facility, outpatient physical therapy clinics, and the ability to repurpose beds. LHC Group is another huge health system JV home health player recently bought by Optum with 400+ health system partners looking to expand into home health. Finally, new players like Contessa (who recently partnered with Mount Sinai as well as Baylor) and Dispatch Health are focused on implementing Hospital-at-Home programs to allow patients more options beyond the hospital setting. Recently on the behavioral health side, Henry Ford Health System partnered with Acadia to open a new standalone behavioral health facility in Michigan.

Form alliances: We’ve already seen the beginnings of this, but hospitals have a big opportunity to work with other systems to form/optimize group purchasing organizations, staffing alliances (one called Evolve recently formed by Northwell, Intermountain, Atrium, AdventHealth, Henry Ford, and OhioHealth), and manufacture generic drugs (Civica Rx)

Cut Costs, Increase Efficiency: This is an unfortunate and painful, but necessary step in the process. No way around it – there’s a lot of bloat and legacy overhead at health systems.

- Simplify Administrative Tasks, Reduce Overhead: Much of this is driven by regulation and documentation/other requirements, but health systems should continue to take a hard look at what positions are necessary*. What responsibilities can we combine? What could be automated or outsourced?* Layoffs are never easy, and this step will be unpopular since health systems are often the largest employers in most markets. IT, accounting, HR, and other buckets in this sphere can be improved upon. Keep an eye on staffing agencies as a key outsourcing movement. Firms like Cross Country Health Care and AMN Healthcare are doing very well in 2022, while other private players including Incredible Health and Nomad Health are raising vast sums of money. There’s also a decent amount of private equity activity in this space. Also, stop building so many buildings? Nothing like the crushing weight of construction and associated overhead costs to make your model inflexible!

- Automation and Revenue Cycle Management: What can newly developed technology enable in the hospital? Ambient physician documentation could reduce clinician admin hours (and burnout!). Solutions can help with scheduling, case management, reduce length of stay, remote patient monitoring, pharmacy fulfillment, or better patient engagement. In addition, outsourcing revenue cycle management can reduce bad debt, cut overhead costs, and optimize billing practices for hospitals and health systems. Just make sure they’re not doing anything that might get you featured on a NY Times article.

Invest in the future: The largest health systems have huge endowments and venture funds (for better or for worse, I’m not here to argue about this with you). Health systems should continue to use these funds to invest in care innovation and emerging trends to not only make higher returns on these riskier investments (AKA, margin boost!) but also use their investment portfolio companies in their own hospitals for the benefit of better, more efficient patient care. Health systems can even partner with venture capital firms. We’ve seen this already involving Intermountain’s partnership with General Catalyst. General Catalyst has also partnered with HCA, Jefferson Health, and more recently, WellSpan Health.

Conclusion

I’ve said this before and I’ll say it again – I’m glad I’m not an operator! All of the above that I’ve laid out are much more risky and easier said than done. Whether this evolving hospital model actually comes to fruition, or if the current operating environment is just a blip on the radar in 2022 remains to be seen, but I’m a proponent of the evolving integrated health system model regardless, and my belief is that diversification away from high-cost acute care will ultimately be necessary for long-term survival.

What do you think? What did I miss? Who is building for the hospital model of tomorrow? If you are, I’d love to connect!

Join 9,800+ thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!