Welcome back to another edition of Hospitalogy, where I do all the interesting, extra healthcare analysis stuff that your analysts refuse to do.

(Kidding).

On Thursday, August 24 at 2pm ET, join Freshpaint’s Ray Mina and me as we chat about the latest in HIPAA compliance and digital marketing in a world of Pixel scandals and lawsuits.

For healthcare marketing leaders and compliance executives, this conversation is going to be a must-listen, and we’ll have an audience Q&A where we’ll dive into questions top of mind for you and your organizations! Save your Seat here.

This edition of Hospitalogy is SPONSORED BY OPILIO

Are you tired of settling for ordinary healthcare experience? It’s time to unlock the extraordinary with Opilio – your gateway to a new era of medical excellence! Here is why you should join the Opilio revolution:

- Seamless Integration: Opilio’s platform enables you to integrate virtually any system in your organization with agility and precision, optimized by cloud servers. Say goodbye to tedious manual processes and embrace the power of automation to streamline complex tasks effortlessly.

- Advanced AI and Machine Learning: Opilio’s cutting-edge solutions include Artificial Intelligence and Automated Machine Learning, allowing you to harness the potential of predictive modeling for various use cases. Gain valuable insights, assess risk, predict customer behavior, and make data-driven decisions with confidence.

Ready to embark on a journey towards optimal health and wellness? Don’t miss out on the opportunity to be part of the Opilio community.

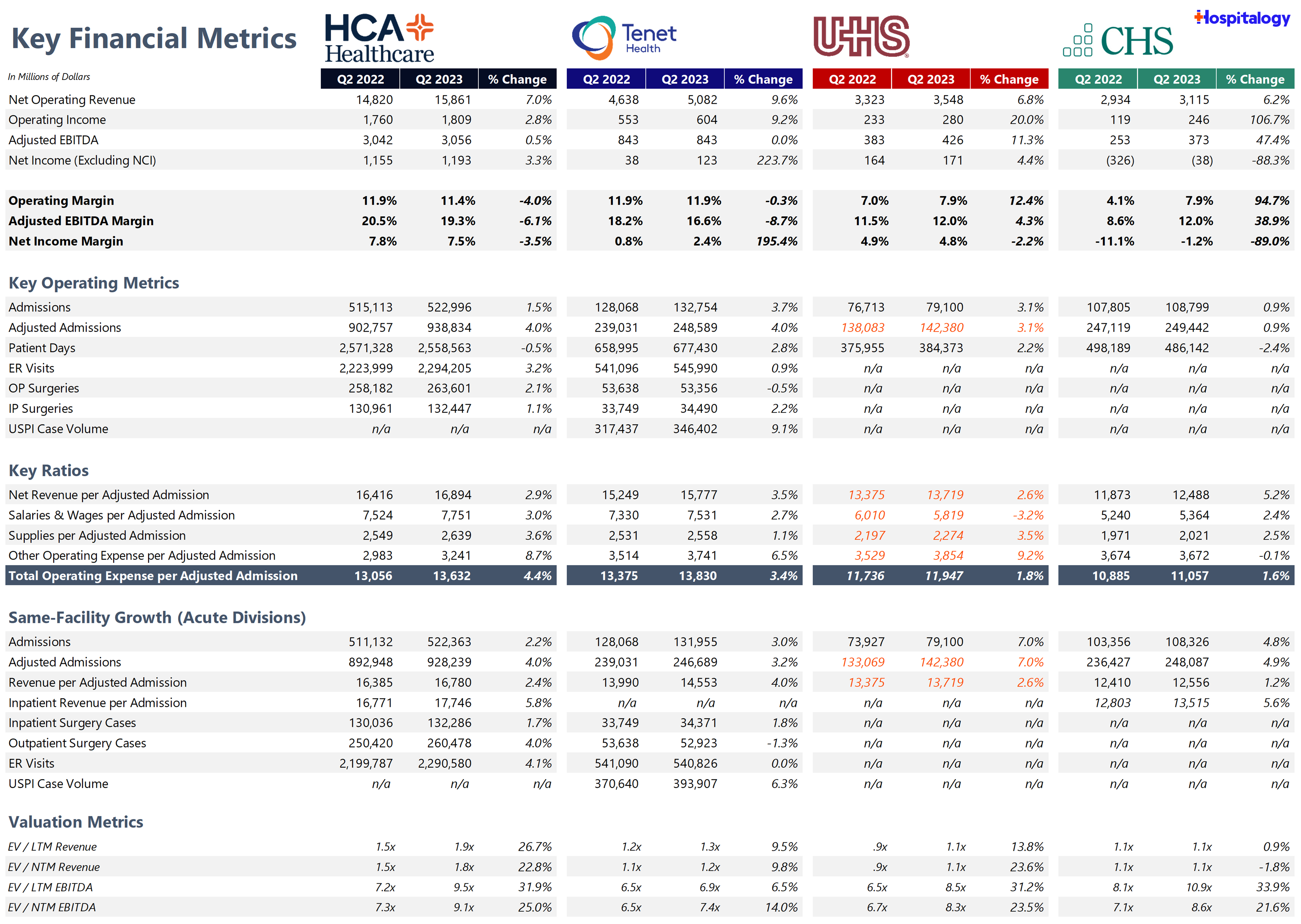

Key Q2 2023 Financial and Operating Metrics from HCA, Tenet, UHS, and CHS

The data book associated with this information is available exclusively to Board Room members.

As you can see, the for-profit hospital operators enjoyed strong same-store volume growth. On the outpatient side, HCA’s surgical volumes grew 4.0% while Tenet’s USPI ambulatory surgery cases rose by 6.3%.

From a Bank of America note on HCA’s Q2, volumes were quite strong: “When looking at volumes vs 2019 baselines, Q2 was actually stronger than Q1 at 5.6% above 2019 levels, vs 5.1% above in Q1. At the same time, UHS also saw its volumes move back closer to the 2019 levels trended forward in the quarter, despite a y/y slowdown in volume growth, which supports the idea that core volumes are actually improving.”

HCA in particular enjoyed strong commercial payor mix in Q2 as its core markets outperform other health system portfolios. From their earnings call transcript:

- “As we said before, and we continue to believe this we feel that within our markets, there’s unique attributes that are driving solid demand for health care services. Population growth continues to be strong in Texas and Florida, in Utah, Nevada, South Carolina, pretty much Tennessee. Across the board, we’re experiencing population growth within our markets.”

- “We have seen throughout the first half of the year, commercial admissions outpaced our total admissions. Again, we think that’s reflective of a strong economy and job positioning that a lot of people have in our communities as well as the exchanges. And so we think those will continue on into the last half of this year. And we’re optimistic that those will continue on into the future, at least in the near-term.”

It’s an interesting dynamic – the for-profit’s (not named Community Health Systems at least) are steamrolling along and providing stellar financial results. Meanwhile, ratings company Fitch continues to expect deteriorating operating margins for hospitals from a more holistic, widespread perspective, particularly in markets where demand is not as strong and where labor shortages are not alleviating:

- “The sector will continue to experience weak margins in 2023 and into 2024, due to an inelastic revenue model, pronounced labor challenges and lingering inflationary pressures, unless payors, governmental or otherwise, begin to hike annual rate increases more in line with the new normal,”

I’m planning to provide Hospitalogy readers with a more comprehensive overview of healthcare from Q2 earnings season, which will publish this Thursday. Notably, CVS’ Q2 was a great read, which I’ll get into on Thursday.

For now, here are the links to the associated hospital earnings announcements above:

Partnerships and Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Venture funding rebound? Silicon Valley Bank published its updated report on venture funding across healthcare in the U.S. Keep in mind that SVB’s report takes into account investment in biopharma, health tech, dx/tools and medical devices. (Link)

Chronic Kidney Testing: CVS-owned Signify Health announced an expansion of its offerings with in-home diagnostic services for chronic kidney disease. Perhaps a tie-in with CVS Ventures-led Monogram Health? (Link)

Amazon Clinic Growth: Amazon Clinic is expanding its services nationwide, operating as a platform connecting several telehealth providers with patients for low-acuity conditions. I broke down Amazon’s healthcare strategy on Thursday here.

Full Practice Authority in CO: Colorado abolished the supervision requirement for Physician Assistants. (Link)

Oracle Cerner Shifts: This Beckers article does a good job of distilling Oracle-Cerner’s market strategy and where the enterprise cloud EMR player is winning (small health systems) and losing (larger health systems, M&A integrations). (Link)

- Ironically, Community Health Systems is transitioning TO Oracle-Cerner platform, announcing “an enterprise-wide, multiyear modernization and optimization initiative that will include an integrated Oracle-powered platform.” (Link)

Private Equity Spotlight: The WSJ published an interesting look into private equity’s influence in healthcare and how stakeholders trying to shed light on PE’s activity are facing roadblocks. (Link)

Telehealth Substance Registry: The DEA is considering making changes to controlled substance prescription via telehealth, including a potential controlled substance registry tailored for telehealth related services. (Link)

Ransomware Attack: Prospect Medical Holdings is suffering from a widespread cyberattack, causing significant operational disruptions. Data breaches and security threats are on an absolute tear in 2023. (Link)

Billing Arbitration Halt: Following a legal decision and a win for provider organizations over insurers, CMS has temporarily halted out-of-network billing arbitration. (Link)

Bright Health’s Funding Secured, but at what cost: Amid financial constraints, Bright Health secured a credit line from NEA. (Link)

Privia’s Expansion: Privia Health announced its entry into the Washington State healthcare market through its partnership with Walla Walla Clinic comprised of 50+ providers at 3 locations, serving as the anchor practice for the enablement company in the market. (Link)

Novant Invests in CMC: Conway Medical Center announced a ‘mini merger’ with Novant Health to enhance healthcare access on the coast. As part of the affiliation, Novant will maintain a minority stake into CMC. (Link)

Insurance Transparency: Health insurance companies are facing increased media scrutiny over the opacity of medical billing and denials. (Link). Along with this story, the Labor Department sued UnitedHealth Group over numerous insurance claims rejections. (Link)

GLP-1 Medication Lawsuit: Manufacturers of Ozempic and Mounjaro are apparently facing legal action over stomach paralysis risks. Lots of interesting dynamics happening with GLP-1s in the face of a rising obesity crisis. (Link)

Elevance Rebrand: Elevance is renaming its Amerigroup segment to Wellpoint. (Link)

Partnership Announcements:

- Orlando Health acquired the Florida Medical Clinic, adding 54 locations, 350 providers, 40 specialties, and 2,000+ FTEs to its network. (Link)

- Cadence and RUSH unveiled a remote monitoring initiative aimed at enhancing outcomes for individuals with chronic conditions. (Link)

- Progyny, Inc. launched a program offering nationwide access to menopause care. (Link)

- WVU Medicine selected QGenda for the management of their healthcare workforce across all its 23 hospitals. (Link)

- Reimagine Care and Memorial Hermann Health System announced a partnership to promote at-home cancer care. (Link)

- Talkiatry and NOCD form a partnership to assist patients diagnosed with OCD. (Link)

- Mark Cuban Cost Plus Drugs enters into a partnership with the pharmacy navigation startup Scripta. (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

CMS Hospital Payment Finalized: Hospitals are receiving a 3.1% inpatient payment increase per CMS’s finalized proposal. (Link)

Babylon is pursuing ‘new strategic alternatives’ after the MindMaze deal was canceled. It’s on the verge of Chapter 7 bankruptcy if it can’t find liquidity. (Link)

Kaufman Hall’s July 2023 Hospital Flash Report was released, detailing improving operating margins along with other trends affecting hospitals including increased bad debt, inflation pressures, and shorter length of stay. (Link)

CommonSpirit and AdventHealth divided up Centura Health’s hospital portfolio, folding the joint operating company back into the two parent organizations. Don’t forget that Centura previously purchased Steward Health’s 5-hospital portfolio in Utah after HCA was unsuccessful in capturing the bid. (Link)

HIMSS and Informa Markets inked a deal to enhance the HIMSS Global Health Conference & Exhibition. Will you still attend?? (Link)

Labcorp acquired Tufts lab assets in yet another example of hospitals outsourcing their lab operations to the duopoly. (Link)

Marathon Health acquired Cerner Workforce Health Solutions Clinics. (Link)

A drug by Astellas acquired in a $5.9B deal received FDA approval for a vision-loss disorder. (Link)

Logan Health and Billings Clinic confirmed their merge effective Sept. 1. (Link)

The Georgia attorney general’s office approved Wellstar’s takeover of Augusta U Health System. (Link)

Essentia Health and Marshfield Clinic Health System signed an integration agreement. (Link)

Quarterly earnings links:

- CVS Health (Link)

- Humana (Link)

- Cigna (Link)

- Surgery Partners(Link)

- agilon health (Link)

- Privia (Link)

- ApolloMed (Link)

- Hims & Hers (Link)

- Amwell (Link)

- Encompass Health (Link)

- Augmedix (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Cedar, developing AI-powered tools to enhance the healthcare financial experience for patients, announced a collaboration and alignment with Google Cloud. (Link)

Charlie Health announced an expansion of its youth mental health platform to 25 states to address the growing youth mental health crisis. (Link)

Geisinger is piloting a heart failure monitoring program using Bodyport’s innovative smart scale. (Link)

KAID Health & Atropos Health collaborate to extract insights from medical notes to advance cancer care. (Link)

Fundraising Announcements:

- HEALTHMAP, a healthcare company providing kidney health management services, raised $100M (Link)

- TytoCare, a healthcare company offering telehealth services, announced a $49M funding round. (Link)

- HerMD, a healthcare company focusing on menopause treatment, secured $18M. (Link)

- FeelBetter, an AI-enabled medication management platform, raised $5.9M. (Link)

- Uptiv Health, a startup aiming to reshape the infusion care experience for patients, launched with $7.5M in funding. (Link)

- Emerson Collective Health, spinning off to form a new investment fund called Yosemite, has announced its first close of an oversubscribed $200M+ fund aimed at accelerating transformative cancer ventures, led by Steve Jobs’ son. (Link)

The Healthcare Hype Cycle: AI in Healthcare

This is the spot where I cover the buzzy, hot topics in healthcare. Currently the flavor of the month is AI in Healthcare.

Duke Health and Microsoft have formed a partnership to ethically utilize generative AI. (Link)

Cognizant broadens its generative AI alliance with Google Cloud and announces the creation of healthcare large language model solutions. (Link)

CareCloud and Google Cloud team up to extend the advantages of generative AI to ambulatory healthcare scenarios. (Link)

Microsoft and Duke Health initiate a 5-year collaboration to delve into healthcare AI and implement cloud technology. (Link)

UMich formed an AI-driven system aims to combat fraud, waste, and abuse, targeting reduced costs and enhanced patient safety. (Link)

Prime Healthcare is transforming inpatient experiences using the AI-driven Steer Concierge Platform. (Link)

Ziff Davis & Xyla enter a partnership to foster innovation through AI, with an initial focus on the healthcare sector. (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- I got to watch Messi play the local MLS squad FC Dallas on Sunday, and what an incredible treat. The man is simply on another level far and away above the peasant class of the MLS. Every touch he made was magnificent and he created so much opportunity for Miami. Heck of a game too, ending in a 4-4 tie and FC Dallas losing in PKs. I caught Messi’s 85 minute equalizing free kick on video and I’ll never forget his performance.

Hospitalogy Top Reads

My favorite healthcare essays from the week

- Daniel Kaplan penned an excellent series on venture capital in senior care, covering a number of trends happening across the space and where payors are looking for investment. (Link)

- On Thursday, August 24 at 2pm ET, join Freshpaint’s Ray Mina and me as we chat about the latest in HIPAA compliance and digital marketing in a world of Pixel scandals and lawsuits.

- For healthcare marketing leaders and compliance executives, this conversation is going to be a must-listen, and we’ll have an audience Q&A where we’ll dive into questions top of mind for you and your organizations! Save your Seat here.