Happy Tuesday, Hospitalogists,

Today we’re jumping into the Walmart-ChenMed rumors and other interesting updates from the week. Heads up – I’m mixing up the format just a little today given the ChenMed news is a bit longer!

Thursday will be a deep dive on a new healthcare data startup Opilio (also the sponsor of today’s newsletter – give them some love!).

Let’s get after it.

Breaking down the Walmart-ChenMed Acquisition Rumors

What’s What: Bloomberg reported on September 8 that Walmart is rumored to be eyeing an acquisition of ChenMed, a longstanding family-owned senior, Medicare Advantage (MA) primary care platform. The family has been in the primary care business for a while, and has a great story behind why they do what they do, which is capitated primary care for underserved populations in urban areas:

- ChenMed is a full-risk primary care market leader with an innovative philosophy, a unique physician-led culture and end-to-end customized technology that is providing coordinated, world-class primary care to the most vulnerable population – moderate- to low-income seniors with complex chronic diseases.

The deal value here is rumored to be in the billions of dollars, and that makes sense considering we’ve seen other advanced primary care assets attract similar sums (albeit in a different macro environment):

- Oak Street Health went for $10.6B (200 clinics, ~210k at-risk members expected at the end of 2023 at time of announcement);

- Summit Health went for $8.9B;

- One Medical went for ~$3.9B and relatedly, Iora Health went for $2.1B (47 clinics, ~31k at-risk members at time of acquisition). Finally,

- ChenMed’s own joint venture with Humana JenCare was rumored (emphasis on RUMOR) to be valued at an alleged $4B, or 3x revenue when it was weighing a sale in mid 2022.

For fun, let’s assume that this deal goes through and Walmart acquires ChenMed for $x billions.

A Brief Analysis of ChenMed

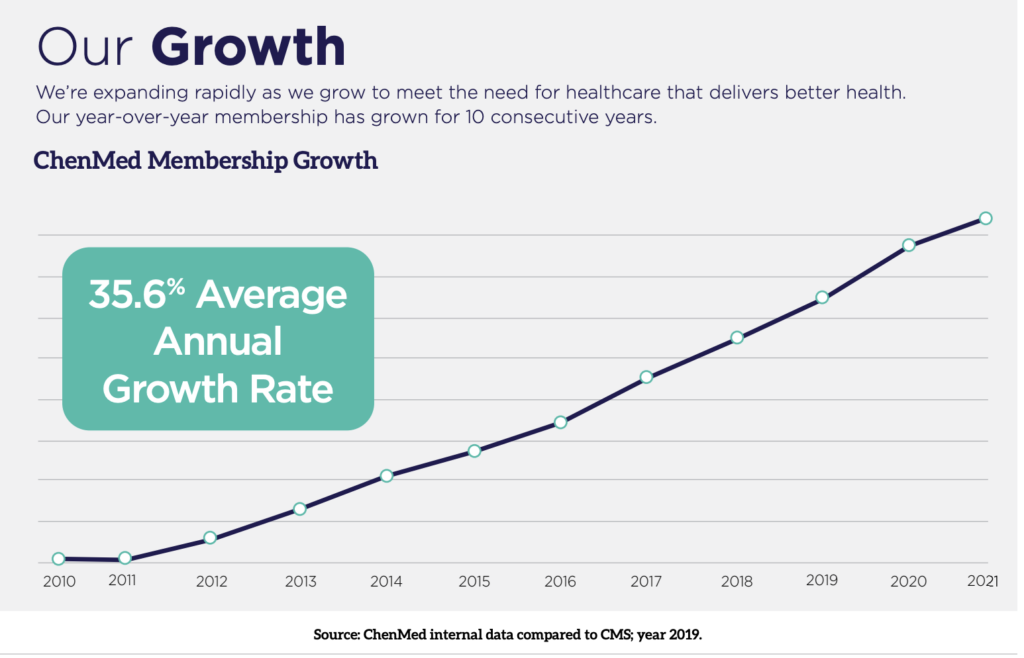

ChenMed has exhibited solid growth over a decade-plus, expanding membership at a 35.6% annual clip from 2010 – 2021:

ChenMed holds 120+ primary care centers in 15 states in 65+ cities as of its last update. It opened 33 clinics in 2022 alone, rivaling the clinic growth of that of Humana’s CenterWell and Oak Street Health.

As far as senior-focused risk-based primary care is concerned, ChenMed is widely regarded as a well-oiled machine, with culture as one of its biggest strengths. Culture and trust is a criminally underrated element within an organization. It manifests its way into all aspects of a services business.

Most importantly, ChenMed’s steadfast culture has afforded it the ability to recruit and retain clinical talent, which is one of the most important aspects of advanced primary care to build patient trust and the right clinical team. You’re only as good as your people. To its credit, ChenMed has achieved operational excellence and stellar patient outcomes to boot.

In summary, ChenMed has some great things going for itself.

Walmart Health’s Recent History

What might alignment with Walmart look like? To help inform that question, let’s look at what Walmart has done in healthcare in recent memory. From my retail health update in October 2022, some history you need to know:

Originally, Walmart had an ambitious vision to open up consumer-friendly Walmart Health clinics very quickly across a number of regions, announcing the plan to do so back in 2019. Since then, Walmart lost some key healthcare executives and faced other rumored operating challenges, which caused a slowdown in healthcare.

Walmart then came out of the woodworks and acquired little-known virtual care provider MeMD, which has since been renamed Walmart Health Virtual Care.

It then partnered with UnitedHealthcare and Optum on a 10-year collaboration focused on Florida and Georgia, including a co-branded Medicare Advantage plan in Georgia to include Walmart Health locations with Optum’s guidance.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Then later in 2022, Walmart unveiled significant expansion plans. On October 26, Walmart announced plans to open 16 new clinics over the course of 2023 in Florida around Jacksonville, Orlando, and Tampa.

Since that announcement, Walmart plans to double the number of Walmart Health centers in size by the end of 2024 to 75+ clinic locations. And this is where Walmart sits today.

Pivoting the potential ChenMed acquisition, why Walmart, and why now? My bet is on the simple economic idea of scarcity.

And maybe some FOMO.

Advanced Primary Care – Walmart’s Scarcity Play

As we’ve covered, over the past 24 months, we’ve seen several notable clinic-based, national advanced primary care players snatched up by a Walmart competitor:

- Walgreens is ‘reinventing’ itself through healthcare and making a big bet on VillageMD;

- CVS is in a state of transition with Oak Street Health leading the way; and

- Amazon is dabbling in care delivery with One Medical.

So here’s a simplistic take, along with some speculation:

Maybe Walmart looked up, saw certain competitors spending billions of dollars in healthcare delivery, and figured it was missing something.

Maybe Walmart’s execs dove into their healthcare strategy after sitting stagnant for a few years and started to think “wow, there really aren’t many national primary care businesses left, and we can’t scale Walmart Health fast enough on its own, and we might get some questions from investors on healthcare since everyone else now suddenly holds significant national primary care assets.”

And perhaps the timing is just right for ChenMed too. ChenMed wants to sell – now – before MA risk adjustment headwinds, and before top-line growth slows. The signals seem pretty clear, with family stepping down from the business and a new CEO at the helm.

This set of facts just might create a perfect storm of events for Walmart to want to make a splash play in healthcare.

SPONSORED BY OPILIO

Elevate your healthcare strategy with Opilio.

Worried about navigating the complex world of AI and losing control of your data?

Opilio offers the perfect blend of cutting-edge AI and data integrity. Experience predictive insights, effortless integrations, and an empowered workflow – all while ensuring HIPAA compliance.

Dive into the future of healthcare, confidently with Opilio.

I can’t help but feel flashbacks to Amazon-One Medical in the sense that it’s a bit fuzzy to identify the immediately accretive value to Walmart.

ChenMed has been primed to sell, and the writing was on the wall. The firm is likely selling high to a retail who wants one of the last remaining scarce advanced primary care assets. I imagine Walmart can leverage ChenMed to further its healthcare growth objectives, but also maintain similar footing to competition.

Humana and UnitedHealth Group are valuable channel partners, and the Medicare Advantage market as well as the supplemental benefits market is growing. If Walmart really does buy ChenMed, I’d expect to see Walmart take a significant step into MA, which should have nice downstream effects on its business as the population ages.

If you’re Walmart, ask yourself: “Do we even need to respond to our major competitors making legitimate healthcare moves?” I don’t know the right answer to that question. But if Walmart buys ChenMed, that purchase would be its largest healthcare acquisition to-date, by ten-fold.

Big Picture: 2023 is Year of the MA Primary Care Clinic

2023 has shaped up to be the Year of Advanced Primary Care and enablement amid the Oak Street Health sale, Aledade’s raise, Humana’s growth with CenterWell, Optum’s and VillageMD’s acquisitions, and now the Walmart-ChenMed rumors. The land grab for America’s growing senior population is underway, and it’s clear we’ll see multiple winners as the tide rises.

Here are some open questions:

- Why does Walmart want to take on risk? Why did Amazon?

- Consequently, do we need to redefine ‘retail health?’

- The ChenMed brand and messaging as a family-led organization is unbelievable and no doubt one of its strongest features as a healthcare delivery organization. Will selling to Walmart – or anyone else, for that matter – taint that? I mean, can you maintain your family-owned messaging if you sell to the Fortune 1 company? Will that affect clinician recruitment?

- Assuming Walmart really is trying to buy ChenMed – there are fewer and fewer attractive, scaled primary care clinics out there. Will other bidders emerge?

What are your thoughts on all of this activity? It’s fascinating to watch, and I’m sure there is plenty of nuance to consider.

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

Health Systems opt for Epic: In recent weeks, Intermountain and UPMC have switched from Cerner to Epic. Rather than lost market share, both moves really moreso exemplify health system consolidation. For instance, UPMC is consolidating nine EHRs into one, while Intermountain internally has decided to bite the bullet and get onto one system by 2025. UPMC will be on Epic by 2026, and Epic continues its reign of dominance over large health systems and academic medical centers. Meanwhile, Oracle has questions to answer related to its strategy and growth under Oracle (especially with the bad VA PR). Going global? (Link) (Beckers – why UPMC chose Epic for its EHR)

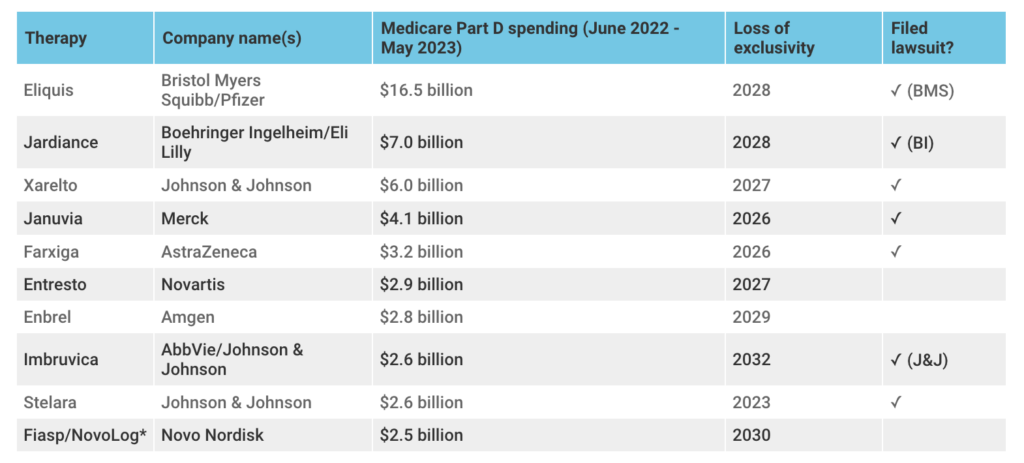

CMS Announces 10 ‘Negotiable’ Drugs: Comprising around $50 billion in total spending, CMS announced the following drugs for price negotiation through the Inflation Reduction Act. Once negotiations complete, new prices will take effect in 2026 (Link) (Endpoints Analysis)

CMS Launches new Payment Model – AHEAD: CMS is implementing a new state-based total cost of care model building upon Vermont’s ACO Model and Maryland’s Total Cost of Care model (the most successful VBC program to date). Notably, the model is designed for states, hospitals, and primary care practices. It’ll provide global capitation for hospitals set against Medicare FFS benchmarks to cover both inpatient and outpatient services. CMS will partner with a max of 8 states on the model. Really interesting stuff and you can see where CMMI wants the puck to move – behavioral health integration, more coordination between primary and specialty care, payor alignment with states, and incentivizing hospital participation as well as increased primary care investment. Will it be enough? (AHEAD Overview) (Factsheet PDF)

J&J’s Massive Split: J&J undertook a $40 billion division to further its pharmaceutical and medical technology growth. (Link)

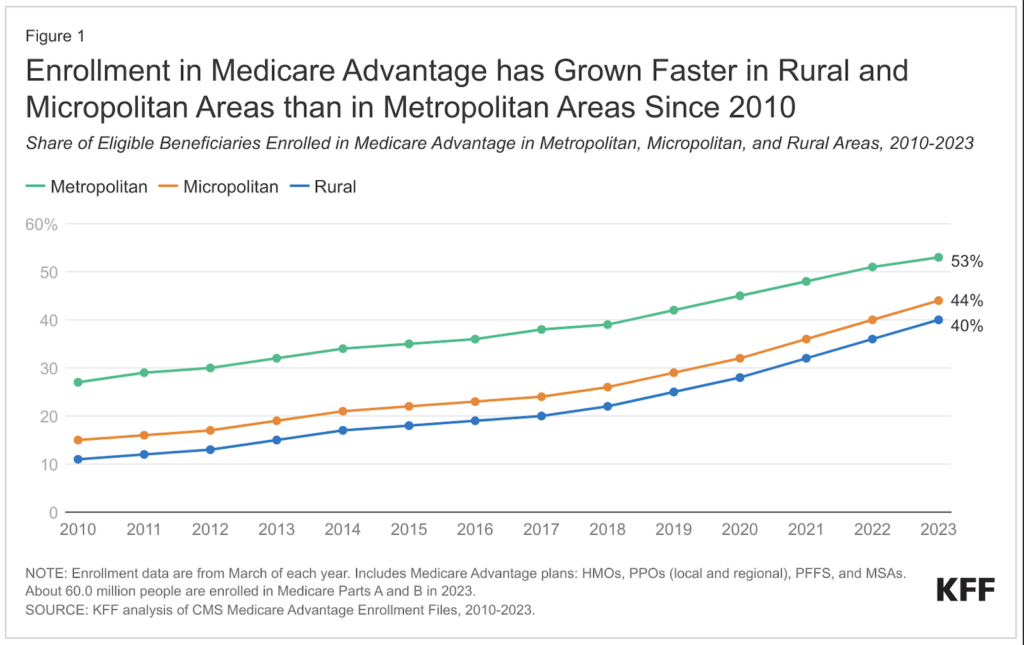

Medicare in Rural Regions: KFF wrote a nice analysis on trends and growth in Medicare Advantage enrollment in metropolitan, rural, and micropolitan areas, noting that rural MA penetration is increasing most rapidly in the latter two. On an unrelated note, I had no idea that micropolitan was a word. (Link)

Rural Medicare Rejections: On a related note, here’s another interesting trend that seems to be coming to a head with the above MA penetration: more rural health systems are going out of network with MA plans. (Link)

Oscar Health’s New Hires: Oscar Health is opening its doors to ex-Aetna execs to steady the ship. (Link)

Hospital Labor Market Stabilizing? Nonprofit hospitals experienced a deceleration in wage growth, as reported by Fitch. (Link)

A Notable Launch: In a Hospitalogy exclusive (woo!), the Notable team shared with me the launch of their latest product, called Notable Assistant. The goal of Assistant is to provide patients with a single entry point to health system services & info for any scheduling or access needs.

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- I wanted to take this section today to thank everyone who reached out with congratulations or words of support after my Thursday send and baby announcement. I was overwhelmed by the response, and deeply appreciate your words of encouragement.

- Keep an eye on Apple’s annual product launches today. Rumor has it that the next iteration of the Apple Watch may contain a blood pressure monitor, which would be pretty cool.

- Judy Faulkner hates golf and therefore you will never find me working for Epic. I’m not sure why golf is catching strays in the Epic CEO’s blog, but I’d love to learn more about the rationale. Contrary to popular belief, golf is more accessible than ever. A walkable Par 3 course or Top Golf is a great company outing. But hey, what do I know?! Also, totally fine with no alcohol personally – but in Wisconsin! Respect.

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)