Lots and lots of healthcare stuff happened this week, so here’s your weekly dose of everything you need to know. Luckily you subscribe to Hospitalogy – healthcare’s best kept secret. Shoot this newsletter to a colleague to support the cause.

Thanks so much to Verifiable and Weaver for sponsoring today’s send!

SPONSORED BY VERIFIABLE

Recent shifts in the healthcare industry demand innovative strategies for provider network management.

That’s why Verifiable automates provider data verifications, to speed up the credentialing process and help organizations effectively scale their networks.

Once seen as tedious, manual, and costly, credentialing can be a competitive edge, unlocking:

- Enhanced revenue performance

- Increased provider satisfaction

- Accelerated network growth

To help you navigate this rapidly changing landscape, Verifiable and Salesforce share how they centralize provider data, automate credentialing, and expedite time to revenue in this on-demand webinar.

Healthcare Headlines

GLP-1 Kidney Study News takes down Dialysis Names

- Novo Nordisk’s GLP-1 trial was testing whether the widely used diabetes drug, which contains the active ingredient semaglutide, could delay progression of chronic kidney disease and lower the risk of death from kidney and heart problems.

- The clinical trial was halted early because it was clear that the treatment would work for the designated population

- Consequently, dialysis stocks – and other healthcare services names – tanked after news on Novo Nordisk’s kidney trial involving Semaglutide hit the wire. DaVita, Fresenius, and Outset Medical stocks were down double digits on the week. DaVita even issued a statement on the matter.

- The potential clinical indications for GLP-1s are insane, and they hold incredible long-term potential…but these selloffs are an overreaction to a market beholden to whimsical emotions rather than fundamental demand. Still, 2023 feels like an inflection point as payors and employers grapple with ways to cover the expensive drug amid an explosion in demand and clinical indications.

$11B UnityPoint-Presbyterian Healthcare Services Merger canceled

Announced last year, UnityPoint and Presbyterian Healthcare Services are calling off their merger with no known reason in mind. (Link)

Both health systems lost money on operations in 2022 in tough markets. The cross-market merger would have created a 50-hospital system across New Mexico and the Midwest. UnityPoint’s CEO is also stepping down.

Keep an eye on Presbyterian. The system could be an attractive partner for Risant or… HATCo (although the latter seems to want to target something in the $1B – $3B range per this Beckers interview)

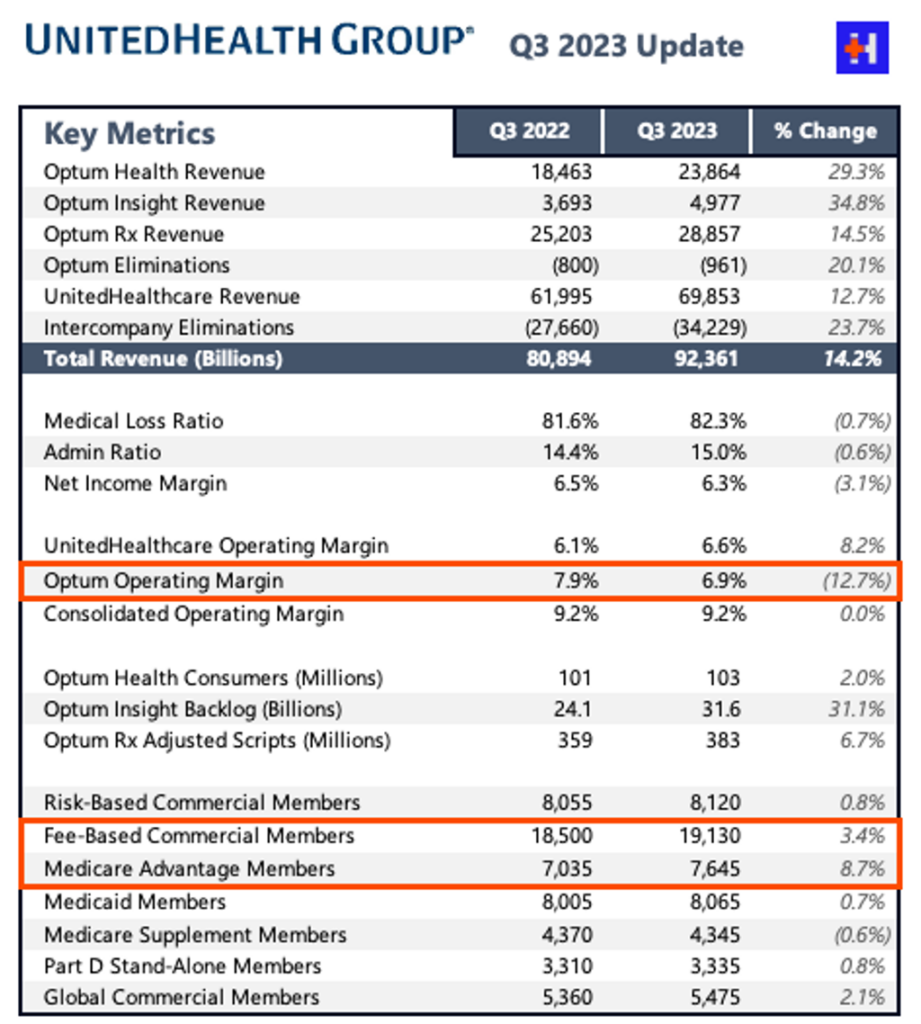

UnitedHealth Group’s Q3

UnitedHealth Group posted another business as usual quarter, but Optum’s notable underperformance from higher than expected utilization and long-term investments as noted in my Q2 earnings summary continues. It’s a situation worth monitoring, as UHG has invested significant resources and capital into Optum as its growth engine for the foreseeable future.(Link)

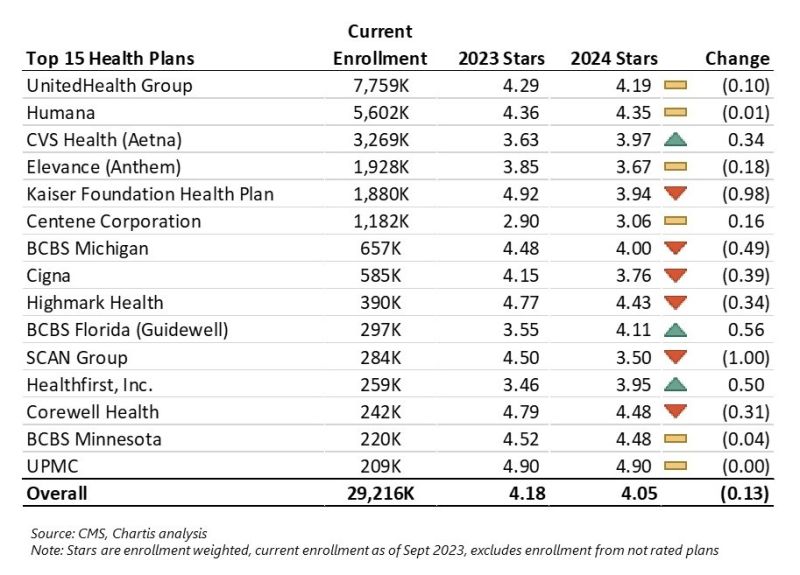

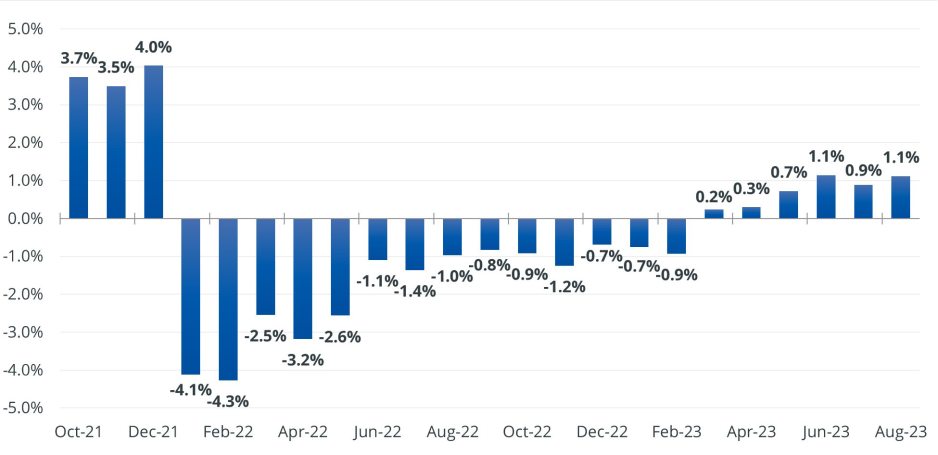

MA Star Ratings Decline for the second straight year

After a decline in Medicare Advantage star ratings last year, many MA plans saw further star ratings declines. Here are some highlights and tidbits from the data published this week:

- About 42% of Medicare Advantage plans that offer prescription drug coverage in 2024 earned four or more stars, compared with just over half this year. (Link)

- Many traditionally high-performing nonprofit plans performed poorly.

- “The market’s average star rating fell to 4.05 (4.04 per CMS) which is the lowest it’s been since 2017” – from Nick Herro’s excellent breakdown and table below.

- Full list of MA plans and star ratings here

Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

The Kaiser strike is over – Kaiser workers will get a $25 California minimum wage and a 21% raise over 4 years among other stipulations for the 85,000 Kaiser employees. (Link)

Walgreens continues to try and transform operations into a profitable, sustainable healthcare player. The struggling retail pharmacy chain plans to cut up to $1B in costs, drop CAPEX by $600M, close struggling stores, and, interestingly, close 60 VillageMD locations to focus on VMD’s density in existing markets. Walgreens also announced the hiring of Tim Wentworth as CEO, who holds substantial experience in healthcare at both Evernorth and Express Scripts. Finally, Walgreens launched a DTC telehealth offering. (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

A consortium of investment partners is funding SurgNet Health Partners, a new ASC management company that launched on October 10 and is looking to use fresh funding to partner with existing ASCs and physician practices. (Link)

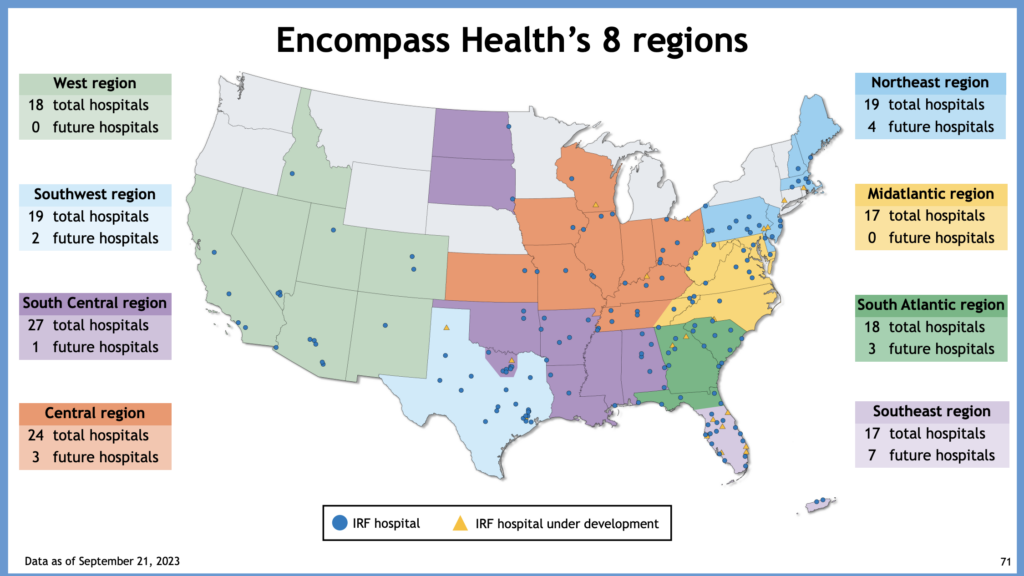

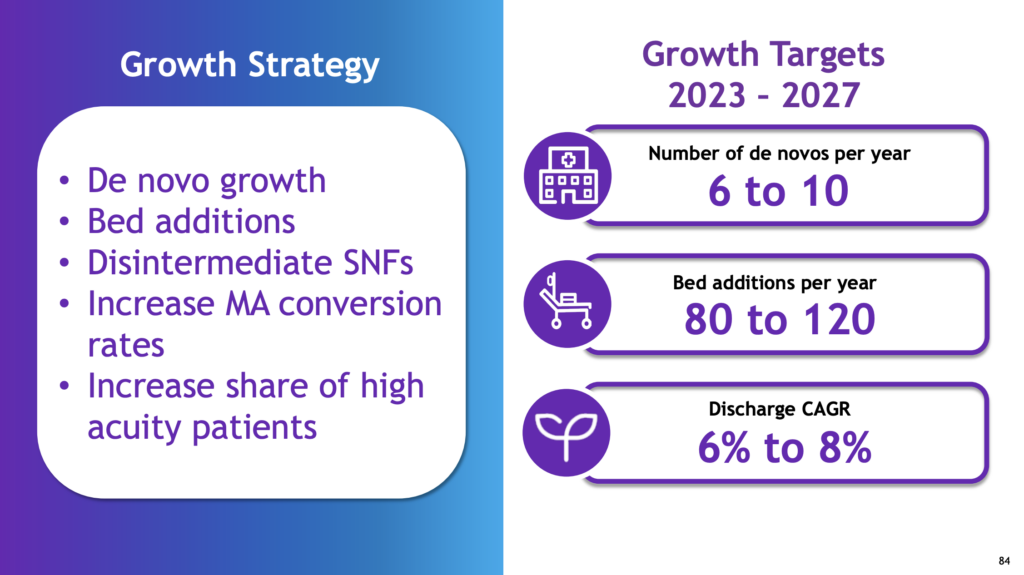

Encompass Health held its investor day in late September, giving a wonderful overview of its business model and future expansion plans within the inpatient rehabilitation industry, a woefully overlooked segment within the post-acute care sector. (Link)

Envision is splitting into 2 entities post-bankruptcy and cutting $7B in debt:

- The low margin physician staffing business – Envision Physician Services, and

- AMSURG, the more desirable outpatient surgery center biz

Ironically, Envision bought AMSURG in 2016, so we’ve really come full circle here. I’m interested to see what happens to this segment long-term (Link)

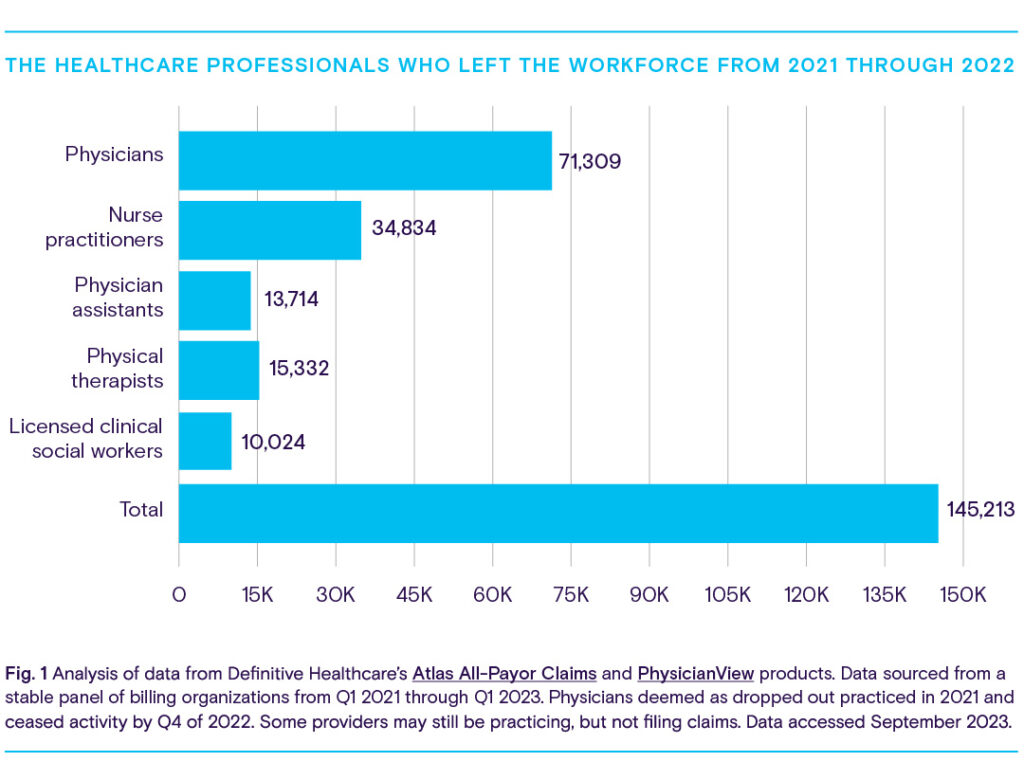

Definitive’s latest report on healthcare staffing shortages is a nice overview of the labor landscape as it sits today with burnout, departures, and more dynamics:

Oscar gave us some good information on its planned ACA expansion: (Link)

Humana’s CEO Bruce Broussard will step down in 2024 to be replaced by Envision’s Jim Rechtin (yes THAT Envision). (Link)

Partnerships and Product Announcements:

AdventHealth’s Primary Care Network in Florida partnered with Wellvana to help the health system transition its primary care services into value-based care arrangements. (Link)

Walmart is rolling out Included Health’s telehealth services to its employees nationwide…but I have to wonder what happened to Walmart’s acquisition of telehealth platform MeMD and subsequent rebranding to Walmart Health Virtual Care? It seemed as if that’s scaled enough to provide this level of support, so Included must have a solid offering given the two have worked together since 2016. (Link)

Highmark partnered with Spring Health to expand access to behavioral health services. (Link)

AndHealth joined forces with Lower Lights Health to address the specialty care access crisis in Ohio. (Link)

CHRISTUS Health expanded access to care in partnership with Conduit Health Partners. (Link)

Parsley Health launched a comprehensive gastrointestinal care program aimed at lowering costs for employers and plan sponsors nationwide. (Link)

Cedars-Sinai and K Health introduced an AI-driven virtual care app for new and existing patients in California. (Link)

Luna unveiled value-based products to reduce the cost of musculoskeletal care and improve outcomes. (Link)

Headspace collaborated with Oura to develop a high-tech approach for managing stress and mental wellness. (Link)

Blue Cross Blue Shield of Massachusetts expanded access to specialty care for its members. (Link)

Atrium decided to implement an AI ‘copilot’ across its hospital system. (Link)

Cedars-Sinai providers became accessible 24/7 via an online platform. (Link)

Dialyze Direct formed a strategic partnership with Northeast Georgia Health Ventures to bring home dialysis services to SNFs in Georgia. (Link)

Visana Health and WIN teamed up to offer women’s care and family-building benefits to each other’s patients. (Link)

Noom offered a clinical obesity management platform to employers. (Link)

Syra Health entered into a strategic partnership with Maricopa County to address healthcare disparities. (Link)

Alto Pharmacy and Mark Cuban Cost Plus Drug Company collaborated to deliver hundreds of low-cost medications to patients across the U.S. (Link

SPONSORED BY WEAVER

Beyond internal policies and procedures, healthcare providers are often required to generate, reconcile, and submit countless reports to stay in line with complex state, federal, and industry regulations.

And let me tell you…

It’s a lot of work.

That’s why Weaver helps organizations automate manual tasks, significantly reducing manual efforts associated with repetitive tasks.

To streamline your workflows, Weaver put together a great article to help you spot automation opportunities and optimize operational efficiency. Read More

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

Rite Aid filed for Chapter 11 bankruptcy protection. The struggling retail pharmacy player managed to secure $3.45B from existing lenders while it figures out how to right-size a sinking ship to the tune of $680M in losses and $8.6B in total debts. (Link)

Epic Systems generated $3.8B in 2022 revenue according to Forbes…which begs the question – if one of the most successful software firms ever to date, with overwhelming market share in the large health system market, ~35% market share in the acute care hospital market, and 48% of beds – makes $3.8B a year, what does that say for the entire healthcare vertical SaaS VC-backed market? Do we need to level-set expectations? (Link)

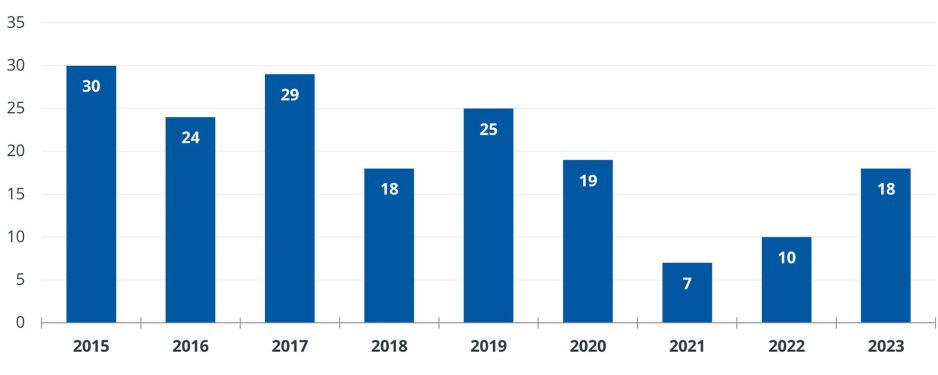

Kaufman Hall’s Q3 overview of hospital M&A activity. “Announced transaction activity remained high in Q3 2023, continuing this year’s trend of activity returning to pre-pandemic levels. Eighteen transactions were announced, well above the seven transactions announced in Q3 2021 and the 10 transactions announced in Q3 2022.” (Link)

KH noted that in 2023, transaction size dropped to pre-pandemic levels, and financial distress is a major factor this year, given recent margin pressures for health systems:

FTC is moving forward decisively on imposing a sweeping ban on noncompete clauses, as confirmed by the agency’s head. (Link)

Healthcare M&A volume saw a decline in the third quarter of 2023, according to acquisition data from LevinPro HC. (Link)

St. Luke’s and Aspirus Health based in Minnesota and Wisconsin respectively, formalized their previous merger LOI announcement by signing a definitive merger agreement this week. It’ll create a 19-hospital system in the region. (Link)

Evernorth plans to enhance MDLIVE’s virtual care experience for patients and clinicians by acquiring Bright.md. (Link)

Vitori Health acquired Flume Health’s TPA Operations. (Link)

Prime Healthcare is selling Alvarado Hospital Medical Center to UC San Diego Health. (Link)

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

Microsoft unveiled new generative AI products designed to aid health systems, marking continued significant advancement in the space. (Link)

Andreessen Horowitz provided insights on the commercialization of AI in healthcare, focusing on the perspective of the enterprise buyer. (Link)

Teladoc outlined its strategic priorities, with a focus on AI, mergers and acquisitions, and musculoskeletal health. (Link)

Cleveland Clinic collaborated with TikTok to enhance search capabilities, indicating a growing intersection between social media and healthcare. (Link)

Northwell Health established a Cardiovascular Institute aiming to revolutionize the delivery of heart care. (Link)

Fundraising Announcements:

- Capital Rx raised $50M (Link)

- Optimize Health raised $18M (Link)

- Good Doctor raised $10M (Link)

- Prevounce Health raised $7M (Link)

- MDisrupt raised $3M (Link)

Hospitalogy Top Reads

My favorite healthcare essays from the week

- Food For Thought: The Potential Ripple Effect of GLP1s

- Bessemer’s 2023 State of Health Tech report

- Betty Chang’s Digital Health Vendor Library

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)