Welcome to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 27,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)

Oak Street Health Growth Analysis

How has Oak Street Health’s growth trajectory and profitability changed throughout its life as a private, public, and now vertically integrated company? Since I have the data from its S-1 going all the way back to 2013, it’s a fun exercise to see how things have played out for one of the OG value-based care clinic models. If you want a full deep dive into Oak Street Health and CVS, I did that here!

This edition of Hospitalogy is sponsored by ADONIS

Mark your calendars for March 6th at 2:00 PM EST:

Adonis is hosting an exclusive 1:1 chat with me, where we’ll be delving into the pivotal trends and challenges poised to redefine financial success in healthcare for 2024 and beyond.

This session will be a first-of-its-kind opportunity to access findings from our comprehensive research involving 100+ Finance, Operations, and Revenue leaders.

Expect in-depth discussions on evolving cost management, enhancing patient experiences, achieving sustainable growth, and the innovative strides in RCM and AI that are setting the pace for excellence.

Register today and be at the forefront of healthcare financial innovation – you won’t want to miss it!

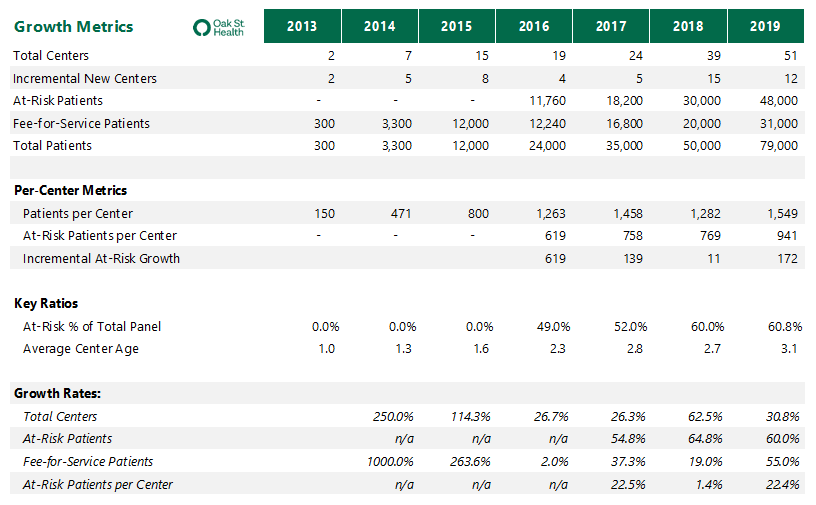

Oak Street Health’s Private Life

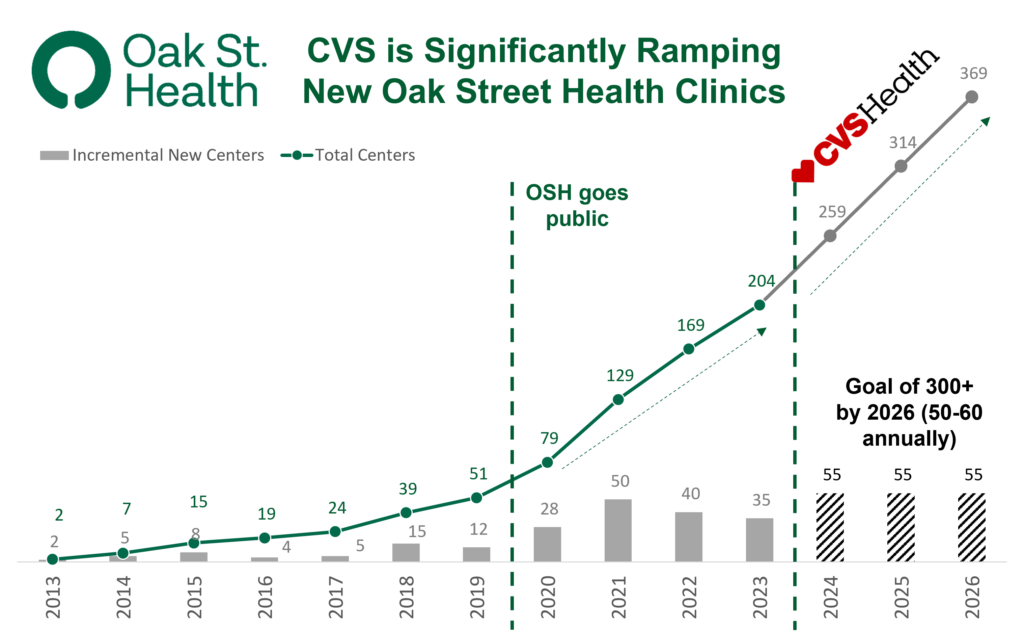

This section of growth is most relevant for founders in the space – what kind of growth did Oak Street Health (OSH) manage when going from 0 to 1? Albeit in a low interest rate environment, OSH launched with 2 clinics and grew to 51 by the end of 2019, its last year as a privately backed company:

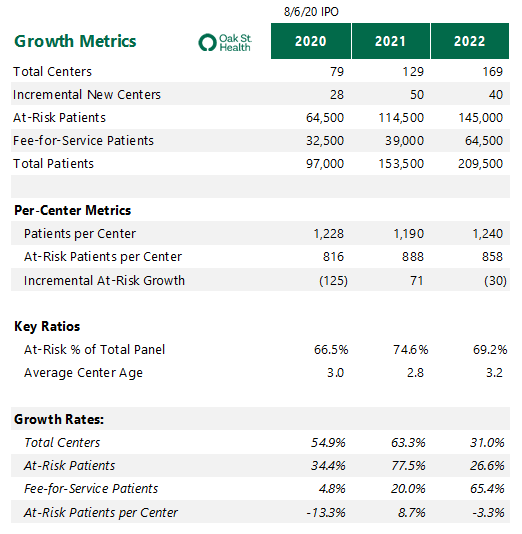

Going Public

Oak Street Health IPO’d in late 2020 and you can see the quick ramp up in planned clinic growth, scaling from 79 clinics in 2020 to 169 by the end of 2022. In its first 6 years of operations, OSH hit 51 centers. With public capital, the advanced primary care firm grew by 50 centers in just one year:

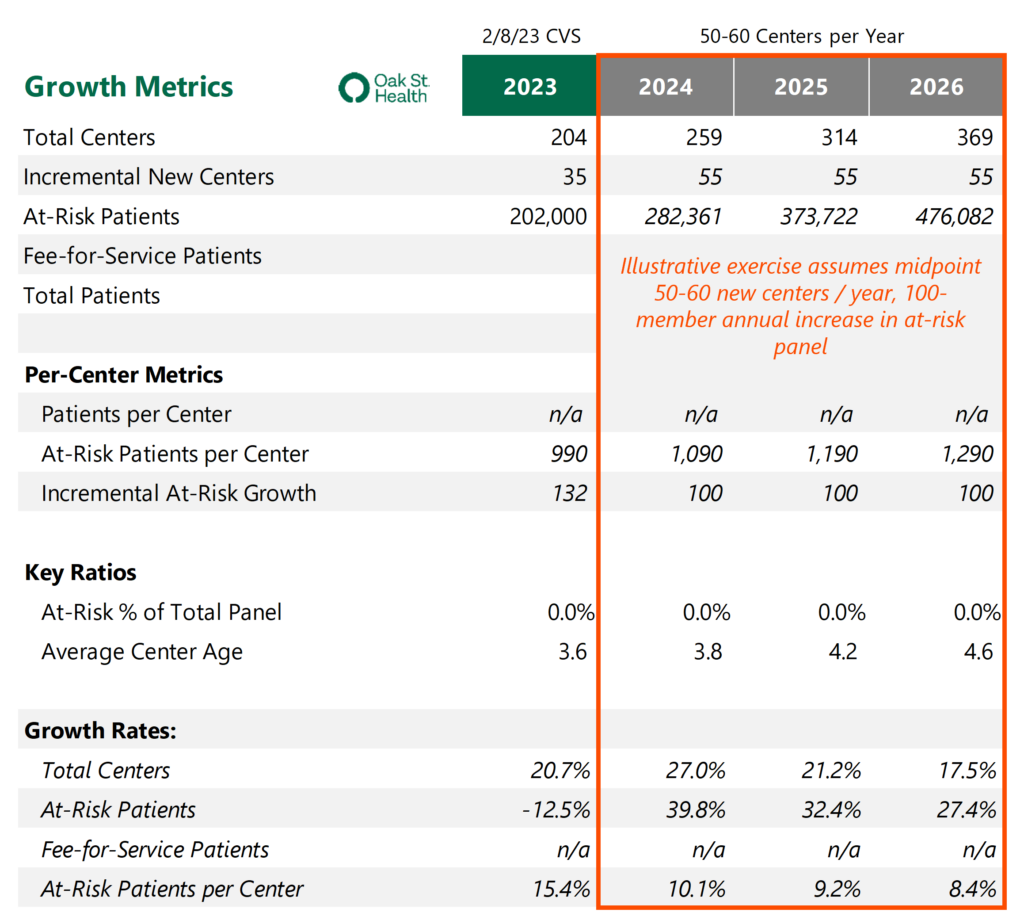

CVS has the Juice

Now, here’s where we are today. CVS wants to pump capital into de-novo Oak Street Health clinics to the tune of 50-60 per year through 2026. As a private company absorbed into a larger corporation with a massive revenue base, Oak Street Health has a much larger runway to scale without necessarily worrying about profitability and quarterly investor sentiment.

CVS also recognizes the potential of scaling Oak Street Health and the embedded economics OSH presents once the majority of its clinics reach maturity of patient panels (e.g., at-risk patients over a critical threshold, and center age is 6+ years).

- “We also recognize the tremendous opportunity to scale Oak Street’s clinics to reach more seniors across the nation. At their current rate of expansion, we expect Oak Street to have over 300 clinics by 2026, at which point we project they will have more than $2 billion of embedded Oak Street adjusted EBITDA.”

From public capital to private strategic priorities, CVS is going all-in on Oak Street Health. Even with the projected growth, there’s probably more demand for advanced senior primary care services than there is supply:

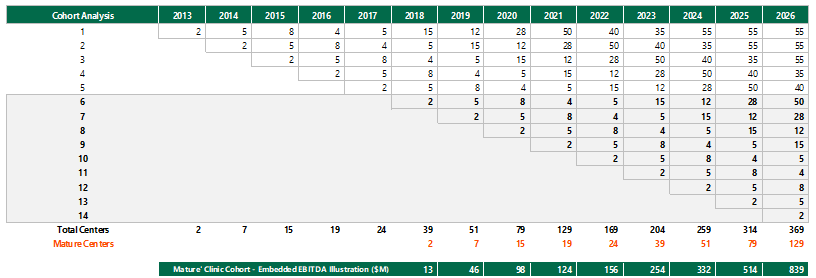

Embedded EBITDA Economics: Applying CVS’ thesis to cold hard financial numbers, I put together an illustrative exercise seeing what CVS might want to see happen in their Oak Street Health clinics. Keep in mind that Oak Street Health, as a growing public company, noted that true clinic level profitability doesn’t really start to take off until that particular clinic reaches a ‘mature’ state at 6+ years. Some of Oak Street Health’s initial clinic cohorts (granted, probably in the most attractive markets) have hit $7M-8M+ in EBITDA.

Extrapolating this out to 2026 and assuming all engines go, OSH will have 129+ mature clinics. For sake of a bit of conservatism, assuming fully embedded EBITDA of $6.5M per center, this cohort will hit ~$849M in profitability.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

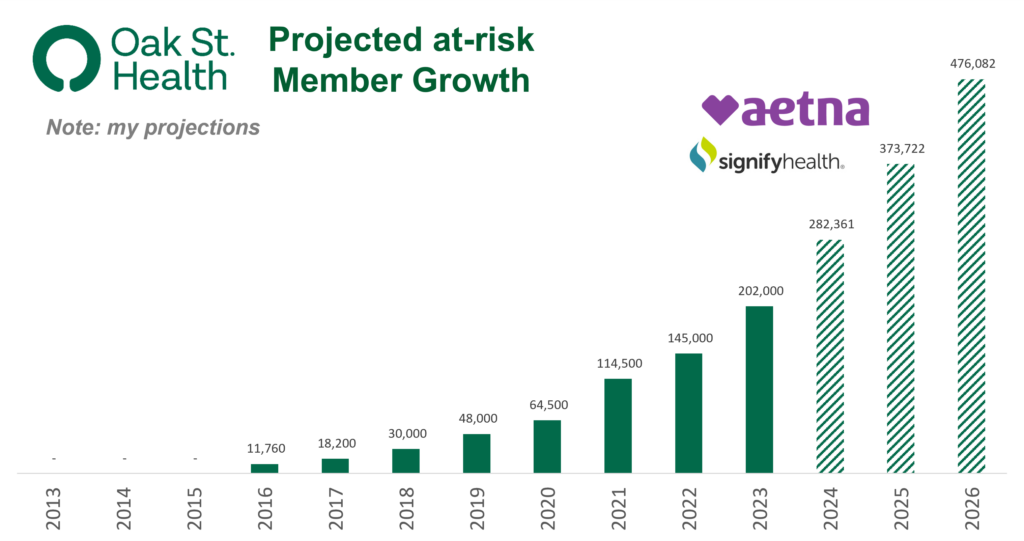

Now consider CVS’ $10.6B purchase price in context. There’s more to the story. CVS thinks it can cut this ‘maturity’ J-curve a significant amount by juicing at-risk panel growth with Aetna members or through in-home assessments with Signify Health, lowering acquisition costs.

- “We project in 2024 that 95% of our centers that were open in 2021 and prior will be profitable, which was about over 120 of the 129 centers at that time. More importantly, of our 39 centers that are in kind of our year 6 or more mature, those will have between $6 million and $7 million of clinic level profitability. And finally, for our centers with over 2,000 at-risk patients, which we refer to as our mature centers, still some growth opportunity, but getting close to full. Those centers will have over $8 million [of clinic level profitability]…”

Adding to this, CVS can introduce more elements to the OSH care model, perhaps by using its pharmacists and pharmacy techs for patient engagement and medication adherence purposes. Doing so would also boost its script growth, helping boost financials across its enterprise.

- “We project that our investment in Oak Street will drive double-digit returns on invested capital over time as clinics mature and synergies are realized.”

Key Takeaways: Oak Street Health is Paramount to CVS’ Future Success

In 2024, CVS priced its MA plans low to maximize member growth, adding 800,000 lives signaling to me they believe in the OSH-Signify-Pharmacy flywheel long-term.

To me, Oak Street Health’s high-touch clinic model with high-needs, chronic patients is the linchpin in the flywheel to drive overall organizational success by keeping patients within the CVS model across health plan, PBM, pharmacy, and care delivery.

Adding to the above, Oak Street Health’s main business goals from day 1 aimed to lower total cost of care by preventing unnecessary acute events and managing chronic disease, all while providing a better patient experience. All of these goals hit on major financial objectives for CVS over the coming years including the largest near-term lever: boosting its MA plan star ratings.

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 27,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)