Hospitalogists,

I’m excited to co-publish this piece alongside Unlock Health’s Chief Revenue Strategy & Managed Care Officer, Kevin Thilborger – an expert in the space with decades of strategy and advisory experience.

Kevin works at Unlock Health (Unlock), which is an end-to-end strategic growth marketing agency with extensive experience across provider organizations and risk bearing organizations. Given their unique positioning in healthcare, Kevin has held ongoing, interesting conversations with payor and provider executives across healthcare and wants to share findings from those conversations with the Hospitalogy audience. Thanks to Unlock for sponsoring this collaborative article, and I think you guys will benefit from the discussion!

Bottom line – there are 3 pressing pain points facing health systems and other provider organizations in 2024 across patient acquisition strategies, accurately validating return on investment (ROI) for strategic initiatives, and finally, finding flexibility to respond to the volatile, rapidly changing healthcare landscape today amid a rise in competitors, vertical integration, and more.

These challenges are pressing across almost every provider organization Kevin talked or worked with. Along with identifying the challenges, we’ll share Unlock’s considerations for tackling these problems with best practices and strategic growth in mind.

Let’s dive in.

1) Patient Acquisition Headaches: Not Getting the Right Patients or Enough Patients Through the Door

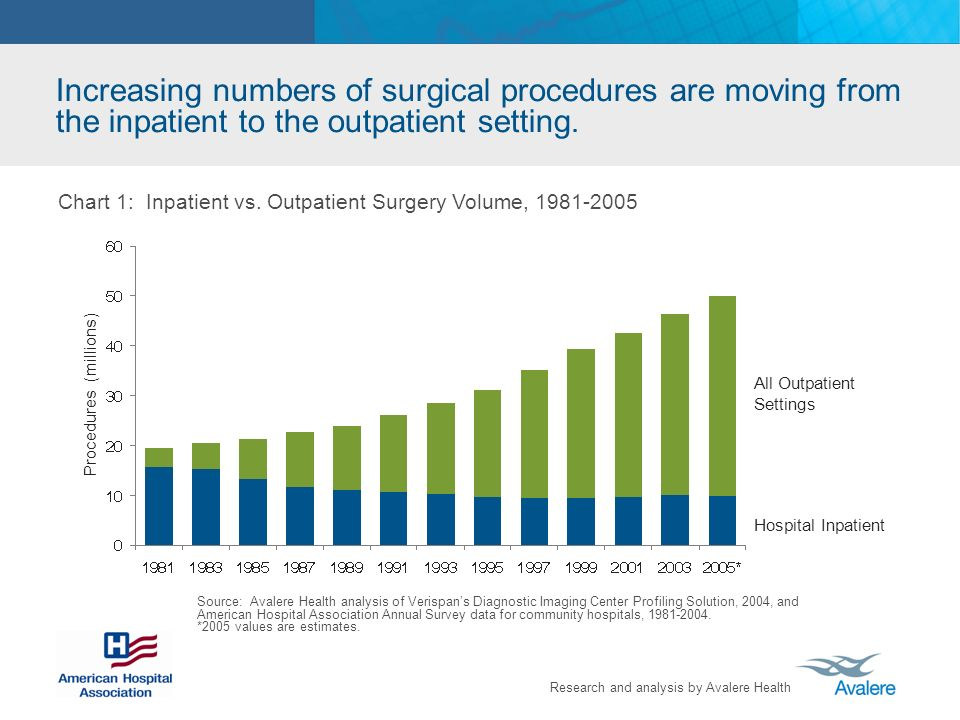

I’ve covered plenty of times on Hospitalogy the number of threats provider organizations face from a competitive standpoint. Accelerating outpatient migration is leading to more intense competition given the lower barriers to entry in order to stand up an offering on outpatient services. Unprecedented financial challenges over the last number of years for providers in almost every market means that it’s more important than ever to meet volume and revenue benchmarks. From a qualitative standpoint, health systems are increasingly combating rampant distrust of healthcare institutions.

Source: American Hospital Association

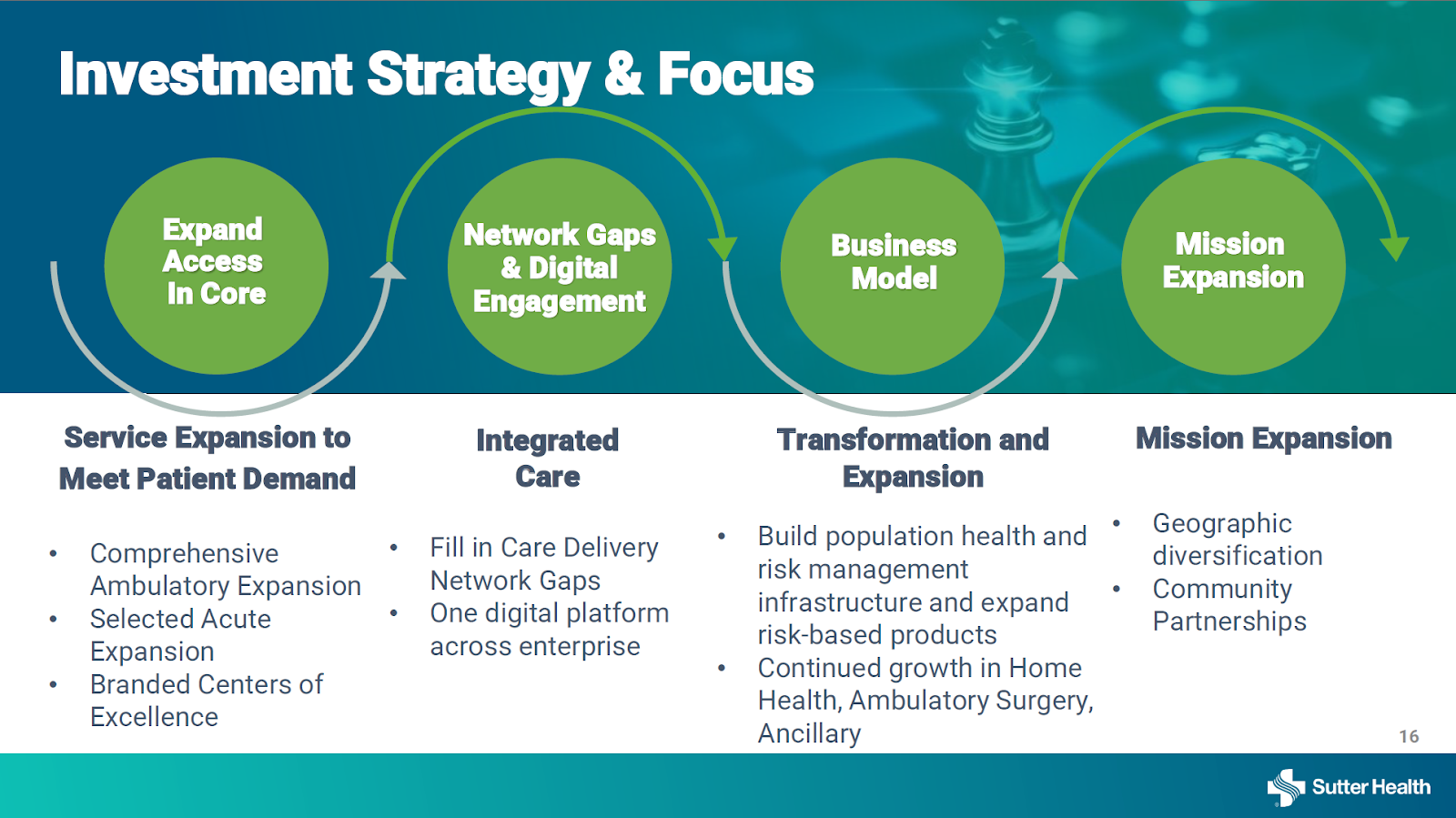

For these reasons, we’ve seen health systems double down on their ambulatory footprint to prevent network leakage. Physician alignment, smaller neighborhood ‘micro’ hospitals, ASC development, urgent care acquisitions and joint ventures, and care navigation strategies are all top of mind for provider organizations to maintain competitive market share, boost their brand in local communities, and generate patient trust to walk through their doors.

Source: Sutter Health JP Morgan Healthcare Conference 2024 Presentation

Additionally, the front door for health systems is increasingly digital using telehealth, website access, patient-friendly, contextualized information, and more. With rising consumerization, it’s more important than ever to meet patients where they are and provide trustworthy, timely access to information.

So what’s the best path forward for your organization?

Unlock has seen a distinct differentiation between provider organizations that have cohesive, effective marketing strategies for patient acquisition compared to those that haven’t made it a definitive organizational priority.There’s a clear opportunity for you to work with someone like Unlock that does the data-driven dirty work to A) understand where your revenue is coming from (revenue & payor mix), B) dive into operating and market share data to identify and target the right patient populations given your offerings or service lines, and C) develop and execute a thoughtful marketing strategy more confidently around smarter data-driven decisions.

2) Give me the Numbers: Flying Blind Trying to Measure ROI

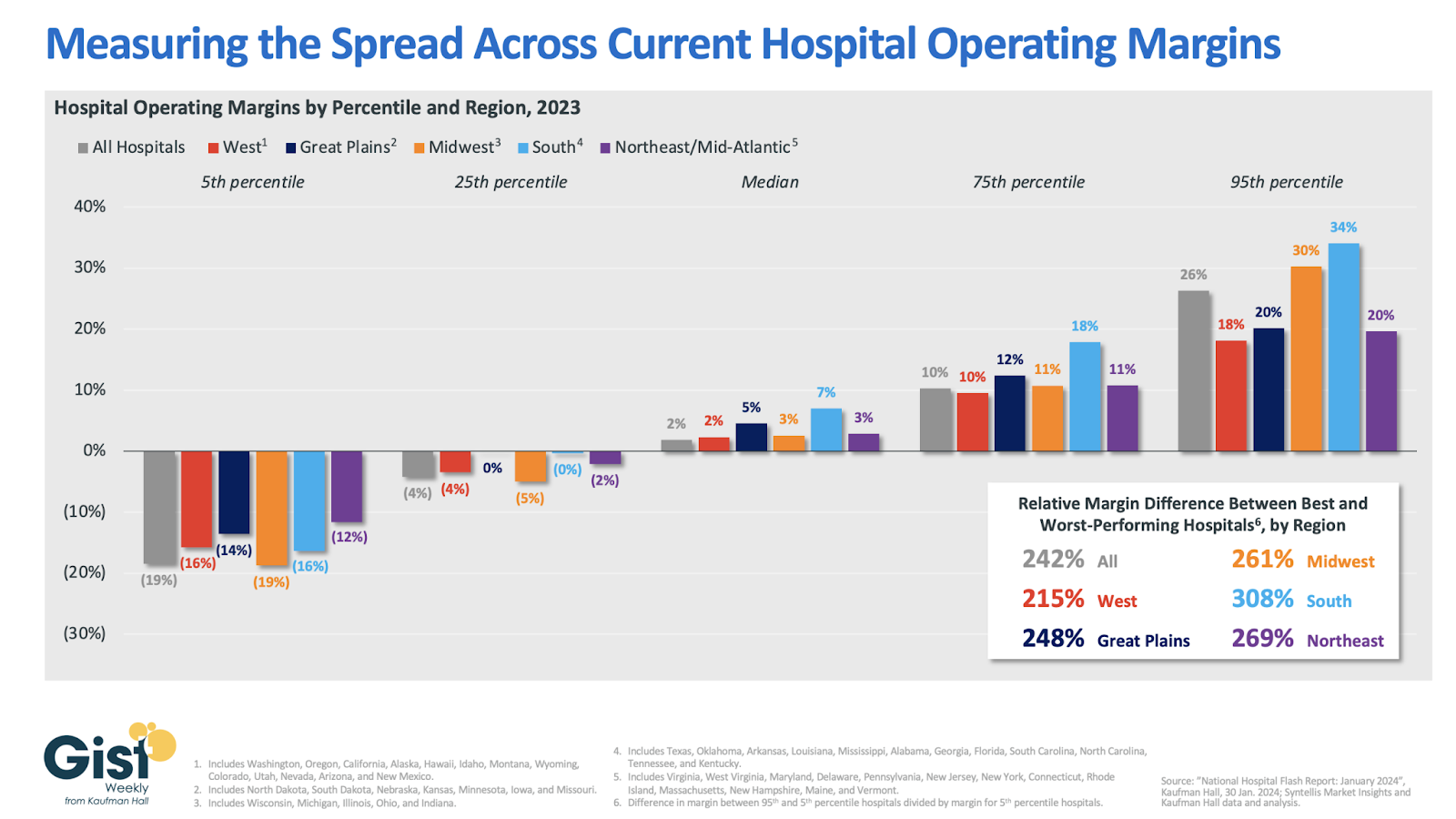

A recent fascinating Gist Healthcare graphic shed light on the dynamic that Kaufman Hall has characterized as a ‘bifurcation’ of health system performance:

Source: Gist Healthcare

And as I’ve brought up in past Hospitalogy sends, providers are having to do more with less in 2024. While utilization is on the rise, so many health systems are still struggling with labor capacity, supply inflation, and professional services expense growth.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Given all of these financial challenges providers/systems are facing, how do you invest in new technology or new initiatives if there’s not a clear way to measure ROI? This dynamic is a huge pain point for payor & provider leaders, as you need to justify the cost of your investment dollars for each and every move you make within the organization. The stakes are high.

Despite this need for clear ROI validation organizationally, very few (if any) systems are able to accurately measure ROI and understand the value behind their investments. The ability to create a full funnel picture of ROI in-house is extremely challenging given disparate systems and a lack of dedicated resources. Systems are relying on limited, cobbled-together, and/or incomplete sources that don’t necessarily produce visibility into reliable ROI data that connects the dots from marketing investment to patient acquisition, which can hinder the ability to develop effective strategy.

In Unlock’s experience, it’s better (and more preferable from an executive’s standpoint) to work with one integrated platform solution that offers everything you need, rather than that cobbled-together offering of vendors & point solutions.

Healthcare in general is moving away from that, point solutions are consolidating, and Unlock has a great end-to-end technology platform that integrates systems and provides actionable, CFO-defensible ROI.

3) How Do We React to Ongoing Industry Change?

As with the above issues, in 2024, things are volatile. While we’ve touched on provider organization challenges, there are plenty of headwinds on the payor and risk side as well – from Medicare Advantage, to vertical integration dynamics, to an unexpected rise in utilization, and even how best to implement AI. Even more uncertainty exists for risk-bearing entities.

Medicare Advantage headwinds include but certainly are not limited to star rating declines, enrollment growth deceleration, a proposed decline in rates for 2025, competitive pricing, and of course, risk adjustment changes.

- Humana management publicly commented on the state of MA, saying the managed care giant doesn’t know how the industry as a whole can withstand “this kind of increase in utilization, along with regulatory changes that will continue to persist in 2025 and 2026.”

- Adding to this, Humana noted “The Medicare Advantage sector is navigating a complex and dynamic period of change as we are all working through significant regulatory changes while also absorbing unprecedented increases in medical cost trends.” – Humana Q4 2023 earnings call

The rest of healthcare isn’t immune to these changes, either. All of these changes are trickling down to enablement players and other risk-bearing organizations as well. On the provider side, health systems and other providers are having to deal with an uptick in utilization management, prior authorization, and tougher rate negotiations on both MA and commercial contracts.

So, the time to prove out business models – including what’s actually competitive and differentiated versus what isn’t – is now. Understanding the present and future pain everyone in the broader managed care environment is facing is key to a successful managed care strategy, whether you’re a payor or provider.

A distinct part of that differentiation lies in working with individuals like Kevin and Unlock experienced in complex revenue and managed care strategies. As with the first two pain points, Unlock’s end-to-end solution also works with your organization to analyze payor contracts, identify areas of concern, and facilitate seamless discussion around hairy communications like contract negotiation and network participation. Based on folks both Kevin and I have talked to, these discussions are more contentious than ever and as a result we’ve seen an uptick in health systems going out of network with both MA and commercial payors.

Along with this friction, price transparency and the public publishing of negotiated rates is quietly starting to wreak havoc within these conversations. Knowing how to navigate price transparency files will be paramount to organizational success in 2024 and beyond.

In a Rapidly Evolving Industry, Don’t be afraid to ask for help

Whether you’re on the payor or health system side of the equation, it’s hard to keep up with the constantly changing industry. Hopefully this essay and diving into these pain points and a discussion around potential strategies has been helpful. But it’s not a sign of weakness to ask for help and develop best practices from consultants and industry veterans who have walked the walk. I enjoyed chatting with the Unlock team, and someone like Kevin would be a great person to talk to if you have any questions around problems your organization is facing, or the differentiated work Unlock does for their healthcare-specific client base!

Thanks for reading! Until next time,

Blake Madden & Kevin Thilborger

Kevin Thilborger’s biography:

Kevin Thilborger has led activities for health plan and health system services, nationally assisting clients in their transformation to value-based care. He has worked with all sizes of health systems and provider types including multi-state Academic Medical Centers assessing and implementing fee-for-service, pay for performance and capitation contracts across the United States. He has also advised and implemented changes in national, regional and local health plans in Medicare, Medicaid, and commercial business.

Kevin has over 25 years of health care industry experience working for medical groups, insurance carriers, and consulting firms on turn-around strategies, managed care negotiations, direct-to-employer arrangements, and overall operations improvements.

About Unlock Health

Unlock Health is the industry’s only agency that combines experts in managed care, marketing, and technology to create a one-stop shop approach to strategic growth. Our comprehensive team of experienced professionals are among the best and brightest – melding together the full spectrum of disciplines healthcare organizations need to determine, achieve, and prove insightfully informed growth goals and CFO-credible ROI. From transformative data and research findings to compelling storytelling and game-changing creative, Unlock is an unmatched partner for empowering growth.