Maven Clinic’s $125M Series F: The Journey so far, and the Road Ahead

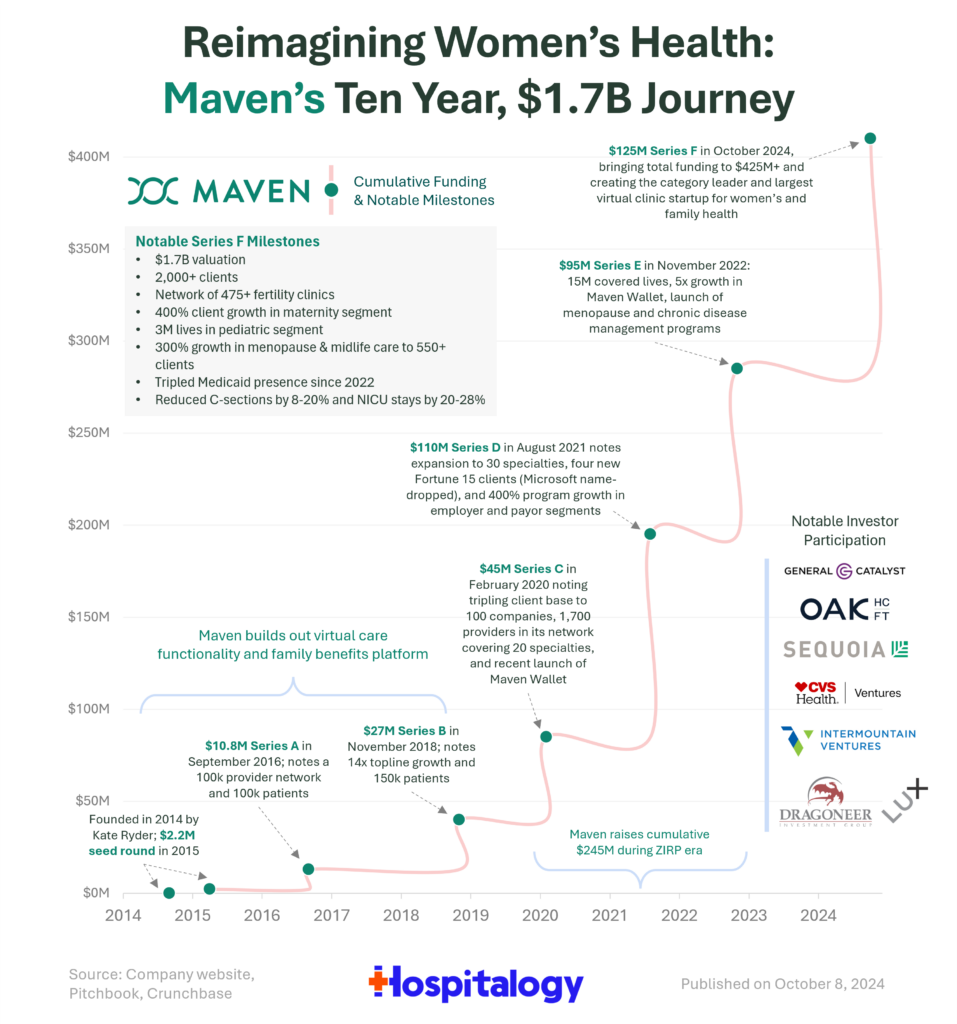

Maven Clinic, a leading tech-enabled women and family health startup, announced its $125M Series F today at a $1.7B valuation, and there were some interesting tidbits in its launch announcement about where Maven has been, but also where it’s headed over the next 10 years.

- Quick breakdown of Maven’s Business Model – Health benefits administration and virtual care delivery dedicated to women and families: Women’s health & maternity are high cost for employers, and women and families experience fragmented, disconnected care. Maven wants to deliver better maternal outcomes end-to-end – from fertility to menopause & beyond – by leveraging 24/7 virtual care, fertility, mental health, doulas, nutrition, PT, and access to specialists. Doing so enables Maven to take full risk on total cost of care (generating savings through reduced NICU visits, better mental health, quicker return-to-work, lower-cost fertility treatment) while also serving employers through health benefits (fertility, HSA, FSA) administration. Maven targets employers and health plans for its services and works with 2,000+ clients to date.

Maven also laid out its 10-year roadmap, stating they’ve just ‘scratched the surface’ of the 4T healthcare industry (I know you marketers were chomping at the bit to include that number in there somewhere). Apart from the buzz, Maven has some pretty interesting stuff planned and ongoing in the space, innovating and changing women’s and family health in a few ways, including a focus on 3 levers they outlined as follows:

- We are evolving payment methodologies & fertility benefits administration in a way that aligns much better with what patients want and need – and we’re doing it in deep partnership with the payers and provider groups

- We are nailing, once and for all, value-based care models for maternity care – again in lockstep with the nation’s largest payers and provider groups who want to change the status quo

- We are dramatically moving the needle on patient experience and engagement globally, empowered by AI and technology, to meet a wide range of patients (across countries, geographies, and socioeconomic bands) with the support they need, in the way they need it

So let’s dive into those real quick from Maven’s perspective.

Fertility benefits administration: through its Maven Managed Benefit (MMB) – it’s no surprise why Maven mentioned further investment in its fertility benefits administration platform as the first expected use of capital. Fertility treatment is expensive. Plenty of margin for the taking in fertility which is why you’re seeing both VC and PE dollars flood the space – though much of this activity may be focused on IVF, whereas Maven aims to support fertility pathways without IVF to drive comparable savings. This offering is likely much more scalable and profitable than is value-based care delivery and taking on full risk. Maven noted 25% of its fertility members get pregnant without IVF. Finally, Maven’s growth of MMB is impressive – it has become the “largest fertility benefits provider globally by lives under management.”

Value-based maternity care – Maven Maternity: given the episodic nature of giving birth and the disconnected state of various healthcare personnel beyond just the doctor and nurses (mental health, pelvic floor therapists, doulas, sleep coaches, etc.), Maven connects these individuals and layers on its tech with real-time data to create a care team with the right level of engagement and resources to support the expecting mother, and importantly, does so in a culturally competent way. To these points, Maven has hit up to 28% reductions in NICU stays for newborns and has also reduced C-sections. Maven will continue to put capital into both fully insured and Medicaid populations (notably missing: calling out the commercial segment) where states or payors support its programs. This is Maven’s bread and butter as 90% of Maven clients offer its maternity program.

Postpartum Care and Return to Work: Here’s where Mavin gets it, and having recently lived (and living) this experience, Maven’s messaging resonated with me. Maven extends support beyond birth, where after 1-3 days the hospital hands you your child and says “good luck, see you at your follow-up OB/GYN appointment!” That’s…terrifying. And having access to 24/7 care and specialists to boot would’ve been a game changer during that time.

Menopause & Midlife Support: its care delivery segment launched during 2022 to women dealing with midlife health issues or chronic diseases, and Maven’s fastest growing care delivery segment noting 300% YoY growth.

Patient Experience and Engagement: Topline numbers of how many covered lives you hold are sexy, but increasingly unimportant in today’s digital health ecosystem as partners need to deliver material value to employers and payors to prove their worth. Now more than ever, you need to be able to engage with members and provide them with a delightful experience – how many touchpoints with patients? Is behavior changing? Can you provide better, actionable data in real time to drive meaningful results? Maven will have to answer these questions as it continues to move into this sphere across its portfolio of products.

- “We’ve been in this space long enough to remember when people worried robots would one day replace doctors. As AI overtakes the headlines, we know advanced technologies are meant to play a different role than human caregivers, and will not replace them in many circumstances. They will, however, dramatically improve those interactions, by sharpening our ability to synthesize the “so what” of a wide range of conversations and data points (clinical and non-clinical), leading to needle-in-a-haystack type insights that fundamentally change care quality.” – hell yeah.

When my wife and I (let’s be honest…really just my wife) were going through pregnancy and birth, I could understand why a business like Maven exists. Healthcare professionals do an amazing job, but layering on additional tools, resources, and support would go a long way to make a patient feel cared for and supported along the way, improve patient outcomes, bring more babies into the world (a true joy of humanity), and of course, tack on some additional revenue streams.

Turning to strictly business, and all of that rosiness aside, Maven has some questions to answer in finance and valuation land.

Here are some of my questions given the late stage Series F raise, raising $200M+ during zero interest rate environments, and the $1.7B unicorn valuation, in very similar fashion to Sword Health’s price tag and the looming Hinge/Omada IPOs:

- Maven is a VC-backed company. What’s the exit strategy and who are the buyers? In total, Maven has raised $425M+. Will Maven eventually exit to a large payor or other employer-focused strategic, go public, or flip to PE for continued rollup and capital support?

- As you can see in the graphic, Maven raised an extremely large sum during the ZIRP (zero interest rate policy) era. Does the current $1.7B valuation make the problem worse or appropriately value the company for what it is & could be?

- Series F is super late stage – has Maven built a sustainable, cash-flowing operation? And on this note, we’re seeing a growing number of late-stage health tech companies poised to hit public markets or enter the next phase of their journey

- What’s the current state of value-based care and taking on full risk? It’s pretty capital intensive. For that reason I’d maybe expect to see Maven shift more to employers.

- How will Maven leverage AI???? (kidding) but also they hinted toward it near the bottom of the website release.

- Which celebrity will invest in Maven next?? (also kidding)

I’m a huge supporter of Maven and other focused models like Maven working to bring concierge level care at scale in a fragmented healthcare system. I love everything they’re about. I just worry we’re repeating the valuation and business sins of the past, and wonder if we’ve learned from our mistakes in health tech venture capital land. Shout out to women-led founders, and shout out to the great commercial success Maven has seen so far during its 10 year journey.

Resources

Series A announcement

Series B announcement

Series C announcement

Series D announcement

Series E announcement

Series F announcement

- Maven’s latest post on its Series F and 10 year roadmap

Built in NYC article on Maven