One quick ask: I’m trying to hit 50,000 subscribers by the end of the year. If you could share Hospitalogy with a colleague I would greatly appreciate it!!

And if you’ve missed my recent Hospitalogy emails and announcements, I recently revamped my community offering – including new pricing tiers and better benefits. I’m gathering a great group of folks working in health system strategy, corporate development and similar functions.

If you’re a VP or Director working at a health system or provider organization, you will get a lot of value out of the community as the content, fireside chats, and conversations all revolve around the latest developments in health system transformation.

It’s free to apply to and check out – only pay if you want to (though it’s a great value!). Apply to join here!

CommonSpirit Health’s 2024: a year of Portfolio Realignment

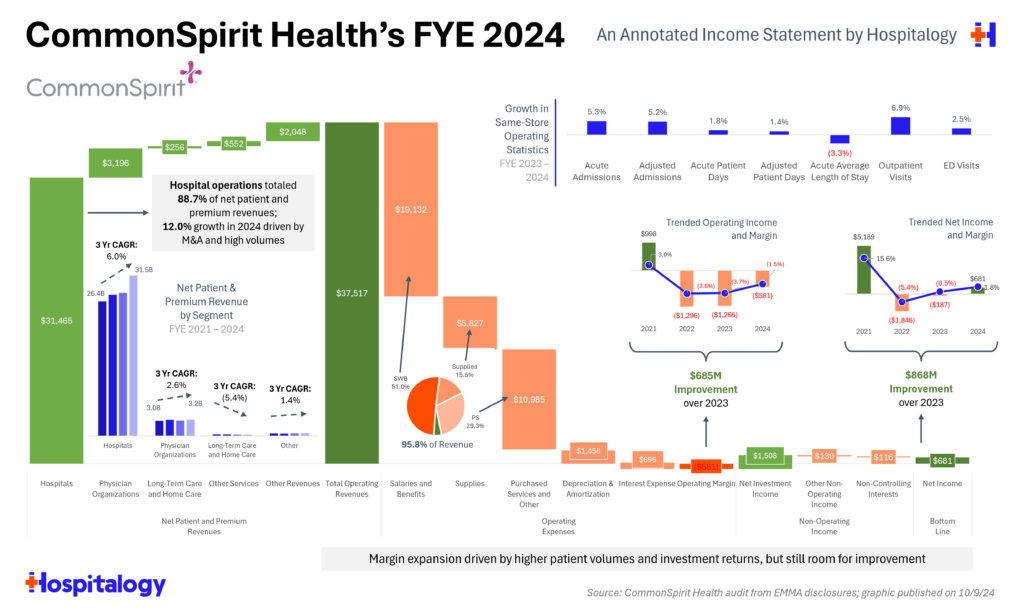

As the largest pure-play nonprofit health system, CommonSpirit Health (CS) released its 2024 annual financial and operating results with some good tidbits for Hospitalogists on health system transformation and other strategic goals.

Here’s a quick overview of how CS fared in 2024 – and as a reminder, their fiscal year ends June 30, 2024:

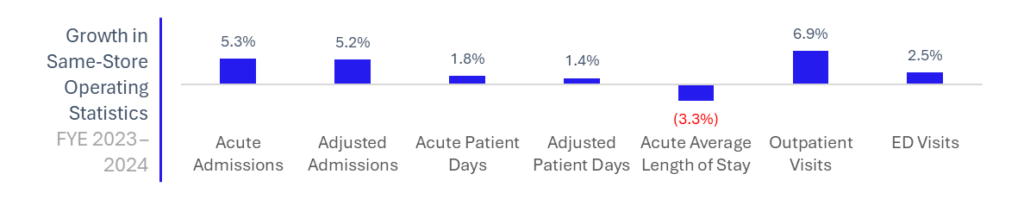

Zooming in on various important aspects, highlights from CS’ 2024 include strong patient related revenue growth (11.4%) buoyed by recent hospital acquisitions, high patient volumes, efficient throughput (drop in length of stay) and favorable payor mix. Same store volumes displayed strength across the portfolio:

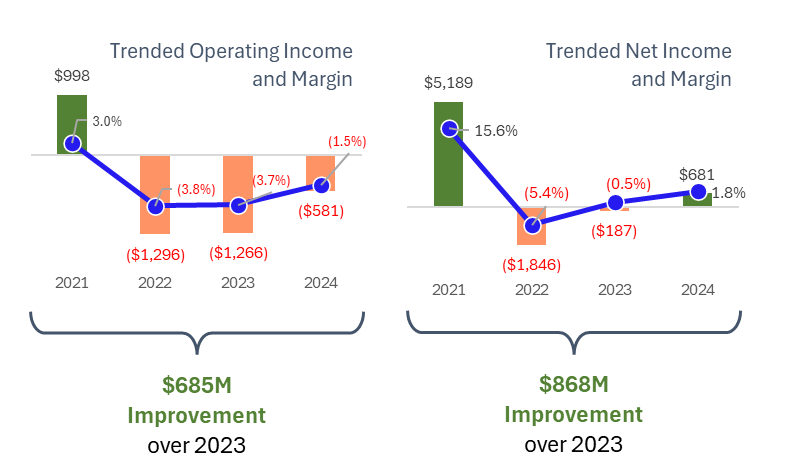

Despite all of these improvements, CommonSpirit still squeaked out a negative operating margin – (1.5%) as it continues to recover from the pandemic environment, it continues to realign its operating footprint around key markets, and its expenses continue to right-size from ongoing cost-saving initiatives.

Investment returns once again saved the day on the net income side of things, generating ~$1.5B in marked-to-market gains and strengthening the balance sheet.

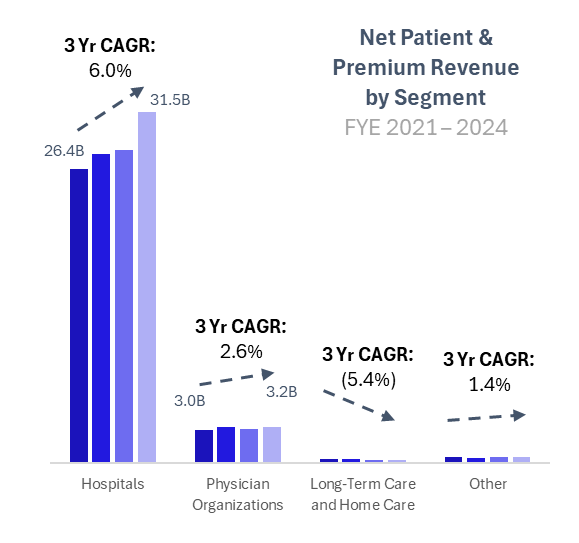

Turning over to revenue by segment, I went back a few years to analyze a 3-year growth trajectory for CommonSpirit. Its hospital and physician segments are doing decently, while its ancillary segments have either taken a hit, lost funds (pandemic relief funding) or have been divested.

Look at this huge chunk of change gained in 2024 from recent hospital acquisitions (5 in Utah from Steward, Centura Health unwind):

Turning to strategy overview, CommonSpirit’s bondholder call was interesting. I’m not sure how many other health systems put on an investor call like this but it was very informative about its strategy & finances in similar fashion to a publicly traded hospital. There are some good thoughts included in this summary, but here are my main takeaways:

- CommonSpirit added 56 ambulatory sites in fiscal 2024 and consolidated its reporting divisions to 5 key regions

- With a Capex budget of ~$1.9B, CommonSpirit is taking a system-level, top-down approach to strategic priorities across its portfolio in line with its One CommonSpirit 2026 roadmap

- On the inpatient side, CommonSpirit is focused on adding beds where it makes sense – in higher acuity areas and in markets where demographics support growth in a setting with little to no growth

- From a transformation perspective, CommonSpirit is taking a market-by-market approach to growth across hospital expansion, physician alignment, and ambulatory access including cancer centers and behavioral health, which looks to be a point of emphasis for many health systems in 2025.

- Specifically called out its recent acquisition / portfolio realignment of Centura and partnership with Kaiser.

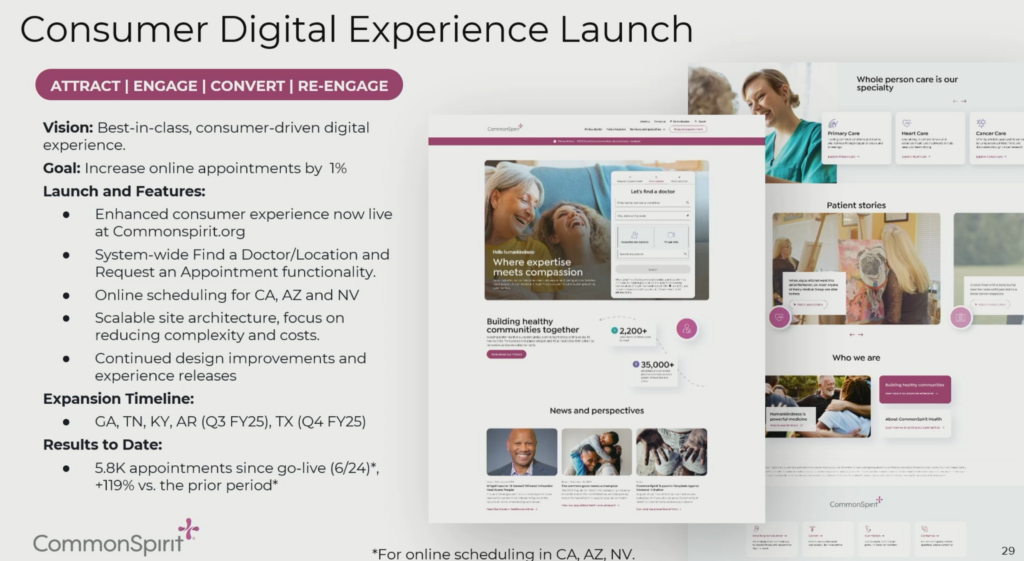

- Beyond pure services, CS is concentrating its capital into data and infrastructure improvement (digital front door and consumer-centric investment):

Cost containment and callouts on future opportunities for growth include the current favorable payor mix shift; strong patient volume growth and length of stay improvement; contract labor decreasing another 10%, and operating efficiency on the cost side – $580M in value capture initiative (operating expense performance – RCM process improvement, supply chain, payor contracting, pharmacy, and purchased services)

Finally, and already noted by me above, CommonSpirit saw strong investment returns in 2024 resulting in a stronger balance sheet and a strong shift to the green on a net income basis.

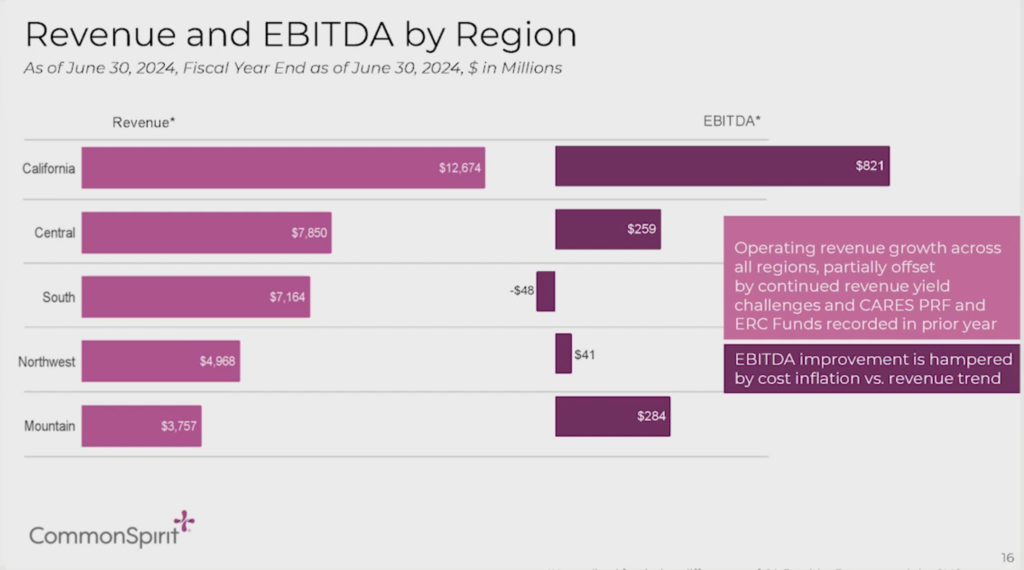

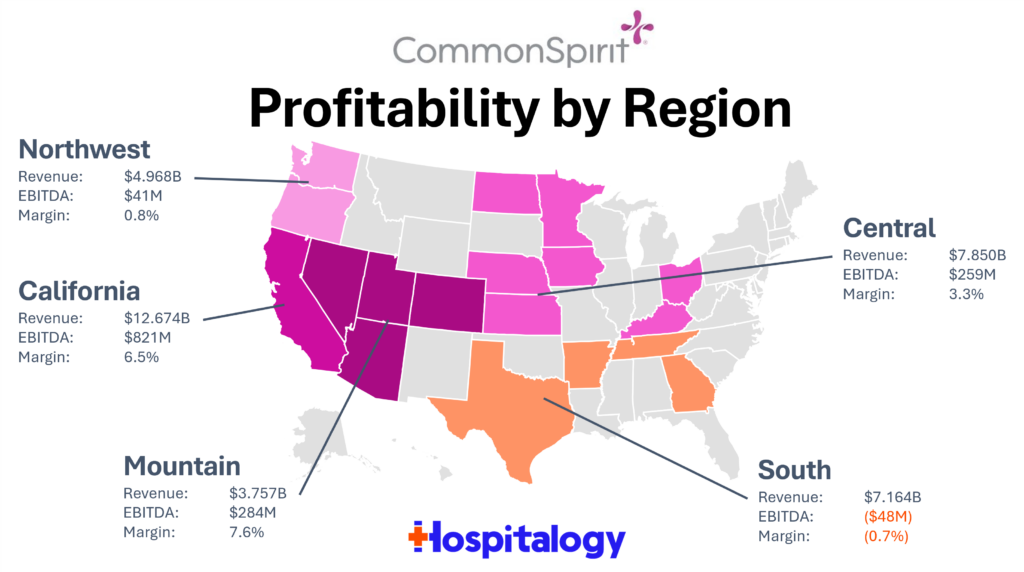

Here’s a final slide I thought was interesting, which is revenue and EBITDA by region for CommonSpirit. California and Colorado / Mountain outperform on a margin perspective by a sizable gap.

Here’s a better visual the CommonSpirit team can feel free to use:

(note that I went back and forth on including Arizona in Mountain or South as I couldn’t find a region breakdown by state for CS).

Interestingly, CommonSpirit noted its intention to move to a single EHR – Epic – and is moving the South region over first by June 2025 as a part of its larger One CommonSpirit strategy laid out by 2026, which includes things like IT & digital front door transformation, better revenue cycle management, operating model consolidation, cultural flourishment, and more.

Recent M&A

Finally, here were some notable acquisitions and divestitures CommonSpirit called out, including its most recent sale to UCSF, unwinding Centura Health, and purchasing 5 hospitals in Utah from Steward (after HCA’s bid for the hospitals fell through due to FTC involvement):

- February 2024: CommonSpirit transferred two hospitals and associated clinics in San Francisco to the University of California – San Francisco Health. The transfer was finalized in August 2024.

- August 2023: CommonSpirit and AdventHealth unwind Centura Health. CommonSpirit now manages its hospitals and clinics in Colorado, western Kansas, and Utah, while AdventHealth operates its facilities in Colorado.

- May 2023: CommonSpirit’s Centura Health acquired five hospitals in Utah, over 40 clinics, and ambulatory services, for $705 million from Steward. Additionally, they initiated a 15-year master lease agreement for the real estate, with minimum annual payments of $95 million.

- September 2022: CommonSpirit sold MercyOne, a JOA between CommonSpirit and Trinity in Iowa, to Trinity Health for $613 million.

That’s it for the breakdown on the largest nonprofit in the U.S. – though that title may slip from its grasp in the coming years. We’ll see!

Recent, Notable Fundraises

- Abridge reportedly raises $250M (!) at a $2.5B (!!) valuation.

- Healthie raises $23M in a Series B to continue building its ONC-certified EHR + marketplace for longitudinal care.

- Alchemy raises $31M in a seed round (!!!) to help scale pharmacy operations at FQHCs and similar facilities with a focus on HIV and Hep C populations.

Notable Finance and M&A

- For-profit M&A involves 26 hospital deals, including HCA, Tenet, CHS, and UHS.

- Catholic Medical Center will be acquired by HCA.

- Atlantic Health System announces a strategic partnership with Saint Peter’s Healthcare System.

- U.S. Physical Therapy announces the acquisition of a 50-clinic physical therapy management services organization.

- OneOncology closes its acquisition of United Urology Group.

- Cooper University Health acquires Cape Regional Health System.

- Molina Healthcare acquires ConnectiCare for $350M.

- Cardiovascular Associates of America acquires Novolink Health, a pioneer in high-risk home care.

- SurgNet Health Partners acquires Tuscaloosa Endoscopy Center.

- Oura acquires metabolic health company Veri.

- Foodsmart partners with TPG’s Rise Fund to expand the health impact of food care nationwide.

- Linus Health acquires Together Senior Health to enhance its platform and workflow capabilities.

- Reveleer acquires Curation Health, expanding clinical intelligence capabilities.

- Fullscript acquires Rupa Health.

- VMG Health acquires healthcare consulting firm Carnahan Group.

- GE HealthCare closes its acquisition of Intelligent Ultrasound’s clinical AI business.

- Milliman acquires Pluritem Health and launches a real-time clinical data platform.

- Iredell Health System purchases Davis Regional Psychiatric Hospital and Medical Center.