Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, innovation, and strategy twice weekly. Join 40,000+ executives and investors from leading healthcare organizations by subscribing here!

October Healthcare Executive Summary

Notable moves, policies, and strategies from around healthcare.

Everything about the MA Star Ratings Debacle as all payors sue CMS over 2025 star ratings

Amidst restructuring, CVS explores breaking up. CVS also plans to exit core infusion services, with possible job cuts, in a marked change from its previous vertical integration strategy.

Elevance announced its $2.7B acquisition of CareBridge, which will help launch a new home health service line. Elevance has been extremely busy in building out Carelon in 2024, also debuting its primary care enablement platform developed in partnership with CD&R – Mosaic Health.

HCA deploys Commure’s ambient documentation and other solutions company wide as HCA’s exclusive ambient platform (note the turn of phrase there – not documentation – platform) – a massive undertaking and one of the largest potential deployments of AI ever, considering HCA is the crown jewel hospital operator sitting on a $60B annual revenue base. I wrote about Augmedix (acquired by Commure) partnering with HCA here, piloting ambient technology in the ED setting, and this deployment looks to be across both inpatient and ambulatory environments. and the AI scribe thesis appears to be playing out – ambient as a wedge product into a broader platform/solution across a health system, and deeper integrations into areas like RCM.

- The multi-specialty, EHR-agnostic platform, co-developed by Commure and HCA Healthcare, is designed to support critical workflows in emergency departments, hospitalist operations, and ambulatory care.

Baylor, Novant, Providence, and Memorial Herman form Longitude Health – an innovation incubator for the 4 health systems and plans for much more excitement. I caught up with their leadership this week and posted an inside look at Longitude Health to my community here.

CMS published results for Medicare Shared Savings 2023. MSSP is the most popular, most successful value-based care program and overall generated $2.1B in net savings (excluding ACO administrative costs). “ACOs led by primary care clinicians had significantly higher net per capita savings than ACOs with a smaller proportion of primary care clinicians. These results continue to underscore how important primary care is to the success of the Shared Savings Program.”

650+ clinicians form Scrub Capital, a conglomerate of medical professionals aiming to reshape healthcare through venture investments and pairing founders with physician advisors/folks doing the real work in the scene.

Optum launched a flagship primary care clinic in Arizona which is Optum branded – as I mentioned in a primary focused group XPC, it’s a very notable change from Optum’s prior strategy of separating physicians and care delivery from the physical Optum brand. Very corporate and something to watch.

Quick Hits:

- AMA Lawsuit: The AMA sues MultiPlan and insurers for allegedly fixing physician prices.

- Medicare Advantage: Medicare Advantage plans made $7.5B from ‘questionable’ assessments in 2023, per OIG.

- General Catalyst: General Catalyst is earmarking $750M for healthcare investments.

- Sanford & Marshfield Clinic Announce Merge: Chronic merge-failures Sanford and Marshfield Clinic Health System sign an agreement to merge.

- Change Healthcare Cyberattack: A cyberattack on Change Healthcare impacted 100 million people, per OCR.

- Elevance Earnings: Elevance lowers guidance amid ‘unprecedented’ Medicaid challenges.

- Lina Khan & Antitrust: Lina Khan’s antitrust bid may hinge on upcoming election outcomes.

- FTC Premerger Rule: FTC finalizes a premerger rule with nine key takeaways.

- Steward Sell-off: Steward completes the sale of its physician group Stewardship Health to Rural Healthcare Group.

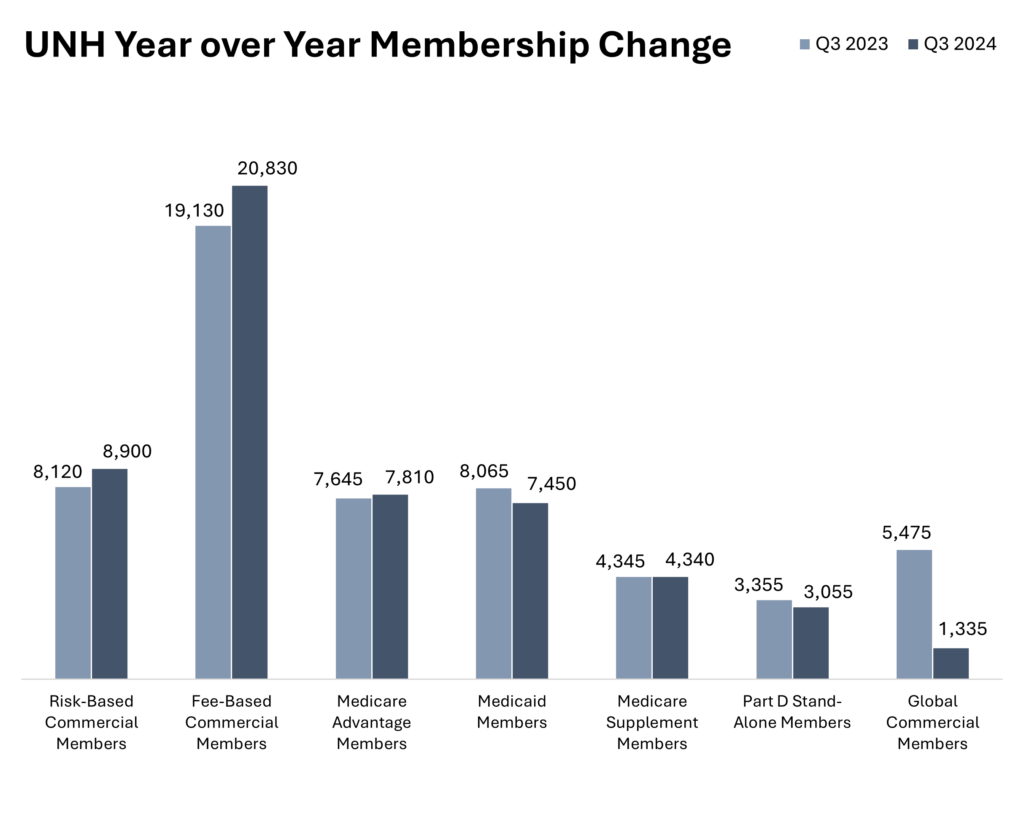

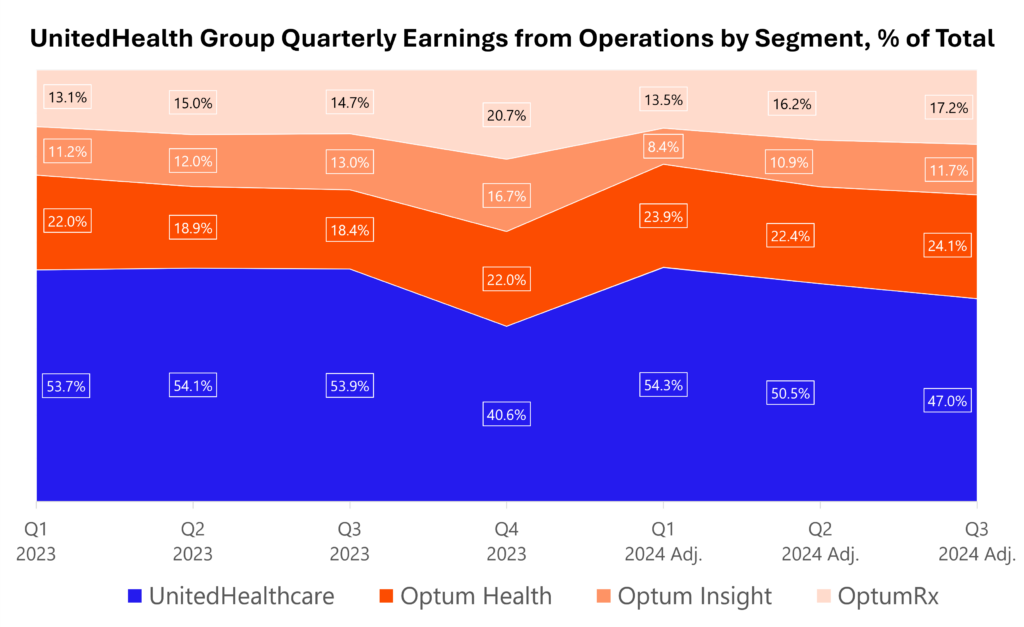

Quick UnitedHealth Group Earnings Snapshot

Resources

- Bessemer’s State of Health Tech 2024

- Kaufman Hall’s Q3 2024 M&A report

- SVB’s Future of Health Tech report

Community content:

- Fireside Chat: the current state of ASCs in conversation with Atlas Healthcare Partners CEO Aric Burke

- The evolving Oncology vertical integration landscape

- 1H 2024 nonprofit health system financial and operating update

Hospitalogy Essays from October

- HLTH 2024 Recap: Key takeaways from the HLTH 2024 conference include advances in value-based care and tech integration.

- Astrana & Awell: Inside Astrana’s partnership with Awell to differentiate in value-based care.

- Maven Clinic’s Growth: Celebrating 10 years, Maven Clinic raises $125M to expand women’s health services.

- Humana’s Medicare Squeeze: Humana grapples with a star rating downgrade affecting its Medicare Advantage plans.

- Mercy Health’s Financials: Mercy Health’s financial report reveals key 2024 performance metrics.

- CommonSpirit’s 2024 Strategy: CommonSpirit Health outlines its 2024 strategy focusing on operational efficiency and portfolio realignment.

- Credentialing Compliance with Medallion: How to turn credentialing compliance into a win using Medallion’s solutions.

If you’ve missed my recent Hospitalogy emails and announcements, I recently revamped my community offering – including new pricing tiers and better benefits. I’m gathering a great group of folks working in health system strategy, corporate development and similar functions.

If you’re a VP or Director working at a health system or provider organization, you will get a lot of value out of the community as the content, fireside chats, and conversations all revolve around the latest developments in this specific area.

It’s free to apply to and check out – only pay if you want to (though it’s a great value!). Apply to join here!