Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.

Utilization Returned in a Big Way in 2024

Way back in January, we saw plenty of hubbub around the elevated patient volume trends entering the new year, along with several other positive operating factors for hospitals throughout 2024:

- Length of stay decreased

- Acuity rose

- Payor mix improved

- Same-store admissions increased

- Contract labor mitigated

- The stock market experienced strong returns

“Fitch revised the rating for U.S.-based nonprofit hospitals from “deteriorating” to “neutral” in a Dec. 9 report, anticipating continued financial improvements next year. Fitch forecasted a median operating margin of 1% to 2% “barring unforeseen shocks” as the patient volumes are strong in many markets and hospital leadership teams focus on increasing access and capacity.”

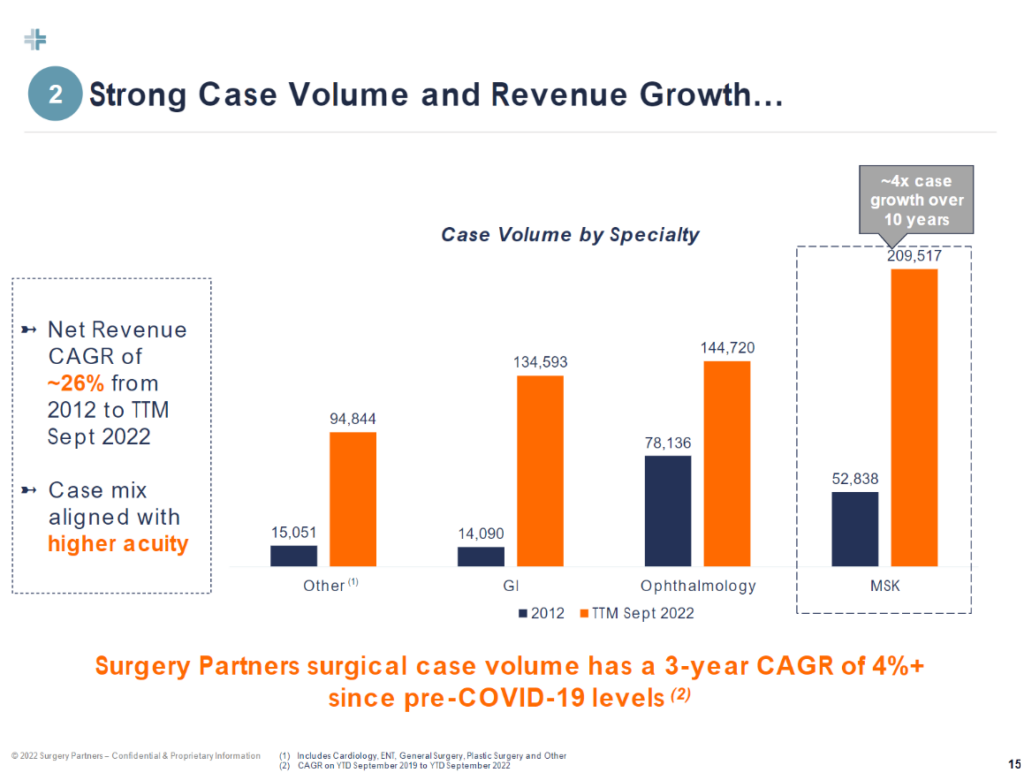

In 2024, two specialties dominated outpatient growth conversation: orthopedics, and cardiology. Orthopedics leads the way as CMS continues to add eligible ortho cases (total shoulders & ankles this year), while cardiology presents a compelling growth opportunity for outpatient migration.

Meanwhile regional nonprofit health systems are focused on asset transformation in the midst of outpatient surgical growth. Remember when I wrote about the health system commentary at JP Morgan 2024 in January around the aforementioned outpatient growth strategy and prioritizing for density in existing markets – this transformation will play out over the next several years.

- Other health systems are plotting their own expansions. Sacramento, California-based Sutter Health plans to add more than two dozen ambulatory care centers in the next four years, in addition to dozens of primary and multispecialty care sites. Henry Ford Health is investing $2.2 billion to expand its main campus in Detroit — the largest investment in its 108-year history. AdventHealth’s growth strategy includes expanding its outpatient operations, with plans to double its number of urgent care centers to more than 100, he said.

Entering 2025, the hospital industry’s adjusted admissions growth is generally back in line with the long-term trend stemming all the way back to 2019 – pre-pandemic. So in 2025, expect hospital volumes to grow at a decelerating rate.

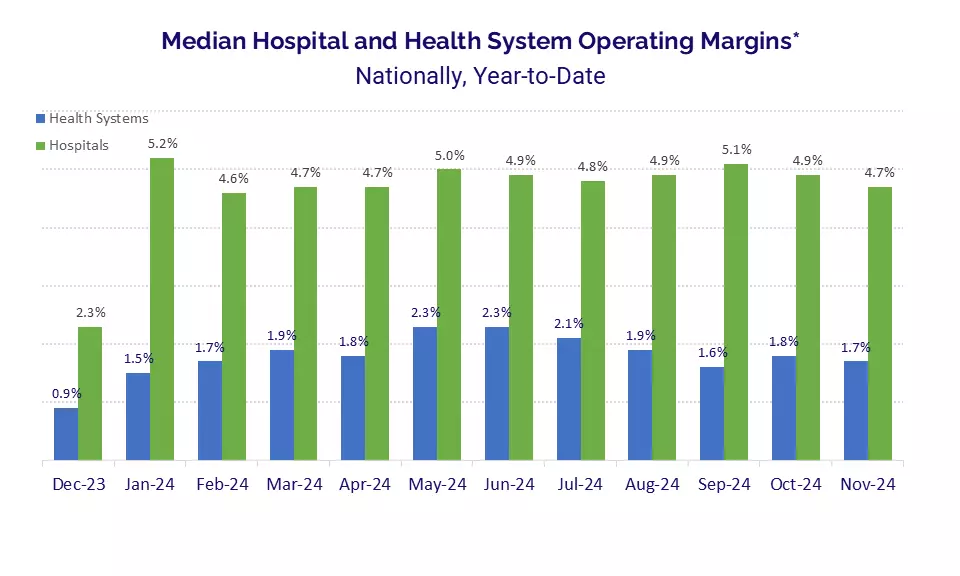

Hospitals Enjoy a Stable Operating Environment in 2024, but Performance Bifurcation Persists

The best hospitals are doing better.

The worst hospitals are performing worse and still dealing with many of the same issues from 2022.

Meanwhile, ratings agencies’ outlooks for health systems are mostly stable for 2025.

The price maker systems enjoyed margin expansion and outperformance.

Stock market performance bolstered nonprofit health system balance sheets in 2024.

Over the long term, what will define success boils down to operating excellency, density of assets within markets and…population growth.

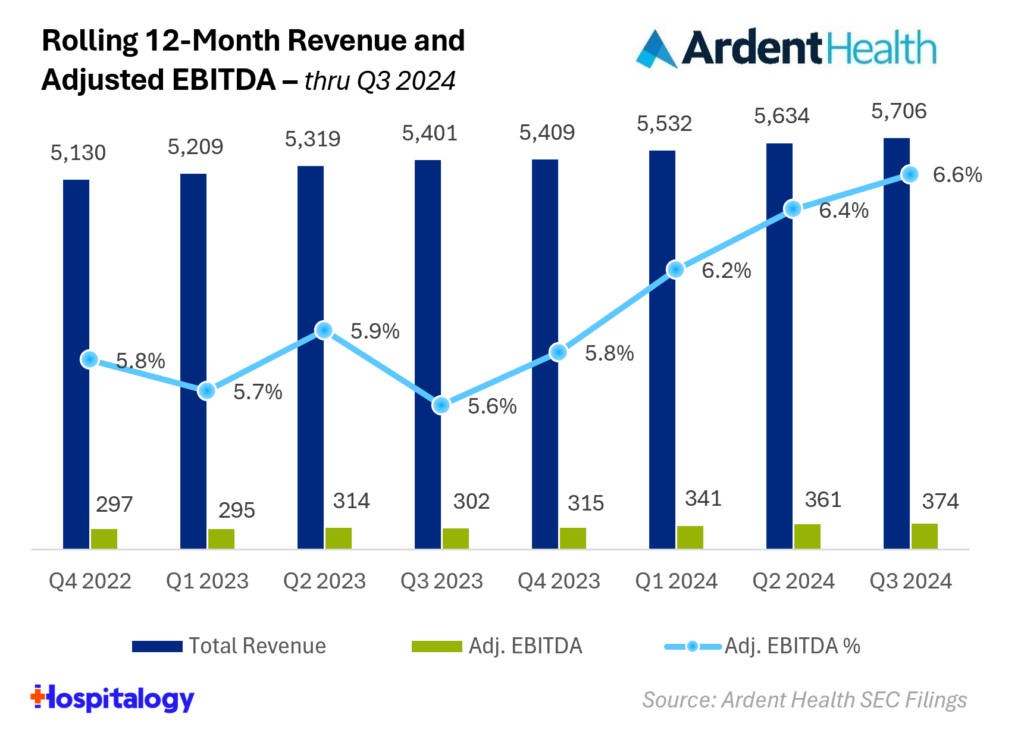

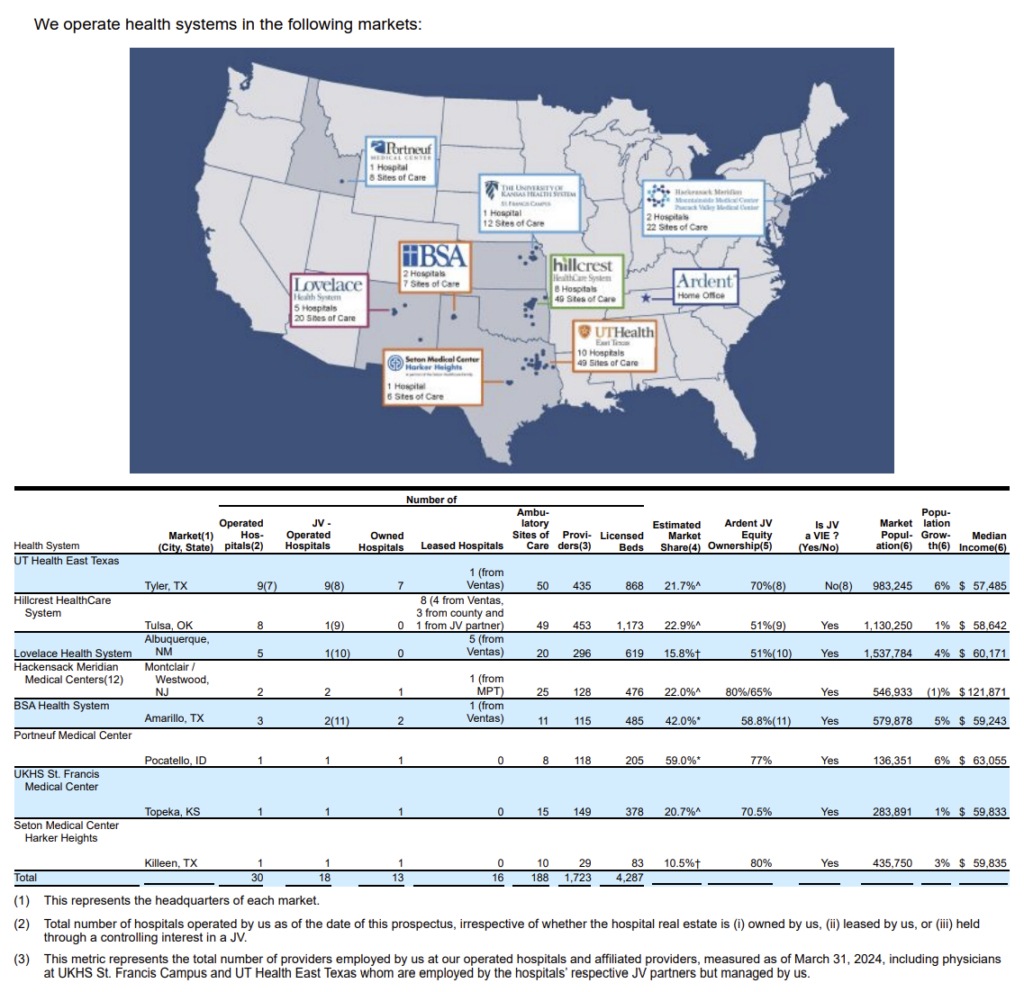

Ardent Health Goes Public

As the first hospital operator to go public in quite a while, Ardent Health hit the public markets in mid 2024. Ardent operates 30 hospitals and generated $5.7B in revenue over the past 12 months ending in Q3 2024.

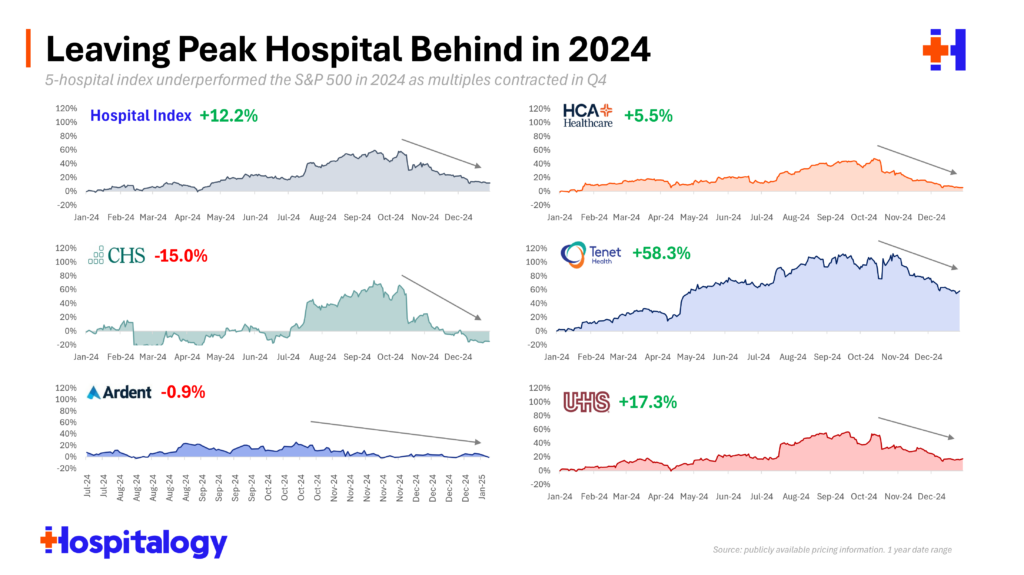

2025 Outlook: we’re past Peak Hospital Entering 2025?

Hospitals rebounded nicely in 2024, but what happened in Q4? Despite common positive themes like the rising tide of patient volumes, contract labor dissipating, and improving payor mix, this year will be a difficult one to follow. In fact, we’re past peak hospital for a while, for a multitude of reasons including:

- Volume growth, but deceleration

- Favorable supplemental, direct payment programs that may not persist

- Increasingly untenable position of hospital physician employment subsidy models

- Potential for reform in key areas including site-neutral payments or Medicare sequestration

Of course the question is “where do we go from here?” And the answer may look like more M&A to strengthen market presence. As the operating environment rebounded throughout 2024, hospitals reached a peak valuation around September/October and since have sold off into the new year. Look for 2025 to be a stable-to-growing year for most large health systems, while the bifurcation issue for underperformers festers.

Other key issues heading into 2025 include:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Trump Admin policy changes (Medicaid, ACA subsidy expiry, site neutral payments, 340B)

- Shifts in payor mix (more Medicare, lower exchange volumes)

- Continued contract labor mitigation

- Professional fees / purchased services cost inflation & shortages; union strikes; subsidy trend

- Rural hospital woes

- Medicare Advantage denials

- Investments into cybersecurity and AI

- Local market portfolio realignment

- Ability for health systems to negotiate their commercial prices

Fitch’s outlook: Success increasingly depends on recruiting and retaining talent in a hypercompetitive labor market, improving productivity and investing in key areas like artificial intelligence and IT infrastructure. Hospitals excelling in these areas — often with strong market share in growth markets — are likely to reach the top of the rating scale. “These very successful organizations will also have a predisposition to maximize that market essentially with annual payer negotiations, in a ‘mind the gap’ mentality that keeps them at the upper end of the payment scale,” according to the ratings agency said in its report.