Hospitalogists,

I’m back from the mother land (Austin) after convening with my teammates from the mothership (Workweek) feeling energized and nostalgic. Austin is a special place for me.

Today we’re diving into the Pennsylvania health system merger mania and specifically breaking down details of the recently announced Jefferson Health – Lehigh Valley Health Network merger. My in-laws are from the area, so they might be interested in this one!

Thanks so much to NeuroFlow for sponsoring today’s send. They have a great platform in mental health so check out their new maternal mental health launch below.

SPONSORED BY NEUROFLOW

Exciting news for healthcare professionals: NeuroFlow has launched innovative digital care pathways specifically designed for maternal mental health.

With 75% of women with perinatal conditions going untreated, NeuroFlow’s integration into healthcare systems is improving the industry in a major way, addressing critical gaps in maternal healthcare.

These pathways harness smart logic to deliver tailored assessments and resources for each stage of pregnancy, detecting declines in mental health and swiftly pinpointing when enhanced care is necessary.

Now, you’ll have a tool that covers essential topics like preparing for pregnancy, managing prenatal anxiety, and identifying signs of postpartum depression.

See for yourself how NeuroFlow is revolutionizing support for expectant parents.

Blake’s Breakdown:

Going a bit deeper on an interesting topic, theme, or resource

What the heck is going on in Pennsylvania?

We’ve seen a flurry of mergers and activity among health systems in the PA marketplace state-wide. Here’s a quick rundown of recent moves over the past few years. In no particular order:

- Kaiser Health’s Risant buys Geisinger, closed in April 2024;

- In October 2021, Jefferson Health acquires Einstein Health Network (bringing Jefferson to 18 hospitals in total);

- UPMC – Washington Health System officially joined together June 1st, 2024

- Butler (Pa.) Health System and Excela Health merged and are now known as Independence Health System as of mid 2023

- In early 2024, Penn Medicine announces intentions to merge with Doylestown Health

Finally, one of the bigger health system merger announcements of late occurred back In December 2023, when Jefferson Health announced intentions to acquire Lehigh Valley Health Network, bringing Jefferson Health to 30 total hospitals assuming the merger closes.

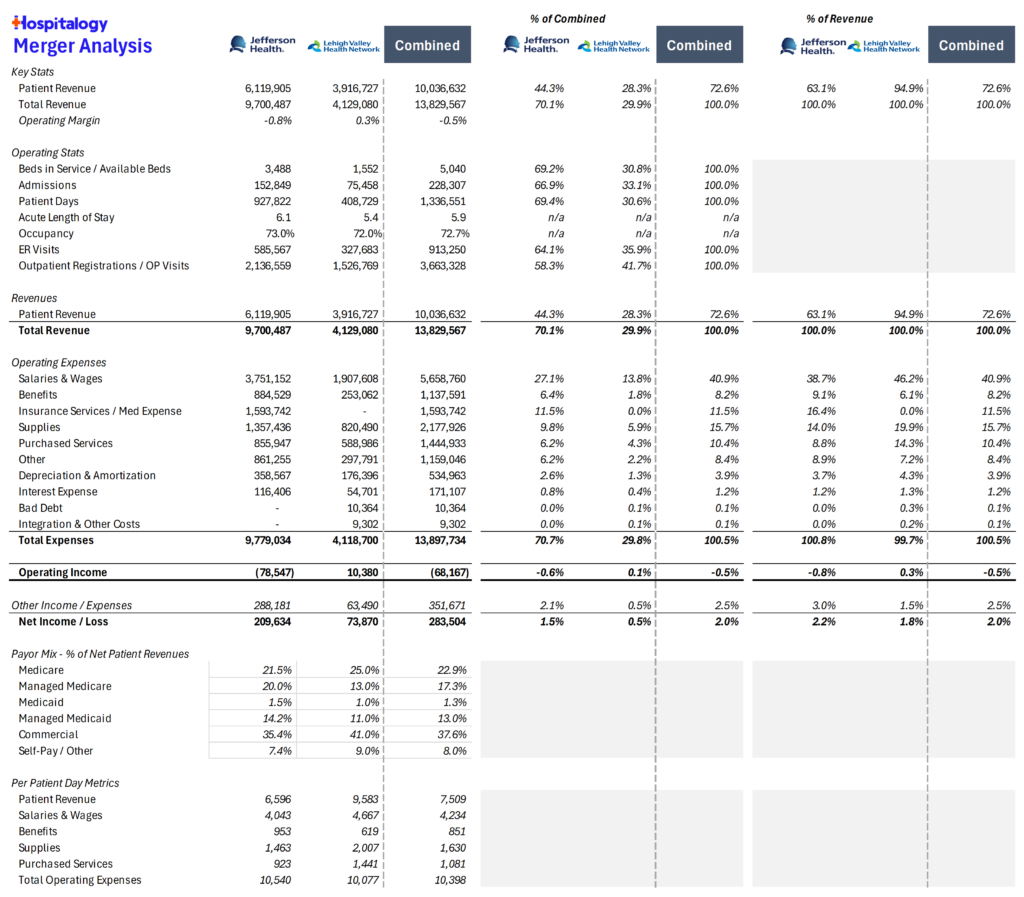

Here’s a quick rundown of the consolidated entity’s financial and operating footprint based on fiscal year-end June 30, 2023 statements:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

What are the notable things to look for when studying a merger like this? Do I find analyzing random health system mergers on a Thursday in June fun? (yes)

Topline numbers are important:

- Combined revenues are $13.8B

- Combined Operating Margin is -0.5%

- Combined Net Margin is 2.0% (driven by investment returns not shown above – wild)

Footprint is important, too:

- 30 hospitals

- 5,000+ beds in service

- 700+ sites of care

- 65,000 employees

- 228,000+ admissions

- 3.6M outpatient visits

What’s not in the numbers? E.g., what the heck is going on in PA competitively? There’s a reason why all of these smaller health systems feel the need to consolidate. Usually moves like these happen from a posture of… “hey, we just need to survive” or, just as important and more likely here, is this move is a reaction to what everyone else in the market is doing.

Simply put, everyone else in the market is getting bigger to stave off rising costs, create a sexy narrative of growth and ‘synergies’ for stakeholders, and survive in a tough market.

The following seems to be true for Pennsylvania and these consolidating players:

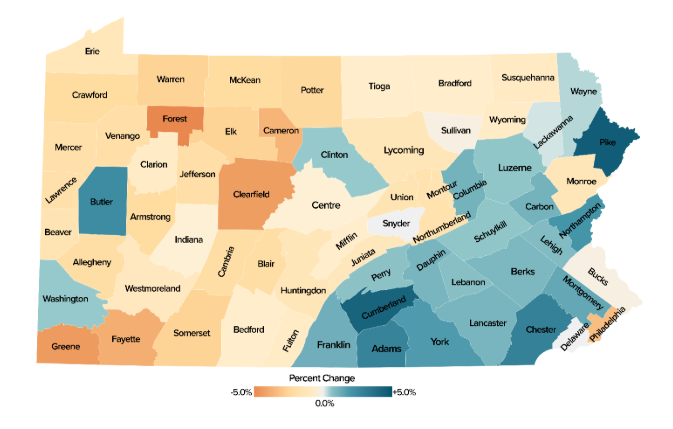

- Pennsylvania is a tough market demographically (2023 census growth data):

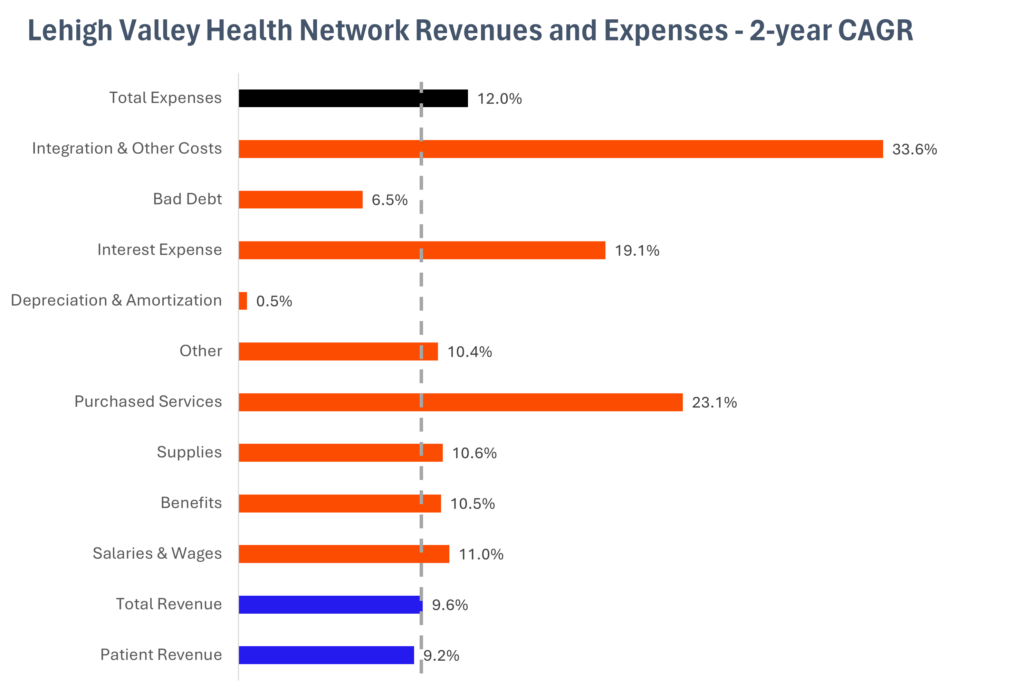

For LVHN and many systems, expenses are outpacing revenues. It quickly boils down to a numbers game: If revenues minus expenses are positive, then your business is sustainable.

The past two years haven’t been sustainable:

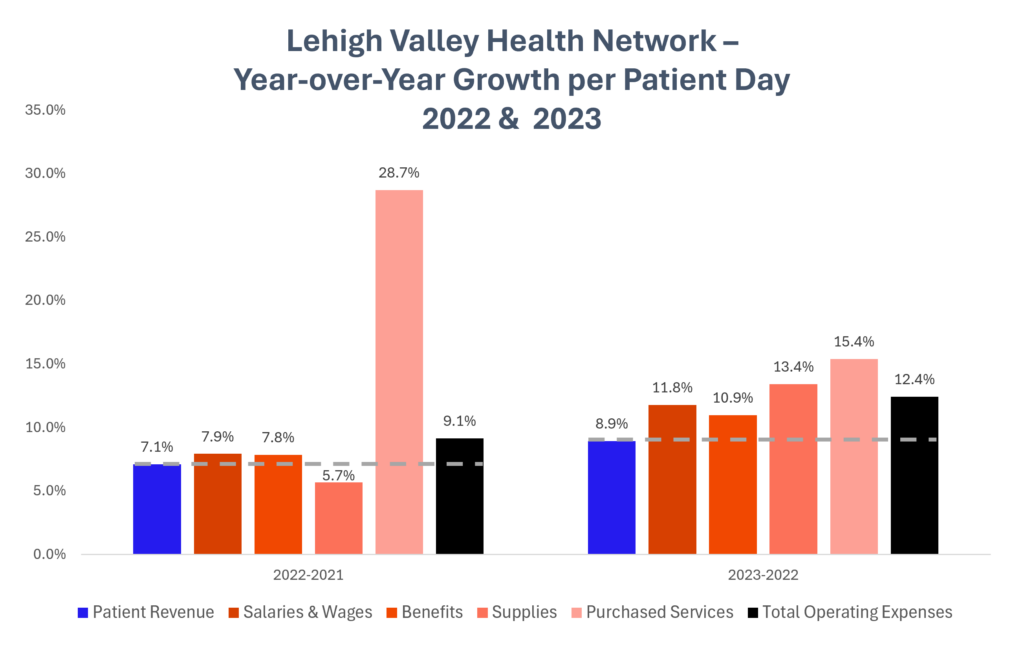

Look at this growth in purchased services per patient day. Almost every metric on a per-patient day basis is growing faster than patient revenues:

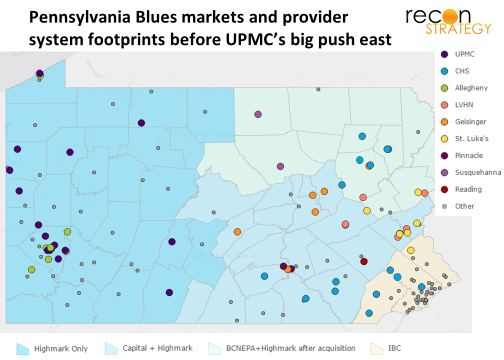

Finally, growth prospects outside of merging are limited. You’re surrounded on all sides:

What’s the takeaway here?

Health system transformation is coming for your market whether you like it or not. Transformation includes developing a dense network of healthcare delivery assets, merging to survive, and leveraging partnerships and new technology to compete with increasingly savvy outpatient participants.

At some point, you either have the assets to bully people around, or you take the price you can get!

Further reading and resources:

- https://www.phc4.org/browse-our-data/mapped-by-phc4/

- https://reconstrategy.com/2017/07/upmcs-race-to-the-sea-and-the-tentative-steps-towards-highmark-geisinger-alliance/

- https://www.health.pa.gov/topics/Documents/Health Planning/SHA Complete Report_2021.pdf

- https://www.kff.org/affordable-care-act/fact-sheet/the-pennsylvania-health-care-landscape/