I hope you all had a great HLTH conference for those in attendance like me. Raise your hand if you got lost trying to find meeting areas while traversing the insane stimulating casino environment!

My time at HLTH was chock full of meeting interesting companies and people, catching up with old friends, and getting the lowdown of how people are thinking about healthcare and innovation entering 2025. My voice was shot by the end of a few days, but the conversations were worth it.

Several people asked me what my goals are at conferences, and it’s a bit more fluffy than folks trying to chase deals, important people, or raise funds. I wanted to touch base with existing Hospitalogy sponsors, help folks understand what sponsoring Hospitalogy in 2025 looks like, and of course, write about interesting people, companies, and concepts to inform my content.

If you had any hot takes from HLTH, I would love to hear from you!

(What you can’t really see there to the left of the Sphere is the Wynn golf club, where Turquoise Health’s CEO Chris Severn shot an alleged 73. I wasn’t there though, so I can’t confirm. Maybe next year.)

AI the Great Connector

Any write-up you read on HLTH will mention AI. If it doesn’t, you may need to get your eyes checked by someone demoing an eye health medical device at next year’s convention. AI was everywhere at HLTH, and I noticed palpable excitement around it. In general, AI – and generative AI – in healthcare is still very ‘pie in the sky’ but it feels much more real in 2024 than it did. Certain use cases are playing out as companies and startups leverage AI to connect disparate data sources, or train models to create operational efficiencies in the OR.

If I had to pick one theme, it would be that 2024 is the year of connectivity or…if you’re into buzzwords…interoperability.

Next up for AI is a move into semi-autonomous agents that will act as the great extender and a substantial boost in productivity for healthcare workers. I heard from several companies including GE HealthCare and Hippocratic (well on its way along this journey) developing resources for its 2025 roadmap and beyond.

My main reservation around AI today is how much noise still exists in the language around ‘AI-enabled’ health tech companies. Even with demos and announcements, it’s really hard for me to know what’s real and what isn’t. Obviously I’m not a clinician or the one making decisions, but with so many companies focused on similar tasks, you have to believe consolidation continues to play out in favor of unified platform solutions. For instance, GE HealthCare announced its launch of a connected platform CareIntellect starting first in oncology. Whether it’s the best technology or not, I would think GE HC’s existing distribution alone favors them to win enterprise contracts and deploy AI enabled solutions into the future.

Regardless of the hype around AI, it is, and will continue to, create value – whether it’s cleaning up data and connecting that data to create systems of intelligence, automating call center or other burdensome administrative functions like claims adjudication, or creating agents to extend existing FTEs, all stakeholders are paying attention to AI strategy in 2025.

What will remain important is how teams vetting AI-enabled products stay disciplined and do appropriate DD – how clinician voices are included, understanding who’s liable for what, and implementing the right guardrails around use cases.

Heard at HLTH

I got to catch up with several organizations (including some Hospitalogy sponsors), and here were some interesting takeaways from those conversations:

- Prenuvo: I was able to catch up with Prenuvo’s CEO Andrew Lacy for a conversation riffing about the state of our healthcare system. It was really interesting talking to someone clearly deeply passionate about healthcare, yet more from an outside, consumer perspective which is one I hear less often. Andrew is more bullish than ever on the role of the consumer in healthcare and health tech, and Prenuvo want to continue to push the needle on innovation in imaging as scans get sharper and faster, and data gets better. I asked him about all of the pushback from the medical community around utilization/access and incidentaloma concern, and his response was to say how the good of what Prenuvo is doing far outweighs any potential con – especially since those criticisms come from those who have never actually used the Prenuvo platform. He was also incredibly excited about AI, saying there were countless ways to use it to reduce incidentalomas, analyze potential masses or other concerns in a much more accurate way, and boost & extend the productivity of Prenuvo radiologists. Long-term, Lacy believes the consumer will grow to be the ultimate payor in healthcare, and they’re positioning themselves for a consumer-oriented future in healthcare – one where Prenuvo can deliver as much information as it can in a 45-minute scan. Whether you align with his thoughts or not, I respect Lacy’s vision and enjoyed our conversation.

- Arcadia: Michael Meucci, Arcadia’s President and CEO, was gracious enough to sit down with me and give me his thoughts on value-based care and riffed on healthcare with me for a bit. They’re looking forward to more deeply integrating with CareJourney after the recent acquisition – saying it’s a match made in heaven given that Arcadia’s data provides an inside-out view whereas CareJourney analyzed publicly available datasets to give an outside-in perspective. Michael viewed VBC in a sort of ‘course correcting’ state in 2024 or a sort of 7th inning stretch ready for the next phase. Michael also mentioned his interest in parallels between the travel industry and healthcare industries, and his viewpoint was that EHRs, similar to what happened to Sabre, will fade into the background and eventually allow for better functioning connective tools to sit as a layer on top (Expedia, Kayak, Priceline, Booking, Travelocity, etc.). Priorities for Arcadia in the new year include adding new products and services with CareJourney, improving digitization in healthcare, and delivering AI at scale to its customers. Great convo.

- CareBridge: sold for a rumored $2B price tag to Elevance but you didn’t hear that from me.

- Jorie AI: Is changing the game with AI-enabled revenue cycle management – helping both health systems big and small along with physician practices do more with less – from capturing the long tail of small copays to reducing A/R days, Jorie had a big presence at HLTH this year. Look for more from this organization in 2025.

- PEP Health (a Hospitalogy sponsor): continues to make headway with their proprietary PEP score and inbound payor interest

- Care Continuity (a Hospitalogy sponsor): Has some big launches and product announced for Q1 with AI in the care navigation space for health systems.

- Greater Good Health: Is scaling NP-led value-based care by being boring and doing the blocking and tackling needed to excel in the space. GGH is focused on tier 2 markets (full-practice authority states) and provides tooling and infrastructure (along with MD oversight when needed) for NPs to succeed in the GGH model. Another great convo in VBC.

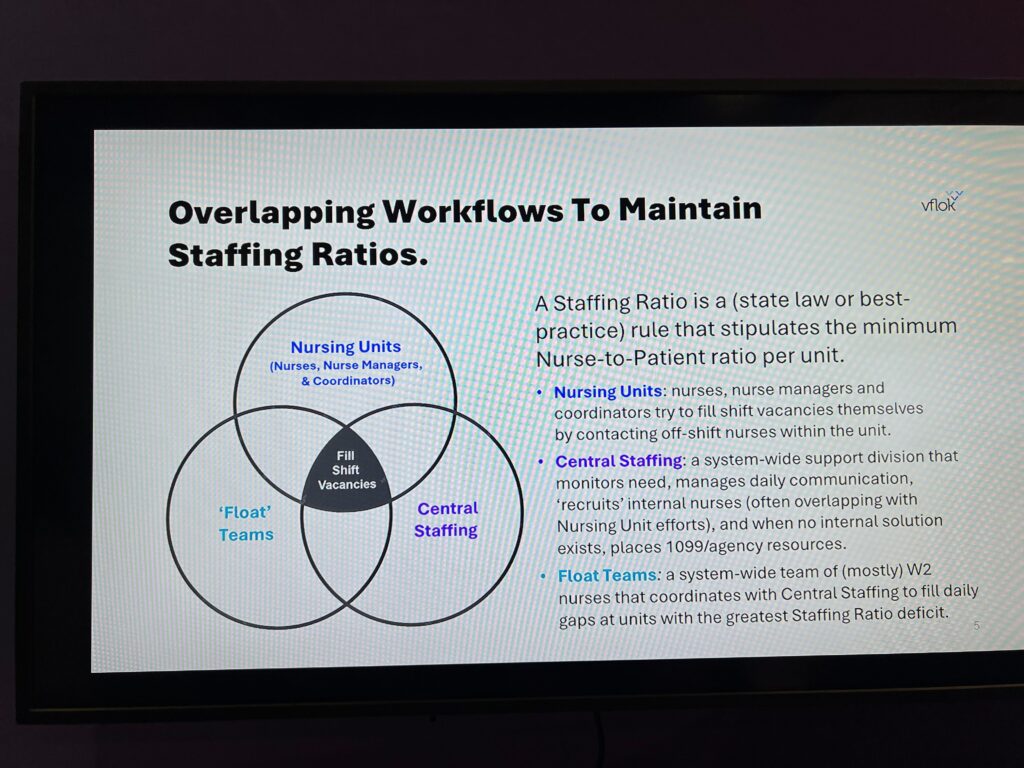

- I spent a bit of time at Wellstar’s new-ish venture studio Catalyst, which just incubated its first ever company in Vflok focused on solving for operational bottlenecks in nurse scheduling, centralized staffing, and is connected to real-time data from Wellstar.

- CalmWave AI: Also part of Catalyst, is using AI to reduce non-actionable alarms (i.e., a potential patient problem or sort of false alarm) by 58%, and increasing from there as their model gets smarter. CalmWave’s solution results in less stressed out ICU personnel and happier patients who can actually sleep. Calm Wave’s founder Ophir Ronen told me the concept for the startup originated with his father, who was in the ICU after a serious procedure and sent him a video of the ICU alarms blaring – saying with a resigned expression to his son “all I want to do is sleep.”

- CalmWave uses something called transparent AI which helps their team understand how the AI is reasoning through conclusions. Their team is constantly testing models in an ultra conservative way on retrospective and real-time patient data (vital signs, medication effects, etc.) to make data-driven recommendations for the ICU care team and reduce alarms.

- Final note – I asked Ophir about malpractice liability – e.g., I hope nothing goes wrong but who is responsible if it does? The hospital covers liability, but tools like CalmWave are helping to reduce malpractice cost and risks rather than enhance them further, which presents a big potential cost savings opportunity on premiums in the future.

alvee: I caught up with alvee’s founder Nicole Cook briefly (who was still at HLTH taking meetings with a newborn – I don’t know how you founders do it but that’s some serious dedication). Their team is leveraging AI to integrate social determinants of health into existing clinical workflows for health systems. She told me in one case – if I remember the number correctly – a health system unlocked $52M in additional revenue to work with underserved patients.

Mass General Brigham is spending – or spent – $10M in total on an AI scribe pilot / deployment, testing out both Abridge and Nuance.

On the lookout: Areas to watch in 2025 include ICHRA (which is sadly very mainstream to talk about now – I heard both puts and takes on the space while at HLTH), pediatric Medicaid (and Medicaid in general), deeper deployment of ambient.

That’s it for my thoughts on HLTH. The buzz in the room was palpable, but the health system and payor folks were scarce. Still, anecdotal but I seemed to notice more physician/clinician representation than ever before. HLTH is great at what it is – a brief escape from the slog and reality of day-to-day patient care and operations to learn about what’s coming next, and how problems are being solved in 2025.