Omada Health is next up on the public markets, files its S-1 to follow Hinge

Omada filed its S-1 (linked here in all its glory) on Friday, and I’ve included some highlights below for you guys. For Hospitalogy community members, you can watch my conversation with Omada’s founder Sean Duffy here – probably one of his more recent interviews prior to their filing, so very timely and diving into current, trending topics with the firm. A more robust dive will probably come in the next week or so.

Following Hinge, Omada serves a similar employer and payor demographic (with some key partnerships with PBMs) and runs cost-saving, high quality chronic disease management programs across areas of high need and spend including hypertension, diabetes, MSK, and of course, obesity. In the filing Omada touts its effectiveness as a full-stack virtual platform.

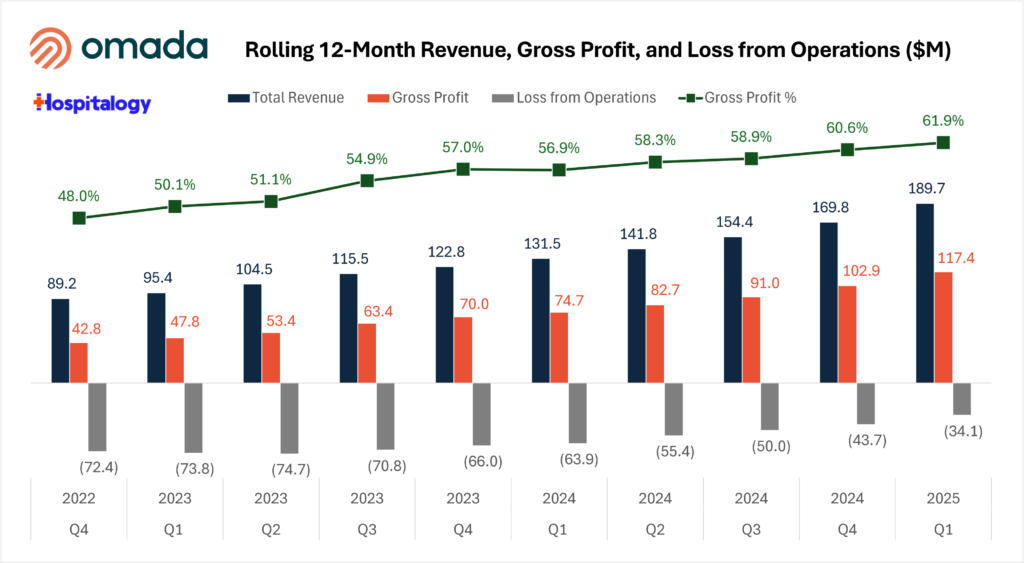

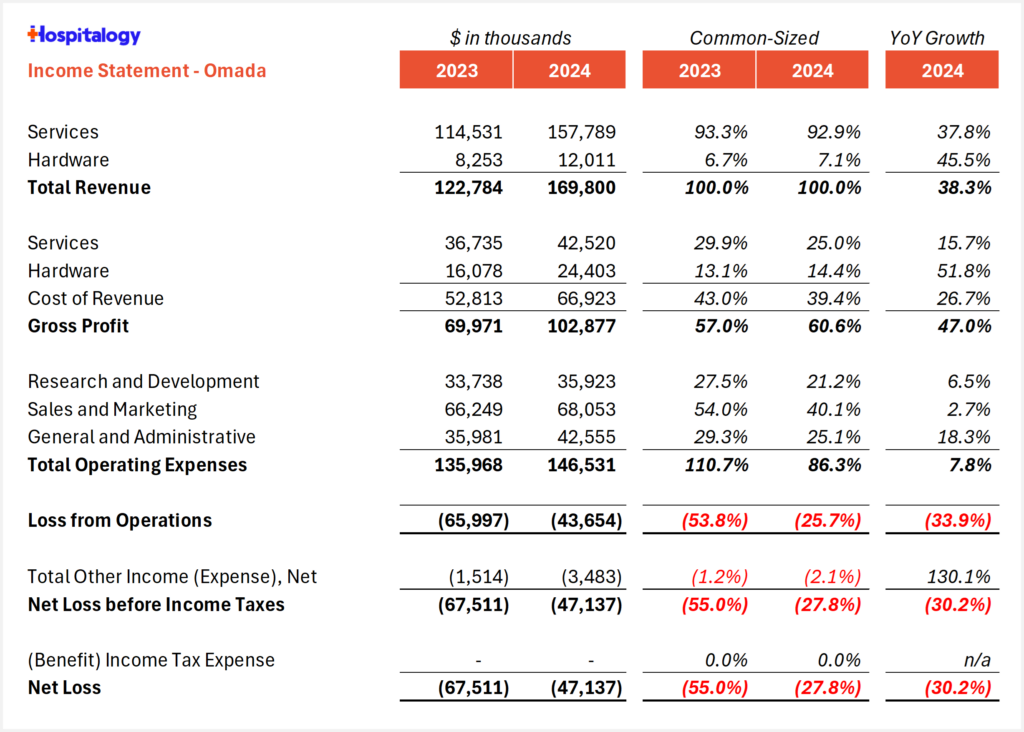

Financials: In 2024, Omada generated $169.8M in revenue (38.3% YoY growth) and $102.9M in gross profit (60.6% margin), while its losses totaled $43.7M – substantial but shrinking quickly.

Hinge Health Aims for ~$2.4B Valuation in IPO Filing

In an updated prospectus linked here, Hinge Health disclosed its Q1 2025 numbers as well as its intention to go public at a share price range between $28 and $32.

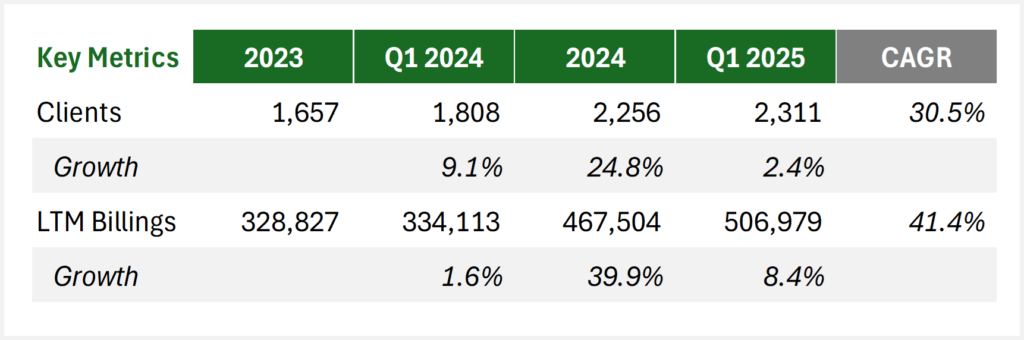

At the implied midpoint, Hinge would be publicly valued at around $2.4B. It looks as if Hinge’s investors got the memo, as the company is taking quite the haircut to its last reported private valuation of ~$6.2B, if memory serves. Like I laid out in my Hinge S-1 analysis and my thoughts on its invest-ability, it’s the right move. And now…it’s sure to entice some folks into the tech-enabled space. What about you? And based on this haircut, I have to wonder what valuation Omada will aim for. For instance, as a quick thought exercise, if Hinge hits around $500M in 2025 revenue (their Q1 25 calculated billings being $506M), a $2.4B valuation implies around a 5x forward revenue multiple. So I’m pleasantly surprised. In Omada’s case, assuming 40% revenue growth in 2025 and applying a similar multiple gets you to ~$240M in forward rev and an implied valuation of ~$1.2B. That sounds…not crazy and reasonable upside for what you’re paying for? Someone check me on that. Health tech valuation practicality?

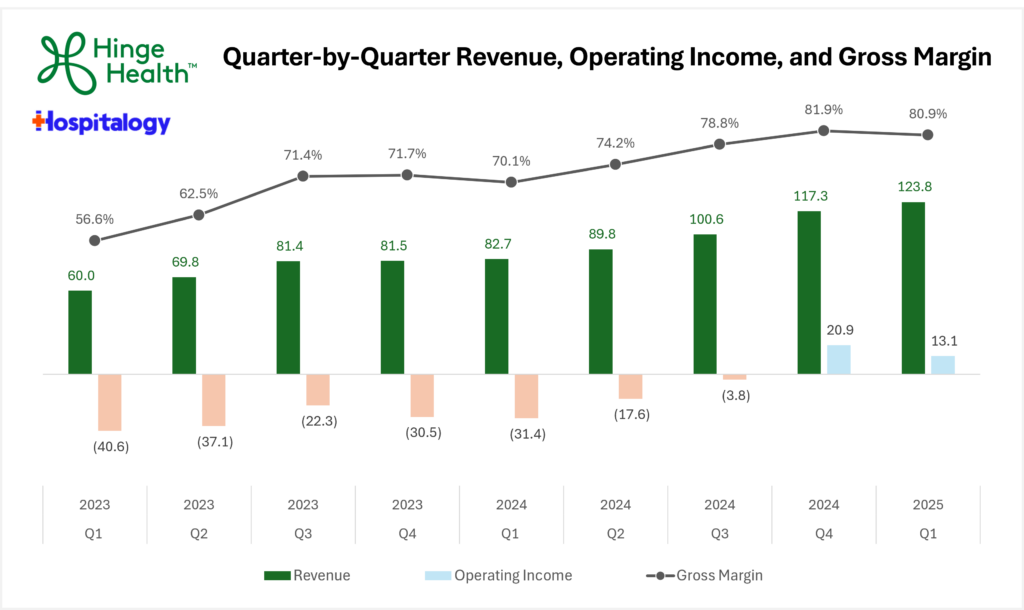

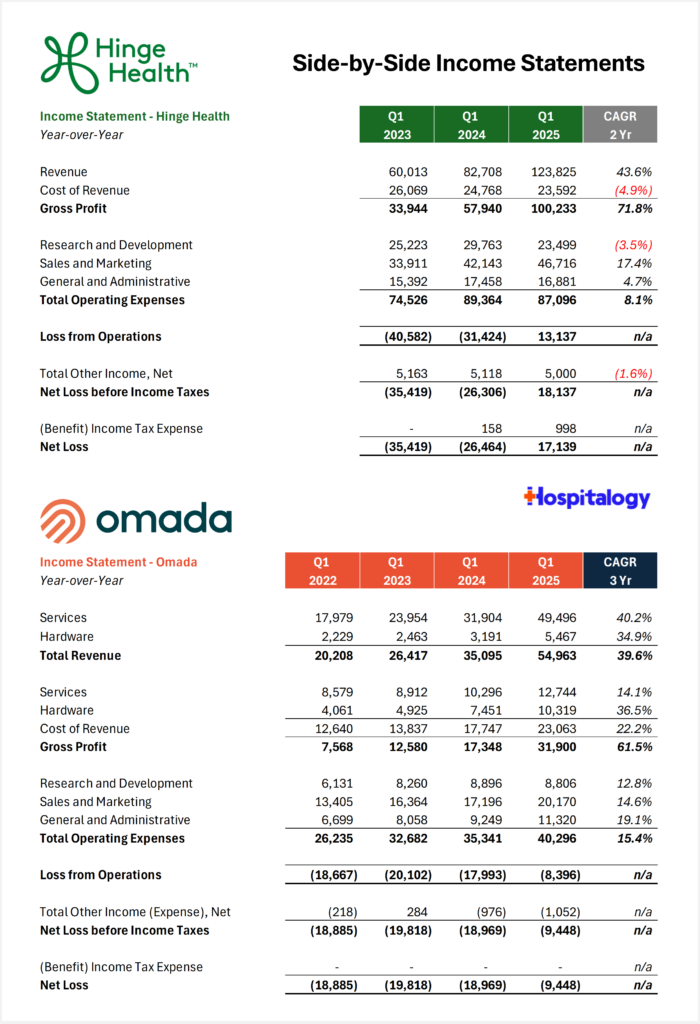

Here’s a side-by-side comparison of Hinge and Omada income statements in their most recent quarters. Hinge turning a nice profit. Omada working toward that goal fast-like.

You can see the year-over-year trend (and yes, I know it says net loss even though they’re making money. I’m too lazy to fix it at this point). Omada was even nice enough to give us an extra set of four quarters back in 2022 – something they weren’t required to do. Revenues are growing, and gross profit is increasing even faster than revenues, displaying some impressive operating leverage from both soon-to-IPO firms. The question is whether that’s sustainable into the future, but for now it appears to be working out. And both Hinge’s and Omada’s Q1 ‘25 results are impressive as hell. 49.7% and 56.6% revenue growth over Q1 ‘24, respectively:

UnitedHealth Group’s CEO Andrew Witty steps down

One of the more shocking headlines so far in 2025, UnitedHealth Group’s Andrew Witty is stepping down after perhaps the Empire’s managed care titan’s worst Q1 print ever, including its first earnings miss since 2008 (I broke down their Q1 in plenty of detail here if you want to learn more). Someone needs to take the blame for UnitedHealth’s woes in both Optum and Medicare Advantage – across severe v28 transition challenges, way higher than expected utilization, and poor engagement with new members – and it appears as if Witty is the scapegoat for the job.

Don’t worry about UnitedHealth Group, though. Replacing Witty is Stephen Hemsley, who knows his business when it comes to the company – he’s an OG, joining in 1997 and running the firm from 2006 thru 2017. As I heard from a third party…”you don’t bet against Stephen Hemsley.”

For now, UNH stock is down 40+% on the year, and investor questions arise around United’s full capitation strategy with Optum including the all-in pivot to value-based care, something Witty set in motion over the past decade in building Optum’s physician base.

Trump signs new executive order on drug pricing, reinstitutes ‘most favored nation’ policy. Plus, CMMI’s new strategic vision

In an executive order scant with details beyond triumphant nice-to-have’s, the new administration established its goals to reform drug pricing in the U.S. Here’s a good breakdown of the context of the executive order from Politico.

Citing other developed nations drug prices and the profit levels in the U.S., the executive order seeks to create a ‘most favored nation’ policy within Medicare, something Trump tried to implement in his first regime but was ultimately bogged down by…the swamp? Big Pharma? However you want to characterize his antagonists, things didn’t pan out.

Still, between that and calling out enabling direct-to-consumer sales to Americans, the takeaways here are clear: this administration is focused on the consumer, and trying to find pockets where it can create competitive forces in healthcare.

The executive order is unclear on the…execution of its policies, but stakeholders squarely in the spotlight here include pharmaceutical manufacturers and PBMs, since the DTC programs potentially seek to disintermediate them. Meanwhile, in theory, lower drug prices would benefit patients and payors (lower medical spend).

- Also, a quick note on something I found hilarious. In a recent presser, Trump seemed to allude to a certain ‘neurotic billionaire’ (Elon Musk) paying $88 for ‘fat shot drugs’ in London while paying $1,300 in New York. The video is something else. What timeline is this again? (Oh yeah. The most insane one, since Lizzy Holmes’ new partner seems to have raised $20M and formed a new BLOOD TESTING company. You really can’t make this stuff up. )

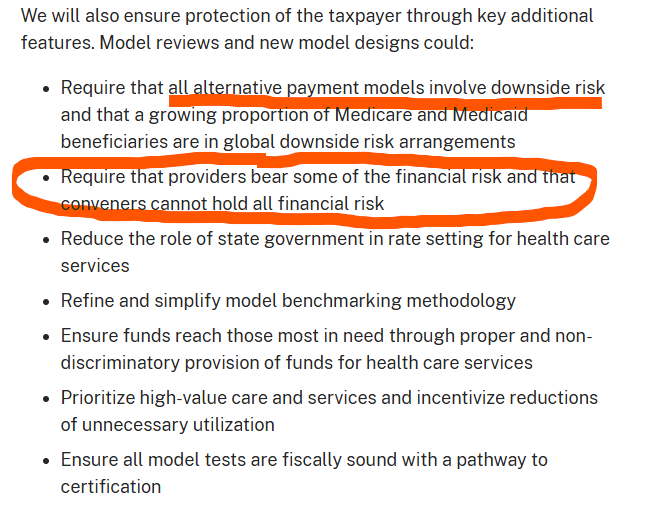

CMMI’s New Strategic Vision: Today CMMI held a virtual event to unveil its new strategic direction under the helm of Dr. Oz. centered around 3 key pillars in the MAHA movement, and nothing unexpected:

- Promoting evidence-based prevention

- Empowering people to achieve their health goals

- Drive choice and competition

Obviously these sound great, but the actual implementation of these policies will ultimately decide the future of healthcare under the new regime. So some of the specific mechanisms mentioned included reforming state certificate of need (CON) requirements and requiring independent providers to participate in downside risk arrangements (AKA, conveners or enablers can’t take the downside risk burden from their contracted physicians if I’m interpreting that note correctly) so that’s somewhat notable. What else did you guys find in the announcement? Hit me with your thoughts.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

More Large Health System Patient Revenue Analysis Stuff since I can’t help myself

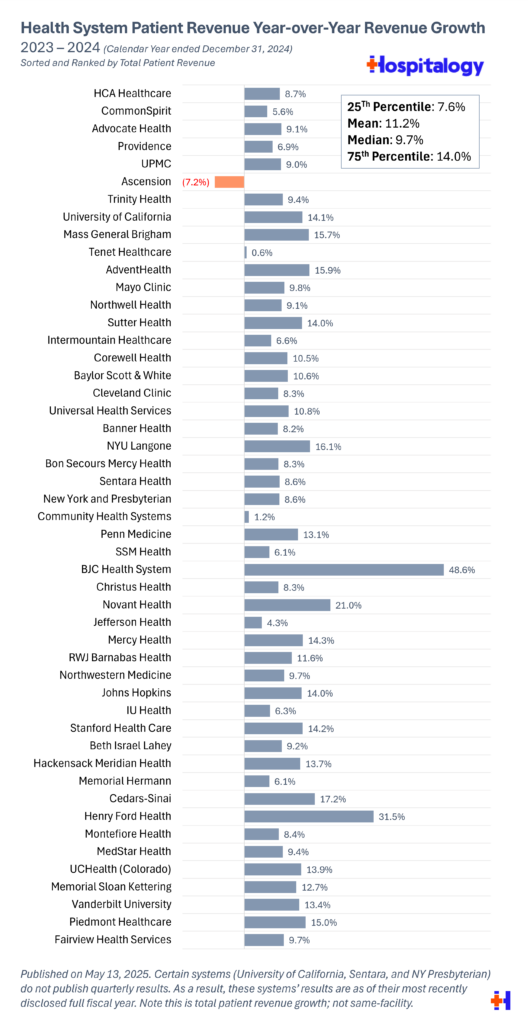

Health System Patient Revenue Growth Analysis: Here’s a nice, clean graphic you all can steal from me add to your internal presentations on health system performance. It lists the top 50 hospitals and health systems by total patient revenue, and the bar graph shows 2024 patient revenue growth over 2023 – as of this calendar year. Median patient revenue growth for 2024 was 9.7%, so pretty solid for the large for-profit’s and nonprofits as utilization returned in a big way. It’s why we’ve seen a decent amount of margin recovery and expansion in 2024. 2026 will be a different story with ACA enhanced subsidies expiring.

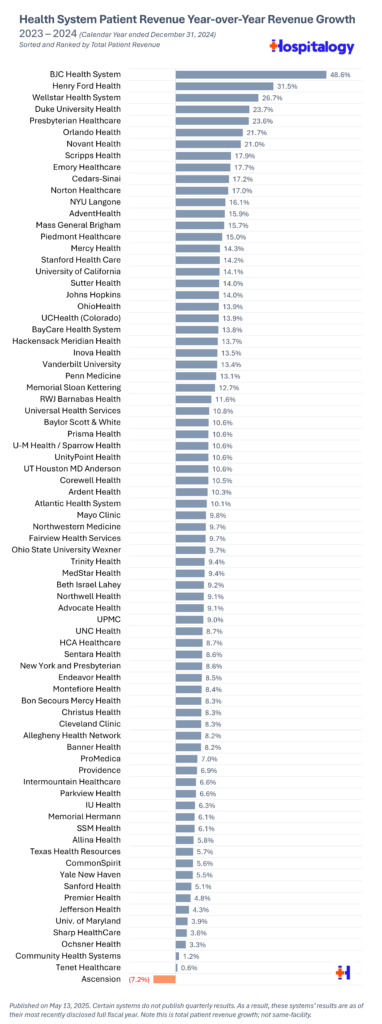

And here are the top 80 health systems (for the most part, anyway. I probably missed some names) sorted by patient revenue growth, with the biggest jumps at the top coming from M&A (note that this isn’t same-facility growth – it’s total growth):

Hospitalogy Top Reads & Resources

My favorite healthcare essays from the week

- Don’t forget to register for my upcoming roundtable! It’ll be a must-attend for all strategy, corp dev, investors, and anyone wanting to get caught up to speed on the latest happenings around payors and providers. Register here.

- The one and only Acquired podcast (in-depth, long business breakdowns) did an episode on Epic, and while I haven’t gotten around to watching it, that doesn’t mean you shouldn’t! Here’s the link.

- My old firm VMG Health released their annual flagship 2025 M&A report, and it’s always worth a read. Download it here.

- Check out PEP Health’s new white paper on how to measure patient trust – see where you earn it (and where it breaks).*