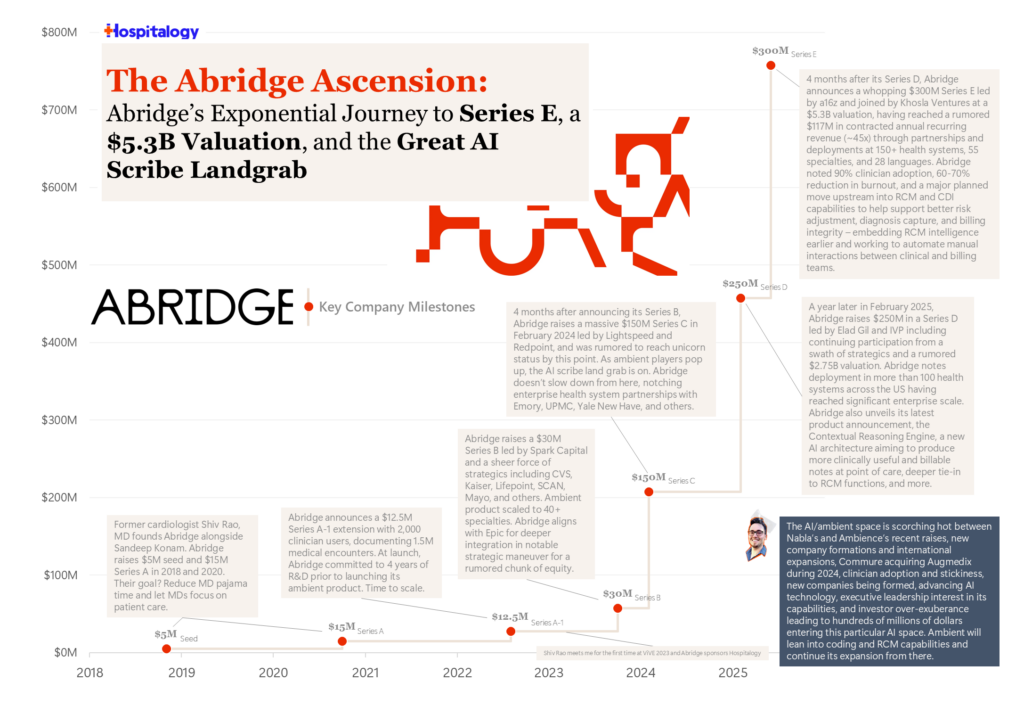

After several marquee late-stage fundraising announcements last week between Sword, Nabla, and Tennr, today Abridge announced a $300M Series E, bringing the ambient player’s valuation to a stratospheric $5.3B. We also received several new signals as to the future of ambient technology, and it all boils down to RCM, coding, and documentation.

Along with noting $117M in contracted annual recurring revenue in 2025 (per Axios) and over 150 deployments with enterprise customers, Abridge expanded on its plans for its new Contextual Reasoning Engine to move upstream into revenue cycle management functions, capturing more diagnoses at the point of care while staying out of the way of clinicians to do their work.

Here’s the full ascension of Abridge, from company founding to today, listing public fundraising announcements:

Commure comes to play: Meanwhile, Commure also announced a $200M raise out of General Catalyst’s Customer Value Fund (which is an interesting fund), itself noting partnerships with 130 health systems across its array of AI products, aiming to become the Olive 2.0 (sorry couldn’t resist) AI intelligence layer for enterprise health systems and care delivery organizations nationwide. In the past year and a half, Commure has acquired Augmedix (I did a financial breakdown of Augmedix in Q4 2023), acquired Memora Care, noted a partnership with HealthTap in 2025, and shared its own vision for AI agents across RCM, contact centers, and more earlier in 2025.

Commure also has its own plans to go public within the next 2 years as the IPO window thaws, and based on activity from both players, both Commure and Abridge will be heavily focused on ambient and RCM growth in the coming years.

Bottom Line: AI scribes have outgrown their name, those well capitalized are pushing deeper, and the space as a whole should be considered something beyond a simple scribing technology as they push into other upstream use cases along with agentic workflows. The next battleground for ambient will be against the EHRs deploying their own AI solutions and, as they move into doing more and more…potential looming regulation as we’ve just seen with the UK designating them as medical devices.

Novo Nordisk lays down the hammer on Hims & Hers

In one stroke of the pen, a federal judge wiped out an entire underground healthcare marketplace.

Well, not quite. But it’s probably pretty close to that in healthcare. On Friday, a federal judge ruled semaglutide can officially stay off the FDA shortage list. Keep in mind that being on the shortage list allowed for compounders to produce their own semaglutide, a short-term workaround to make a quick buck. And it was always going to be a short-term workaround. Hims & Hers was one of these such players.

The question, now, is whether these mostly DTC telehealth players have appropriately prepared for the fallout. And some of that fallout is here today: Novo Nordisk announced the end of its partnership with Hims & Hers, starting some major beef by citing deceptive marketing, patient safety risks, and failure to adhere to the compounding shortage ruling.

- Based on Novo Nordisk’s investigation, the “semaglutide” active pharmaceutical ingredients that are in the knock-off drugs sold by telehealth entities and compounding pharmacies are manufactured by foreign suppliers in China…The report also found that a “large share of [these Chinese suppliers] were never inspected by FDA, and many of those that were [inspected] had drug quality assurance violations.

Recall back in April the Ozempic and Wegovy manufacturer partnered with the likes of Hims & Hers, LifeMD, Ro, and potentially some others to distribute GLP-1s to a wider net at more favorable pricing terms through NovoCare. At the time, it seemed like a win-win. Novo Nordisk gets distribution, and these telehealth firms score preferred partnerships.

Well, it turns out Hims & Hers may have been skirting the rules, and they in particular were the only ones not to play nice. Probably has something to do with the chunk of change they spent on compounding facilities (and this one is US.-based).

- A spokesperson for Novo told Reuters that its other telehealth partners have made good-faith efforts to transition patients from copies of Wegovy to the branded option. “Over one month into the collaboration, Hims & Hers Health, Inc has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of ‘personalization’ and are disseminating deceptive marketing,” the spokesperson said.

As I see it, all of this hubbub around GLP-1 shortages and compounding is a marketing and positioning play by Hims & Hers with the American consumer. For months they’ve been positioning themselves as the consumer healthcare company of choice – for the American people, to get them the care they deserve – sick of the system, etc. So they’re positioning themselves against Big Pharma and other healthcare constituents as a signal of trust to consumers – at a time when consumerism is on the rise and MAHA is a thing.

Still, as the Hims CEO, it must be exhausting for Dudum to constantly deal with controversy after controversy. Hims & Hers dropped 30% on the news of the Novo Nordisk hammer coming down. Hims’ CEO Andrew Dudum responded to the accusations saying Novo was misleading the public, and that the drugmaker was engaging in patient steering to Wegovy in an anti-competitive and anti-patient manner. Weak sauce. Hims was the only company called out. Nevertheless all of the madness is fun to follow.

Would love Hospitalogists’ perspectives here. Is Hims & Hers a pill mill, a substantial business, or something in between? From my perspective, I do think they’ve found a market need, provide a service, and are running a profitable operation doing so (at least from the outside looking in) but man, they do get in their own way a lot.

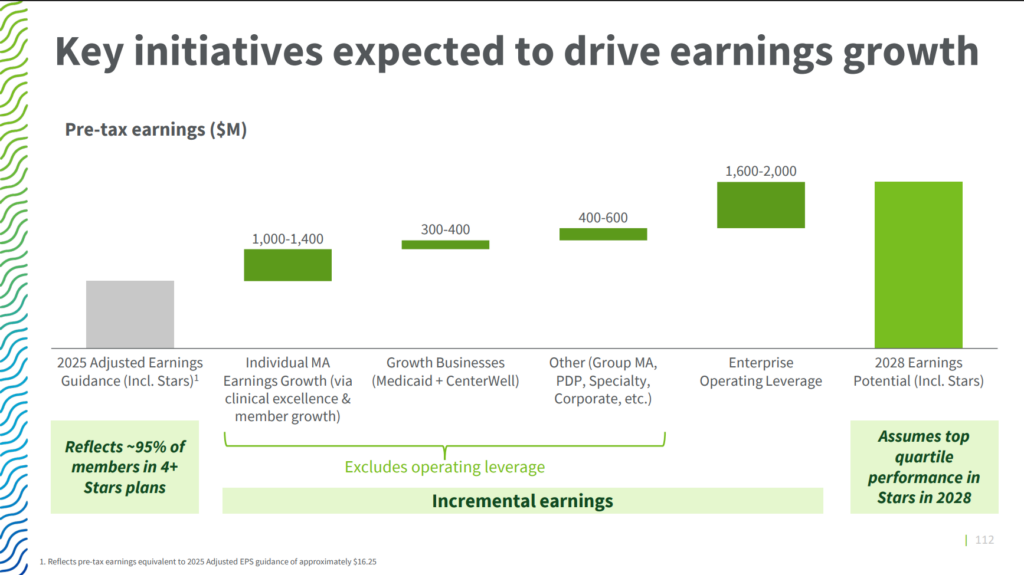

Humana’s Investor Day: 4 More Years

Humana’s 2025 Investor Day laid out a four‑year roadmap that turns a turbulent 2024‑27 recovery period into a re‑acceleration story by 2028. Here’s a quick TL;DR:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Business Reorientation: “This is a senior healthcare services business.” Along with CVS investing $20B into consumer-oriented initiatives, now Humana is calling itself a consumer healthcare company! Health insurance becoming consumer oriented? Color me shocked.

- Stars Hangover: 4-star plans plunge from 94% in 2024 to 25% in 2025-2027. Expectation for quality bonus rebound in 2028. As a result, Humana profitability will dip in 2026, stay flat in 2027, then resume growth in 2028.

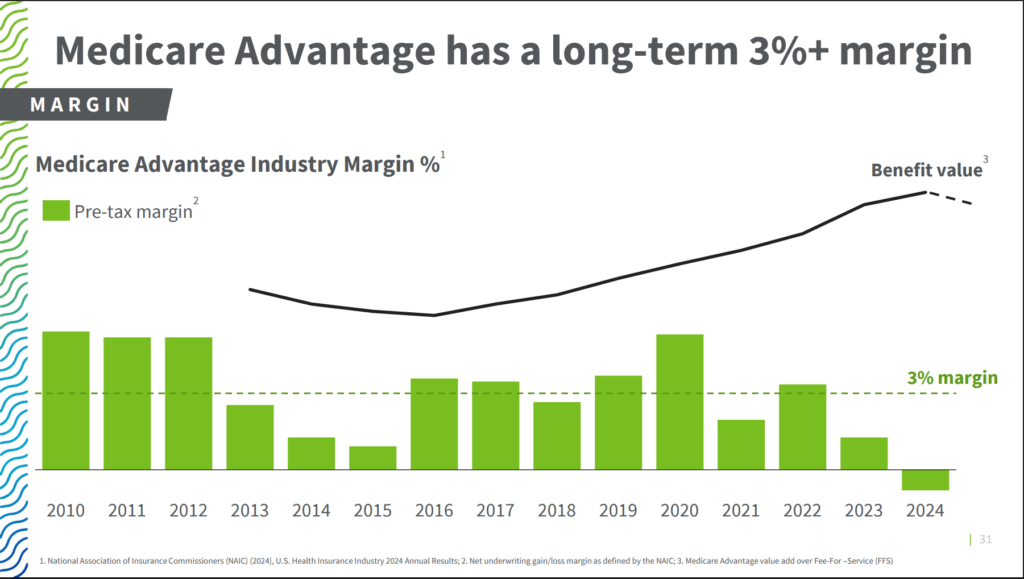

- Margin Recovery Plan: Humana plans for a path back to 3% pre-tax MA margin through 150+ bps in administrative cost leverage, then a combination of clinical outperformance – better preventive care strategy with CenterWell, diagnosis integrity, and medication adherence, etc.

(side note: what a fun little squiggly design on the left!)

- Excluding the effects of consolidating CenterWell JV locations, Humana expects to drive significant operating leverage through supplies centralization and consolidation which will also improve working capital, optimizing internal expenses for travel and entertainment (sorry Humana employees no conferences for you), and standardizing policies enterprise-wide with a focus on retention. Humana also plans to consolidate its outsourced services from ‘multiple dozens of partners’ to ‘less than 10 partners’ if that says anything about the movement from point solutions to platforms in healthcare. Hint: it says a lot.

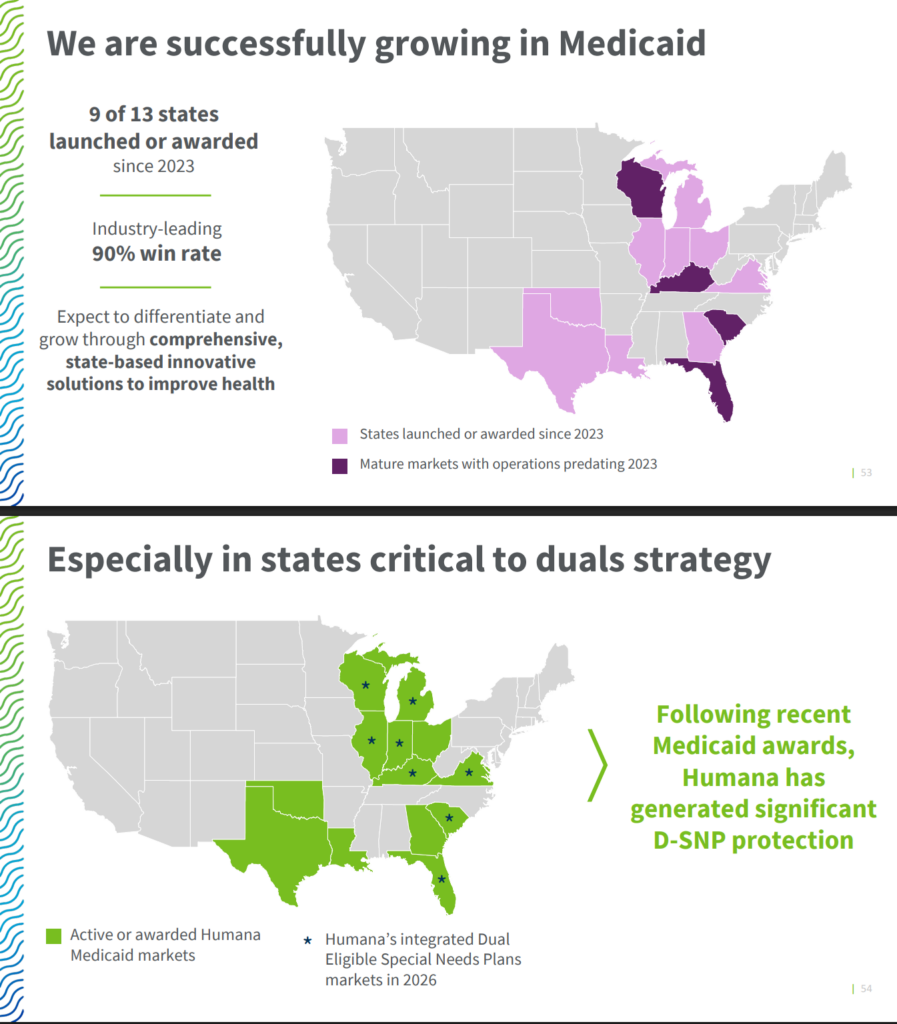

- Growth Levers: Humana expects Medicaid revenue to grow from $13B to $20B by 2028 and CenterWell volumes to grow, with a callout to D-SNPs and entering Georgia in 2026. “Medicaid and CenterWell will be more prominent parts of the business by 2028.” Members using CenterWell Pharmacy, for instance, save $450 PMPY in medical spend and have a 15% higher NPS. Patients who use CenterWell in Humana’s vertically integrated model create 2 to 4x greater enterprise margin potential. Humana positions CenterWell as a leading chronic care delivery platform.

- CenterWell added 80 facilities in past 24 months. They also have the put/call structure for 100 additional sites with Welsh-Carson which will drive significant operating leverage. Target $3M contribution margin per center at maturity. 60 centers currently meet this target.

- CenterWell Home Health (prev: Kindred) is 350 agencies across 37 states. 70%+ of Humana MA members live in CHH service area. Focus will continue on adding density to existing markets, launching new ancillary outpatient services (hmm…infusion acquisition? More home health tuck-ins?) and broaden post-acute navigation models beyond DME, home health, and skilled nursing

- Tremendous potential and growth in specialty pharmacy as a scaled payor agnostic player

- Tech Stack and Innovation: Ambient documentation pilots live in 70+ CenterWell rooms after beginning pilot earlier in 2025. But who?!? Prior‑auth automation initiative is targeting greater than 50% instant decisions by 2026. As mentioned, Humana is consolidating dozens of vendors down to fewer than 10.

- Analyst Reaction: Market reaction was positive toward the updates, trading up marginally since June 16th.