I wanted to give a quick shout-out to my colleague and friend Jared who’s getting married tomorrow! Give him some love on Twitter! He’s also asking for some marriage advice, so lay into him.

Today I’m doing my best Beckers impression by diving into “3 stories and trends to watch!” in 2023:

- The integration of primary care and behavioral health

- Venture capital activity in a recession

- Will hospitals rebound in 2023?

Let’s get after it!

Join 6,300+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Continued integration of Primary Care and Behavioral Health.

Behavioral health has a ton of steam. CMS is prioritizing whole-person behavioral health across a number of initiatives, and Medicare telehealth visits for behavioral health have skyrocketed. This trend isn’t going away anytime soon, especially as telehealth has found a major haven in behavioral visits.

Along with behavioral health, primary care has seen a ton of investment activity and attention as value-based care continues to grow.

As we continue to de-stigmatize mental health and understand that mental health = physical health, these two industries will intertwine and converge over time into an evolved, more holistic understanding of what primary care is (social, physical, mental).

Primary care practices or platforms will develop behavioral health ancillaries as reimbursement policy incentivizes such changes.

It’s a win-win: Patients get access to whole-person care while primary care ops are bolstered financially, which should hopefully continue to spur investment in the space.

Added investment dollars would hopefully enable higher comp for behavioral health clinicians and incentivize more to enter the workforce, helping to address chronic workforce shortages in the market (along with telehealth).

I know it’s a rosy picture. There are still major challenges to get to where we need to be in behavioral health mostly in existing reimbursement structures that hamstring the ability for a primary care practice to build out a behavioral care team as well as the existing shortage of behavioral professionals available.

I’d love for CMS to continue to incentivize behavioral integration through enriched reimbursement / codes to groups that have done so.

Finally, we should consider redefining the visit. Instead of tying reimbursement to fee-for-service, or per-visit, let’s consider some type of hybrid payment that allows PCPs to build out care teams and work with patients asynchronously to enable the care model of tomorrow.

How healthcare investment activity might shift in a recession.

Over the last 2 years, we witnessed a flood of activity in the health tech space. Valuations hit all-time high’s with the abundance of cheap capital for growth, and emphasis on profitability was at an all-time low. A lot of investment activity happened in these anomalous conditions.

Now, healthcare and health tech firms are facing the Great Reset in which companies over-hired, and we’re now unfortunately seeing the washout of growth as valuations crater, capital tightens, and profitability as well as cash burn bubbles to the top of the priority list. Consolidation in digital health will continue to take place over the next 6-12 months as firms get left out in the cold and cash dries up.

But there’s a compelling opportunity for investors to take advantage of macro conditions and general bearishness in the investing landscape. Those with conviction and well thought out, data-driven beliefs have a distinct edge to make some great investment plays and provide lifelines to solid firms temporarily down from factors outside of their control. The better run companies and grittier founders will prevail.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Here’s how investors are pivoting in the current environment:

Longer investment horizons, slower pace. Don’t be fooled. There’s still a LOT of capital in the market. General Catalyst just launched a $670 million healthcare fund and venture capitalists raised a record sum of cash in 2021. Investment activity is still well above 2019 levels, and although the expected run-rate of around $21B for 2022, that amount is significantly above even as late as 2020 ($14.7B – credit to Rock Health).

- The only dynamic shifting here is pace. Investment funds will likely deploy capital at a slower rate than what was seen in the past couple of years. Instead of raising and immediately going to town on rounds, investors will allocate over a a longer time horizon – 2 to 3 years and be pickier with their decisions. Some may even pivot to the public markets.

Emphasis on attractive unit economics. AKA, investors will be focused on a clear path to profitability. Growth is now secondary to attractive unit economic plays as investors revert back to traditional private valuation metrics (burn multiple, etc).

Creative deal structures. While the amount of capital in the market signals a founder-friendly environment, that dynamic seems to be shifting back to the investor. As a result, we may see more creative deal structures, perhaps even considering debt as part of raises as investor leverage increases.

Madden’s Musing: Despite the common rhetoric and market washout, investor appetite still seems to be strong in healthcare. This environment will create resilient, scrappy founders and therefore companies. Some of the best companies in the world were founded during 2008, so here’s hoping for a similar result this time around in healthcare, which seems to lag other industries by 10 years. Some areas to watch would include startups focused on specialized conditions (MS, cardiology, etc.), infrastructure plays developing tools for hospitals and practices, and data plays focused on analytics and innovating care delivery models.

Will Hospitals Rebound?

I dove into hospital earnings on our past two Tuesday roundups (you can look at the HCA and Tenet write-up here and the CHS and UHS write-up here).

TL;DR – HCA and Tenet are back to business as usual while UHS and CHS seem to be stuck in a rut operationally. It’s quite the tale of two hospital operators as Tenet and HCA continue to focus on building out their outpatient footprint and diversifying revenue streams through ancillary/post-acute services by investing in USPI, urgent care footprints, or home health agencies (Brookdale).

Meanwhile, UHS seems to be chronically struggling with retention and CHS suffered from some idiosyncratic challenges related to short term stays and much lower revenue from those procedures that were reclassified as outpatient.

As far as publicly traded hospital activity in healthcare is concerned, we should expect to see some favorable factors for hospitals in general in the back half of the year:

Demand. Operators are expecting a return to more normal demand utilization in 2H 2022, at least in the short term (AKA, assuming monkeypox doesn’t become another pandemic or another ‘Rona variant pops up). The return of more seasonal demand means that hospitals should see higher utilization in Q4 as folks hit deductibles in the back half of the year.

Contract Labor. Travel nurse contract labor is returning to earth – albeit, slower than expected. As a percentage of SWB, HCA’s contract labor dropped to 8% (from 10%) and Tenet’s dropped to 6% on a similar order of magnitude. Similarly, CHS’ contract labor dropped from 13% to 10% of SWB

Rate Lifts. Hospitals are getting a huge 4.1%+ lift for inpatient services (MUCH higher than the proposed 3.2%). CMS definitely did hospitals a favor with the biggest IPPS payment bump in the last 25 years. This bump, along with commercial lifts, should relieve some pressure for the largest operators after the tight environment they’ve faced over the past 6-12 months.

Although hospitals should expect some recovery in 2023 as things return to normal, the industry is still facing some overarching headwinds.

The shift to outpatient care settings continues to put pressure on inpatient admissions (a good thing in my mind, as this leads to reduced hospitalizations, lower costs, and added patient convenience). As mentioned, HCA and Tenet see the writing on the wall and are expanding outpatient / post-acute services upstream and downstream.

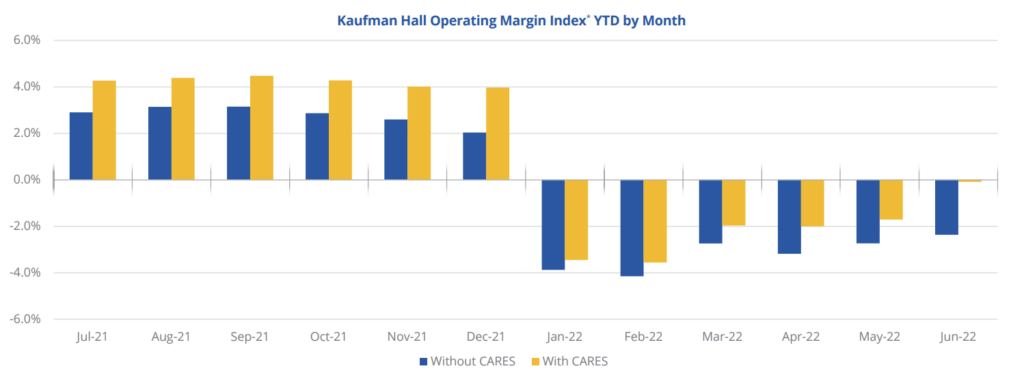

A majority of hospitals NOT named HCA or Tenet are still struggling according to Kaufman Hall. Expenses are still floating near all-time high’s and the median operating margin is still (barely) sub-zero. Meanwhile, the Fed is raising rates, leading to higher borrowing costs for hospitals already operating in the red. You have to wonder how this dynamic (if continued) leads to anything else other than more consolidation.

At the same time, you can see the path to recovering positive margin in the back half of the year (again, credit Kaufman Hall):

Questions remain as to whether healthcare remains the recession resistant industry stalwart it has been in the past given increasing dependence on elective procedures to boost the bottom line while deductibles march upward. Given how strong and stable demand is in healthcare in general as well as the prevalence of the ACA, I have to think it still is.

What do you think? Is healthcare – and are hospitals – still recession resistant? Is the traditional hospital slowly getting choked out by the secular outpatient shift?

Miscellaneous Maddenings

- Am I going to keep bringing attention to stunning James Webb Telescope photos? Yes. Yes I am! I can’t get over how much of an improvement it is over Hubble.

- Alphabet’s AI neural network DeepMind has apparently successfully predicted the structure (paywall) of nearly all proteins known to science.

- Dr. Glaucomflecken had another banger on PBMs as someone who is injecting some much-needed comedy into healthcare alongside Nikhil and others.

Hospitalogy Top Reads

- Bessemer developed a fantastic analysis on benchmarks for growing health tech businesses.

- Wah Yan wrote an interesting piece on the intersection of Web3 and biopharma and Sean John Thompson wrote a similar piece in late June on Vibe Bio – both covering potential Web3 use cases in healthcare and drug discovery.

- Jacob Effron had a great discussion with Tom Lee talking all things Amazon/One Medical and Galileo.

- McKinsey dove into healthcare workforce issues and talked about 6 strategies organizations could pursue.

Join 6,300+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!