Welcome to another lit installment of Hospitalogy.

Today we’re diving back into the Amazon-One Medical deal! I’ve already written a deep dive on the economics and potential for Amazon, but there were also some interesting tidbits in the proxy statement, so we’ll be walking through some of the more interesting nuances of the deal today.

Let’s get after it!

Join 7,200+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Inside the Amazon-One Medical Deal

“Class, please turn to page 32 to follow along.”

Let’s set the playing field and put everything in context on the behind-the-scenes happenings.

One Medical bought Iora Health, a value-based care primary care platform in June 2021, for $2.1 billion. Risk-based businesses require a lot more capital than do fee-for-service based services.

One Medical knew that it needed to raise cash (about $300 million) by the end of 2022.

Bloomberg recently revealed that Party A mentioned throughout the document was CVS, who had been in talks with One Medical starting in October 2021.

CVS offered One Medical an $18 / share purchase price on June 2. One Medical management responds with “that’s great, but we’re going to have to move the deal forward on an expedited timeline. Oh, AND you won’t get exclusivity.” AKA, One Medical and Morgan Stanley wanted to shop around to other strategic buyers.

A week later on June 9, Morgan Stanley manages to get Amazon involved in the 11th hour by telling Amazon that One Medical had received a buyout offer from another party. Amazon had been in general talks with One Medical on a potential commercial partnership (presumably with Amazon Care) throughout the first half of the year but mentioned an interesting in buying One Medical outright after hearing there was takeover interest.

Notably, after acquisition rumors hit mainstream media outlets in early July, no other parties got involved.

CVS starts to get cold feet on the deal after noting concerns with the expedited timeline, non-exclusivity, and reviewing the diligence materials (financial and operating information).

Amazon offers $16 / share. One Medical says “not good enough.” Amazon ups it to $18 / share on July 2 subject to One Medical’s Q2 performance. Offered deal terms also included a $400 million reverse termination fee (10% of the deal value), a 2.5% termination fee for any competing offer, and an agreement to provide One Medical with $300 million in financing to keep the lights on.

One Medical reaches back out to CVS, saying that they were considering other ‘strategic options’ and time was of the essence. CVS bows out.

Deal terms ultimately get revised to $18 / share offer price, $300 million in unsecured debt financing, $195 million reverse termination fee, and a $136 million termination fee (in the event ONEM gets a better offer price).

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Amazon and One Medical reach a deal on July 21, 2021.

Diving into the valuation methods.

In addition to the deal timeline and politics involved (must have been fun to be a fly on the wall in board room discussions), I found the Morgan Stanley (”MS”) valuation methodologies very noteworthy as far as public market valuations are concerned.

As a part of the deal, Morgan Stanley was charged with making sure that the deal was “fair” for shareholders, AKA, shareholders are getting an attractive offer from Amazon. To do so, MS conducted various valuation analyses of One Medical to make sure that the purchase price fell within a calculated valuation range.

Valuation Methods used and One Medical share values calculated:

- Public Trading Benchmarks ($7.50 – $15.75)

- Discounted Equity Value Analysis ($11.25 – $21.50)

- Discounted Cash Flow Analysis ($11.75 – $21.50)

- Premiums Paid Analysis ($11.59 – $14.90)

Let’s dive into the assumptions used in each method.

Method 1:The fairness opinion provided a good overview and landscape for tech-enabled primary care platforms in the public markets.

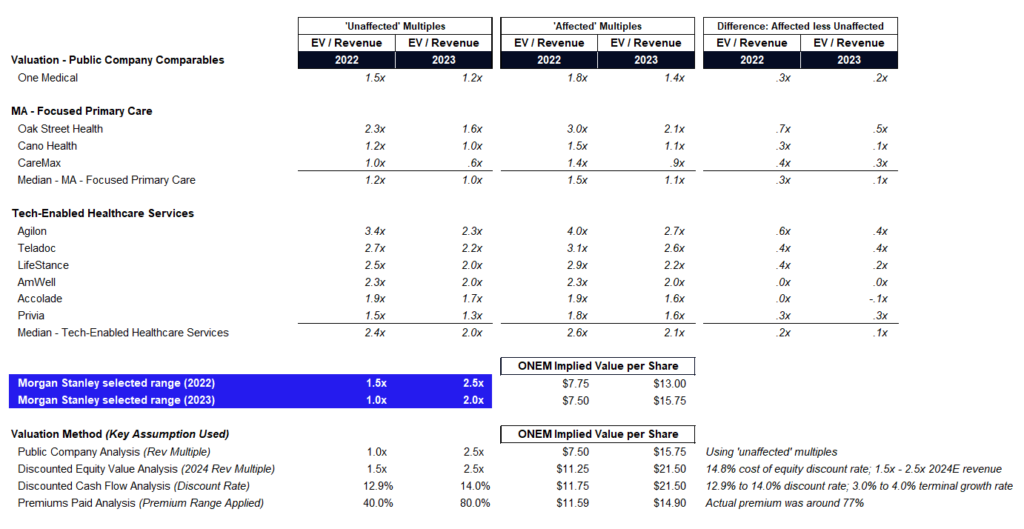

In looking at method 1, MS developed the following market multiples map for the tech-enabled services landscape, bifurcating between more general tech-enabled players and the companies focused on Medicare Advantage specifically (top section of the below).

MS focused on 2022 and 2023 revenue multiples on July 1 – called the ‘unaffected’ multiples (prior to the news announcement that bid up other players in the space). For illustrative purposes, I included the ‘affected’ multiples and the difference between the two so you can see the impact that takeover rumors had on the whole landscape).

After selecting a range of 1.0x – 2.5x across 2022 and 2023 revenue multiples, MS calculated One Medical’s equity value per share at a range between $7.50 and $15.75 – below the takeover price of $18.

Translation: the premium at the time on a multiple basis was well above One Medical’s publicly traded peers

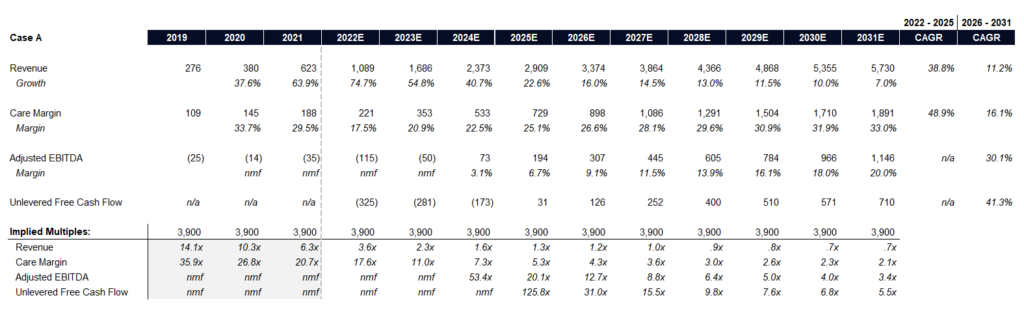

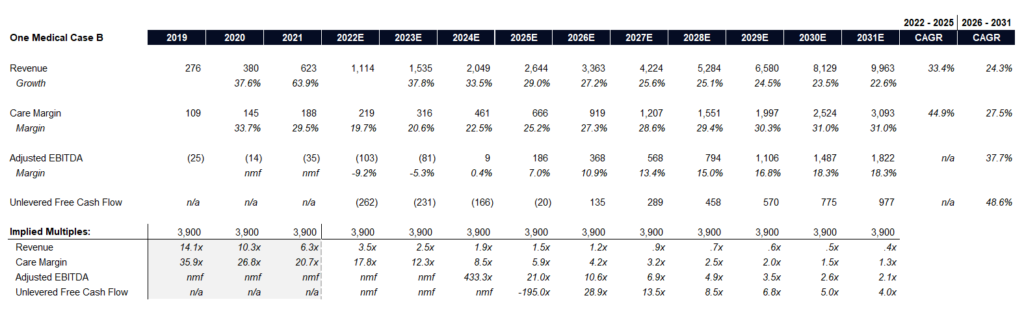

Methods 2 and 3: For its cash-flow based analyses (Equity Value and Discounted Cash Flow analyses) MS used two internal One Medical forecasts in its analyses, Case A and Case B.

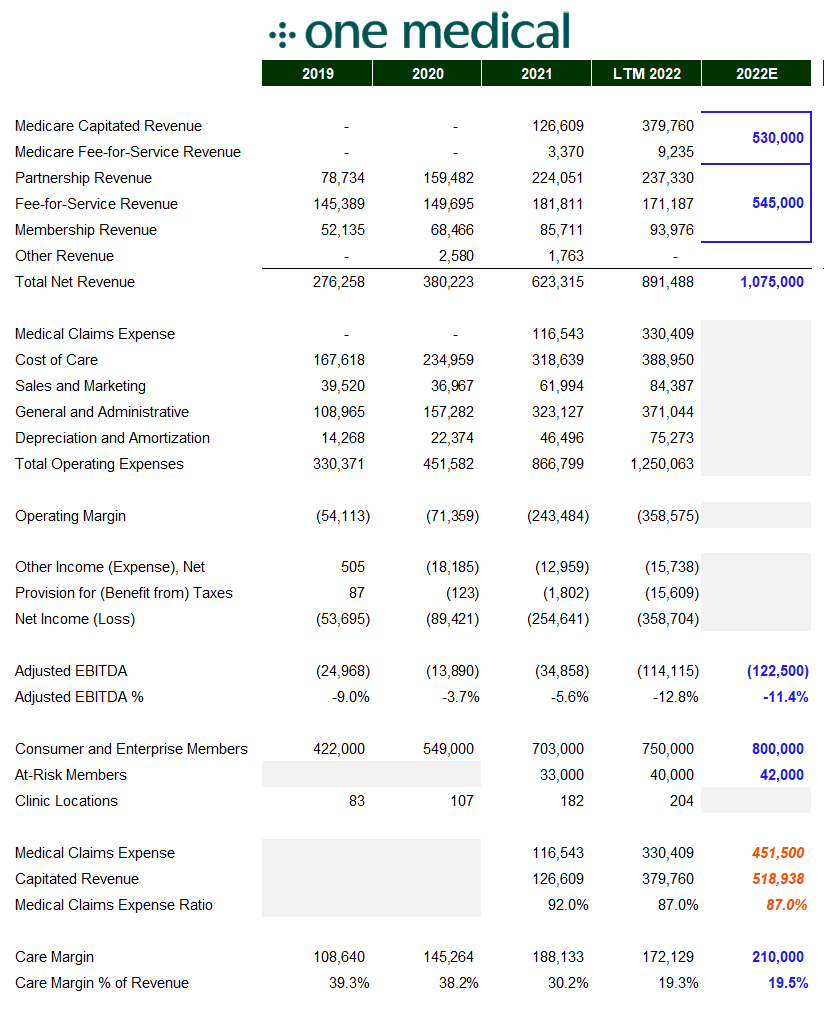

Morgan Stanley created internal financial projections in conjunction with One Medical management and developed a fairness opinion for the merger based on a few familiar valuation methodologies:

Case A assumed lower long-term capital investment in future growth starting in 2024 as a result of the current macro economy but projected higher cash flow and revenue through 2025:

Case B assumed higher long-term capital investment and subsequent long-term growth with significantly more cash flow in the out years (2026E – 2031E; AKA, higher terminal value):

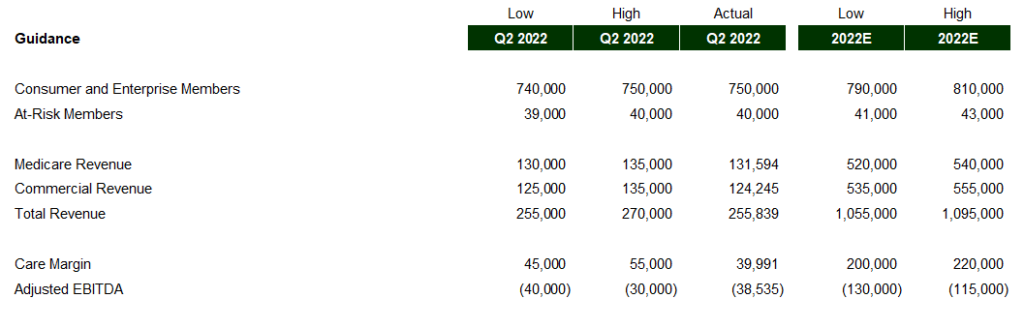

I won’t opine as to the feasibility of these projections, but I WILL tell you that all of the metrics (revenue, care margin, adjusted EBITDA) all sit at the high end – or ABOVE the high end of One Medical’s guidance range that it disclosed in Q1 2022. So, take that for what it’s worth

Methods 2 and 3 differ in the sense that MS seems to be valuing just the equity component of the business in Method 2 whereas a discounted cash flow analysis (the typical bread and butter of finance and valuations) values the entire enterprise and then adjusts to calculate an equity value, then subsequent value per share.

- In Method 2, MS assumed a 14.8% discount rate and applied a 1.5x to 2.5x revenue multiple…to…2024 estimated revenue. Only then could MS get to a per-share value that includes the proposed $18 per share purchase price

- Similar funk was used in Method 3, the DCF approach. MS applied a discount rate ranging from 12.9% to 14.0% along with terminal values between 3.0% and 4.0% (funny, my firm always uses 2% – 3%) to fit nicely with the $18 per share purchase price.

Finally, Method 4 was pretty straightforward. MS applied an average premium range of 40% to 80% to One Medical’s stock price to calculate the value of a stock given historic premium takeovers in the public market. MS also noted that the average 27-year premium for a buyout is 40%, but that didn’t stop the bank from doubling the total for the high end of its range.

Even after applying the wide range, its per-share value calculated as of July 1 was $11.59 to $14.90.

My Brief Commentary and Thoughts

It’s pretty clear that One Medical wanted to sell quickly and One Medical’s Q2 results seem to mirror that sentiment. Most of its earnings results fell at the low end of its guidance ranges, and the business is in a state of transition as it integrates Iora.

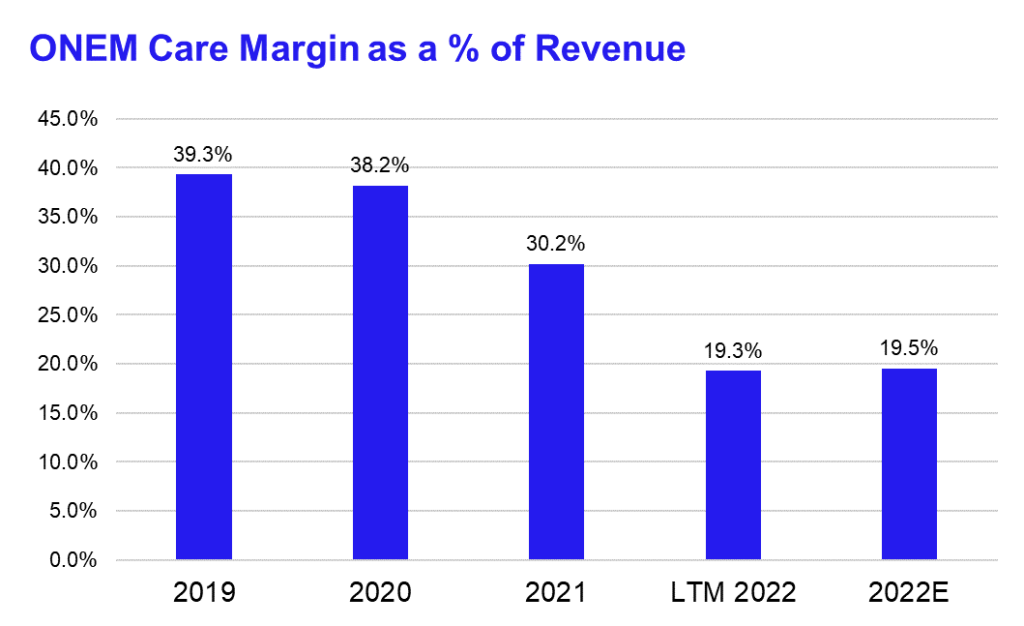

Although I believe in the long-term longevity of the business model (emphasis on long-term) it’s pretty clear based on the valuation assumptions used – most notably, a multiple of revenue on 2024E revenues for a business that is half risk-bearing – that Morgan Stanley struggled to justify the purchase price given One Medical’s current economics. As seen in the graphic above, its model was somewhat deteriorating across key profitability metrics.

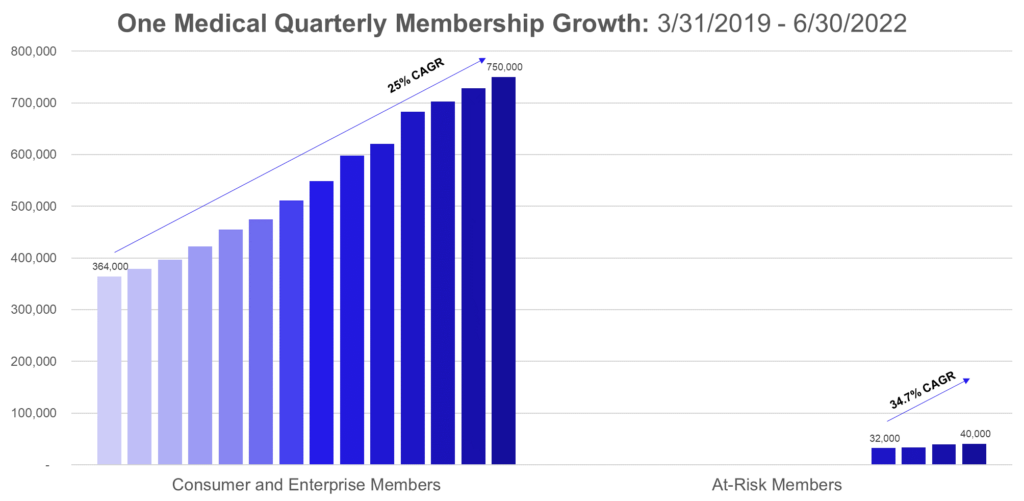

Here are some extra charts just because I made them, think they look spiffy, and wanted to include them:

Bottom Line: The business of value-based care in particular is tough. It takes a while to transition and grow patient panels all while operators require reserve capital, other capital accruals, and open de-novo clinics. Did One Medical make a huge mistake by acquiring Iora? Is that what ultimately led to the buyout?

If you made it this far, thanks for reading! Please feel free to hit me up with any and all thoughts about the MS analysis, including anything I might have missed. It’s some interesting stuff and has lots of implications for tech-enabled services.

Miscellaneous Maddenings

- A 20 year old student from USC took $27 million raised from his friends and family (note: some friends and family, I mean sheesh, is something sketchy going on here??) and made $110 million by dumping it into Bed Bath and Beyond stock. At one point, he owned 6.2% of the entire company

- This thread about the best parts of being in a relationship was very wholesome.

- Decoldest Crawford (yes, a real name and a football player for Nebraska) signed an NIL deal for a heating and cooling company, and the commercial he produced is every bit as good as you think it would be given his name.

Hospitalogy Top Reads

- Jacob Effron shared his latest interview with Brad Smith, founder of CareBridge, Main Street Health and Aspire and former head of the Center for Medicare and Medicaid Innovation

- This read from Frontiers for Good on women’s health research and its underfunded status is worth your time.

Join 7,200+ smart, thoughtful healthcare folks and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!