Happy Thursday, Hospitalogists!

As I’m out on leave, today kicks off our guest-posting series, a benefit extended to members of my community, Board Room. Over the next handful of months, you’ll hear from several of them, and first off the block is Michael Stratton, the Founder of HealthDataAtlas, a company focused on providing insights into healthcare markets and the entities that comprise those dynamics. I’ve chatted with Michael about physician dynamics before, and figured this post would be an interesting way to analyze some markets and understand how healthcare strategists think about the world. If you’re in these markets, or if you have any insights to share, please feel free to respond to the e-mail or reach out with your thoughts!

This edition of Hospitalogy is sponsored by my friends at Weaver

When it comes to spotting problematic, time-consuming accounting pain points on hospital and physician practice financials, not many are better than Weaver.

It is mind-boggling that in 2023, we’re still calculating things like net collections, net accounts receivable, and bad debt manually at provider organizations.

That’s why Weaver created Hi-Arc.

Using Hi-Arc and your own internal data, accounting teams can automate time-consuming tasks while improving financial transparency, becoming an instant value-add through:

- Automating lengthy month-end processes;

- Offering more realistic pictures of net revenue and A/R estimates;

- Identifying reasons for rejected claims;

- Analyzing bad debt more quickly

Stop the guesswork and lengthy spreadsheet review. Get more accurate, real-time net revenue and A/R estimates. Check out Weaver’s Hi-Arc and book a demo to see how it can cut your monthly close by hours.

Diving into the physician specialty dynamics across Atlanta, Phoenix, and Orlando

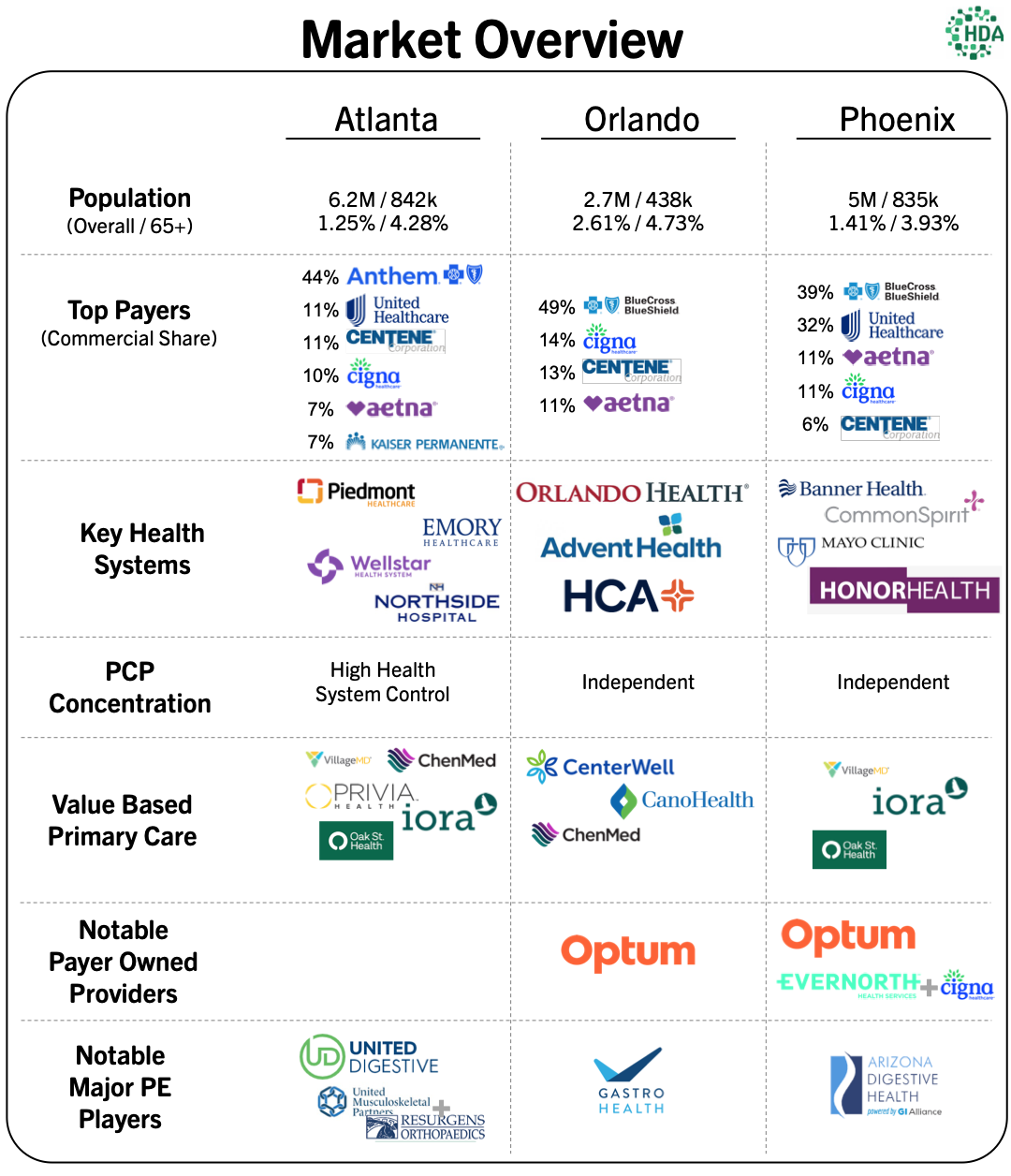

Understanding local healthcare market dynamics is critical to optimizing strategic decisions. Market Demand & Payer Structure, Regulatory Structure, and Provider Dynamics contribute to how much power an organization will command in a market. Accurate data in these areas is critical to understanding the entire market.

Our focus is on Provider Dynamics. We break them down into these areas:

- Referral Source Concentration – Does a particular health system or market participant control referrals by owning a large portion of the primary care market in that area?

- Health System Concentration & Facility Options – Does a particular health system control most of the facilities?

- Provider Consolidation/Concentration by Service Line – Is there excess ownership concentration of any particular specialty? If so, what is their market share of providers?

- In Market Services Available* – For rural areas, which services are not available in the market?

To illustrate these dynamics we analyze 3 geographic markets: Atlanta, Phoenix, and Orlando across 4 service lines: Primary Care, Cardiology, Gastroenterology(GI), and Orthopedics.

These markets are not as simple as they would appear on the surface. Some key takeaways from the analysis are:

- Atlanta has a deep battle in the value-based primary care space. Has Oak Street lost this battle due to their de novo strategy?

- Private Equity(PE) backed provider groups control over 40% of the GI market in both Atlanta and Phoenix. Will this trend continue in other markets?

- Phoenix is the only market where an independent cardiology group has over 10% of the market. Will ASCs allow cardiologists to detach themselves from hospital systems and will this trend pick up?

Referral Leverage Lives in the Primary Care Market

We will begin our breakdown starting with the PC market. Generally speaking, PCPs are the gatekeepers to specialty referrals and provider groups that can employ a large share of these providers have referral control to downstream specialists. For health systems, this means referrals stay within their own network.

The following breakdown is based on the number of providers employed by group.

Note: Names simplified for presentation.

Atlanta

Atlanta has the highest level of health system control at around 50%, however none of the individual health systems have over 30% of the providers.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

In addition, Atlanta has become a prominent market for value-based primary care. VillageMD, ChenMed, Iora, Privia, and Oak Street all have locations within Atlanta!

Oak Street has not made significant headway into the market, despite starting around the same time as their competitors. Their competitors have grown through acquisition while Oak Street has pursued a de novo only strategy. We cannot help but conclude that their current strategy has held back their PCP market penetration. In fact, they are less than ¼ the size of their next largest competitor – Iora.

Orlando

Health systems have significantly less control of the PCP market within Orlando. Despite a very concentrated hospital market with 3 major systems owning most of the hospital beds, there are only 2 present in the primary care market- Orlando Health and Advent Health. This is because HCA, the other major Health System, does not own any primary care assets in the Orlando market.

Continuing with the value-based primary care analysis, there are a different cast of characters in the market: Centerwell (Humana), having the largest market share, with Cano Health and ChenMed representing a smaller but sizable presence.

In addition, Optum has a large presence in the market.

Phoenix

Phoenix has neither significant IDN control nor concentration of major players within the market.

Oak Street faces a similar situation to the Atlanta market as the same characters are present with significantly more providers: VillageMD through their Summit acquisition and Iora via One Medical. Similar to the Atlanta value-based market, Oak Street can be seen at the bottom, with less than 5% of market share of providers.

On the payer side, Cigna and Optum have sizable presences in this market.

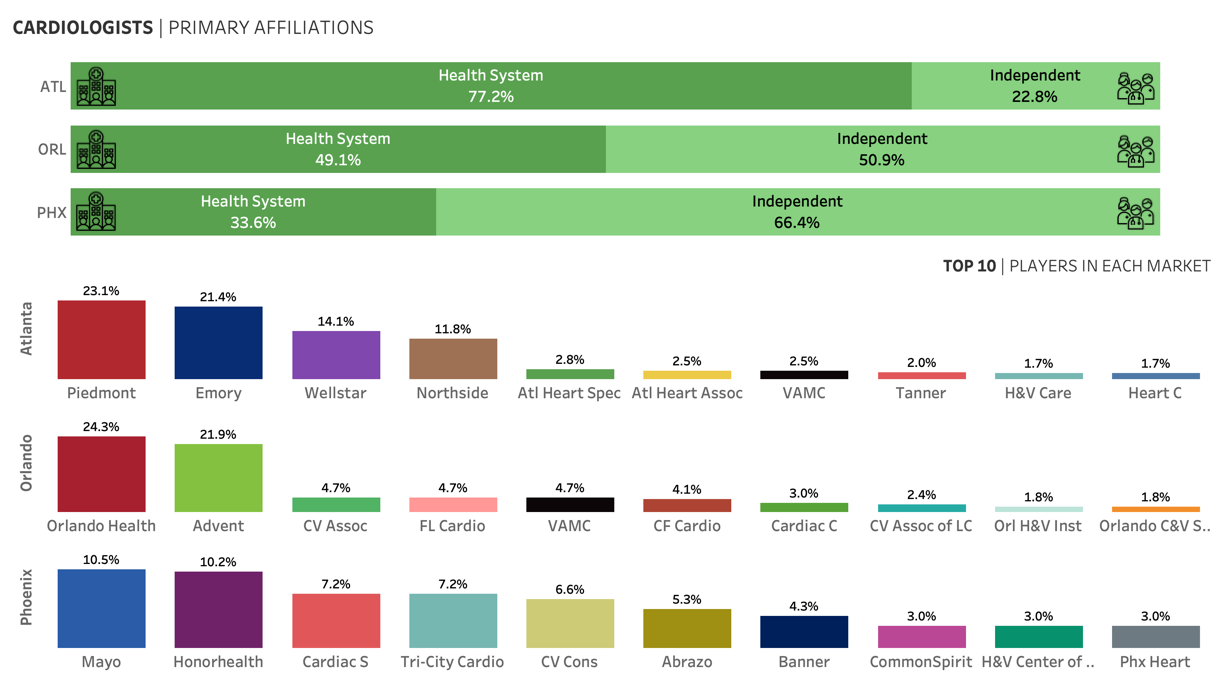

Cardiologists

Cardiology has traditionally been a highly hospital-based specialty, with most procedures requiring a hospital setting to perform; however, regulatory changes are allowing some procedures to move into Ambulatory Surgical Centers (ASCs). ASCs provide a relatively less expensive alternative to Inpatient and Outpatient settings of care to patients. Moving procedures into an ASC benefits cardiologists by allowing them to capture a portion of the facility fee on top of their professional fee through facility ownership. The opportunity to invest in ASCs has attracted significant PE interest in other specialties and is likely to occur in Cardiology as well.

Both Atlanta and Orlando are dominated by large health systems- Atlanta by Piedmont and Orlando by Orlando Health.

Of the markets analyzed, Phoenix is the only market where an independent group had over 10% of provider share. Can we expect the market to remain primarily controlled by independent practices or can we expect some consolidation to occur as procedures move into ASCs?

Gastroenterologists

PE is known to have a long standing presence within the GI market. As expected, all three markets have a PE backed group in their top three provider groups.

Atlanta, which was dominated by health systems in other specialties, finally flips for GI as PE backed United Digestive employs 36% of providers in the market. It is followed by Digestive Health of GA and GI Specialists of GA. Interestingly, all 3 groups are affiliated with one of the major health systems’ clinically integrated networks.

Emory is the only health system with a major GI presence.

In Orlando, Advent Health and Orlando Health have major GI practices with PE backed Gastro Health taking second position.

While Mayo has a large presence in Phoenix, Arizona Digestive Health, part of PE backed GI Alliance, has approximately 25% of the market.

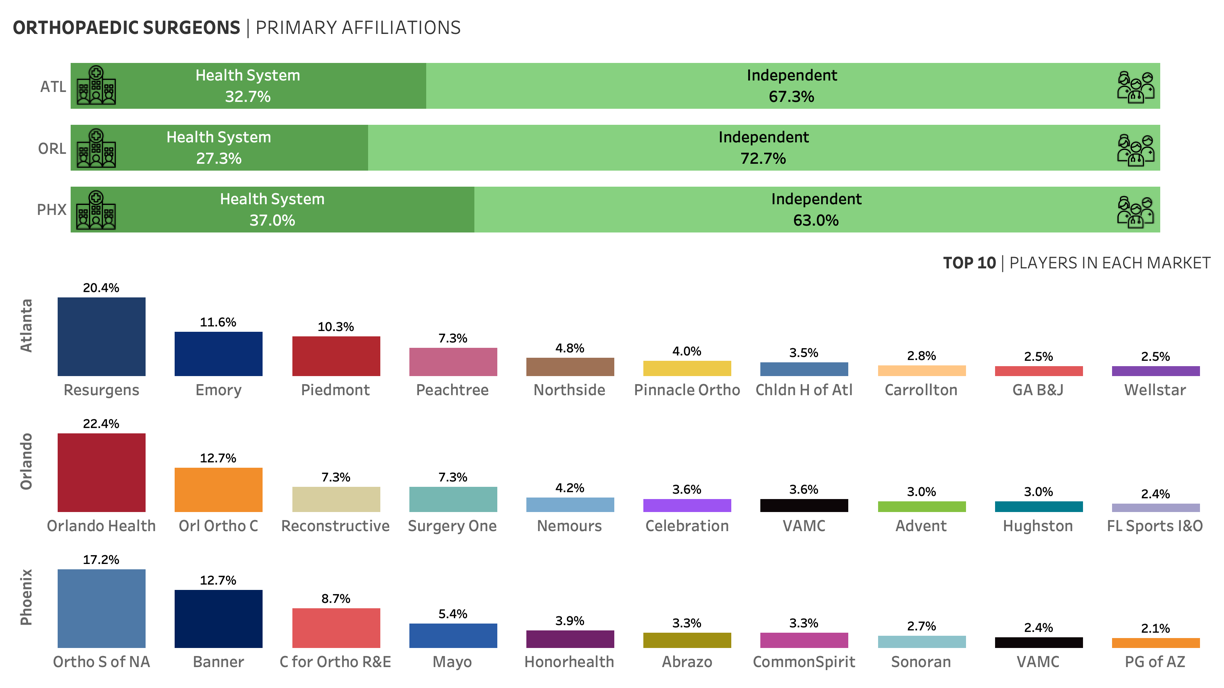

Orthopedic Surgeons

Orthopedic surgery has traditionally been a holdout of independent providers, but it has quickly become well penetrated by PE firms. Atlanta and Phoenix both have PE backed platforms as their largest provider groups.

Atlanta’s orthopedic market is significantly less concentrated by the health systems; however, it is dominated by PE backed Resurgens, having 20% market share, ~2x that of its closest competitor.

Orlando Health is by far the largest player in Orlando but is trailed mostly by independent practices.

Orthopedic Specialists of North America has the largest presence in Phoenix, but it hasn’t cracked 20% yet.

The complexity will continue!

Market structure will continue to become more nuanced as provider acquisitions continue to emerge across the industry.

At HealthDataAtlas, leveraging data to understand healthcare markets is our core focus and we’ve only scratched the surface of what’s possible. We’d love to hear your thoughts and where you think we should take our analysis next. If Blake invites us back, we’ll go even deeper on these topics!

If you’d like to get in contact with us, connect with me on LinkedIn or send me an email to [email protected]

Notes:

We defined the PC market to include providers that practice Family Medicine or are General Practitioners or Internal Medicine Generalists.