Welcome to the new Hospitalogy Tuesday format until I’m back from leave. I’m going full-on executive summary mode, with lots of bullet points and interesting tidbits, but lighter on deep analysis for now.

Let me know what you think, and if there’s anything else you guys would like to see. We’ll return to regularly scheduled Hospitalogy Tuesday programming in December!

Also, thanks to Verifiable for sponsoring Hospitalogy today. Stay tuned for a piece coming out this Thursday on the state of healthcare valuations too.

Onto this week’s news!

Subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)

SPONSORED BY VERIFIABLE

In an era where efficiency defines success, manual credentialing feels painfully archaic.

Verifiable is changing the game.

By automating over 3200 primary source verifications, Verifiable slashes credentialing packet completion time by a staggering 78%.

This doesn’t just quicken the pace — it revolutionizes it.

Network teams operate 4X faster, rapidly onboarding providers and safeguarding an average revenue surge of $243,000 per provider.

Traditional CVOs can’t compare.

With Verifiable, you’re not just adopting a system; you’re embracing a smarter way to grow and scale in healthcare.

Make the switch, witness the transformation, and leave outdated credentialing methods in the past. Ready to experience the difference?

Healthcare Headlines

BrightSpring’s IPO Comeback

- After filing an S-1 in October 2021, then pulling the plug on those IPO plans in late 2022, BrightSpring IPO rumors have re-emerged. The home health and hospice player generated $5.6B in revenue in 2020, and more details to come as it files an updated S-1 assuming IPO plans go through and the healthcare public markets thaw out. BrightSpring’s footprint is impressive with 900+ locations across the U.S. and provision of care for complex patient populations (IDD, polypharma) (Link)

FTC Sues USAP

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- The FTC has decided to pick on Welsh Carson’s (WCAS) US Anesthesia Partners as its punching bag for all things physician practice roll-ups and market dynamics in healthcare. More details on this to emerge, but for now, the FTC is alleging that USAP may have entered into price setting arrangements or anti-competitive market share alignment with other players. An important one to watch as the FTC tries to meddle in smaller healthcare M&A (Link) (JD Supra analysis)(Full PDF complaint)

CommonSpirit’s Struggles & Strategies

- The nation’s second largest nonprofit health system had a memorable week, posting a $1.4B loss while also unveiling a new population health management MSO, shrewdly named Population Health Services Organization (PHSO) so that you’ll never forget it. (Financials) (PHSO announcement)

Partnerships and Strategy Updates:

Anything affecting decision making in healthcare – notable moves and strategies for healthcare operators to keep on your radar.

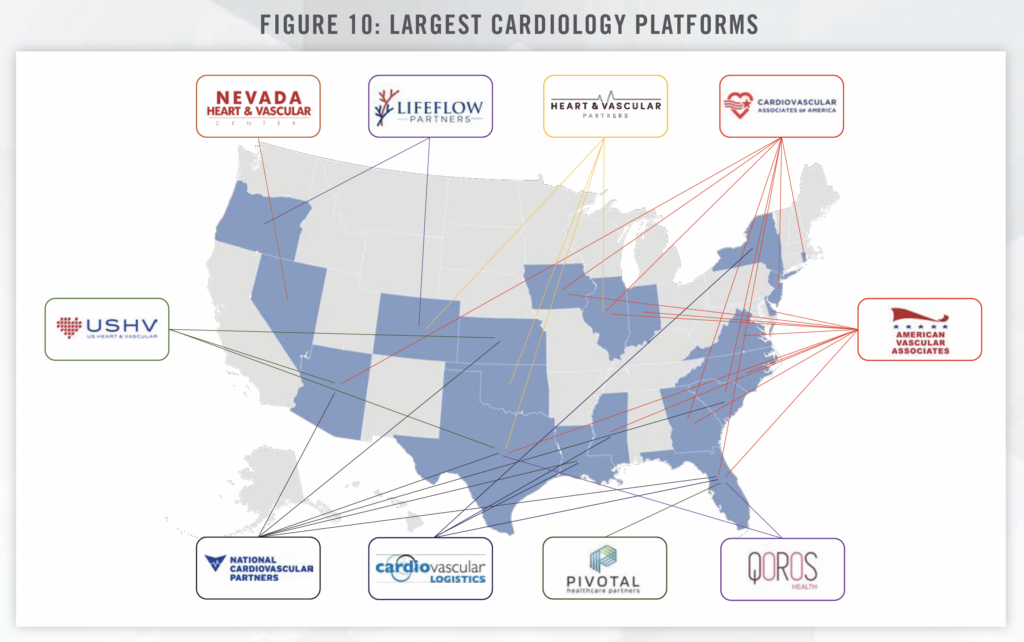

PE investment in ASCs: VMG Health published a nice report on private equity investment in ambulatory surgery centers. “Notably, cardiology has become the fastest-growing specialty as ASCs invest in technology and higher acuity procedures continue to move to the ASC setting.” (Link)

State of Cardiology Report: Speaking of cardiology, a 2023 outlook from Healthcare Appraisers dove nicely into the cardiology industry and current drivers of growth, ASC trends, ancillary activity, observed multiples, notable transactions, and more. (Link)

Amazon Subscriptions: Amazon is evaluating new subscription services in both the grocery and healthcare sectors to latch on to its Prime membership. (Link)

Oracle’s Care Innovation: Oracle introduced some new capabilities in its ‘next gen’ EHR focused on transforming patient and provider experiences. (Link)

Mercy’s Home Program: Mercy initiated its inaugural Hospital-at-Home program in St. Louis. (Link)

Walgreens’ Care Delivery Model: This Fierce article on Walgreens was an interesting little look into what Walgreens is trying to accomplish in healthcare during its company transformation, integrating both care delivery and pharmacy components into its model. (Link)

Costco’s Virtual Offer: Costco introduced $29 virtual health consultations for its members in partnership with Sesame. Jumping headfirst into the healthcare game! Costco has a lot of interesting healthcare offerings and could build something in the space for its members…if it wants to. I mean, if it can keep healthcare costs at a static price in the same way it can a hot dog, there’s no telling what Costco could accomplish in healthcare!! (Link)

Bright Health’s Wind-Down: The insurtech provided an update on its ACA wind-down, stating its near completion of claims runout. (Link)

Partnership Announcements:

- Intermountain’s Select Health partnered with Mark Cuban Cost Plus Drugs to increase transparency and provide lower prices for members. (Link)

- Dock Health partnered with DPC player Hint Health to bring its task management and workflow automation tool to Hint. (Link)

- Ophelia partnered with MSK provider Vori Health to help address pain without use of opioids. (Link)

- Five health systems launched virtual nursing units recently and have found success mitigating labor challenges. (Link)

- SCAN Group invested in Guaranteed’s hospice technology services that prioritize inclusivity. “The decision to join forces with SCAN Group marks a strategic step forward in Guaranteed’s goals of expanding end-of-life care delivery among vulnerable underserved aging adults, according to McGlory.” (Link)

Finance and M&A Updates:

Anything related to the financial side of healthcare and M&A.

- Intermountain experienced a 35% decline in operating income in H1 2023 due to rising expenses. Link

- Northwell increased its operating margin threefold to 1.8%. Link

- Ascension ended the fiscal year with a $2.7B loss, influenced by heightened expenses and a one-time impairment loss. Link

- The Hospital at Westlake filed for Chapter 11 bankruptcy amidst challenging industry dynamics. Link

- CVS Health developed a novel vertical integration strategy for Humira biosimilars, which Drug Channels’ Dr. Adam Fein does a great job of breaking down. Link

- Hospitals urged the FTC to abandon proposed updates to pre-merger regulatory filings, deeming them ‘largely unnecessary’. Link

- In true Beckers fashion, their team aggregated financial results from 21 health systems into one nice summary article. Link

- UF Health officially integrated Flagler Health+ into its healthcare system. Link

- Innovaccer platform’s MSSP ACOs generated savings of 47.5%, totaling $370 million in PY 2022. Link

- Union Health entered an agreement with HCA Healthcare to purchase Terre Haute Regional Hospital. Link

- American Physician Partners filed for bankruptcy officially after months of rumors at the staffing firm. Link

- Pipeline Health announced its intention to sell a hospital and depart from Texas. Link

Digital Health and Innovation Updates:

Notable fundraising announcements, health tech product launches, breakthrough innovation, and reasons for optimism.

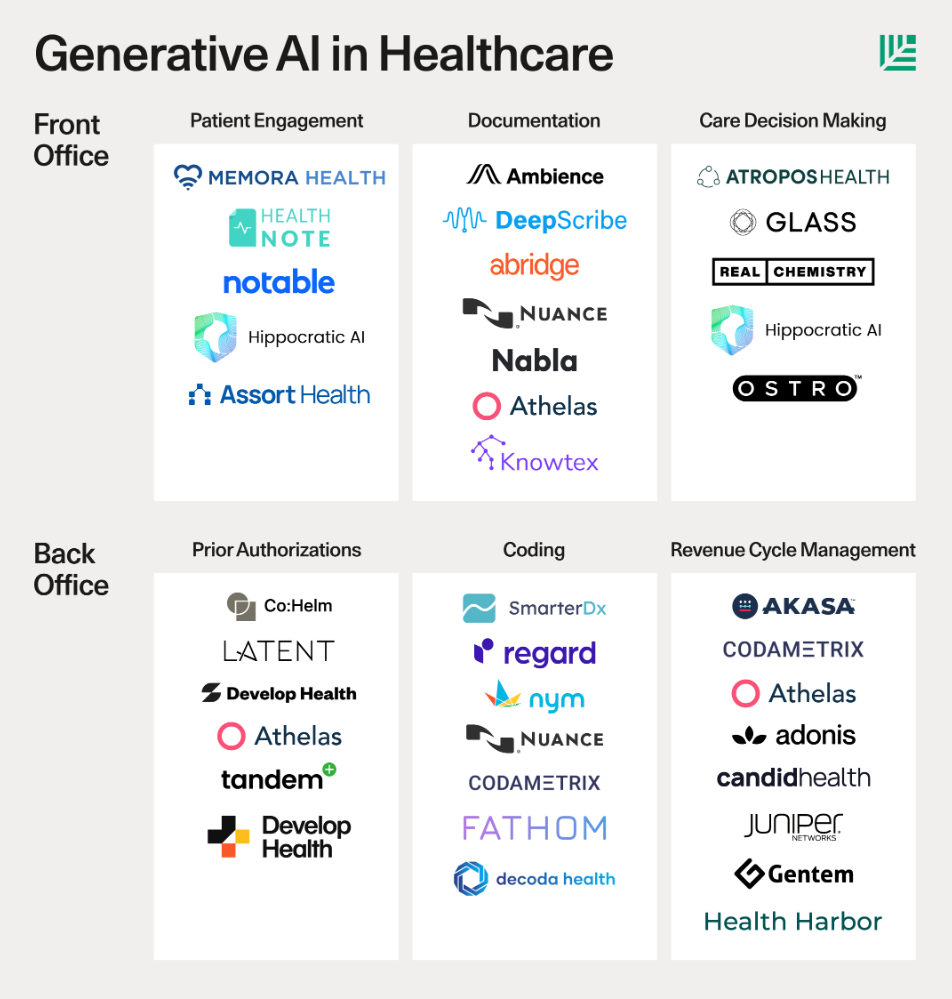

Sequoia’s commentary and analysis on generative AI in healthcare – everyone’s favorite topic! Link

- A Bain & Company and KLAS survey revealed that 80% of US healthcare providers have accelerated IT and software expenditure, with AI as a primary focus. Link

- Eldercare startup Papa lost contracts with prominent health insurance firms after some safety and patient concerns. Link

- Neuralink began recruiting participants for its inaugural human trial of its brain-computer interface. Link

- Solera Health introduced a weight management solution tailored for payers and employers. Link

- Forum Health launched innovative AI technology to detect early signs of heart disease. Link

- Caraway, a Gen Z health provider, acquired the digital group therapy platform Sesh. Link

- Unite Us, a tech company centered on social determinants of health, laid off employees due to profitability challenges. Link

Some AI Updates:

- Orion Health rolled out new healthcare AI-enabled patient navigation services. Link

- Oracle announced its plans to release generative AI tools that integrate with EHR systems. Link

- GE HealthCare and Mass General Brigham are coordinating on an AI algorithm to pinpoint missed care opportunities. Link

- OSF HealthCare enhanced patient care accessibility using an artificial intelligence diagnostic system. Link

- Google declared its financial support for AI-driven digital health initiatives. Link

- Microsoft and Paige are collaborating to develop the world’s most extensive AI model dedicated to cancer detection. Link

Fundraising Announcements over the past few weeks:

Healthcare IT companies’ venture fundraising total was $1 billion in the second quarter of this year, down slightly from the $1.3 billion raised in the first quarter. But the second quarter’s funding total was still significantly higher than the mere $451.3 million raised during the fourth quarter of last year. (Link)

- Ibex raised $55 Million (Link)

- Integral raised $7M (Link)

- Scala Biodesign raised $5.5M (Link)

- Arialys raised $58M (Link)

- Bold raised $17M (Link)

- Sempre Health raised $20 Million (Link)

- Carenostics raised $5 Million (Link)

- AWAK raised $20M (Link)

- Bold raised $17 Million (Link)

- Summus raised $19.5M (Link)

- CardioOne raised $8M (Link)

- Awell raised $5M (Link)

- Take Command raised $25M (Link)

- Corti raised $60 Million (Link)

- Vivante Health raised $31M (Link)

- Allina Health raised $30M (Link)

- Amenities Health raised $10M (Link)

- Mural Health raised $8M (Link)

- Corti raised $60M (Link)

- Inbound Health raised $30 Million (Link)

Miscellaneous Maddenings

Fun, random stories & updates from Blake

- Dare I say it…Texas is looking…good at football?? a 38-6 stomping of Baylor? Has equilibrium returned to the world?

Hospitalogy Top Reads

My favorite healthcare essays from the week

- This was a great study that dove into the rapidly expanding role of the APP in care delivery: “The proportion of visits delivered by nurse practitioners and physician assistants in the USA is increasing rapidly and now accounts for a quarter of all healthcare visits.” (Link)

- More life sciences than services or tech (which I usually covered) but I enjoyed this dive into Illumina by Elliott Hershberg. (Link)

- This deep dive on drug costs and retail pharmacy pricing factors was a fascinating dive by 3Axis Advisors. (Link)

- HTN and CareOps co-published their annual report on the state of CareOps, which is a great study for anyone working in the space to understand the best practices of established players. (Link)

- Eric Topol’s latest – the expanding GLP-1 family of drugs and their expanded potential use cases (Link)

- And finally…a post-mortem on Babylon…again…but this time more from a general perspective and a warning on AI startup unicorns. (Link)

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 20,500+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)