Good morning Hospitalogists,

I can’t speak about the Cowboys right now. It hurts. Burn it all down, man.

Anyway, time to drown my sorrows in JP Morgan Healthcare highlights, so here you guys go!

Thanks so much to NeuroFlow for sponsoring today’s newsletter. Keep an eye out for an upcoming virtual event we’re doing together!

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 23,700+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Privia, Oak Street Health, and Aledade by subscribing here!

SPONSORED BY NEUROFLOW

Hey Hospitalogists! Blake here.

Today, I wanted to use this part of the newsletter to introduce you to NeuroFlow and tell you to keep them on your radar.

NeuroFlow is making a significant impact for patients, payors, and providers with their technology and analytics platform. Their team is quite literally saving lives by proactively surfacing high and rising risk populations and reaching out with compassionate support and referral to the right level of care – which also drives medical costs down for risk-bearing orgs. Check out their recently published white paper on Strategies for Healthcare Leaders Addressing the Suicide Epidemic.

NeuroFlow and I are doing a virtual event together in February, but in the meantime, I’d love to share a powerful success story with you:

- Check out this story of how NeuroFlow partnered with Atlantic Health System to fill in the gaps for a patient looking for – and previously failing to find – mental health services, preventing serious future adverse events.

What’s Top of Mind for Health Systems post-JP Morgan

The JP Morgan Healthcare Conference always delivers great content to understand growth strategies and 2024 outlooks across the healthcare payor & provider landscape. While there was obviously plenty of hubbub around artificial intelligence and GLP-1s (apart from a new potential use case in chronic kidney disease), I think my readership generally knows the latest of what’s going on in that realm and there was nothing really new during JPM.

With that in mind, here were some of the more interesting trends and presentations that caught my eye from the conference. Side note: I had to do an inordinate amount of Googling and detective work to find some of these presentations!

None of this analysis I really consider groundbreaking, but I generally thought these slides would be interesting and relevant to my subscribers. So, here ya go!

Large Health Systems expect a rebound in 2024, with a renewed focus on expanding outpatient strategies

Regional health systems with balance sheets in positions of strength are building out their outpatient books of business to expand market share along with diversifying revenue, and this trend was very apparent at JPM.

- “…*if you look at where [health systems are] looking to invest incremental dollars, **a lot of it is in the outpatient setting…*this transition is going to be by health system, by geography, and it’s not going to be homogenous.” – Parth Mehrotra, Privia Health CEO

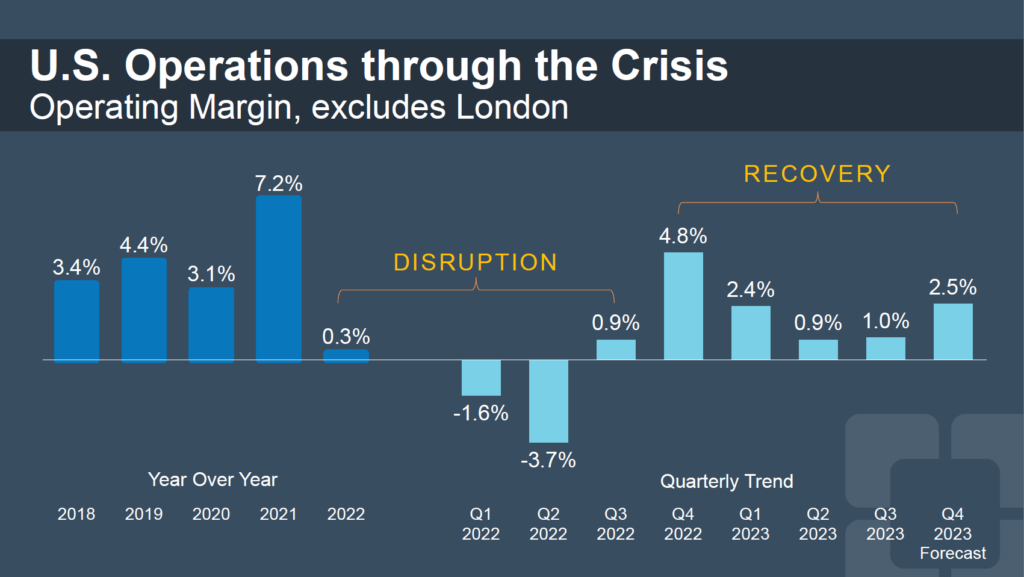

Cleveland Clinic had an interesting slide on health system disruption and subsequent recovery. In 2024, the vast academic medical center is expecting $15.8B in revenue, a 2.7% operating margin, and 7.7% EBITDA margin.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

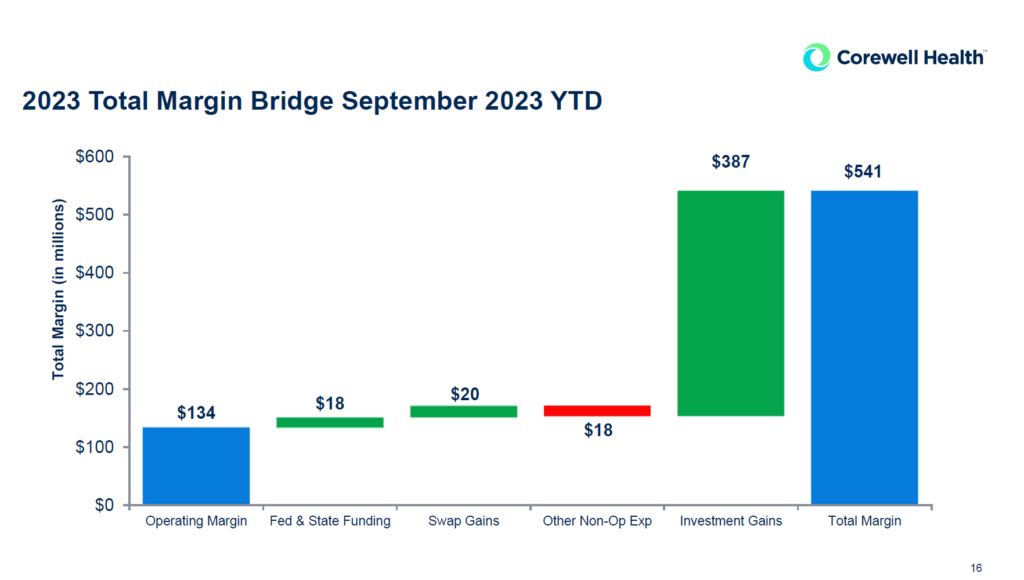

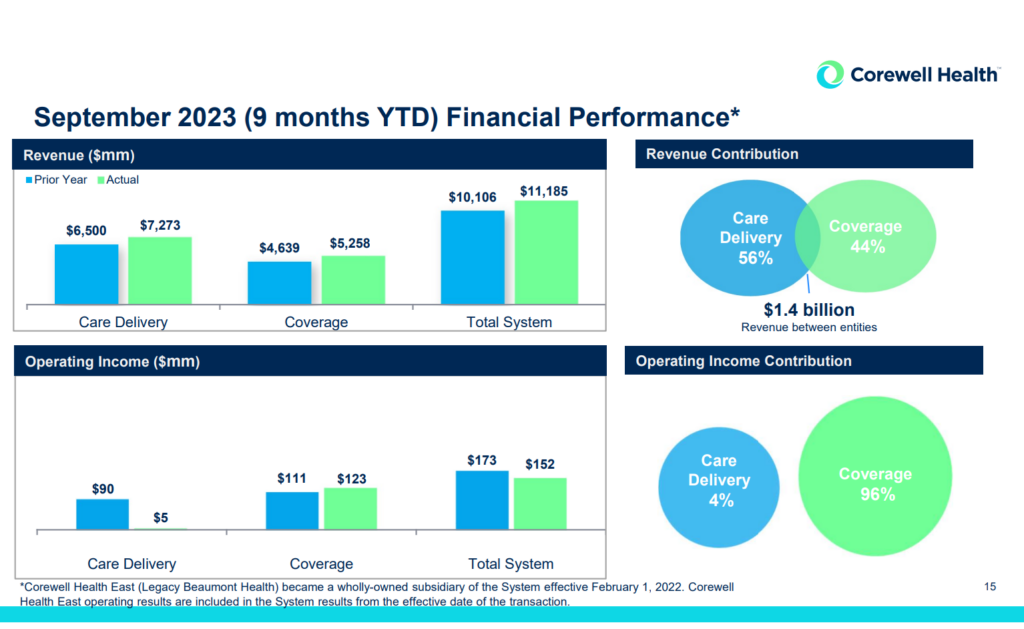

Corewell Health noted $200M+ in expense synergies after the Beaumont-Spectrum mega-merger closed. It also marked up its investment portfolio by 3x its operating margin in 2023!! Net margins for nonprofits will be way up this year – we will probably see a lot of investment markups across nonprofit portfolios in 2024 given that the stock market had a strong year.

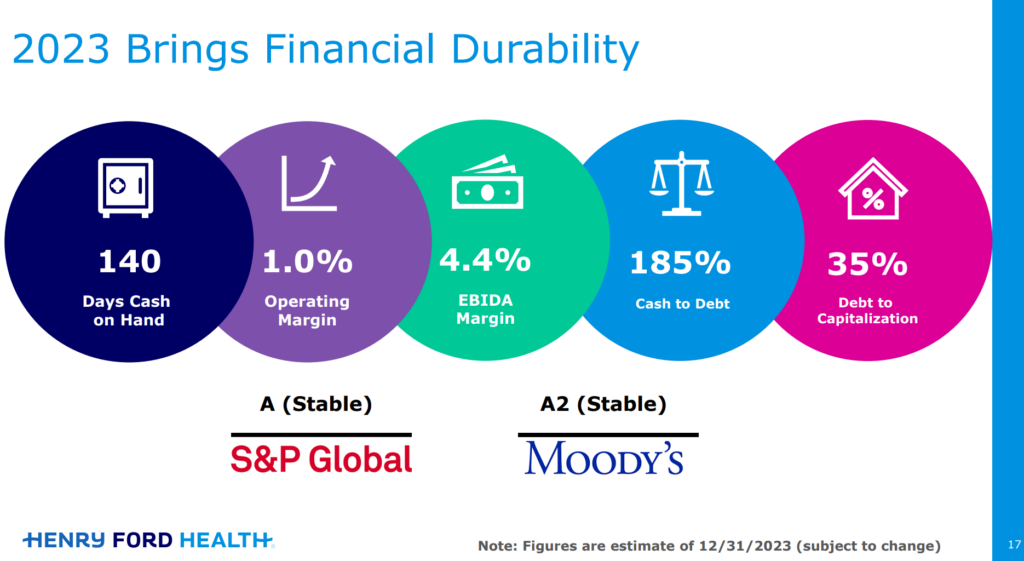

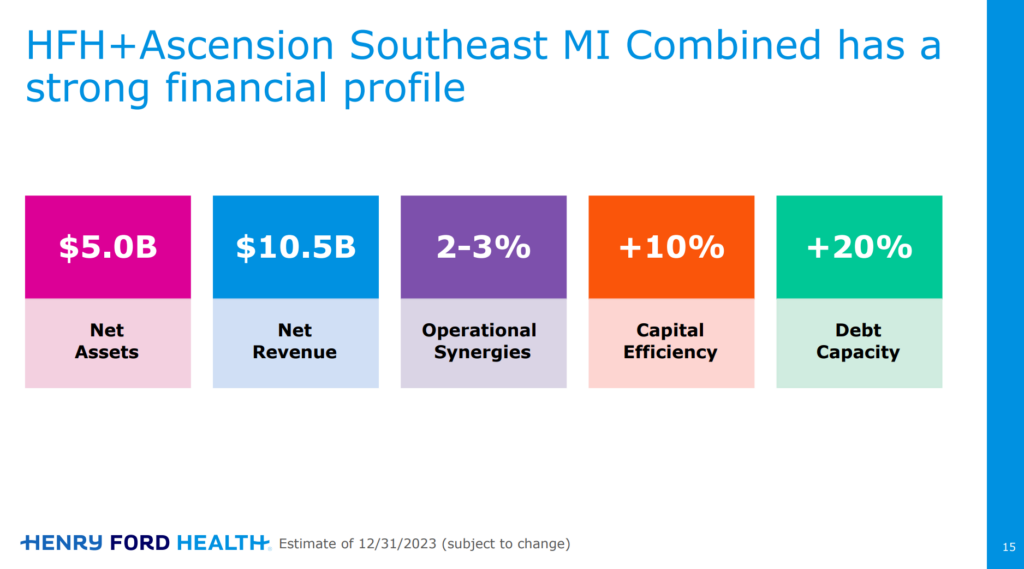

Henry Ford Health rebounded financially in 2023, noting a strong combined profile on the heels of its ‘joint venture’ with Ascension which included multiple hospitals, a health plan, and other associated assets:

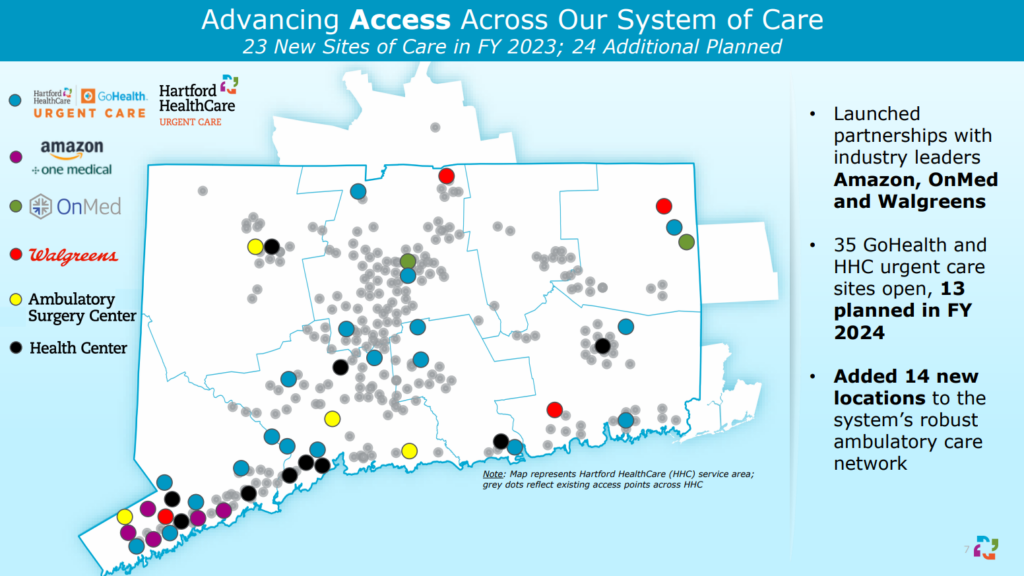

Hartford HealthCare noted several partnerships and 23 new sites of care as part of its Connecticut ambulatory footprint:

Baylor’s dominant, incredible market share and presence in Texas (courtesy of Bob Herman):

Intermountain had plenty to say during its presentation but is also developing a de-novo strategy on community hospital buildouts, ASC placement, and diagnostic imaging centers:

Intermountain also had an interesting note on maximizing its 340B footprint. With the margin opportunity there, 340B will be a huge point of emphasis for hospitals in 2024 given the recent ruling seemingly increasing the scope of the program.

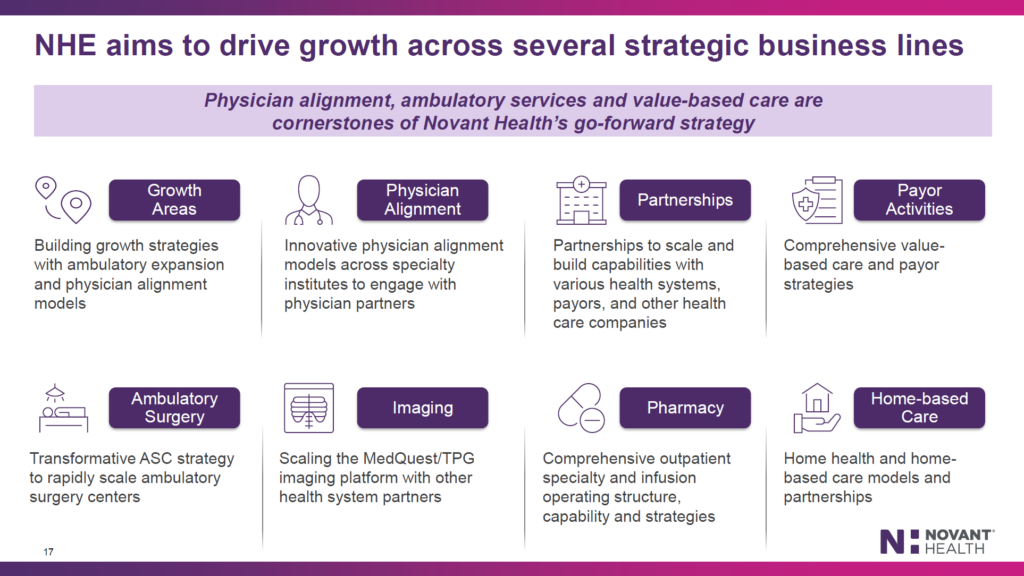

While noting South Carolina as its next “core” market, Novant also spent several slides on its new initiative called Novant Health Enterprises – its engine for creating diversified growth. Notice a theme yet?

Novant noted several partnerships through NHE with the likes of Privia, GoHealth, and other health systems to develop new downstream referral sources, catchment areas, and population health strategies:

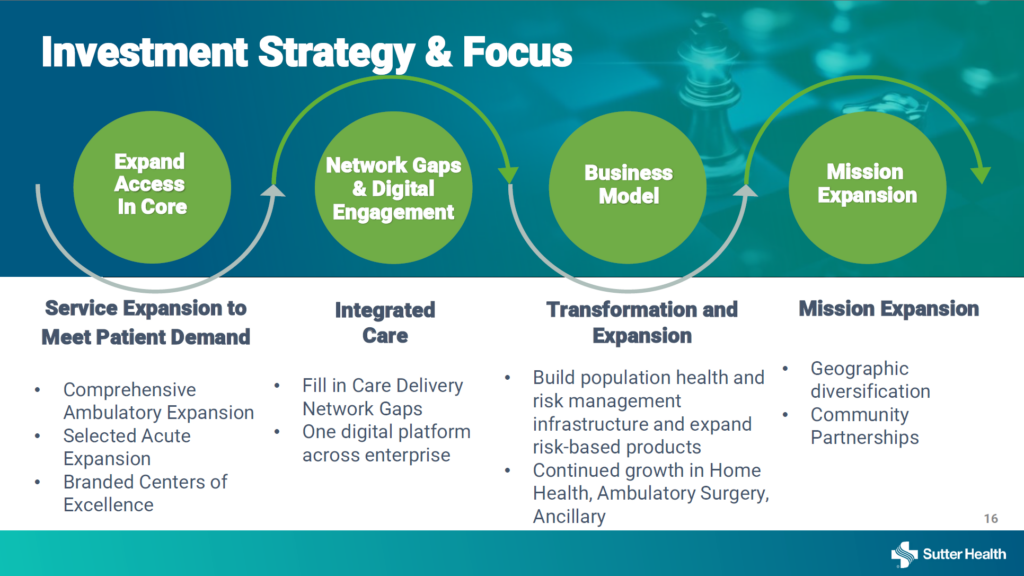

Similarly, Sutter Health wants to continue to fill in gaps in its geography with ambulatory sites of care:

The Bottom Line: Outpatient Growth is a Core Focus Area for Health Systems, and a Rebound is likely in 2024 for Large Players

Assuming a rise in outpatient utilization sustains, weakening CON laws, and a renewed focus on physician alignment, expect to see stronger health systems double down on things like de-novo ASC development, urgent care acquisitions, and increased investment in higher acuity subspecialists on the inpatient side. Based on notes from reporters on-site like Tara Bannow, CommonSpirit, Sutter, IU Health, and others all noted the need for health system evolution via revenue diversification. Parth and I also predicted this trend to unfold, so that’s pretty cool.

Meanwhile for the weaker systems, you’d probably expect to see consolidation, extreme focus on cost pressure, service line closures, and potential divestitures – if allowed at all in today’s M&A environment.

Finally, you have to wonder whether all of these initiatives (innovation, ambulatory, focus on capturing outpatient migration in local markets) will fall apart if inpatient utilization ticks back up too. Hospital change management and business model transformation is incredibly difficult, and it’s easy to slip back into the old, familiar ways of doing things.

Were you at JP Morgan? What’d you notice on the health system side that I might have missed?