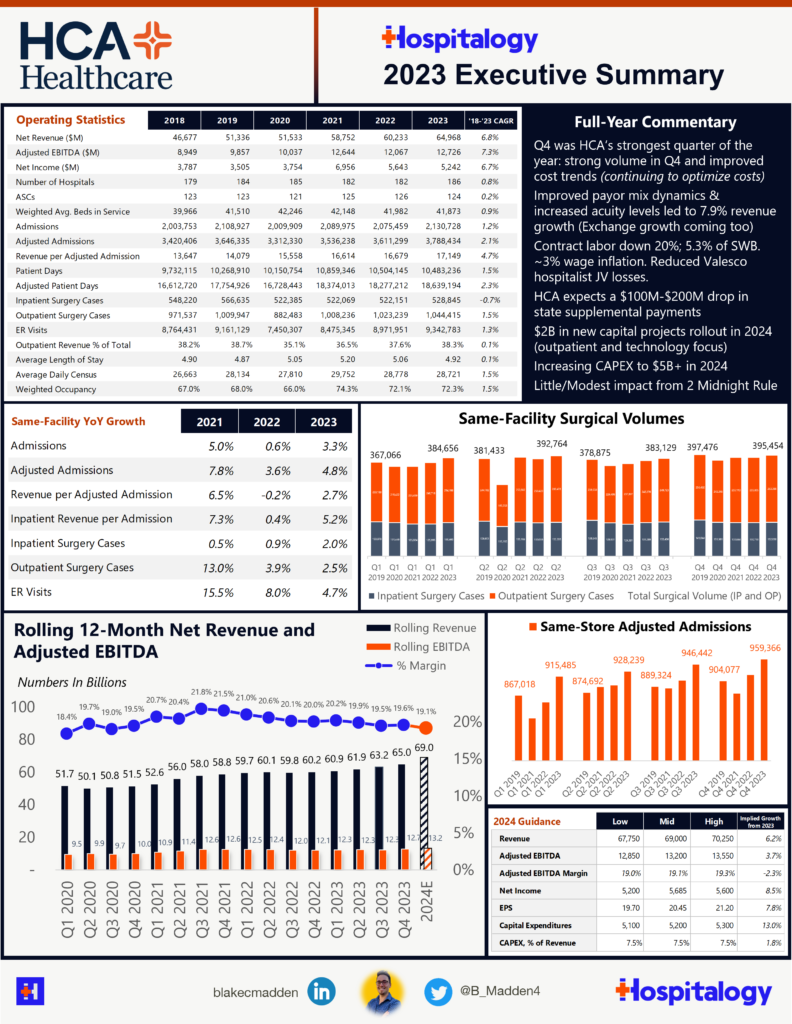

8 Key Takeaways From HCA’s 2023

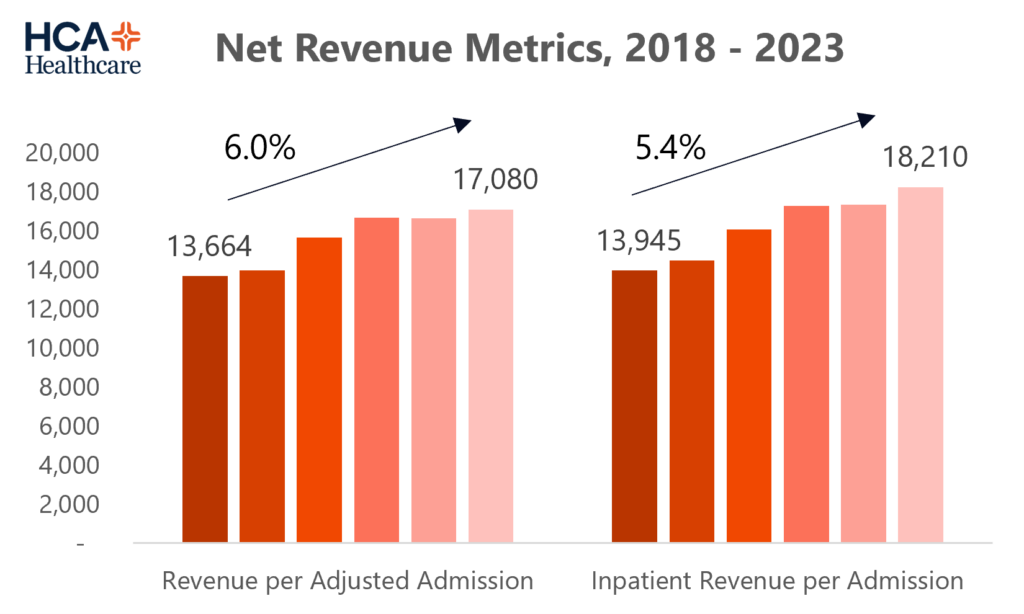

- Higher acuity, better payor mix = increased $$$ per admission

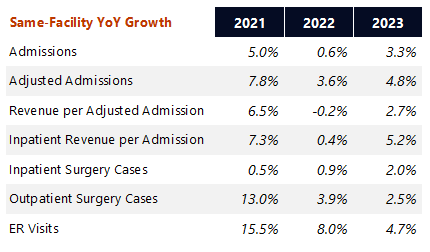

- Strong same-store volumes – Q4 was its strongest quarter operationally

- Increased capital spend with several OP projects coming online in ’24; long-term focus on tech infrastructure

- No insight / view into rising Medicare utilization but they’re getting a ton of Medicare-related admission volume regardless

- Labor market normalized – 2-3% wage inflation expected moving forward

- Lower pro fees costs from Valesco, but industry wide pressures in this area

- Two-Midnight Rule emerges as a potential tailwind for HCA, headwind for payors

- Headwinds from state supplemental Medicaid dollars (100M-200M)

Resources:

- Earnings Release Link

- My breakdown of HCA’s 2023 investor day

- Please note that my HCA data book (with quarterly data back to 2018) and charts are available exclusively to Board Room members

HCA 2023 Earnings Breakdown

Who better to kick off the Hospitalogy one-page executive summaries than HCA Healthcare, the 186-hospital operator generating $65B in annual revenue?

HCA continues to buck the trend as a unicorn in the acute care space. Here are the big takeaways from their full year earnings call (and if you missed my very deep breakdown into their investor day, you can find that linked here).

Payor mix and acuity is up and to the right for HCA. HCA’s ability to negotiate ever higher rates, coupled with investments into high acuity service lines, drive outsized net revenue per admission growth. Adding to these dynamics, HCA should see some decent benefit from Exchange members rolling off Medicaid and into higher reimbursing commercial plans given the growth in both Florida and Texas in the marketplace (30-35% of Medicaid members are rolling into ACA plans)

Same-store volumes are through the roof. Overall HCA self described its 4th quarter as its strongest of 2023 (makes sense given healthcare volume seasonality as well of course). You can see below that same-facility growth over 2023 was well above that of 2022 as HCA continues to grab admissions market share from other players in its markets:

HCA is ramping up capital expenditures. What are they investing in? A balanced portfolio of inpatient utilization (service line expansion, ER capacity), outpatient (physician alignment, ASC development, urgent care facilities etc.) and IT (RCM, clinical workflow management, ambient documentation, intra-company hospital benchmarking, staffing, etc.)

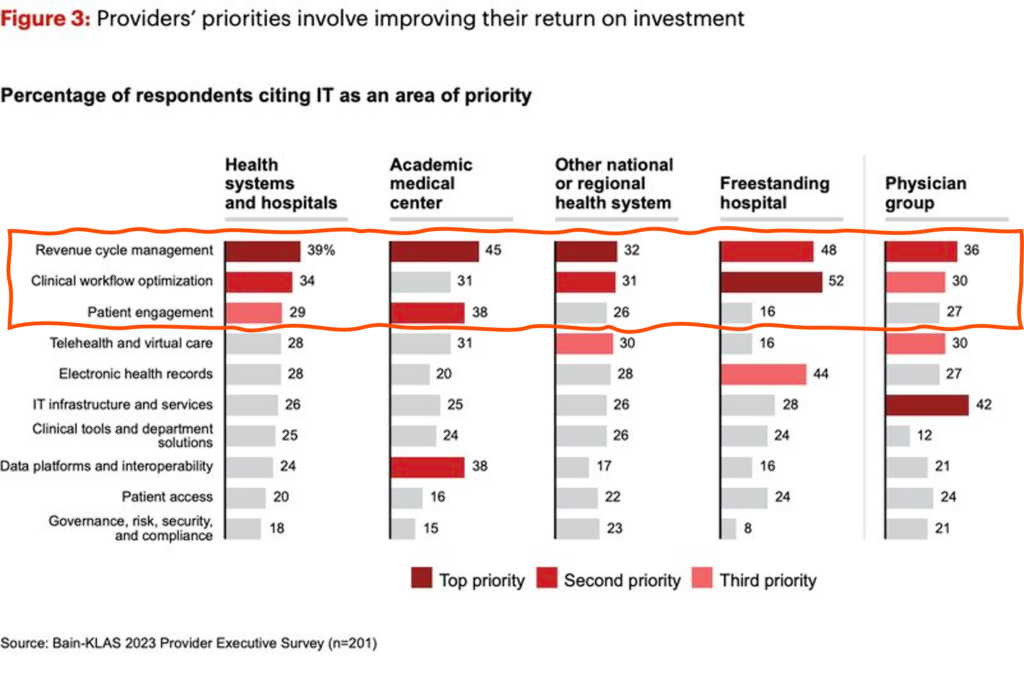

More broadly speaking, on the health IT front, what are overall health systems strategic capital priorities? From a recent Bain survey, revenue cycle management, clinical workflow, patient engagement, and digital front door capabilities top the list:

Medicare utilization trends for HCA are murky. As the broader conversation around utilization and Medicare Advantage takes shape, analysts asked quite a bit about these dynamics. HCA’s Sam Hazen gave a pretty hilarious (in my opinion) response around the perceived uptick in utilization, essentially saying because HCA does so well from strong market demographic growth and market share capture, it’s hard for the hospital operator to parse through those factors to determine whether they’re seeing an overall trend forming.

- For instance, HCA’s Medicare composite (both traditional and MA) adjusted admissions have grown 3.7% → 5.3% → 4.7% → 5.7 over the past 4 years excluding 2020.

- Medicare Advantage admissions in the quarter for HCA were up 10%!!

HCA’s labor market is stabilized. The travel nursing craze is largely over for HCA. Contract labor as a percentage of overall salaries declined another 20% and hit 5.3% in 2023 – way, way down from post-pandemic peaks. Adding to this, moving forward, overall wage inflation will revert back to 2.5-3% annual escalators. This normalization is a reprieve from the previous norm of fast-paced market wage adjustments (at least nurses got a bit of their bag back!)

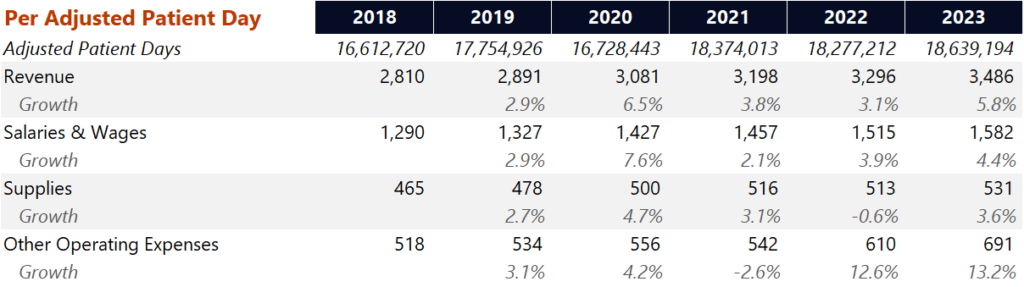

Professional fee losses are alleviating. After acquiring outright its hospitalist staffing joint venture with Envision, Valesco (which sounds way too similar to Valero, by the way), HCA has been working to cut losses here after biting the physician subsidy bullet. HCA noted losses amounted to around $40M – $50M per quarter during 9 months of ownership in 2023, and as they restructure costs, things should improve on the losses front in 2024. You can see the growth in HCA’s other operating expenses, which includes professional services, on a per unit adjusted patient day basis below – 12.6% in 2022 and 13.2% growth in 2023, well above revenue growth:

Lots of chatter around the Two-Midnight Rule. Every day I learn about a new healthcare reimbursement rule or policy I’d never heard of before. Alas, the industry we’re all apart of. Anyway, it felt like much of HCA’s call revolved around investors and analysts trying to understand how the Medicare Advantage market is evolving rather than HCA, since there’s so much change happening in MA right now. One of the regulations analysts spend an inordinate amount of time on were recent changes to the Two-Midnight Rule. Executives are watching the regulatory change here closely, since in theory you could see a modest spike in inpatient utilization (as a step-up from outpatient/observation stays at hospitals).

What’s next for HCA in 2024?

Whether they can parse out the utilization tailwinds or not in their operations, HCA will benefit this year from rising volumes, rising acuity, leverage over payors, and capacity unlocks from an improved labor market. As I’ve mentioned, HCA continues to be unicorn operator in the acute care space, but they aren’t without challenges headed into 2024 – namely, significant controversy stemming from its perceived handling of the Mission Health fiasco (where concessions are likely), and the growth in professional fees that even HCA can’t wish away. HCA also needs to keep thinking about how it innovates from a technology and infrastructure standpoint given the continued outpatient migration shift and long-term competitive pressures that are sure to stay in that space over time.

Finally, expect greater physician alignment initiatives from HCA in the short term. HCA set up a surgical subsidiary called Surgery Ventures back in October 2023, and I would not be surprised to see some population health initiatives emerge in the near future for the organization to flip its massive PCP presence from (at the unit perspective) a cost center into one that might breakeven or profit.

SPONSORED BY ADONIS

Hey Hospitalogists, Blake and Adonis here!

We’re teaming up to get the scoop from healthcare orgs about their 2024 financial and strategy game plans. We’ve got a survey ready, and it’s super quick – just 5 minutes and you’re done.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Your answers will fuel the stuff we create to keep you in the loop with what’s buzzing in healthcare this year. Don’t worry, it’s all anonymous.

We’d really appreciate your two cents. Hit the link below to jump in:

Key quotes

On Medicare utilization trends:

- But in 2019, this is a composite view of Medicare. So it has both Medicare and Medicare Advantage. It’s our Medicare admissions grew 2.6%. You throw out 2020 and 2021 grew 2.1%. 2022 grew 3.4% and 2023 grew 4%. So is there acceleration on our trend? Yes. Obviously, there’s aging baby boomers in the mix there, number one. Number two, we think we’re taking out market share. So to judge overall utilization patterns around that is really difficult for us. There’s population growth in our markets.

- When you look at adjusted admissions, on the same combination payer class. Again, 3.7% in 2019, 5.3% at ’21, 4.7% in ’22 and 5.7% in ’23. So a slight acceleration, but a function, we believe of aging baby boomers and a number of beneficiaries moving in the program, population growth for us in market share gains. So it’s hard for us to judge underneath that, whether or not there’s some structural change in utilization, that’s almost impossible for us to discern with the data that we have.

- I will start with the Medicare volume, as I know that’s been the topic. We have seen some growth in our Medicare Advantage admissions, which were roughly up 10% in the quarter, which is pretty consistent for what we’ve seen throughout the year. And we think this probably a combination of conversion from traditional Medicare fee-for-service. So all of some of our volume gains and maybe a bit utilization, it’s hard for us to break that down in its entirety on there. In terms of our revenue per admit between Medicare Advantage and Medicare has been very consistent through the year as well. So we didn’t see any really step change in the fourth quarter of that material amount.

On volume growth:

- …seasonality trends have returned in the latter half of 2022 and they continued in our estimation into the latter half of 2023 with the natural seasonality that we see in our outpatient areas as well as some of our other surgical areas for the most part, from the third quarter of this year to the fourth quarter.

- And for the year, our inpatient surgeries were up 2%, and our outpatient surgeries were up 2.5% so a slight migration, if you will, into the outpatient setting. And we think that will be generally consistent as we push into 2024. We do have a number of ambulatory surgery centers that have opened or will open in 2024. We’ve made a few acquisitions in certain markets with ambulatory surgery centers, and we continue to invest in our hospital operating suite as well as improve our processes just as we are improving our emergency room process with our revitalization program, and we think that will continue to be a value-add for our patients and for our physicians and help us with our volume pursuits. So that’s how we’re judging the surgical space. If you look at cardiac underneath that, our cardiac volumes continue to grow very robust and are actually growing in the mid-single digits and we think, again, that’s reflective of our overall program development, expansion into new service lines underneath cardiac in responding again to our patient needs and physician needs and ways and we believe are productive for our organization.

On the Two-Midnight Rule:

- When I think about the 2 midnight rule, Sam alluded, it’s too early for us to judge the impact of this rule. We know it’s got a period to be implemented, we believe ultimately it’s going to benefit our patients. And we think over time could be some moderate positive results for us. But we’ve seen no impact yet, but we believe over time, as we go through ’24, there could be some modest benefit as we go through that.

- …it’s a pretty big change for the payers. And so there might be some administrative differences as it gets implemented through the year.

On the labor environment:

- We finished the year roughly, I don’t have the exact average here at 90% acceptance rate. In other words, we weren’t able to take roughly 10% of the patients who were referred to us through our transfer centers and such. That improved throughout the year as we went from maybe the mid-to-high in the first part of the year, to a little better than that in the second half of the year. We’re still below where we were in 2019. But what we have seen is more patients coming through our transfer centers and other patient navigation program that we did in 2019. So we feel good about the inflow, if you will. We are still at times in situations where all of our capacity is not open and available, and that’s what generates these situations where we can’t receive the patients that are coming through these navigation programs and transfer centers.

- We think that will continue to get better in ’24 as we have capital coming online as our hiring patterns continue to improve. Our turnover, as I mentioned in my commentary, has also improved.

On the growth in professional fees and Valesco losses:

- As we have mentioned throughout the year, we are managing through pressures on professional fees and hospital-based physician costs. But we saw an improvement in the sequential rate of growth in both the third and fourth quarter. Sam mentioned, we also saw an improvement in our Valesco joint venture, which was in line with our expectations. We are confident in our plans to continue working through what we believe are industry-wide pressures in this area.

- On Valesco, as we mentioned, it came in line with our expectations, which think last quarter, we sized just under $50 million or so a quarter. As we continue to work on multiple improvement initiatives, including further integrating that joint venture into HCA. We expect to see continued improvement going forward. Next year, I think Valesco for the full year will equate with about the same amount we recorded this year, but we had 9 months this year versus 12 months obviously in 2024.

- On the professional fees in Valesco, we have a number of initiatives with teams working on that only further integrate into our operations, but to continue to figure out adjustments to those programs. Our professional fees I’ve talked to, we have seen a decline in the sequential rate of growth. So we’re a bit encouraged with that as we go into ’24, we would expect those sequential declines to continue. And we’re working hard through multiple initiatives, whether it be revenue enhancements, program adjustments or are looking at opportunities to internalize some of those programs.

On supplemental payment decreases:

- For 2024, we are anticipating benefit from a new program in Nevada. But based on current assumptions, we expect some modest headwinds when we aggregate the impact of all of these supplemental programs and we believe this could range between $100 million and $200 million for the year.

- We are expecting overall, when we aggregate all the programs to potentially be a headwind anywhere between $100 million and $200 million, largely due to settlements that we received this year, we don’t expect to reoccur and then the Florida beginning accrual had an impact to that.

- we view supplemental payments is really just part of our overall Medicaid revenue portfolio. I think we’re up to 17 or 18 states with supplemental payment programs right now. As I mentioned in my comments, each of these programs have a level of complexity, multiple attributes to it that affect the timing when we recognize those. In the quarter, as I mentioned, we did recognize the benefit of the new North Carolina program that was anticipated. We had settlement in Texas and we began accruing Florida accounts for it. So we can maybe offline give you a quarter-by-quarter breakdown. But those were the main things that affected us during the fourth quarter. But I will mention even with the supplemental payment programs, the core operations of the business remains strong. When we look at core revenue growth as well as our revenue per admit growth, we believe the supplemental payments were just added to what was already a strong quarter.

On capital allocation:

- So we’re pretty consistent in our allocation of capital. It’s not disproportionately oriented to any one category of our business. And we think, again, that approach has yielded really strong returns. It’s allowed us to meet the demand expectations that exist in the market and it’s also responded to our physicians in the way that created the capacity or allowed for the clinical technology that they need to practice their medicine. So we’re stepping it up because we have a growing occupancy on the inpatient side. And then we have opportunities in the outpatient side to expand our networks further in these fast-growing communities.

- These investments revolve around 3 distinct opportunities. The first one includes continued network expansion in facilities, services and workforce to meet the demand growth that we expect in our markets while also supporting our efforts to increase market share. In 2024, we have over $2 billion of new capital projects scheduled to come online that will increase capacity. Additionally, we expect to integrate a number of newly acquired hospitals and outpatient facilities that should complement our networks. The second opportunity includes a robust agenda designed to advance digital capabilities across the company and unlock the embedded value we see in our operations. As high performing as we are today, we believe there is more operational potential inside our company. With evolving technological tools, we are investing to unlock this value…including integrating our revenue cycle and case management functions better.

- our outpatient platform tends to be short cycle returns. We get a real efficient sort of capital allocation with outpatient facilities. And then on the hospital side, we are a hospital-centric health system. And as we invest in our hospitals, those are long-lived assets and they have a longer cycle to them with respect to returns, but they’re critically important to the overall value that our outpatient facilities can generate for our system in the sense that we’re able to navigate the patient further into the healthcare system if they need more acute care offerings. So we have to look at it in both manners. I think to Bill’s point, we have had strong returns, a pattern of strong returns, we have occupancy on our inpatient hospital side in the low 70%, which is a pretty high occupancy level up over where it was pre-pandemic even with the additional beds that we’ve added. So we think the network model that we highlighted for you all at the Investor Day is working and is complemented by the outpatient facilities integrated with the hospital system in a manner that produces really positive enterprise returns for our company.

- Obviously, our technology agenda and our care transformation is a longer-run effort with respect to improved outcomes across different dimensions of our business. And we had some modest success there in the short run. We’re really banking on those programs giving us long-term value.

On Medicaid Redeterminations:

- We’re seeing roughly 30% to 35% of those individuals that were potentially lost Medicaid seem to show up with either HICS or employer-sponsored coverage so that there’s some benefit in that.

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 25,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)