Happy Thursday all!

Today’s is a quick one on Tenet Healthcare’s Q4 and full year 2023 as a follow up to HCA’s I did back on 2/1.

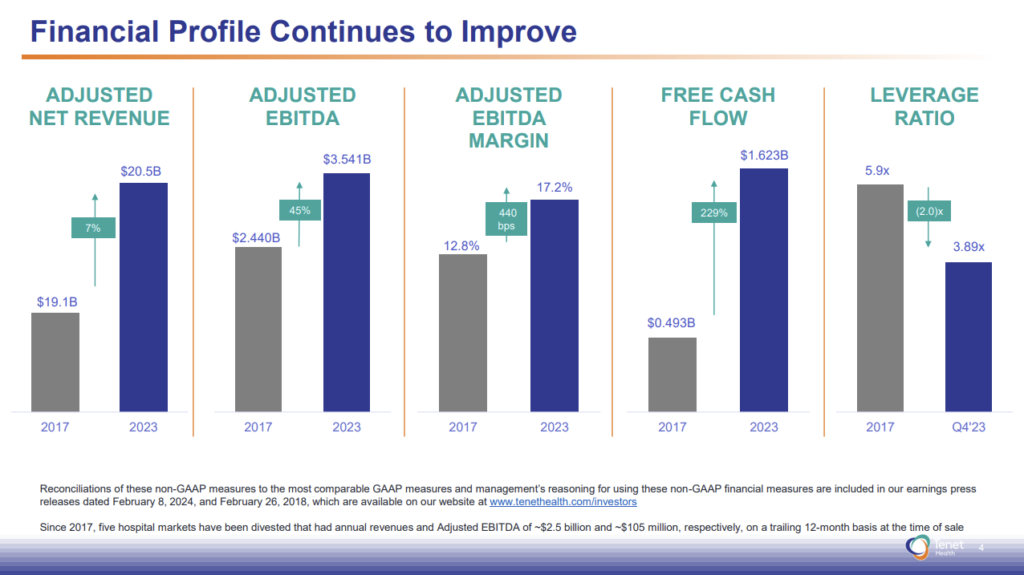

Tenet blew its Q4 earnings report out of the water and was so excited to share it with us, the hospital & ambulatory operator even posted its results prior to its official earnings release date, and it’s relevant for all of us to cover considering the utilization dynamics unfolding in 2024.

Tenet Healthcare – Q4 & Full Year Executive Summary

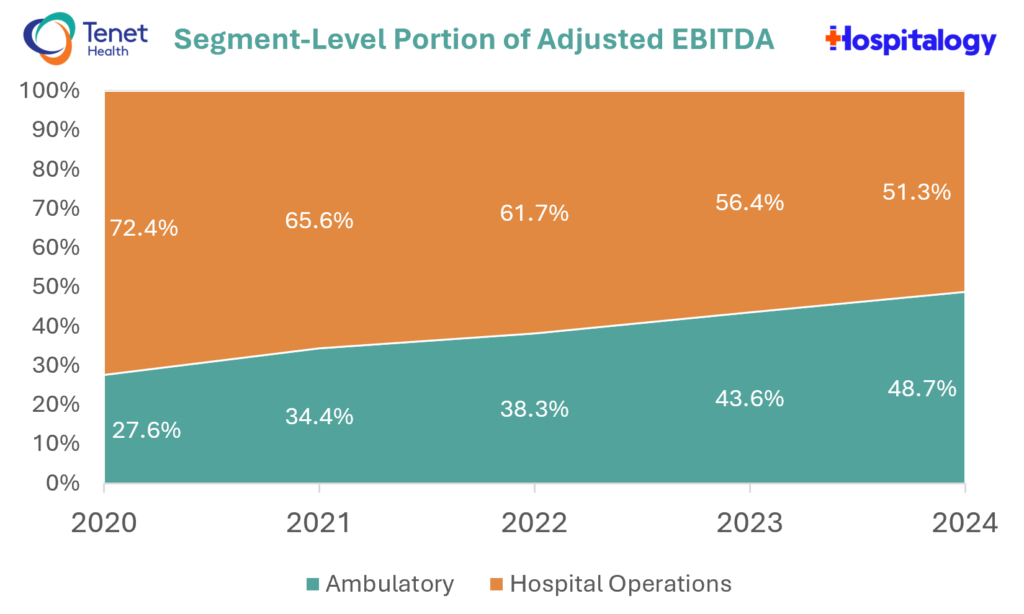

“Tenet is entering a new era, with a greater proportion of our performance coming from our highly efficient ambulatory surgical business and a reduced debt profile, we are well positioned to continue to expand free cash flow further over time.” – Saumya Sutaria, Chairman & CEO Tenet Healthcare

Updated segment reporting: As of this year, Tenet is consolidating its revenue cycle management platform Conifer into a new Hospital Operations and Services Segment which reduces the noise in its segment reporting quite a bit.

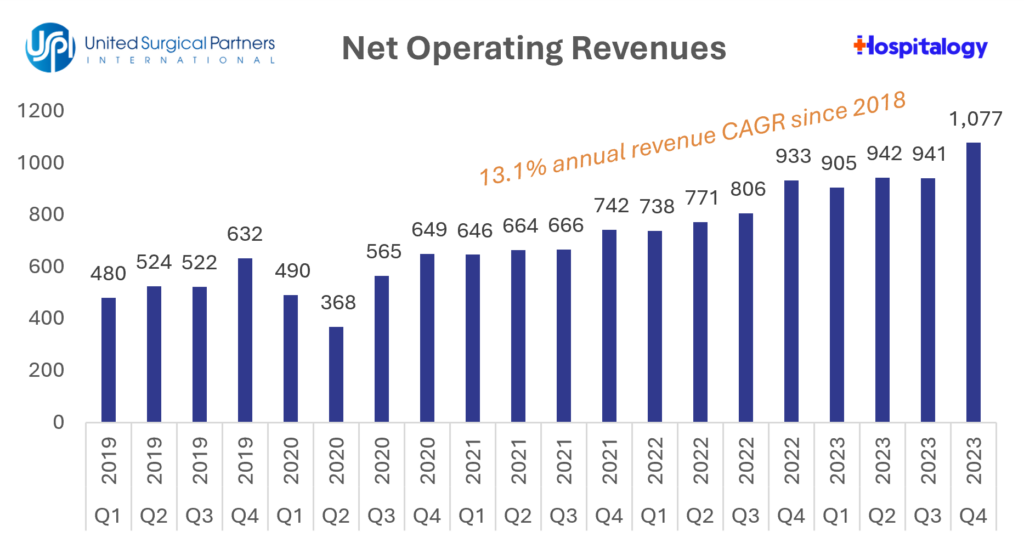

Significant outperformance in Q4: Everything was up and to the right for Tenet in Q4. USPI saw 9.5% growth in same-store revenues, with surgical volumes up 3.9% (albeit on an easy comparable quarter given utilization didn’t really pick up until Q2 of last year).

Hospital Divestitures: Tenet continues to move away from the inpatient, acute care book of business, but still wants to maintain tight alignment with its ASC footprint. To that end, it announced the sale 7 hospitals netting after-tax cash proceeds of $2.55B. Novant is adding 3 of Tenet’s South Carolina hospitals & affiliated operations (practices, etc) while UCI Health is acquiring four of Tenet’s California hospitals in Orange and LA County. As part of these deals, Tenet’s Conifer segment entered into a 15-year MSA to provide revenue cycle management services. So not only did Tenet get a pretty good deal on the hospital sales themselves, they also tacked on a sticky RCM contract on the back end.

Inpatient outperformance → higher acuity. Self explanatory, but Tenet saw strong organic growth on the inpatient side coupled with higher acuity, growing both volumes and revenue per admit on the back of a strong payor mix (commercial mix being ~70% of total revenue for Tenet) and a tailwind from Marketplace growth.

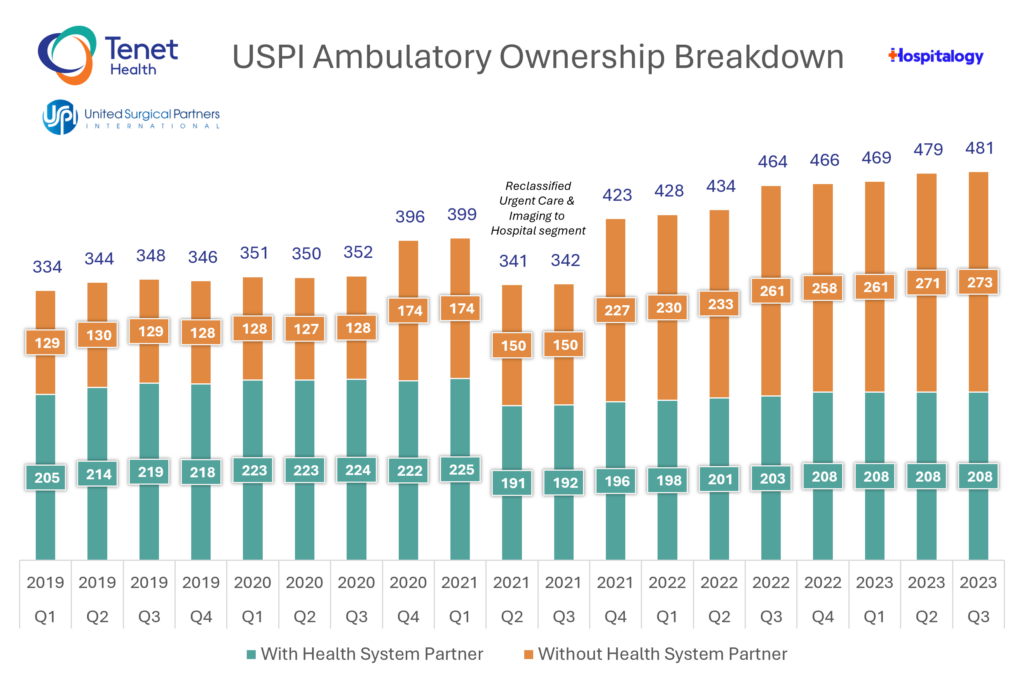

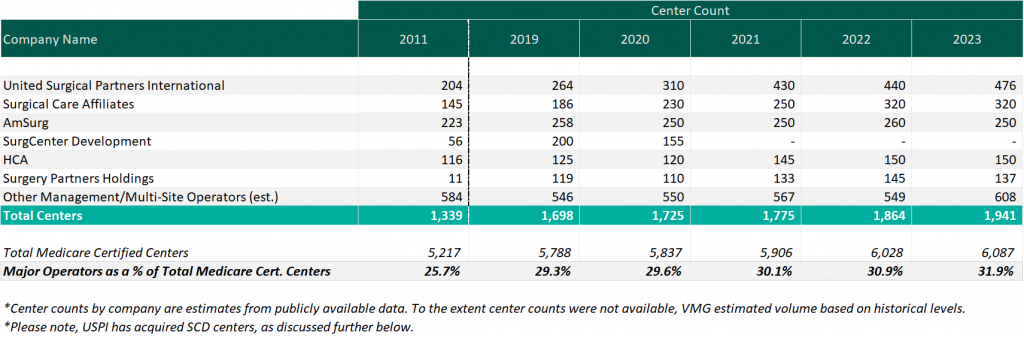

Full-on Ambulatory Focus: In 2022, Tenet embarked on a strategy to significantly boost its ASC presence, setting a goal of hitting 600+ ASCs by 2025. In total, Tenet hit 485 ASCs in 2023 per its Q4 earnings report. To that end, Tenet opened around 30 de novo centers in 2024 with an enhanced focus on higher acuity orthopedic and other services. In 2024, Tenet expects to open around 10-15 additional ASCs and needs to increase its center openings by about 20% a year to hit that 575-600 ASC total by 2025. Tenet walked back that goal a bit on the call, saying they were only interested in high quality deals at attractive multiples and weren’t going to chase growth. $250M in planned investments for USPI in 2024.

My take

As a scaled ambulatory operator with USPI, Tenet is taking advantage of well-known, longstanding paradigm shifts within healthcare:

- Inpatient services are capital intensive and lower margin – a segment Tenet wants to inch away from given a higher interest rate environment and the outperformance of USPI

- On a similar line of thinking, the USPI business is capital light in comparison and much higher margin. Further, payors obviously favor the ASC as a preferred site of service assuming the procedures maintain a similar level of quality, satisfaction, and outcomes for patients. I’ve had many people tell me that the ASC, by definition, is ‘value-based care’ for these reasons – lower cost, more convenient, and there’s physician and payor buy-in.

- Driven by CMS, more and more services are shifting to the outpatient setting, an opportunity Surgery Partner characterizes in the hundreds of billions and an estimated $36.5B market today. At the end of 2023, Tenet operated 206 ASCs with health system partners and another 279 independently.

- More and more health systems are diving into developing ASCs to ‘play ball’ with insurers on site neutral payment – essentially saying “alright, we know these HOPDs are pretty high cost, so what if we moved more toward ASCs and you met us in the middle on rates?” This dynamic, combined with the increasing prevalence of price transparency data, should mean we see less variability between prices for the same service or procedure over time.

- Orthopedics and cardiology (cardiology as an emerging space) will be the two most sought after specialties while GI, Urology, Ophthalmology, and other specialties will provide consistent growth & cash flow.

In 2024, there is increasing demand from health systems for joint ventures in the ambulatory setting. And Tenet isn’t alone in the ASC space. Of course, you have the 800 pound gorilla Optum (SCA Health), AmSurg (recently split off from Envision) Surgery Partners, HCA’s Surgery Ventures, and smaller, increasingly well capitalized players.

Source: VMG Health, ASCs in 2023: a Year in Review

Given how fragmented the ASC space remains (the top 5 players comprise 32% of the market), Significant investment dollars continue to enter the outpatient space focused on providing health systems with developing their ambulatory networks. The most recent example of this playbook happened when TPG invested in Compass Surgical Partners as part of its TPG Growth fund, which also includes GoHealth and other firms focused on building out health system outpatient footprints and other core functions.

Key Earnings Quotes

On Strong Ambulatory Organic Growth and Utilization Commentary:

- I mean our GI physicians over the course of ’23 performed more than 15% more procedures than they did in the prior year as individuals. That’s a pretty big leap. And we think it’s sustainable.

- …the GI-only centers grew faster than [the portfolio] others on average.

- 2023 was a very strong year, and it was across service lines, as I pointed out, GI, urology, ENT, orthopedics, ophthalmology. I mean we had strength across the board.

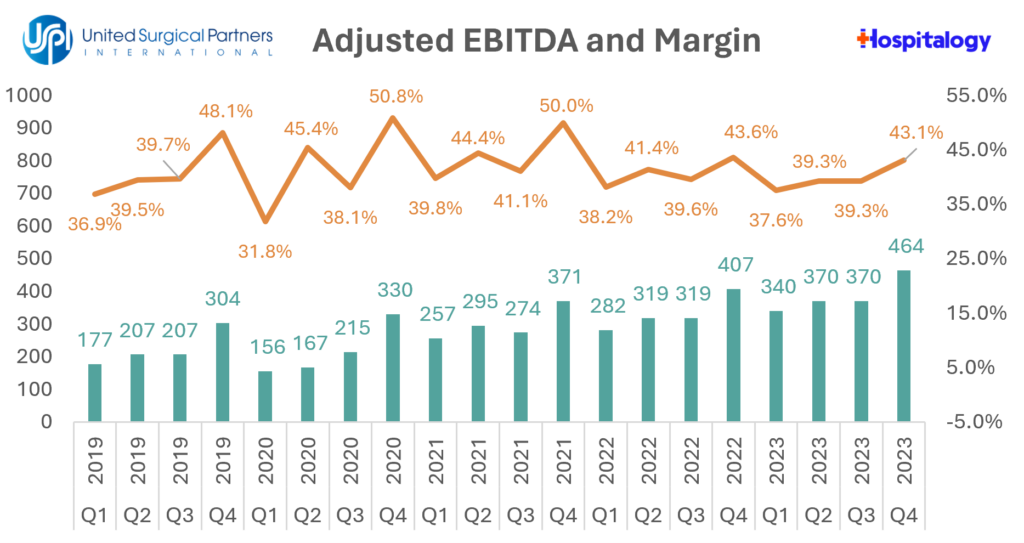

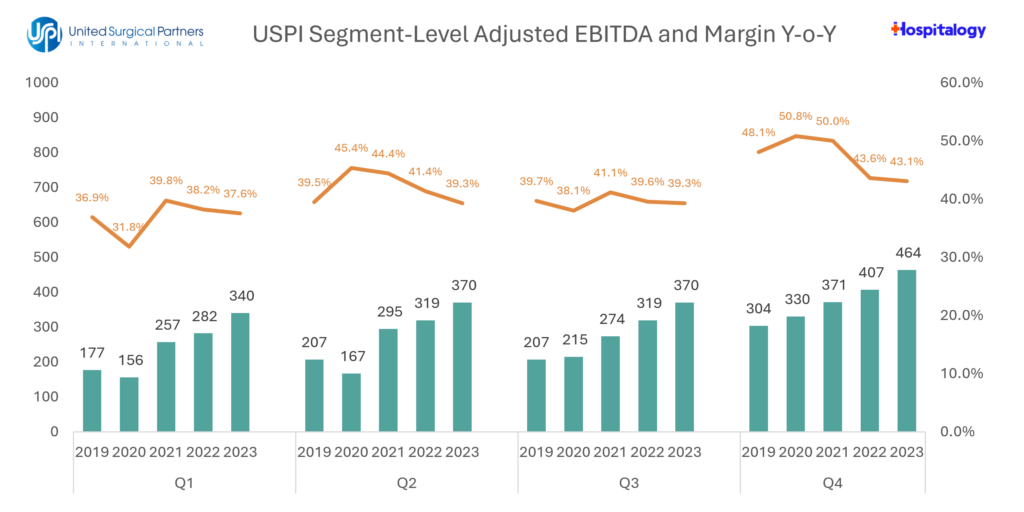

- USPI’s fourth quarter adjusted EBITDA grew 14% compared to last year, and its adjusted EBITDA margin continues to be very strong at 43%. USPI delivered a 9.5% increase in same-facility system-wide revenues compared to fourth quarter of ’22, with same-facility system-wide surgical case volume up by 3.9% and net revenue per case up 5.4%.

- USPI had 9.2% growth in same-facility revenues in 2023, substantially above our long-term goal of 4% to 6% top line growth. Joint replacement surgeries were up nearly 20% in the fourth quarter and over 15% for the year. Throughout the year, we saw ongoing strength and recovery in GI, urology and ENT procedures. This organic growth was driven by continued expansion of service lines and growth in our population of partnered and affiliated physicians as well as the fundamental tailwinds of patient demand for safe and convenient surgical care options.

- As we have noted, we believe that in 2023, we saw recovery in demand that included some impact from deferred volume, particularly in GI and ENT services. Our initial assumption for volume growth assumes that volume will build as the year progresses, reflecting the historically high same-store case growth that we saw in the first quarter of 2023.

On M&A and Growth in USPI:

- We’ve consistently acquired centers at attractive valuations and achieved post-synergy multiples to below 5x, while improving our quality and delivering a 96.6% overall patient experience score under our management. We intend to invest approximately $200 million to $250 million each year and have a robust pipeline to support that level of investment. We also have a healthy de novo development pipeline of more than 30 centers currently in the syndication stages or under construction.

Significant Reduction in Inpatient Contract Labor: By the fourth quarter of 2023, contract labor accounted for just 2.8% of consolidated salaries, wages and benefits, a 62% reduction from fourth quarter 2022.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- In terms of strong expense management, our consolidated SWB was 43% of net revenues in the fourth quarter which was substantially lower than the 46.2% we saw in fourth quarter of ’22, and our consolidated contract labor rate was 2.8% of SWB, a material reduction from 7.3% in the fourth quarter of ’22.

- I would say ’23 was still elevated compared to our historical rates, that’s more in the 2% to 3% range. We are assuming more normalized rates in fiscal ’24 guidance but probably not fully back to those historical rates yet. I would just add, we’re continuing to make investments into our workforce in the right areas on our base wages.

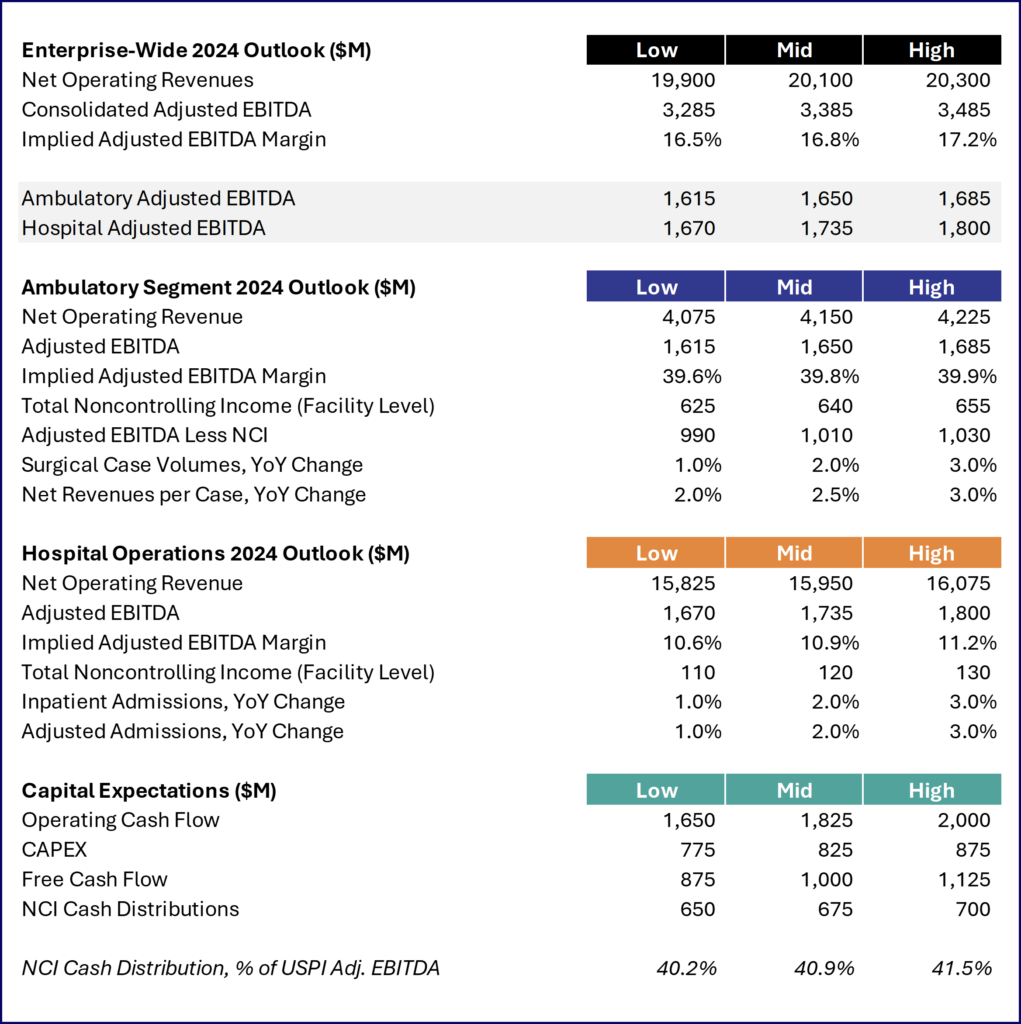

On 2024 Guidance: We are projecting full year 2024 adjusted EBITDA of $3.285 billion to $3.485 billion, which is an attractive 7% growth rate at the midpoint on a normalized basis.

In addition, for ’24, we’re also assuming the following: same-hospital admissions growth of 1% to 3%, adjusted admissions growth of 1% to 3%, same facility USPI surgical case growth of 1% to 3% and USPI net revenue per case growth of 2% to 3%. At a segment level, we expect adjusted EBITDA to grow 8.7% at USPI and 4.5% for our Hospital Segment at the respective midpoints of our guidance ranges on a normalized basis.

- Ambulatory Guidance: we anticipate adjusted EBITDA growth of approximately 9% at the midpoint of our guidance in 2024, based on our expectations of ongoing strength in demand coupled with great visibility into our pricing, 3% to 6% growth in same-facility revenue, continuous improvement in our operating efficiency and additional sites of care joining the portfolio.

- Hospital Guidance: We are expecting adjusted EBITDA growth of approximately 5% on a normalized basis at the midpoint for 2024. This projected growth is expected to be driven by 1% to 3% adjusted admissions growth and continued operating discipline…Additionally, our hospitals continue to enhance access to higher acuity services for the benefits of our patients and communities that we serve.

Capital, Leverage and Hospital Divestitures:

- Hospitals: these [hospital] sales were completed at very attractive EBITDA multiples, evidencing the strength of our assets and the quality of care they provide in their communities. Collectively, these transactions will substantially improve our leverage position. On a pro forma basis, proceeds from these recent transactions have the potential to lower our leverage ratios by approximately 0.6 turns, resulting in a debt-to-EBITDA ratio of approximately 3.3x or 4.2x on an EBITDA minus NCI basis. This is on top of post-tax proceeds of $1.1 billion from our Miami Hospital transaction in 2021 that we used to pay down debt.

- USPI: Look, specifically on USPI, we talk about, historically $200 million to $250 million, now closer to $250 million in capital allocation every year. But the fact is, if you go back over the last 5 years and just look at what we’ve spent and average it out over those 5 years, it’s been quite a bit higher than $200 million to $250 million. We will continue to seek opportunities to add high-quality ASCs to our platform and obviously are comfortable going above the $200 million to $250 million if those opportunities exist.

Competitive Landscape and Sustainability of ASCs Long-term:

- The competitive landscape in the ASC segment is active and intense. And I think that will certainly continue. Look, we think we have a lot of advantages based upon our scale, our physician relationships, our ability to deliver synergies and also just the consistent demonstrated operating excellence over a long period of time. And now we add to that what we think is a best-in-class revenue cycle capability that we’ve built inside of USPI separate from Conifer, inside the USPI that is starting to do work even for non-USPI centers, which is an exciting development.

Resources:

- Tenet Financials

- Tenet Press Release

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 27,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)