Given all of the hubbub around private equity in healthcare, M&A, and capital markets, there’s quite a bit to catch up on in the space.

The FTC held a workshop on March 5 around private equity in healthcare, and I had a chance to join and listen. But while eye-opening and informative, I didn’t think it painted the full picture of compromise that we need with such a contentious topic. So I’m here to add some more nuance to the conversation and why we still need private equity – and private investment – in healthcare.

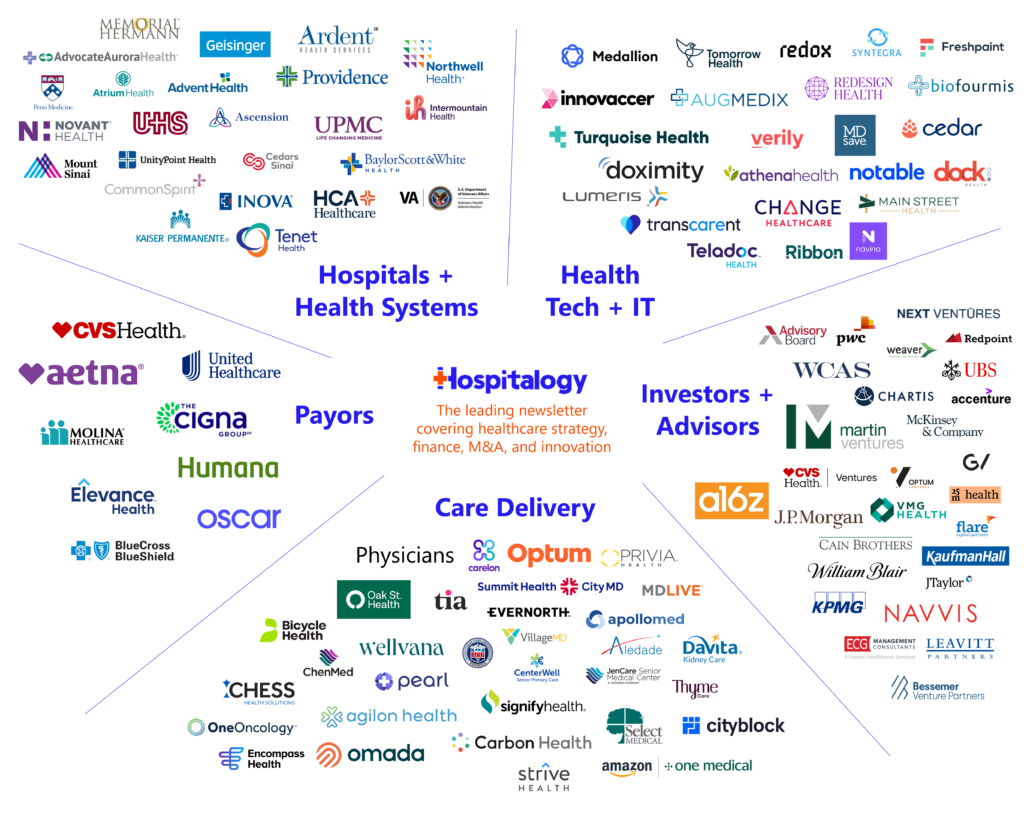

Welcome to Hospitalogy, my newsletter breaking down healthcare strategy, finance, M&A, and innovation twice weekly. Join 28,000+ executives and investors from leading healthcare organizations by subscribing here!

Private Equity in Healthcare: Let’s Find an Equilibrium

Before we get started and you yell at me in my Hospitalogy email replies, I want you to know that the spirit of this conversation is to advance the conversation: to try and bring a thoughtful discussion to the current issues facing private equity in healthcare. Maybe you’ll think this essay is naive – or shortsighted – I don’t care. These are thoughts I’ve had for a while.

Adding to the above, I’m not a lawyer, policy expert, or even a private equity guy.

I’m a former healthcare consultant who happens to know how to write semi-coherently, and I’ve seen my fair share of both good actors and bad actors ACROSS the healthcare system. I’m hoping to add nuance to the conversation because of that lens. A sampling of some of the things I’ve come across:

- I witnessed a PE-backed freestanding emergency room operator blatantly pursue an out-of-network, surprise billing strategy;

- I saw managed care organizations characterizing risk adjustment opportunities as M&A synergies;

- I observed, within a PE-backed physician practice rollup income statement, an expense line-item for referral kickbacks;

- On a due diligence call, I heard a director at a cancer care rollup excitedly mention that utilization was up in their facilities, which would positively influence their overall purchase price, despite the implication that this meant more people in their market were dealing with cancer diagnoses;

- I analyzed absurd projections and assumptions flowing through some shockingly big transactions.

With that being said, I desperately want to find an answer to the following:

How do we find an equilibrium that…

- Protects patients, clinicians, and communities from harm induced by over-indexing on profits;

- Allows for appropriate level of profit and reinvestment for all players (We are capitalists, everyone in America wants to make money, and healthcare is not immune to that);

- Facilitates more transparency in healthcare between key stakeholders (PE firms, providers, and policymakers)

- Incentivizes large capital investment in healthcare while also upholding core healthcare objectives like the quintuple aim (side note – is quintuple the latest iteration? Looks like there’s about to be a ‘sextuple’ aim!)

Source: NeuroFlow

The Public Perception of Private Equity in Healthcare is Abysmal

Those of you who have followed Hospitalogy for a while know I’m a sucker for a great fantasy series.

Right now I’m reading through the Poppy War, a military fantasy trilogy based on mid-20th century China. Core to the novels is the magic system used, where so-called shamans can call various gods within their minds and draw power from them at risk of going slowly insane.

The main character, Rin, is drawn to a particularly ancient and dangerous god: the Phoenix. A god full of never-ending rage and bloodlust whose only desire is to destroy and purge:

- “Burn, kill, devour, consume, destroy. Exact your revenge,” the Phoenix whispers into Rin’s ear throughout the novels.

So since I’m insane, I couldn’t help but see a loose parallel to healthcare.

Many in healthcare – especially on social media – view private equity in healthcare as the Phoenix. A vengeful destroyer in healthcare pursuing selfish, ruthless gain at all costs.

Of course, this metaphor is a bit overdramatic, but it gets the point across (I just like having fun with metaphors, alright? Work with me!)

Working with the metaphor, the Phoenix has caused notable destruction in healthcare:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Prospect Medical Holdings

- Steward Health Care

- St. Joseph’s Home for the Aged

- Envision Healthcare

- Cerebral

- & plenty more if you do a cursory Google search.

The stories are eerily similar, and the bad actor playbook is familiar. PE firm comes in, raises debt, uses the debt to fuel acquisitions, makes aggressive changes to staffing or other important operating functions to juice margin, angers the clinicians, conducts some refinancing mechanisms in the background to irresponsibly extract more value, and then patients get harmed in the process. The facility gets run into the ground after the value extraction playbook ends.

But as devastating as that story of the Phoenix is, and as common as this characterization is personified in mainstream healthcare media, the picture is incomplete. In reality, the Phoenix represents bad actors in private equity, but not private equity itself.

Private equity, in a vacuum, is not good or bad, holy or evil.

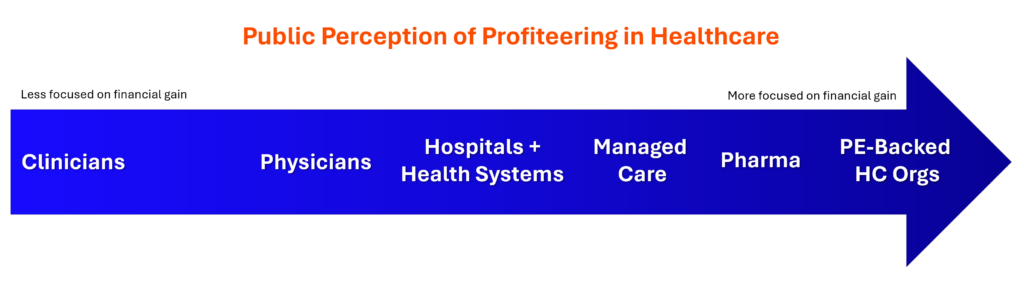

It’s a tool. But too often, it’s a tool used by people who lack integrity and take advantage of the healthcare system for financial gain. The problem lies in the simple fact that our healthcare industry is massive, and there exists regulatory complexity and lack of transparency that presents arbitrage opportunities and loopholes. Private equity has gained a reputation for being one of the worst offenders in this arena. But profiteering extends across healthcare.

This dynamic brings us to where we are today, including the most recent March 5th FTC workshop and movement against PE.

Takeaways from the FTC’s Workshop on Private Equity in Healthcare

Bottom line: The FTC hates private equity’s guts.

In an election year, stemming from action in 2023, HHS, FTC, & DOJ have already taken several sharp actions against private equity and larger-scale M&A:

- The FTC, DOJ, and HHS are conducting an investigation into private equity

- HHS appointed its first ever ‘Chief Competition Officer’ – Stacy Sanders – to address market concentration in healthcare.

- New merger guidelines from the DOJ and FTC were published making M&A tougher

During the March 5th session on private equity in healthcare, folks on the line heard heartbreaking, inexcusable personal anecdotes from nurses, journalists, and policymakers, all with similar stories to tell, which I’ve paraphrased below:

- “Private equity came in. They bought our hospital/facility, and then they cut staffing. They didn’t reinvest profits into new equipment or better working environment. Our complaints and worries fell on deaf ears, and ultimately, quality suffered. Patients suffered, and for that reason, private equity deserves to burn.” Listen to the stories yourself. These are passionate clinicians who have been burned by the private equity phoenix. For them, there is no coming back – no rebirth – from that.

It’s clear private equity has brought this scrutiny upon itself. We’ve all seen the headlines and the typical ‘bad actor’ playbook.

But apart from the absolute dunk fest on private equity (rightfully so in these cases), there were some interesting policies floated during the session which should give you a sense of where future regulation is headed. The following proposals stuck out to me and make sense:

- Increase ownership transparency – knowledge of who owns what, and when. In general, a core theme to all of this (and healthcare and general) is lack of transparency around…everything.

- Stronger antitrust enforcement – better understanding of local market competition, and better definitions of what ‘harm’ to competition and consumers looks like in healthcare.

- Better enforcement around fraud, waste, & abuse – self explanatory. If you do dumb stuff, expect to get caught.

- Preservation of clinical autonomy – counteracting the upward march of corporatization of healthcare, strengthening the corporate practice of medicine doctrine in states (Oregon is looking to do something here), and removing non-competes, which would cause some heartburn for everyone attached to a practice management firm

Overall, despite the constructive policy conversation, I left the workshop disappointed. While everyone’s testimonies and emotions toward private equity were valid and authentic, I didn’t hear a peep from anyone on the other side of the aisle. I wish we had heard from some PE folks, but it’s not the setting for them to engage in. And herein lies one of the biggest problems in healthcare: the siloes, the tribalism, the difficulties in finding middle ground, and the mistrust present throughout.

The State of Healthcare Today

Public mistrust in healthcare institutions is growing. Within the system, physicians and nurses are crying foul about putting profits over patients, executive pay, and corporatization of healthcare.

Capitalism does not jive well with the morality of healthcare, leading to distortion of incentives. Every arbitrage-able opportunity gets exploited to the fullest possible extent until it gets sealed (to name a few historically: rate arbitrage, risk adjustment gaming, surprise billing, etc.) Patient care quality and other important clinical components get lost in the mix as a result.

Still, capitalism is the most tried and true economic system around, and it’s what we’ve got to work with in America. Making profits in healthcare is not a bad thing, even though it’s popular to bemoan profits publicly. I strongly believe provider organizations, vendors, and anyone doing the right work in healthcare deserve to get rewarded for the work they’re doing to support patients in communities across the U.S. The reward for that care provision or service offering is financial margin generation. And initiatives like value-based care, while far from perfect, are working to align those financial & clinical incentives.

However, with that belief in mind, the core problem with capitalism in healthcare is this: there’s a lack of differentiation financially between ‘good’ healthcare firms focused on the right objectives versus the ‘bad’ healthcare firms focused on maximizing profits. In fact, oftentimes the ‘bad’ ones have optimized for gaming the system and generate higher margins and higher returns, providing negative reinforcement and incentivizing bad behavior. This dynamic extends far beyond private equity.

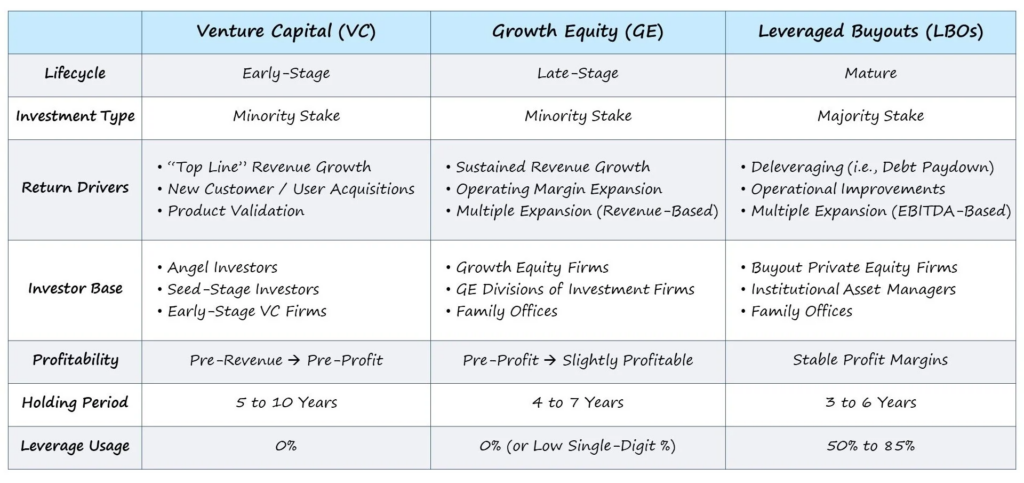

Finally, healthcare is resource intensive. It requires capital and labor, and major sources of funding for those comes from capital markets: private equity, venture capital, debt markets, public equities. Firms need to attract investors in order to grow and sustain their business.

So, there’s a balance to consider. Getting rid of private equity, or regulating them to deal, or shutting down M&A and potential exit paths for PE & VC-backed healthcare organizations, is less than ideal.

Where does private equity excel?

When private equity investments are working, here are the best elements of PE in healthcare:

Providing Capital: One of the biggest sweet spots for private investment in healthcare lies in growth equity – e.g., investing in a maturing business and providing capital for those firms to grow and support their missions – without a change of control in the asset or debt-fueled roll-up play. PE also can help with building out more sophisticated operations, EHR investment, and talent acquisition, equipment, and other uses for capital. Growth equity is distinguished from other types of private equity nicely in the chart below:

Identifying market opportunities, and moving quickly: There’s not many parts of healthcare better than private equity at seeing what new market opportunities are on the horizon, and figuring out which ones are financially feasible. Once that market need is identified, PE has an incredibly efficient ability to build advantageously within that opportunity. For example, private equity firms and real estate developers can work with local governments to determine the need for, say, a behavioral health hospital, or inpatient rehabilitation facility, and build them. PE-backed orgs can also work with health systems to form joint ventures and help them operate more efficiently while unlocking more capital for health systems to reinvest in other initiatives.

We’ve seen this on the payor side too – citing a specific example Welsh Carson Anderson & Stowe’s joint venture with Humana is helping to develop hundreds of CenterWell facilities for senior advanced primary care in a capital efficient way for the Medicare Advantage player. Another PE firm TPG’s Growth fund is investing in ambulatory assets to help health systems develop outpatient footprints within their markets. I think this is private equity’s sweet spot in healthcare – partnering with players to identify strategic initiatives and drive efficiencies while developing those assets.

Driving Efficiency: With profits in mind, PE works to improve overall efficiency of a firm’s operations – acquiring patients, increasing revenue through better collection rates and more sophisticated negotiation with insurers, finding the right vendors to ensure financial sustainability of the operation.

Creating wealth and jobs: PE creates and supports a lot of jobs, both on the provider organization side but also the professional services side. Consultants, lawyers, bankers, brokers, and more rely on deal flow to support their livelihoods. Further, private equity rollups provide physicians with a wealth creation opportunity through offering equity (at the cost of cuts to compensation and risk via giving up control of your practice) and also offer retiring physicians a nest egg and exit strategy by purchasing their practice.

Alternative to other employment options for physicians: Hospitals and payors are large employers of physicians. Private equity firms introduce an alternative to those options and theoretically increases competition for physicians within local markets.

Where does private equity fall short?

As mentioned ad nauseum, while PE can provide the necessary capital and expertise to drive growth, innovation, and operational efficiencies, PE is also the arena in which bad actors can most easily take advantage of the incentives at play, with little organizational accountability or liability.

Of all the players involved in owning or investing in healthcare assets, private equity is seen, again, as the phoenix. The player most heavily incentivized by its own self-guided directives to hit rates of returns – sometimes by any means necessary.

When private equity is at its worst in healthcare – exploited by bad actors – here are the driving forces at play:

- Too focused on profits: The economic incentive to generate outsized returns for the firm’s LPs and extract as much value as possible through any means necessary – financial engineering, cutting costs in draconian fashion, excessive change management

- Lack of transparency: Opacity around the following:

- What privately held firms own what assets and when they acquired them;

- Cap tables, flow of funds, and education around how these things play out with partner physicians or other equity holders in roll-up plays; and

- In the buyout model, once once the takeover is complete, operating changes can include incentivizing over-utilization of services – higher prices – and patient harm through efficiency cuts (staffing changes, purchasing cheaper supplies, etc.). As you can imagine, when costs are cut too aggressively in a services-heavy business, quality of that service often suffers.

- Poor financial management: given short hold periods and lack of accountability – debt saddled assets (preferred 8%+ rate of return), sale-leasebacks extracting value, related party transactions with little to no oversight, badly facilitated tuck-in acquisitions fueled by debt, overleverage of portco assets, and more.

- Financial Engineering: There’s not one spot that distorts reality more in healthcare than an Excel spreadsheet, and I’ve seen that more times than you can imagine. The goal is always the same here – to get to a certain purchase price number or multiple of EBITDA. On a similar note, debt-fueled tuck-in acquisitions to generate inorganic growth for the enterprise are only a good idea when the price is right. Often, it’s not and PE overpays, leading to problems over the long haul.

Oftentimes we’ve seen the worst parts of private equity in healthcare culminate in facility-based services, namely skilled nursing facilities, nursing homes, and hospitals (many areas which PE seems to be exiting). The issues described above result in a value-extraction exercise which inevitably leads to harm to patients, clinicians, and communities.

Where are the breakdowns in the system?

There are tons of things to exploit in healthcare financially, and it’s not just private equity gaming the system. To name a few more commonly noted ones among a laundry list of others:

- Rate arbitrage

- Risk adjustment upcoding

- Fee-for-service upcoding (99214 vs. 99213 etc.)

Along with the above, this article from Nikhil Krishnan does a great job of breaking down current issues affecting healthcare including things like:

- Regulatory Capture

- Certificates of Need

- 340B

- Lack of consumerism and transparency

- Lobbying

- Inability to define quality

A general rule of thumb is…if your finance department identifies it as a revenue opportunity, it happens. There are plenty of players across all healthcare segments fully capitalizing on every possible advantage mentioned above, and more…and they’ve never taken a dime of private equity money. Stated differently, the problems presented and exacerbated by bad private equity actors in healthcare are symptoms of a larger disease within industry-wide practices, and addressing PE in healthcare should ultimately also involve addressing the host of problems exemplified above & more.

What do various stakeholders want?

What does success look like for each side, and how can we build around that?

- For private equity and LPs: As an alternative asset class, producing returns on investment higher – in theory – than the market, as a tradeoff for less liquidity (longer hold periods) to attract investors and make money for their investment firm.

- For physicians and clinicians: Focus on patient care, better access to resources, good working conditions, and fair, competitive pay.

- For patients: Higher quality, accessible care. Reduced harm. Trust.

- For payors and policyholders: Better bang for your taxpayer or premium dollar through improved access, better care, at the lowest price possible. Reduced fraud, waste, & abuse.

Reaching an Equilibrium for Private Equity in Healthcare

Alright. So everything’s been laid out. The good, the bad, and the ugly. What are some things that can be done about the private equity-but-actually-all-of-healthcare problem?

With the stage set, here are some ideas and policy, both proposed and my ideas mixed in throughout, we could think about exploring, with some added rationale for each:

More transparency: This one is low hanging fruit, and a consensus talking point in healthcare. There’s a reason why Mark Cuban Cost Plus Drugs, as a public benefit corporation, unveiled a mission statement around radical transparency in healthcare. The simple fact is that transparency doesn’t exist in healthcare. To that end, understanding who owns what in healthcare, and when they started owning it, and how those factors impact market dynamics like pricing and labor dynamics would be a great start to better understanding whether harm is occurring. Price transparency, ownership databases, and how those things correlate with M&A and referral patterns within local markets, would be fascinating to see trended.

Governance structures: Require any private investor to form a public benefit corporation, but add some more teeth to PBC governance. On that note, explore other potential governance structures for healthcare specific assets to see if you can align company mission with financial incentives. Introduce more education and understanding around cap table structures.

Closing Tax Loopholes: Addressing tax loopholes, such as the carried interest loophole, which allows PE management fees to be taxed at a lower rate, can reduce incentives for private equity buyouts and promote fairer taxation practices

Joint Liability: Implementing joint liability could hold private equity firms accountable for the debt they acquire when purchasing healthcare entities, preventing them from solely burdening the acquired companies with debt

Related Party Transactions & Financial Reform: Taking a closer look at related party transactions, (PropCo/OpCo) models, and sale/leasebacks. Not banning, them but maybe providing guardrails around their facilitation & transparency around terms reached; Limiting leveraged buyouts and capping leverage ratios on portfolio companies; Carried interest reform

Revamping the investment hold period: Instead of 5-7 years (which is around the typical holding period for PE) either require a longer holding period, or when it comes time to exit the investment, introduce a phase-out approach: limit how much of a company a private equity firm can sell at a time to keep skin in the game over a longer time horizon

And here are some wild, likely unfeasible, out of the box ideas:

- Track some sort of standardized quality scores – something core to a business’ success like clinician turnover (anything like this though is hard because then you have to TRACK that)

- Broad MSO-PC structure reform

- Changing / restructuring physician compensation (not gonna happen but changing compensation agreements in general based around productivity would fix a lot of incentives)

- Another interesting idea is forming long-term trusts that invest into healthcare-focused community initiatives similar in structure to conservation trusts.

- You could also just outright ban private equity from acquiring nursing homes specifically given the outsized harm we’ve seen in that space.

Some of these provisions are probably dumb or would affect more financial firms at large, or more healthcare firms industry-wide. When you try to carve out private equity from that equation, or just healthcare specifically within the financial industry, you start to see things get a bit hairy and put those other sectors at a structural, more heavily regulated disadvantage.

What’s the near-term outlook for Private Equity in Healthcare in 2024?

Even though PE players may be the front-page worst offenders in some of these areas, any sweeping changes will permeate throughout all provider organizations, who are doing similar things. PE is also tiny compared to other players in healthcare, and systemic issues are pervasive.

With that in mind, here are current rumblings of real, near-term changes to expect with private equity ownership of healthcare assets:

Labor: Non-compete reform is on the horizon;

Ownership Transparency: More transparency around ownership for Medicare-certified facilities starting with SNFs;

Physician skepticism toward PE: More physician and clinician wariness around private equity, leading to potential recruitment challenges and therefore long-term sustainability;

Pre-disclosure of healthcare-related sales at the state level: McGuireWoods is covering ongoing state-led efforts to scrutinize healthcare M&A deals, and the number of state initiatives (note: mostly in blue states) doing so is growing. While each state’s guidelines vary and many are fuzzy from a details perspective, main provisions include pre-notification of pending sales, review of larger deals, and more:

- Washington

- Oregon

- Massachusetts

- Nevada

- Connecticut

- New York

- Minnesota

- Illinois

- California

- Indiana (expected to be very comprehensive)

- The Indiana law has a much broader reach than many of its peer transaction notice laws that have passed in other states. The Indiana law applies to any merger or acquisition — which includes a stock purchase, the acquisition or transfer of assets, or the acquisition of direct or indirect control — between healthcare entities where (i) at least one of the entities is an Indiana healthcare entity, and (ii) at least one of the entities has $10 million or more in total assets.

Down the line, and as previously mentioned from the FTC workshop, you might expect to see more crackdown on the corporate practice of medicine, stronger antitrust enforcement for healthcare especially among vertically integrated entities, scrutiny of effects on labor markets, and I’m sure plenty more. As the saying goes “every industry can merge, except for healthcare.”

If you crack down on ‘PE-backed roll-up schemes’ where does that leave Optum? Or any health system that has cornered its physician market? Or any potential entrant looking to disrupt or disintermediate these players?

Conclusion: let’s move forward, together

So, what’s the end game given these dynamics? Paul Keckley put it well:

- “In 2024 and an election year, attempted hospital local market mergers will face intense debate and scrutiny from state AG, unions, clinicians, and the community at large. Therefore the burden is on healthcare leaders to convince communities of righteous intentions for patient care and clinical labor.”

The problem today in private equity is that we’re flying blind on the honor system. And as we’ve seen play out several times, there are a lot of folks out there who lack integrity.

A recent op-ed around private equity in healthcare in The Hill caught my eye. It concludes with a couple thoughts:

- Ideally, policymakers would drive private equity out of health care

- This is shortsighted and not what we want.

- As long as private equity remains a significant player in U.S. health care, Americans should have the right to know which hospitals, hospices and other providers are owned by private equity.

- I’m on board with this. We need more transparency in healthcare across the board – not just in private equity. Reducing the problem down to PE is myopic.

But an article like this gets at the heart of what I’d like to see change. Yes – people have been burnt badly by healthcare. But the conversation today around PE is negative to a harmful extreme. And I get why, given media portrayal and real, hard-to-read horror stories. But if you constantly berate the entire industry without distinguishing bad vs. good actors, private equity players as a whole will never play ball. They’ll stay comfortably at their own lunch table. And the Iron Curtain will stay up.

Have you ever had a coach or boss that only thought negatively of you? It takes a rare person to work with an environment like that. While I understand the passion of folks in the room, I’d like to remove the toxicity around this conversation and try to understand what actual compromise looks like. Yes, this sounds like some bright-eyed, bushy tailed sentiment. I get it. I’m still naive enough to think we can all work together. But there are very few, if any, positive and constructive conversations around this with all stakeholders involved in general, and I’m tired of it.

I feel like this essay rambled a bit, so if you made it here, I appreciate you reading the whole thing. To be candid, I struggled to write this and develop cohesive thoughts considering the contentious nature of the topic. I hope this provides some context and nuance around that topic, and I appreciate all of you.

Resources and further reading:

- Becker’s ASC Review. “Healthcare’s 15 top private equity investors in 2023.” Accessed March 21, 2024. https://www.beckersasc.com/private-equity/healthcares-15-top-private-equity-investors-in-2023.html.

- Becker’s ASC Review. “Healthcare’s eyes are on private equity: Here’s why.” Accessed March 21, 2024. https://www.beckersasc.com/private-equity/healthcares-eyes-are-on-private-equity-heres-why.html.

- Bain & Company. “Private Equity Outlook: The Liquidity Imperative – Global Private Equity Report 2024.” Accessed March 21, 2024. https://www.bain.com/insights/private-equity-outlook-liquidity-imperative-global-private-equity-report-2024/.

- Modern Healthcare. “Fitch: FTC, providers, credit.” Accessed March 21, 2024. https://www.modernhealthcare.com/mergers-acquisitions/fitch-ftc-providers-credit.

- Modern Healthcare. “Private equity, physicians, lobbying.” Accessed March 21, 2024. https://www.modernhealthcare.com/mergers-acquisitions/private-equity-physicians-lobbying.

- FAIR. “Private Equity Takeover Is Not Driving Healthcare Crisis.” Accessed March 21, 2024. https://fair.org/home/private-equity-takeover-is-not-driving-healthcare-crisis/.

- Christensen Institute. “Is Venture Capital Bad for Health Care?” Accessed March 21, 2024. https://www.christenseninstitute.org/blog/is-venture-capital-bad-for-health-care/.

- Bloomberg Law. “States Fill Gaps in FTC Crackdown on Health Care Consolidation.” Accessed March 21, 2024. https://news.bloomberglaw.com/antitrust/states-fill-gaps-in-ftc-crackdown-on-health-care-consolidation.

- Hospitalogy. “Why Private Equity Invests in Healthcare.” Accessed March 21, 2024. https://workweek.com/2022/08/11/why-private-equity-invests-in-healthcare/.

- Investopedia. “Opco/Propco.” Accessed March 21, 2024. https://www.investopedia.com/terms/o/opco-propco.asp.

- Federal Trade Commission. “OPP BE Private Equity Healthcare Workshop.” Accessed March 21, 2024. https://kvgo.com/ftc/opp-be-private-equity-healthcare-workshop.

- United States Department of Justice. “2023 Merger Guidelines.” Accessed March 21, 2024. https://www.justice.gov/d9/2023-12/2023 Merger Guidelines.pdf.

- Federal Trade Commission. “Federal Trade Commission, Department of Justice, Department of Health & Human Services Launch Cross-Government.” Accessed March 21, 2024. https://www.ftc.gov/news-events/news/press-releases/2024/03/federal-trade-commission-department-justice-department-health-human-services-launch-cross-government.

- Becker’s Hospital Review. “5 states reviewing healthcare M&A oversight.” Accessed March 21, 2024. https://www.beckershospitalreview.com/hospital-transactions-and-valuation/5-states-reviewing-healthcare-m-a-oversight.html.

- McGuireWoods. “Indiana Becomes Latest State to Enact Mandatory Reporting of Healthcare Transactions.” Accessed March 21, 2024. https://www.mcguirewoods.com/client-resources/alerts/2024/3/indiana-becomes-latest-state-to-enact-mandatory-reporting-of-healthcare-transactions/.

- Morgan Lewis. “California, Illinois, Minnesota: Latest States to Enact Mini-HSR Acts for Healthcare Deals.” Accessed March 21, 2024. https://www.morganlewis.com/pubs/2023/08/california-illinois-minnesota-latest-states-to-enact-mini-hsr-acts-for-healthcare-deals.

- The Hill. “Patients deserve to know if private equity owns their health care.” Accessed March 21, 2024. https://thehill.com/opinion/4544214-patients-deserve-to-know-if-private-equity-owns-their-health-care/.

- MedPAC. “Report to Congress: Medicare and the Health Care Delivery System.” Accessed March 21, 2024. https://www.medpac.gov/wp-content/uploads/import_data/scrape_files/docs/default-source/default-document-library/jun21

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 28,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)