Thanks to everyone for the great comments and collaboration on the largest health systems by revenue piece I published Thursday!

I obviously missed a ton of systems and will be including them in the weeks to come. In the meantime, join my community where I’ll be sharing a data book which includes those revenue figures and links to all recent audited financial statements for the largest health systems in the U.S. Learn about my community here.

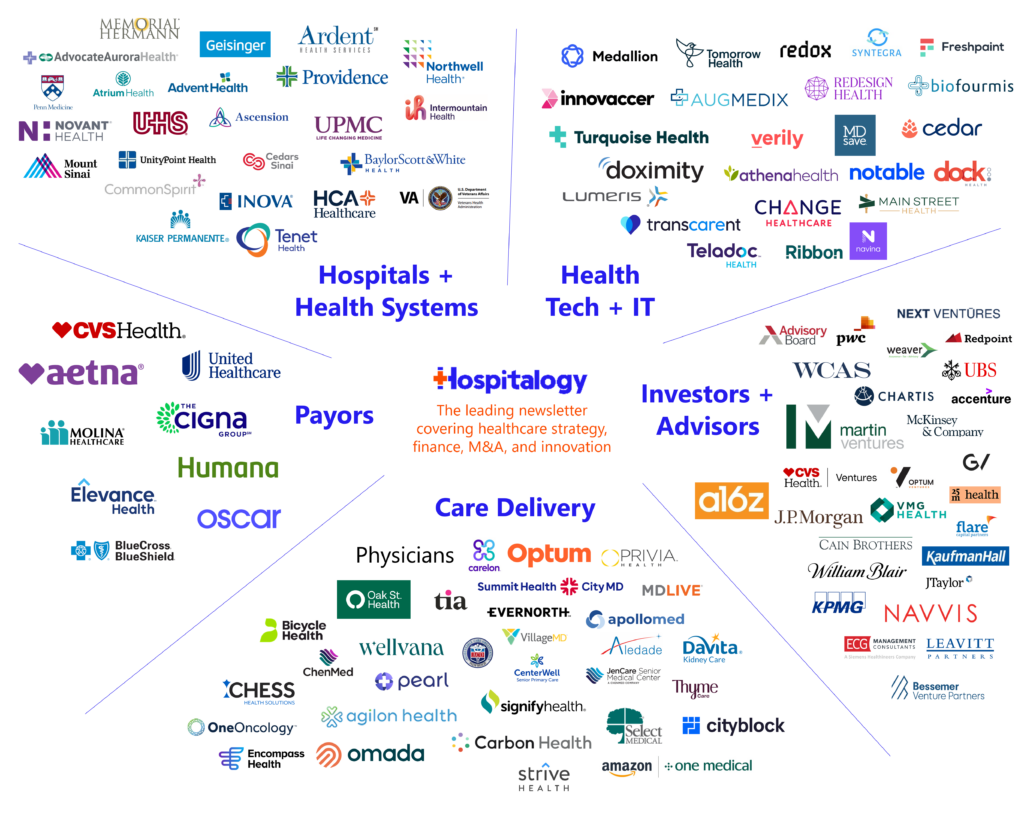

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!

SPONSORED BY WELLSKY

WellSky is hosting an on-demand webinar to guide you through the evolving demands of efficient, value-based care.

You’ll learn the critical role of technology in enhancing hospital throughput, making care transitions smoother, and adapting to the changing landscape of post-acute care.

Hear firsthand from experts at Helion, Ochsner Health Network, and WellSky on how increased visibility and tech-supported transitional care management are key to thriving in value-based care models.

Dive into the power of real-time data to optimize post-acute networks, improve patient outcomes, and curb unnecessary spend.

If you want insights that drive success, go ahead and give it a look.

Elevance makes next Carelon vertical integration play with CD&R

Who: Elevance Health and its care delivery segment Carelon alongside private equity firm Clayton, Dubilier, & Rice (CD&R)

What: The two are forming a joint venture. Carelon is contributing care delivery and enablement assets along with cash consideration while CD&R is adding some of its owned portfolio companies.

Together, the partnership will create the following entity serving 1 million + individuals with advanced primary care capabilities:

- Millennium Physician Group as a 900+ physicians / APP strong advanced primary group located throughout Florida with presence in Texas and North Carolina;

- apree health (the newly rebranded Vera Whole Health and Castlight entity) will focus on under-65 markets and care navigation services;

- Carelon Health’s clinic footprint is small – the presser mentioned 30 sites today with an emphasis on high-risk, polychronic members.

Context: I’ve covered vertical integration more holistically here, but in recent years, Elevance has made major steps toward building up Carelon into an Optum-like care delivery asset. They’re playing catch-up and didn’t even break out services as a standalone segment on their financial statements til recently. Partnering with CD&R shortcuts a capital-efficient avenue toward creating a primary care platform for future growth. It’s a very similar play to what we’re seeing with Humana, CenterWell, and Welsh, Carson, Anderson & Stowe co-developing new senior primary care clinics. In 2024, Carelon has made at least 2 (public) notable moves: buying Paragon and now this JV. If you’re a health system, from a competitive lens, you need to start and continue to think about ways you can compete from an enterprise perspective, and not from siloed service line perspective – because your national competitors are increasingly thinking that way.

What Else is Trending in Healthcare?

An Epic Dispute: Probably the biggest trending topic in Health IT land, Epic ‘shut off’ access to Particle Health, rumored to be claiming Particle was misusing the data. The conflict created quite the hubbub with folks defending both sides. While this topic is outside my area of expertise, it’s clear that we could do with some more trust between stakeholders in this, but also every other area of healthcare. Some handy links below.

Coverage and analysis:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Epic v. Particle – A series of links and context to help understand the current crisis in interoperability (and how we can do better) – Health API Guy’s time to shine baby!! Read it and learn. I loved this quote: “I’m forever the optimist. I believe both these companies and their customers want what’s right: to help patients. These events will certainly have ripple effects in terms of both Epic and Particle customers’ trust in the networks, but my main take is that the tactical actions and who’s right or wrong really isn’t that important. Instead, they can serve as a catalyst and accelerant for the change needed. These events occurred because fraud and abuse are happening because the status quo of the networks only working for Treatment leads to the worst possible incentives. Health data is needed by a broader set of stakeholders in order to serve the patient…”

- Epic, Particle Health dispute exposes broader challenges with sharing patient data, health IT experts say

Hospitals say IPPS proposal inadequate: CMS proposed the inpatient (IPPS) rule for hospitals this week, noting a 2.6% increase along with implementing a *mandatory (note – how many other mandatory models are out there? This seems significant) episode-based payment model called TEAM. Certain players including Premier reacted harshly to the proposed 2025 rule, calling the payment update “dismally deficient” (a fun alliteration) given the state of hospital finances in 2024. The AHA called the payment update ‘woefully inadequate’ which seems to be a favored term in healthcare especially when considering financing updates! Talking points for hospital lobbying includes elevated costs for labor and medical supplies, the state of recovery for many hospitals, and concern around the mandatory nature of TEAM. On the other hand, rating agencies have noted a markedly improving environment for hospitals in 2024. While the recovery for health systems is lumpy and not homogenous, I have to think the worst of health system financial woes are in the rear view mirror.

Hospital M&A volume jumps in Q1 which reflects the poor operating environment: “18 transactions wiht $10B in total revenues for the targets were announced in Q1 2024 – compared to 12 and $3.4B in Q1 2023. The biggest three from Q1 included Summa Health and General Catalyst, Nuvance Health and Northwell Health, and Fairview and UMinnesota.

Home Health Provider Charter Healthcare files for bankruptcy.

RadNet to make its second acquisition in Houston, Texas. RadNet also announces an outpatient radiology partnership with Providence Health System to include seven centers in Burbank, Santa Clarita, and the Northern San Fernando Valley of Los Angeles.

Our favorite VC-backed health tech company Cerebral was ordered to pay $7M in fines for violating privacy laws.

Neue Health raises a $30M financing lifeline from existing investors – yet another fall from grace for Bright Health.

Fundraising Spotlight:

Venture updates & recent notable funding rounds. Non-exhaustive; AI-generated.

- Glen Tullman launches 62 Ventures, a new $100 million fund.

- Grow Therapy raises an $88M Sequoia Capital-Led Series C to advance effective mental healthcare. If anyone wants to wire just 1% of that funding for Hospitalogy feel free to reach out.

- Pelago scores $58M to scale virtual clinic for substance use management.

- InStride Health picks up $30M to accelerate growth into new markets.

- Providence spins out Praia Health with $20M in funding, a new platform-as-a-service for patient engagement built for health systems.

- Manifold secures $15M for its AI-based clinical research platform.

- Tennr lands $18m from a16z to meet US healthcare fax machines with AI. The convergence we all needed.

- Brightside Health raises a $33M Series C. I had a great conversation with Brightside’s CMO Mimi Winsberg. Brightside recently expanded into Medicare and Medicaid

- Home-Based Care Staffing Startup Float Health raises $10 Million.

- Aligned Marketplace launches to make advanced primary care more accessible to employers and raised $8 million in a seed funding round.

- Redesign Health Spinout Beanstalk Benefits launches with $7.5M for benefits platform.

- HealthArc secures $5M for advanced care management platform.

- Milu Health announces a $4.8M Seed Round led by a16z Bio + Health to expand employee access to AI-driven health savings platform.

- Korean startup AITRICS seeks US entry with latest $20M funding.

Partnership, Products, and Pilot Announcements:

Collaborations and launches to keep a pulse on.

- Ascension will outsource Illinois hospitalist functions to a PE-backed staffing firm.

- Samaritan Health Services partners with KeyCare to offer 24×7 virtual care via Epic-based platform.

- Tufts Medicine and Acadia Healthcare break ground on a new Behavioral Health Hospital to serve the Greater Boston area.

- Molina Healthcare, Cityblock partner to give dual eligibles increased SDOH assistance.

- GE HealthCare closes MIM Software acquisition, bolstering its portfolio and advancing its precision care strategy.

- Kaiser launches a food-is-medicine center of excellence.

- HCA Healthcare rolls out in-EHR referrals to Talkiatry’s telepsychiatrists.

- Children’s Hospital LA launches telehealth urgent care.

- Costco teams up with Sesame to offer a weight loss program to members, including GLP-1 drugs.

- Imaging center operator RadNet launches a new joint venture partnership with Providence.

- FSU, Tallahassee Memorial partner for a new academic health center, medical campus.

- Con Secours Mercy Health and Compass Surgical Partners announce the opening of an ASC in Greenville, South Carolina.

- Costco, Sesame expand their weight loss partnership program.

- Private equity backed radiology provider Rayus partners with an AI startup to launch a nationwide whole body MRI offering.

- Photon and Cost Plus team up to offer price transparency and patient choice.

- Sutter Health partners with Abridge. Abridge announced a partnership with MemorialCare as well today as the AI scribe makes quick work of enterprise expansion. Love to see it.

SPONSORED BY A.TEAM

Is the AI revolution in healthcare here, or just hype?

Join the conversation at A.Team’s Gen AI Salon: The Future of Health on April 24th.

Discover how AI can completely transform patient care with insights from Kanishka Rao at Carenostics, learn about AI’s power to streamline operations from Rachel Tornheim at Mount Sinai, and explore its potential in clinical decision-making with Jessica Beegle and Morris Panner.

This event is your ticket to understanding AI’s real impact on health (hint: the impact is massive)!

Join A.Team for a deep dive into the future of personalized healthcare. Don’t miss out!

Register now to secure your spot

Miscellaneous Maddenings

Fun, random stories & updates from Blake

Masters thoughts:

- Scottie is a machine and it goes to show how managing the course and your emotions is 99% of the game when you hit that level. Morikawa, Aberg, and Homa are elite ballstrikers but fell short on 11. At one point 3 players were tied at -6, but things fell apart at Amen Corner. Scottie is head and shoulders above the competition right now and even though he’s basically a robot, it’s well earned and well deserved.

- Rory is such a headcase it hurts. The course played so tough but the guy has had 16 tries at it!!

- I expected more from Spieth and it seems like he’s back in a dark place.

Hospitalogy Top Reads

My favorite healthcare essays from the week

Register for my virtual event on 4/17 talking all thinks value-based specialty care here!

This interview with Dallas-based Baylor Scott & White CEO Pete McCanna was a good read from Beckers. Baylor is a highly respected, very well run organization.

BCG’s report on child care benefits and how employers will have a clear ROI by investing in the benefit for moms and parents.

A study on estimated Savings From the Medicare Shared Savings Program – This economic evaluation found that the MSSP was associated with net losses to CMS. The total budget impact of the MSSP to CMS was small and continues to be uncertain due to challenges in estimating the effects of the MSSP on gross spending, particularly in recent years.

Thanks for reading Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!