Happy Thursday,

2024 is quickly shaping up to be the year of cybersecurity incidents, as rumor has it Ascension has been taken offline Wednesday. I wonder if it has anything to do with relaxing security measures given the number of spin-offs and JVs the health system has announced recently.

Bottom line though…Hackers – and downstream, healthcare’s preparedness for these events – are part of why we can’t have nice things. Everything adds up!

1. Blake’s Breakdown:

Going a bit deeper on an interesting topic, theme, or resource

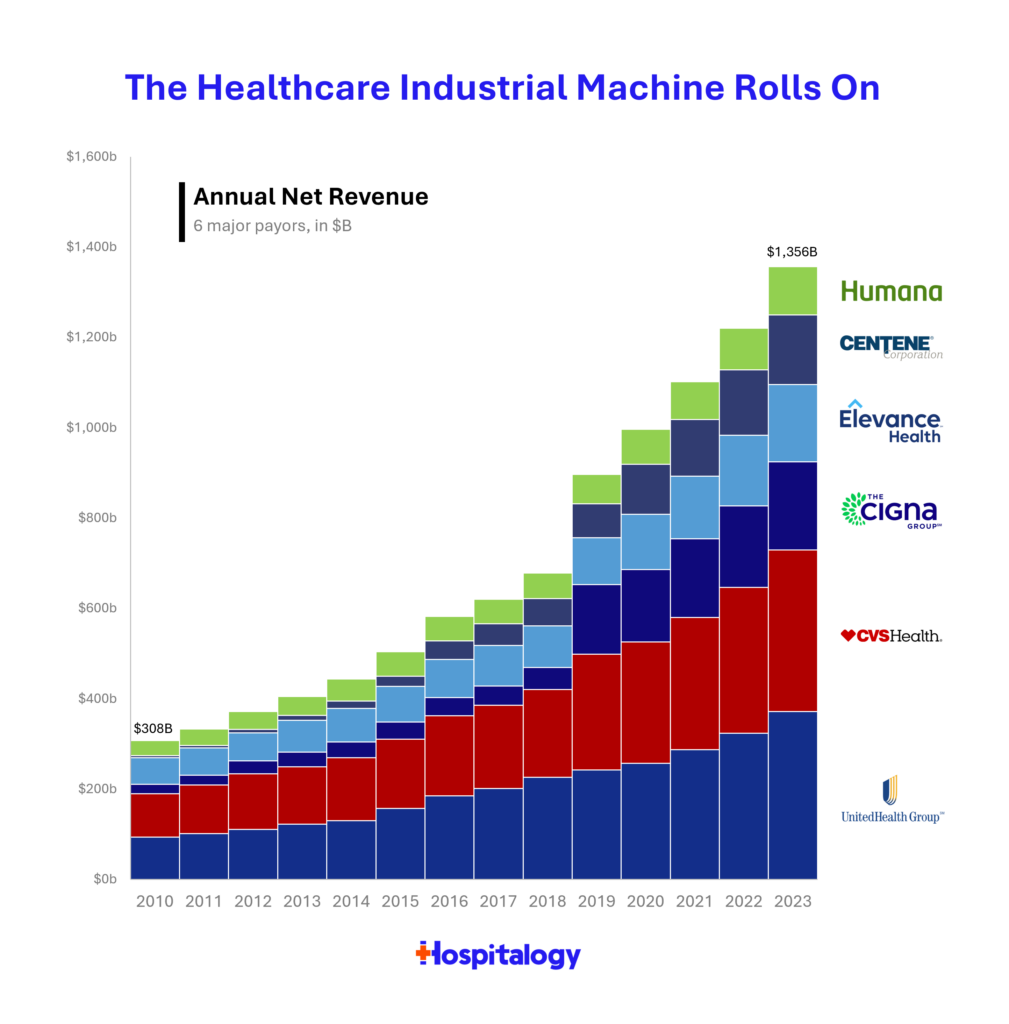

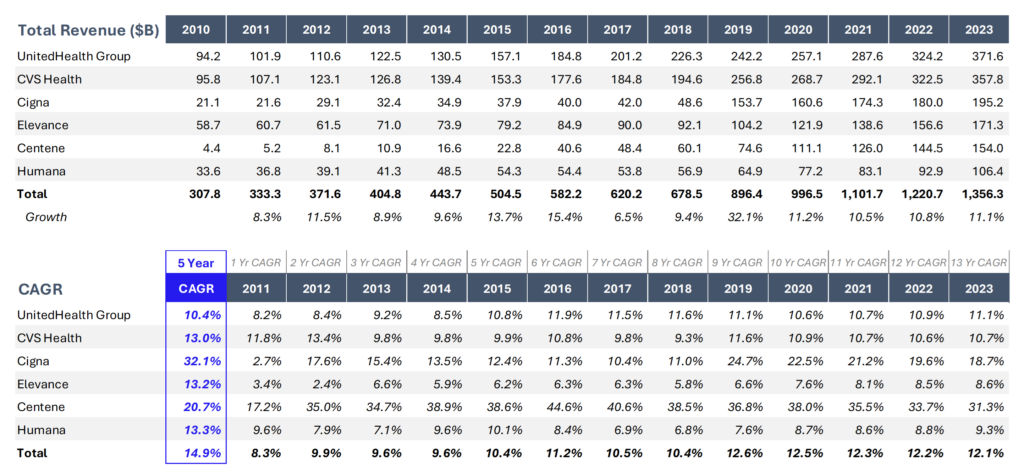

After spending some time in payor land, I figured the below would be a crazy visual to put together. How have the 6 big publicly traded healthcare behemoths fared since 2010, on a pure revenue basis?

Since 2010, these 6 vertically integrated players combined (note: including non-premium revenues) have seen their revenues increase 12.1% compounded annually, from $307.8B in 2010 to $1,356.3B in 2023. Transactions to call out include CVS’ purchase of Aetna, Cigna’s purchase of Express Scripts, and UnitedHealth Group aligning with 90,000 physicians while employing 10,000 of those – spending $30B+ in the last 2 years alone on acquisitions. Don’t be fooled – there is still plenty of room for these players to grow as the U.S. population ages.

What else? One quick callout from the ongoing earnings season! The Surgery Partners Q1 earnings call is worth a read. Most of the major themes I’ve been hitting on this year are present within the report including growth in orthopedic cases, physician recruitment, value-based care, and more.

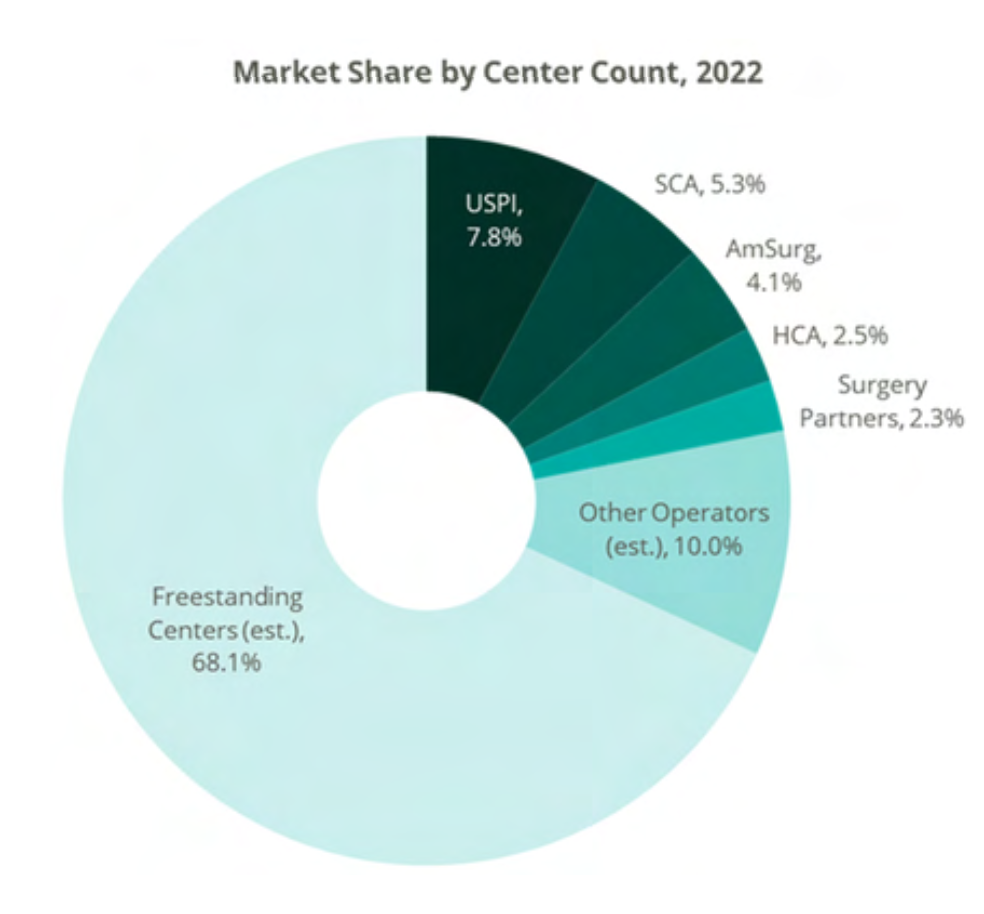

Final note: The ASC market is still incredibly fragmented. VMG Health’s 2024 M&A report characterizes Surgery Partners, one of the 5 largest players, at 2.3% market share of all ASCs. The largest by center count is USPI, at 7.8% of the total ASC market:

Surgery Partners Resources:

- Earnings press release

- Earnings call transcript

- Surgery Partners JP Morgan Healthcare Conference Presentation

2. What’s Trending:

Social discourse and conversations from around healthcare

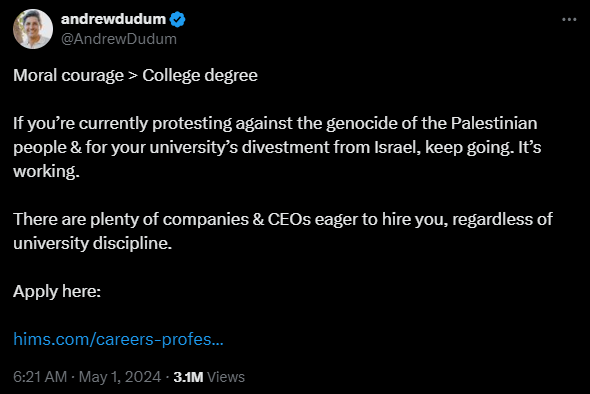

A fascinating dichotomy. Hims & Hers’ CEO Andrew Dudum tweets around the Israel-Palestine conflict have inflamed social media. Despite these actions, Hims & Hers – as a DTC telehealth company in 2024 – is firing on all cylinders, crushing Q1 expectations.

Just like locker room conflicts in football, winning solves a lot of things, but you never want to have “CEO tweeting out polarizing stuff” as a business risk. Dudum has since posted a follow-up thread clarifying his remarks.

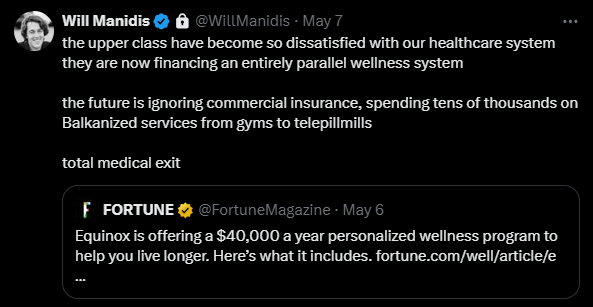

Longevity and the wealthy. An interesting topic on how current longevity ventures – executive physicals, preventive scans, Brian Johnson’s Blueprint program, and now Equinox’s $40,000 annual wellness program – are focused exclusively on top earners, and how a healthcare system is being built on parallel rails for these individuals. I do think longevity is such an interesting space, and holds significant overlap with the current industrial machine. If you’ve come across any interesting models or have a spicy take on the future of longevity + healthcare, I’m all ears!

3. Community Update

The latest from inside my community of healthcare thinkers

Did you know?

Along with writing this Hospitalogy newsletter to 31,000 of you, I have a more intimate community of 50 or so folks in strategy, finance, and innovation who get much more exclusive content and access to me.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

To that end, I just put together a ~30-page report for them putting all of those thoughts and trends in one spot.

The report covers:

- The latest in vertical integration

- Medicare Advantage headwinds and cascading effects

- Return of stabilized, elevated utilization

- Emerging health system outpatient strategies

- HCA Q1 2024 and full-year 2023 one-pagers

- FTC, non-competes, antitrust, and private equity latest

- Q1 digital health fundraising

- Notable Q1 healthcare stories

I spend hundreds of hours each quarter putting together analyses, visualizations, and trends covering everything going on to get organizations ahead of the game!

You can get the report by signing up for my community here: Join my community

Dollars and Deals

Finance and M&A updates

- Steward Health Care Finalizing Financing Deal With Medical Properties Trust to Support Its Restructuring; Steward’s bankruptcy documents reveal sprawling debt, planned hospital fire sale

- Debt covenant violations tick up among nonprofit providers: report

- Cigna writes down VillageMD investment amid shrinking value

- EyeCare Partners Announces Refinancing Transaction Completion

- Aledade and Medical Advantage Team Up To Expand Value-Based Care in Michigan

- Providence Ordered to Pay $200M for ‘Systemic Wage Violations’ – MedCity News

- Merger Creates Premier Orthopedic Powerhouse in South Florida: Atlantis Orthopedics Joins Forces with South Florida Orthopaedics & Sports Medicine

- Growth equity in healthcare: new opportunities for private equity

- Healthcare Realty Trust Announces Strategic Joint Venture With KKR

Earnings roundup:

- Tom Blankenship’s breakdown and visual of Acadia’s Q1 results.

- Astrana Health, Inc. Reports First Quarter 2024 Results

- Alignment Healthcare raises membership guidance but posts $47M net loss

- Talkspace reports 36% YOY revenue growth in Q1 2024

- Surgery Partners, Inc. Announces First Quarter 2024 Results

- Hims & Hers Health, Inc. Reports First Quarter 2024 Financial Results

- R1 RCM is continuing its buyout talks, based on a new SEC filing released on May 6

- GE HealthCare stock falls 14% after release of its first quarter earnings

- Evolent Q1 earnings

- RadNet Q1 earnings

Venture Spotlight

Notable Startups and Fundings

IPO Watchlist: The digital health unicorns most likely to go public per Pitchbook.

- AI-enabled drug discovery company Xaira launches with $1B.

- Rad AI closes $50 Million to empower physicians with AI.

- Sibel Health receives a $17.5M grant from the Gates Foundation to advance maternal health monitoring.

- Trovo Health announces $15 Million seed funding round led by Oak HC/FT.

- Livara Health raises $15 Million to expand value-based musculoskeletal care delivery model.

- Backpack Healthcare raises $14 Million in Series A funding to revolutionize pediatric mental health care.

- Piction Health™ announces having raised a total of $6 million to date and served more than 2,000 patients across several states.

- In-House Health nabs $4M to build out an AI-enabled scheduling platform for nursing teams.

- GroundGame.Health and SameSky Health join forces to close the loop on social and healthcare needs at a greater scale

Submit your Startup: Each week, I want to start highlighting a cool startup doing innovative things in healthcare – with the caveat that I’m asking you to be a bit more transparent. All answers submitted confidentially to me. Submit your startup here.