Today we’re looking at Humana and the operating challenges ahead for the Medicare Advantage focused enterprise.

You guys seem to be liking the waterfall charts with some narrative explaining the trends so we’re back at it again!

PS – I’m still accepting applications for my community, which has focused, curated content and discussions for VPs and Directors in strategy, finance, and operating roles at health systems. If that’s you, apply here.

Humana’s Medicare Advantage Squeeze

Today, Humana issued an alarming 8-k related to preliminary data released by CMS for its 2025 Star Ratings (which will affect 2026 bonus payouts).

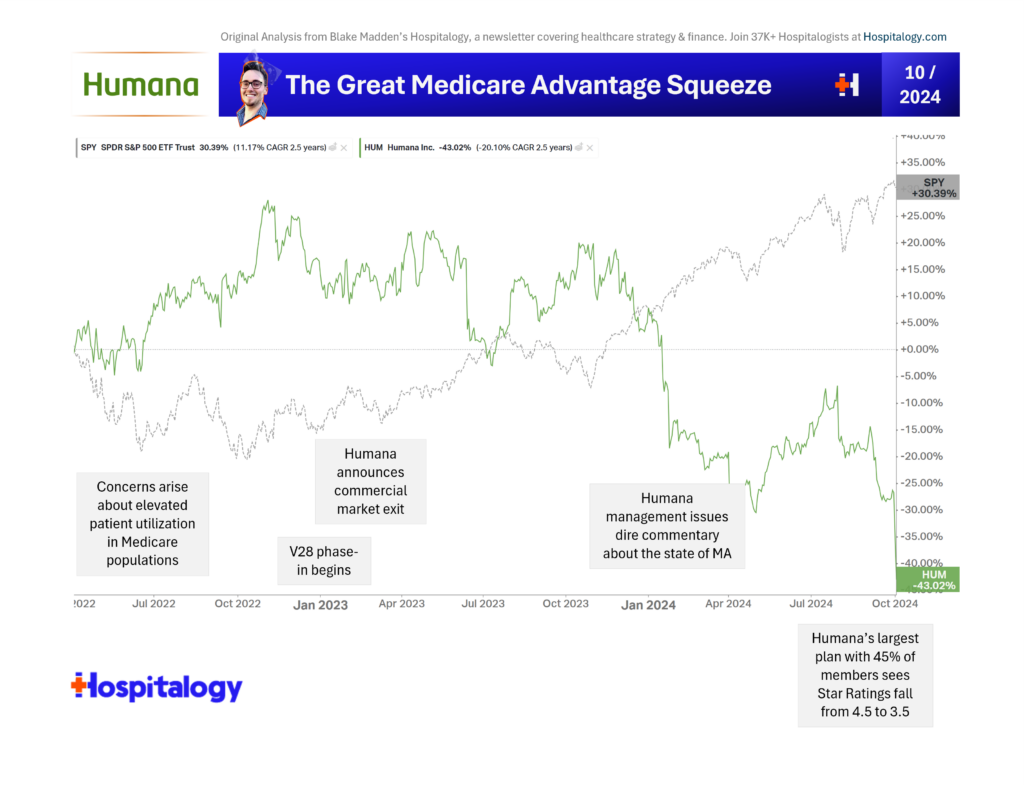

Humana’s single largest plan, fondly named H5216 like a drone from Star Wars, was downgraded to a 3.5 star plan. In 2024, the same plan was rated at 4.5 stars by CMS, exceeding the threshold for quality bonus payouts.

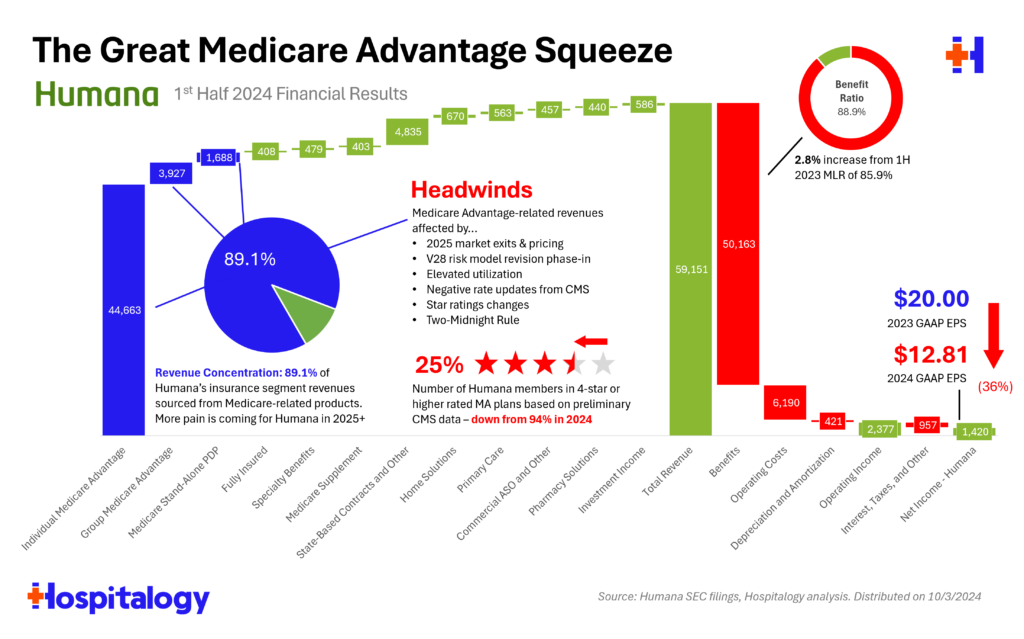

The problem sits in one simple troublesome factor for Humana: 45% of its membership resides in this plan. So as a result, just 25% of Humana’s members are in 4-star or greater plans, which is a massive reduction from 94% of members in 2024.

Humana’s troubles have been ongoing. Since the start of 2024, Humana has seen a 43% loss in market value, with management noting throughout Q1 and Q2 that regulatory changes along with the current utilization environment would be incredibly difficult to stomach.

A quick timeline of notable, high-level developments for Humana and MA, including exiting the commercial markets completely (maybe a move they regret in hindsight?):

Star Ratings are/were one of the single biggest levers MA players could pull in the short term to alleviate margin pressures, and assuming these developments hold, Humana just flopped big-time.

Which leads us to today, and Humana’s declining operation. In the waterfall I whipped together below on Humana’s results from the first half of the year, you can see its revenue concentration in Medicare – 89% of the entire enterprise. So while times are good in Medicare, Humana is thriving.

When times are tough – like now – Humana has a tough road ahead.

Not lost on me is the fact there are several MA players quietly executing. Alignment Healthcare comes to mind as a regional player unaffected by the MA headwind hubbub.

Beyond that thought, here are some open-ended questions for Hospitalogists to explore around Medicare Advantage, and I would love some responses if you have the time to think about them:

- Are star ratings fundamentally broken – and to what extent are the quality metrics, health equity index, etc. prone to subjectivity?

- Both Humana and United will sue CMS over star quality ratings. For UnitedHealth, apparently one bad call center test experience led to a widespread downgrade on that particular measure. And there’s precedent for insurers like Elevance or SCAN suing and winning in court against CMS.

- How will these unexpected results – and sustained pressure in MA well into 2026/2027 – affect the value-based care and downstream ecosystem? Already we’ve seen agilon downgraded at least twice stemming from developments here.

In a year when the market is performing +20% YTD, many of the large diversified managed care players are underperforming – with Humana down 48% year-to-date and CVS down 20 (and considering a company breakup, like I talked about on Tuesday).

Here’s what I wrote in January about what we might see happen from MA headwinds:

- We’ll see a rise in denials and stiffer utilization management

- Payors will try to push / delegate risk for unmanageable populations onto overexuberant enablement players

- Payors will exit noncore MA markets or where pricing is unsustainable

- Payors will double down on their services-based strategies (CenterWell) in an attempt to find synergies for the mothership, drive patient engagement and acquisition, more effectively manage medical costs, and boost plan star ratings.

- Bigger picture though, if an organization like Humana is telling us that the current dynamic is unsustainable, and the primary way to make MA financially sustainable is to keep people from accessing healthcare, what does that tell us about the future state of Medicare? I think the answer probably lies in the middle; i.e., – make sure people are accessing care appropriately – but this is a conversation for another day.

Whatever happens, it is fascinating (from an academic standpoint, not from a patient access or gloating point of view) to see these managed care behemoths, viewed by untouchable or too big to fail by many, struggle.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.