Hospitalogists,

Happy Friday! It’s holiday season. I bet you guys are all thrilled to be reading Hospitalogy news and analysis rather than cozying up by the fire with your family drinking spiked hot chocolate. Right?

One quick note: I made a snafu on Tuesday’s newsletter and need to make it right. I included the wrong link to Navina’s promotion of their webinar discussing AI and primary care. Navina has been an awesome sponsor for Hospitalogy and they are doing some interesting things in building thoughtful AI products to make a significant impact on PCPs, including sharing insights.

Do me a solid and sign up for their on-demand virtual event covering the latest on physicians, primary care, and how they’re leveraging AI in their day-to-day clinical workflows. Here’s the link!

Thanks again to the Navina team for being gracious about this mistake.

Walgreens’ Woes: Retail Pharmacy Giant Reportedly Weighing Private Equity Sale to Sycamore Partners

After a tumultuous run which included making major investments into healthcare delivery assets (most notably VillageMD), Sycamore Partners is reportedly taking Walgreens private as scooped by the Wall Street Journal.

In November, Walgreens parted ways with VillageMD CEO Tim Barry.

It has been a tough few years for the beleaguered retail pharmacy player, and Walgreens has been brought to its knees in 2024. The knockout punch was coming. How did we get here?

Walgreens has been hit hard by uncontrollable secular shifts in consumer behavior. Amazon and others are eating Walgreens’ retail lunch.

The retail side of Walgreens’ business is stagnant and oversaturated with stores, as more consumers shift to online shopping. This challenge is two-pronged. The pharmacy business traditionally operated like a “gas station” model—drawing foot traffic that would lead to retail sales. But as patients increasingly choose online prescription refill services for convenience, fewer people are visiting physical pharmacy stores, resulting in decreased retail shopping at these locations.

So when retail sales sagged, Walgreens needed to make a move in a big way. The big plan involved embarking on an ambitious business transformation journey into healthcare delivery .

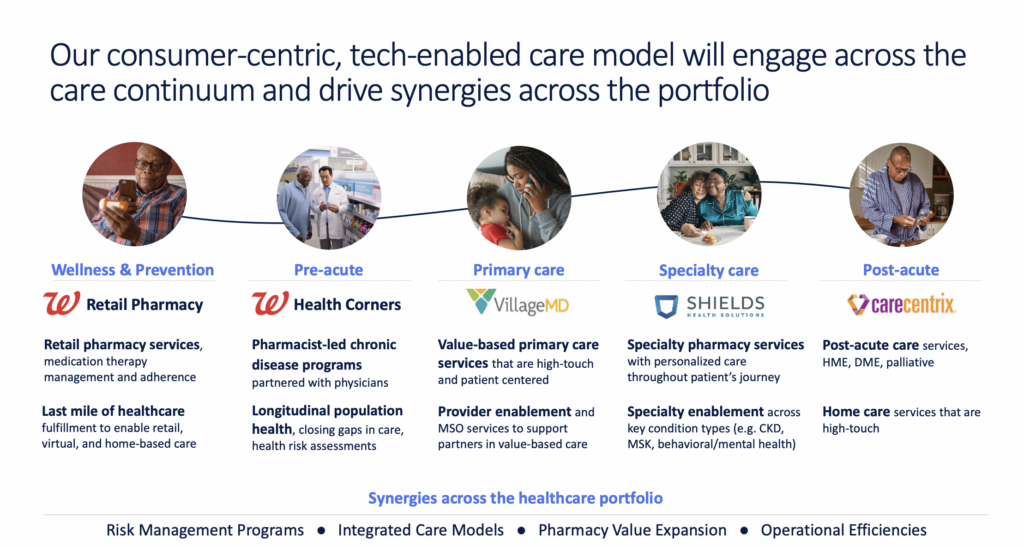

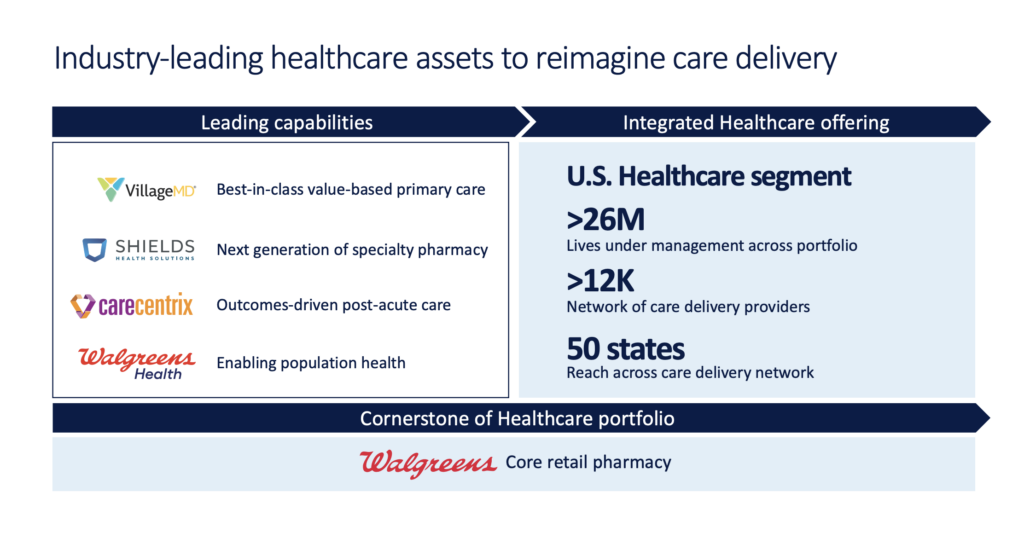

This journey jump-started in 2021 with VillageMD as Walgreens cobbled together the below healthcare footprint to sell a healthcare transformation story, including diving into value-based care headfirst.

Execution, however, didn’t go as planned. As Hospitalogists reading this breakdown know, healthcare is hard. Primary care is hard. Value-based care is hard. This dynamic isn’t unique to Walgreens and VillageMD, either.

Unfortunately this assemblage of assets no longer seems to be industry leading.

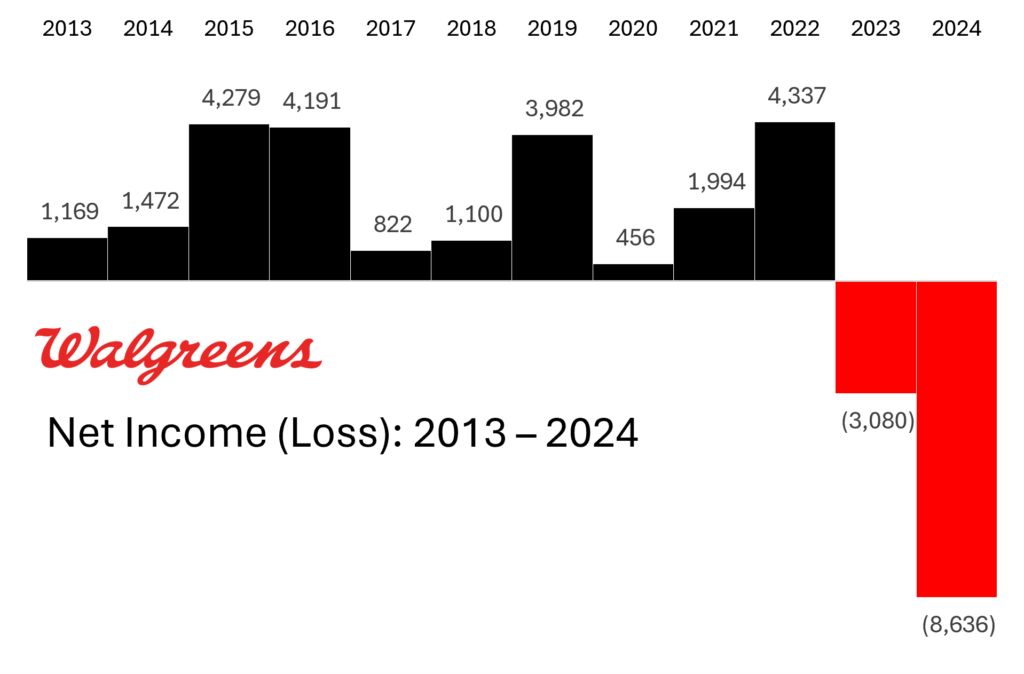

Plain and simple, Walgreens was desperate and overpaid for what it got in a low-interest rate environment. In its 2024 full year earnings release Walgreens incurred an $8.6B net loss on $12.7B in goodwill impairment charges (meaning they overpaid for these companies and the current earnings/economics could not support the acquired valuation, more or less). VillageMD performance weighed down the healthcare story given acute pressures in Medicare Advantage and changes to risk adjustment, along with significant capital and timeline required to build out an appropriate risk-bearing primary care player.

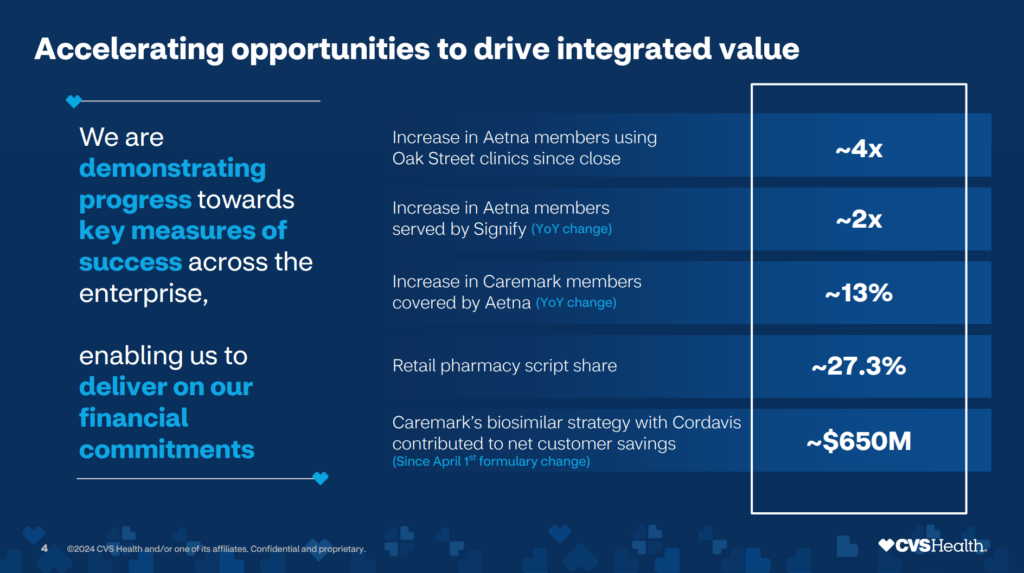

Unfortunately, unlike CVS, Walgreens lacks some of the most important assets to execute on the strategy (at least so far) to make the flywheel…fly – the PBM and the health insurance plan (side note that CVS isn’t doing particularly well either but for its own reasons).

Despite its own struggles, CVS holds a believable narrative to tell investors. From Q3:

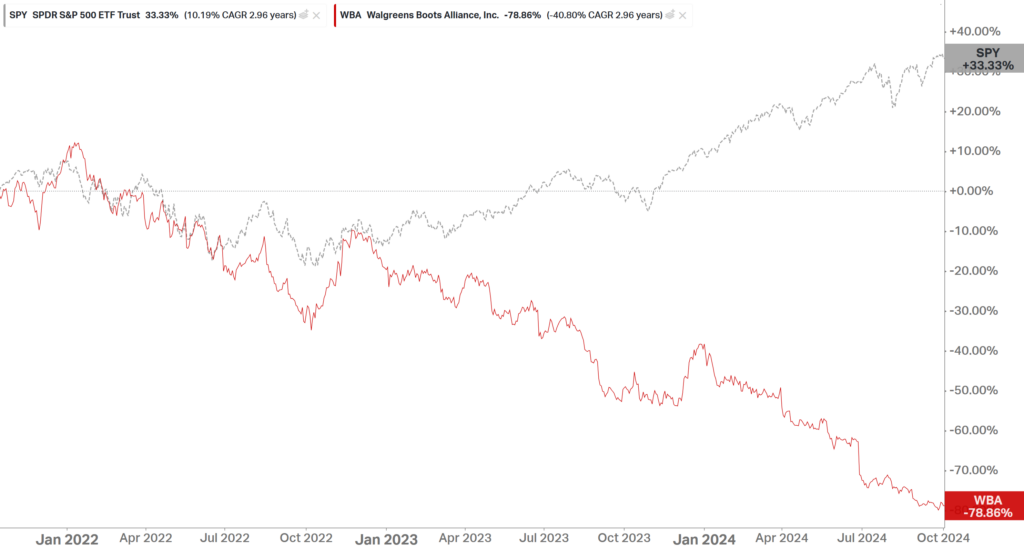

But I digress. This is Walgreens’ share performance since acquiring a majority stake in VillageMD for $5.2B in late 2021, then proceeding to attach Summit Health for $9B in late 2022. At its peak, Walgreens held a $100B+ market cap in 2015.

Today it sits at $8B:

In Walgreens, Sycamore is acquiring a struggling giant, but with a vast revenue base and operating footprint – $147.7B in revenue. While not being an accountant, the impairment charges are largely addressed in 2024, so Sycamore probably thinks there’s significant value to unlock over time as a private company – and tax savings to boot. I’m inclined to agree. Walgreens holds some bright spots. Without being under the gun of quarterly investors Walgreens will have more freedom to reduce its debt load and continue billions of dollars in cost-cutting initiatives (1,200+ store closures in the coming years, capex reductions, working capital reductions). Expect to see Walgreens continue this trajectory but also focus on growing service lines like specialty pharmacy – probably its best acquisition to date.

Looks like KKR dodged a $70B bullet back in 2019 too, eh?

Aya Healthcare to Acquire Cross Country Healthcare

This transaction caught my eye this week in a healthcare travel nursing and staffing consolidation play – Aya Healthcare is acquiring Cross Country Healthcare for $18.61 / share, a 67% premium to its closing price. The purchase price values CCRN at $615M.

Bigger picture: If you’ve been keeping up with hospital earnings calls, the rhetoric is “we have contract labor under control and it continues to improve each quarter.” As large publicly traded hospitals have focused on nursing talent and retention, the travel nursing environment has hit a low point, but there are still opportunities. This transaction to scoop up Cross Country Healthcare is a good pickup for Aya in a “buy the dip” type of play.

The Weekly Executive Summary

Notable moves, policies, and strategies from around healthcare.

Policy and Regulatory

- MA Market Dynamics: The AMA’s report highlights persistent challenges in market competition, while improved Medicare Advantage star ratings benefit UnitedHealth and Centene after their recent court victory. Meanwhile CMS unveiled its proposed rule for Medicare Advantage and Part D, including a provision for MLR calculation reform that would affect provider bonus payouts as part of that equation.

- Trump picks Andrew Ferguson for FTC chair: President-elect Donald Trump has chosen Andrew Ferguson to replace Lina Khan as chair of the Federal Trade Commission. Ferguson is expected to be corporate-friendly and will serve as an M&A unlock for healthcare dealmaking.

- Post-Acute Labor Woes: The nursing home sector faces uncertain staffing mandates and the industry is pushing back.

- 340B Rebates and Drug Accessibility: Sanofi’s plan to implement a rebate model could reshape drug access programs, particularly for high-cost specialty medications. Meanwhile, Minnesota’s 340B report pioneers financial disclosure, setting a precedent for transparency in drug pricing programs.

- Acadia Healthcare faces methadone clinic fraud allegations: Acadia Healthcare allegedly falsified records at its methadone clinics and admitted unqualified patients, according to an investigation.

- Medicaid expansions risk losing funding: Trump allies propose cutting Medicaid expansion funding.

Tech Innovation & Integration

- Emory Healthcare launches population health initiative: Emory Healthcare and Guidehealth collaborate to expand primary care access across Georgia.

- Kindbody – sale or not? Kindbody is reportedly considering a sale – fielding proposals from investors – after a funding round allegedly fell through the cracks earlier in 2024. Kindbody has since denied the rumor. “In the attempted funding round this summer, the company was in talks for a pre-money valuation of $600 million, according to a letter sent to potential investors. More recently, its estimated value has dropped to $400 million, according to people familiar with the negotiations.”

- Ambient AI Updates: Montefiore and Nuance DAX are partnering to reduce physician burnout through AI-powered solutions. Abridge partners with Corewell Health, and also is collaborating with Cambridge Health Alliance to provide AI-powered medical scribe support. Hippocratic AI has secured its first patent for innovations in large language model healthcare applications. Catalight and Nabla are reducing documentation burdens for autism and IDD care providers. Augmedix has achieved Oracle validation for its healthcare integration capabilities. Veradigm is launching an AI scribe to support small and independent practices with documentation needs.

- MSK and Chronic Care Solutions: Hinge Health joined Amazon Health Services, signaling deeper integration of digital MSK care into its searchable employer benefit platform.

- Ro expands access to Zepbound weight-loss drug: Ro is collaborating with Eli Lilly to integrate directly with their consumer platform for streamlined access to Zepbound.

- Longitude Health’s Population Play: New health system nonprofit innovation consortium Longitude Health announced the formation of Longitude PHM, a population health initiative focused on value-based specialty care within health systems.

- RadNet’s DeepHealth subsidiary has expanded FDA clearance for its SmartMammo AI breast cancer screening tool.

Healthcare M&A

- VitalCaring and 43% of Profits: VitalCaring’s legal troubles are big-time, stemming from April Anthony purportedly working on a separate home health company while still being employed at Encompass. The court has mandated VitalCaring distribute 43% (!!!!) of ALL FUTURE earnings to Encompass as retribution. Pretty insane.

- Duly Health and Surgery Partners collaborate on ambulatory care: Duly Health and Care announced a partnership with Surgery Partners for outpatient ambulatory surgery centers in Illinois.

- Expanding Specialty Platforms: Orthopedic Care Partners secured a $185M investment, highlighting private equity’s continued appetite for multi-state platforms. Additionally, Kian Capital Partners and RF Investment Partners launched a nationwide medically-focused optometry platform called US VisionMed Partners.

- Hospital and Provider Transactions: Nonprofits continue to align strategically, with Risant Health’s now-closed acquisition of Cone Health signifying its second health system after Geisinger.

- Home Care and Hospice: Addus HomeCare has completed its acquisition of Gentiva’s hospice services for $350 million.

- Priority Health acquires PHPNI: Priority Health completed its acquisition of Physicians Health Plan of Northern Indiana to foster innovation and care access.

Quick Notables

Collaborations, launches, and other tidbits to keep on your radar.

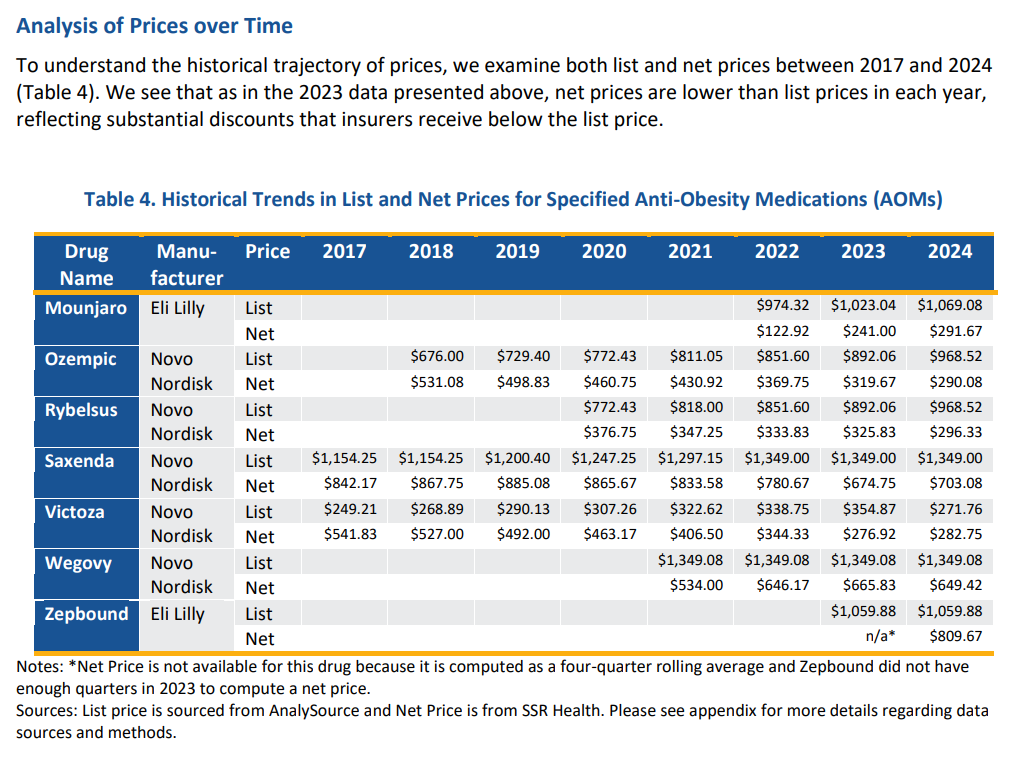

- Net prices for GLP-1s are dropping. Here’s the full report from HHS chock full of recent information.

- Penn Medicine teamed up with Cost Plus Drug Company to secure generic drugs.

- Clearway Health and Sinai Chicago are transforming specialty pharmacy services via their partnership.

- Carle Health and Lumeris are partnering to advance value-based care initiatives in Illinois.

- Marshfield Clinic Health System is using AI-powered solutions to manage and route 55% of patient messages.

- Biofourmis is expanding remote patient monitoring at Lee Health with home-based hospital care solutions.

- Carta Healthcare is acquiring Realyze Intelligence to enhance oncology research and clinical trial capabilities.

- Interwell Health is introducing Acumen Rounder to streamline nephrology practices.

- US Physical Therapy has acquired an eight-clinic practice focused on hand and physical therapy services.

- USAP launched a subsidiary to address unique anesthesia RCM needs.

- PAM Health is acquiring Southern Indiana Rehabilitation Hospital to expand its footprint in Indiana.

- Ouma Health and Marani Health are joining forces to improve maternity care access in underserved communities.

- Medical Home Network and Instacart are collaborating to address food insecurity through innovative community programs.

- Abra Health Group is expanding to Connecticut by acquiring All About Kids Pediatric Dentistry.

- Inspira Financial is acquiring First Dollar to reshape consumer-driven healthcare benefits.

- LucidHealth has chosen Royal Health as a strategic partner to enhance radiology workflow solutions.

- WelbeHealth is expanding its PACE services with the opening of a new center for seniors.

- Rightway and Curai Health are expanding access to virtual care through a new strategic partnership.

- Blue Cross and Blue Shield of Minnesota is broadening behavioral health services access for members.

- TT Capital Partners is investing in Collaborating Docs to accelerate its innovative practice management solutions.

- Google is releasing open foundation models – Health AI Developer Foundations (HAI-DEF) which is a public resource to help builders develop applications in certain specialties like radiology.

- Medical Home Network and Instacart are partnering to tackle food insecurity with innovative delivery models.

Recent Fundraising Announcements

- Redesign Health raises a whopping $175 million to scale its healthcare venture building efforts.

- Capstan Medical garners $110M for their robotic-enabled heart valve repair tech.

- Cleerly raises $106 million led by Insight Partners, boosting its efforts to innovate in heart health diagnostics.

- Rock Dental Brands brings in $90M to continue their growth spurt and added a new Chief Development Officer to the team.

- Qi BioDesign secures $75M for their genome editing technology.

- Beta Bionics announces the closing of a $60 million Series E financing, pushing forward in developing bionic pancreas systems.

- Converge Bio raises $55M to expedite drug discovery and development with GenAI.

- Soda Health closes an oversubscribed $50M Series B led by General Catalyst (here’s their investment thesis) to scale its Smart Benefits Operating System. Benefits administration in general is a hot space entering 2025.

- Cala Health raises $50M to expand wearable tremor therapy. Shaking up the treatment scene!

- PhotoPharma secures $46M and inks a manufacturing partnership with Gentex.

- Sirona Medical secures $42M in Series C financing to enhance customer success with its cloud-native Unify platform.

- TailorMed secures $40 million to expand the largest affordability network into a comprehensive platform, transforming patient access to care nationwide.

- Hyro AI raises a $35M Series B round to enhance its AI-driven communication platforms. I’ve had the chance to connect in the past with Hyro’s founder Israel Krush, and they are a no-nonsense, no-frills company striving to build good patient-facing AI contact products for health systems and provider organizations. Cool to chat and about, and this space is filling up quickly.

- Sage secures $35 million in Series B funding to transform senior living operations across the US and beyond.

- Sollis Health completes a series B funding round of $33M led by Foresite Capital to support growing demand for personalized, high-touch healthcare.

- Morgan Health announces a $25M investment in Merative to strengthen access to coordinated care for children with neurodevelopmental conditions.

- Roon raises $15M to replace “Dr. Google” with real doctors sharing videos about illness treatments.

- Practice Better secures $13M to scale its health practice management offering.

- Fello raises $10.4M, tackling the loneliness epidemic with a peer support platform.

- StretchDollar raises $6M to assist Oscar Health with its ICHRA-focused services. Like I said, benefits.

- ThoroughCare secures $5 Million in Series A funding from Empactful Capital to push the boundaries of patient care.

- Tuva Health raises $5M seed funding for its first-of-its-kind open-source platform.

- Cofactor AI secures $4M funding to combat claims denials, bringing AI into the fray.

Hospitalogy Reads & Resources

Good healthcare essays and resources from the week

- I loved Kevin Wang’s piece on MVO vs. MVP for its practical, no-nonsense approach to product building without overengineering.

- An overview of the MAHA movement.

- ProPublica’s look at a small-town oncology feud is a gripping story of how individual choices can impact a whole community and exposes poor incentive alignment on multiple levels – physician compensation and productivity, health system profits and oversight, health insurance inability to recognize overbilling or fraudulent behavior, and more.

- This McKinsey article is a smart guide on turning healthcare’s challenges into opportunities.

- The Christensen Institute’s take on health insurance innovation connects big ideas with actionable solutions.

- Rock Health’s analysis maps where healthcare innovation is heading along their innovation maturity curve.

- This GoodRx tracker on weight-loss drugs is a neat, data-filled window into real-world trends. Relatedly, the KFF explainer on obesity drug coverage is a solid overview on how policy shifts could impact future obesity care.

- HBR’s piece on personalization nails the gap between tech advancements and actual patient care.

- Bain’s analysis predicts significant shifts in primary care delivery models, with hybrid approaches and retail health gaining traction.