Happy Friday, Hospitalogists!

Today’s send is an overview of Bain’s recent healthcare private equity report (linked below) which always makes for a great read for folks in/around the space.

Also, I’ll see you in Austin during SXSW! Get ready for a Healthcare Happy Hour.

Join Lance Armstrong, Ben Freeberg, me, and other industry experts for a night of networking and health tech conversation, and maybe even some spicy takes.

📅 When: Tuesday, March 11 | 5:00 PM – 7:00 PM CDT

📍 Where: Driftwood Downtown, Austin, TX

Register now to save your spot; space is limited: https://lu.ma/6anqugot

Takeaways from the Annual Bain PE Healthcare Report

Let’s dive into what’s been happening in healthcare private equity…or should I say, what’s poised to happen since with $75B in dry powder waiting to be deployed, 2025 is shaping up to be a banner year.

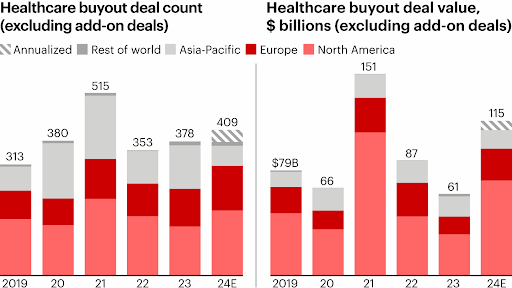

According to Bain’s latest report, Healthcare Private Equity Market 2024: Year in Review and Outlook, last year closed out with a bang, hitting a record ~$115B in deal value.

Here are a few takeaways that caught my eye:

First, what fueled global healthcare PE to reach ~$115B in 2024, making it the second-highest deal value we’ve ever seen on record?

Just a few massive transactions—five deals over $5B, compared to just two in 2023 and one in 2022.

After some years of uncertainty, big moves are back, and healthcare PE is poised for some serious growth (although overall U.S. private equity activity is 53% lower than it was this time last year).

So far, startups like Transcarent have announced acquisitions, spaces like RCM are seeing rollup plays (Machinify) and others like Datavant are gearing up for a wave of M&A activity. For those closer to the space, I would love to hear what you’re watching in 2025.

For the rest of us, here’s a solid overview from Bain.

Sector Highlights in North America:

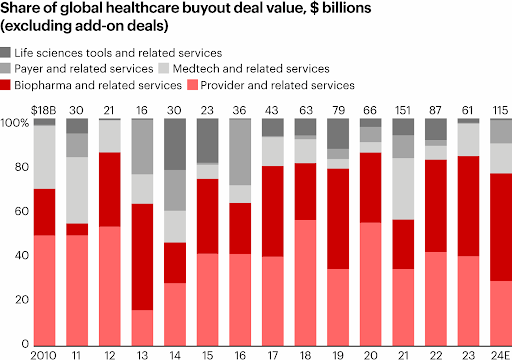

Provider Services: Major investments were made in provider services, reflecting ongoing consolidation in fragmented markets such as veterinary care, dental services, and primary care.

Healthcare IT: Investments in healthcare IT were driven by a major focus on optimizing providers’ efficiency, investments in clinical trial IT infrastructure, and advanced analytics by payers.

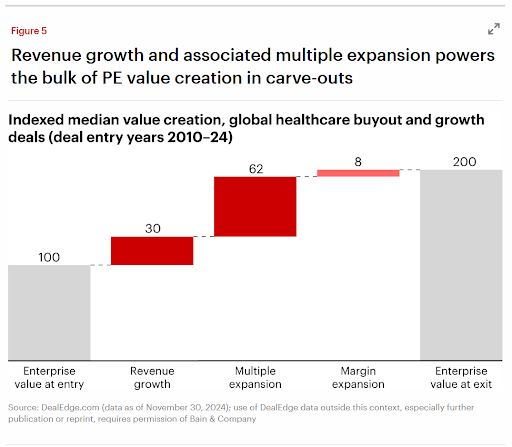

Mid-Market Innovation: Mid-market private equity funds demonstrated strong performance, gaining momentum with more carve-outs and a sharp focus on maximizing exit values. Bain attributed exit value accretion primarily to multiple expansion (of course) followed by revenue growth, and then margin expansion. Pretty interesting to see most of the value created in the actual aggregation process – multiple expansion in developing a rolled-up platform – rather than helping the portco operate more efficiently.

Biopharma: The biopharma sector also attracted substantial investment, more or less in line with years prior. It’ll be interesting to see how the Inflation Reduction Act affects investment over time.

Regulatory Environment: The FTC intensified its scrutiny of private equity’s role in healthcare transactions. In March 2024, the FTC held a workshop detailing concerns with various private equity investment strategies, and in May 2024, it launched a public inquiry with the DOJ to explore potential anti-competitive risks in PE transactions that may undermine competition.

In the second half of 2024, the U.S. Federal Reserve started cutting interest rates, making borrowing cheaper and showing a vote of confidence in the economy. At the same time, Japan and India had benefited from steady growth and a positive investment environment.

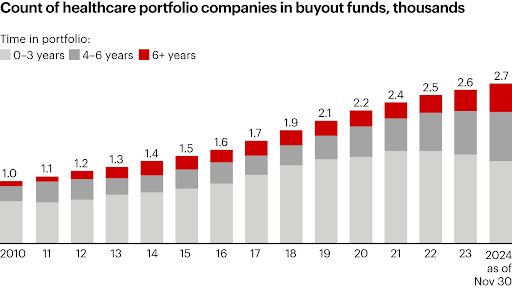

Looking ahead, with more assets piling up in private equity portfolios (see graph below), plus rising pressure from limited partners to cash out, it looks like we’re about to see more sponsor exits soon.

Plus, as the WSJ has also recently reported, physician practice management (PPM) deals are stirring back to life.

After years of stalled activity (blame labor costs, regulation, and bankruptcies), 2024 saw strategic buyers bridging valuation gaps, with major deals in ophthalmology and gastroenterology. Kristian Werling, a partner at McDermott Will & Emery, expects to see great continued growth ahead for PPMs, especially those in chronic care management and more complex specialties.

So, what’s next?

- Will buyers and sellers finally see eye to eye as valuations level off? And with LPs needing liquidity, will competition heat up or cool down?

- With biopharma investment ramping up with more early bets and bigger clinical trial spending, will this drive long-term PE growth in the space?

- Are corporate partnerships the new M&A playbook (i.e. TPG + Cencora, CD&R + Elevance)?

- And will will PE keep leaning into carve-outs and niche plays, like Astorg’s move in assisted reproductive tech (ART)?

Read Bain’s full report for more, and let me know what you think.