Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.

DispatchHealth and Medically Home merge, Updates on Marathon Health, 23andMe’s Bankruptcy and more Healthcare news this week

source: Business Insider

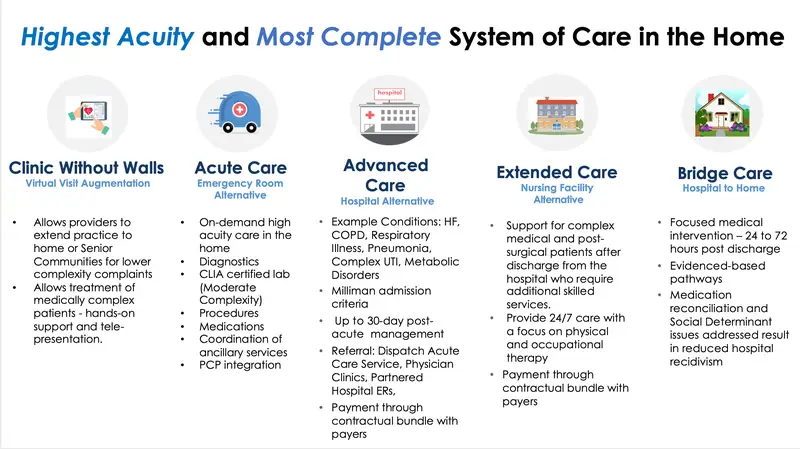

Dispatch-Medically Home Hospital-at-Home Merger: DispatchHealth and Medically Home announce a merger aiming to create the nation’s largest provider of hospital-level care at home, expanding acute care access outside traditional hospital settings. Both of these firms, at the height of the pandemic, had each raised hundreds of millions of dollars, and the merger speaks to what I imagine is the growth curve of the hospital-at-home program, consolidating to create a more comprehensive platform to serve HaH and any other at-home programs, such as SNF@Home, and well, survive in 2025. Hospital-at-home in general is in a bit of flux, as CMS extended the program’s waiver thru March 31, and since then, CMS extended the waiver thru September. Either way, not a great spot to be in given such material stroke of pen risk. Hopefully we find a more permanent solution to HaH here soon.

- NewCo, which will continue as DispatchHealth, will operate in 50 major MSAs in partnership with 40 health systems and other risk-bearing entities.

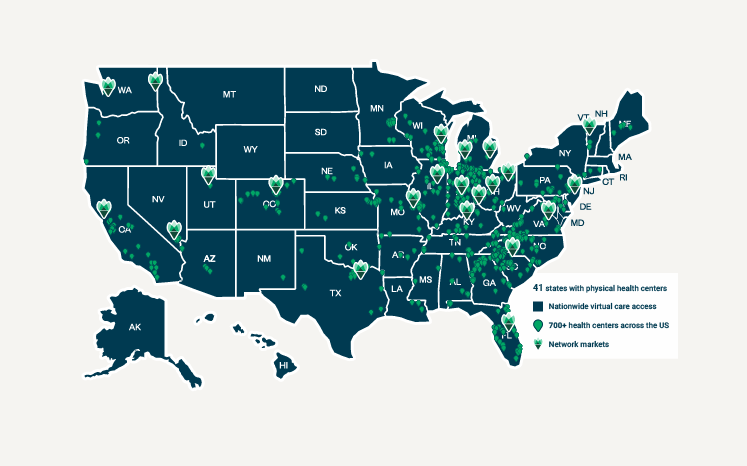

source: Marathon Health website

Marathon Health – Everside Post-merger update: This was a good little update on a company doing some good work in the primary care employer space – Marathon Health (after merging with Everside in mid 2024). One year post-merger, Marathon Health celebrates becoming the largest open-access advanced primary care network in the U.S., significantly expanding employer-sponsored healthcare. Some highlights included in the presser:

- Footprint: more than 3 million covered lives, through more than 750 health centers across 41 states and virtual care nationwide. Up from 2.5 million covered lives across 680 health centers in the year since merging.

- Marathon noted employer-sponsored direct primary care as an ‘explosive’ segment of growth.

- Tech platform implementation: In the past year, Marathon Health successfully migrated 368 health center locations and 1,290 clinical teammates, to Ignite — a single technology platform for Marathon Health’s care teams, patients, and clients. Over the same period, the company achieved 96% client retention (stable year-over-year) and 90% provider retention (improved year-over-year).

- ROI: Marathon saves employers $1,800 per engaged member, on average.

- Will Marathon go public? Seems like they’re at pretty robust scale and doing quite well. And don’t forget Everside filed an S-1 way back in 2021. Five years ago Everside was generating ~$180M in revenue.

From Stat’s Health Care Inc, an interesting tidbit: The Trump administration released its proposal to crack down on enrollment within the Affordable Care Act marketplaces. If you scroll to page 241, you’ll see that CMS estimates somewhere between 750,000 and 2 million people will lose ACA coverage next year under this rule, while also slashing $17 billion in spending.

- Estimates also indicate instituting Medicaid work requirements would knock off ~5.2 million individuals or so from the program.

23andMe Bankruptcy: Genetic testing company 23andMe files for bankruptcy amid significant financial losses, leading CEO Anne Wojcicki to resign after nearly two decades to put her into a better position to vie for the company. Struggling with declining consumer demand and mounting debt, now we’re asking the question around who’s getting all that data, which apparently is up for grabs. Love that for the rest of us. Personally I’m glad I never did one of these. I also respect Anne’s fight for her company at the most foundational level of all of this.

Medicare Fee Changes: This was a good read from (my former firm!) VMG Health’s Frank Cohen on Medicare’s 2025 Physician Fee Schedule across core payment changes including an overview of the conversion factor and healthcare inflation (the MEI), RVU redistributions, geographic updates, changes to chronic care management and RPM programs, and more.

Navina’s AI Funding: Shout out to Navina, a Hospitalogy sponsor, on their Series C! Navina secured $55M to scale its AI-driven clinical insights platform, particularly targeting expansion within value-based care. Navina holds partnerships with players like Privia and agilon and they’ll use the newly restored coffers to expand their footprint from there and double down on their AI-enabled capabilities.

- By the way, and I’m not saying, but I’m also just saying…Hospitalogy sponsors stay winning. I mean I actually haven’t tracked it but most of the folks who work with us seem to be doing pretty well. By the way, totally unrelated my brand partner’s email is [email protected] for sponsorship opportunities. No reason for mentioning that.

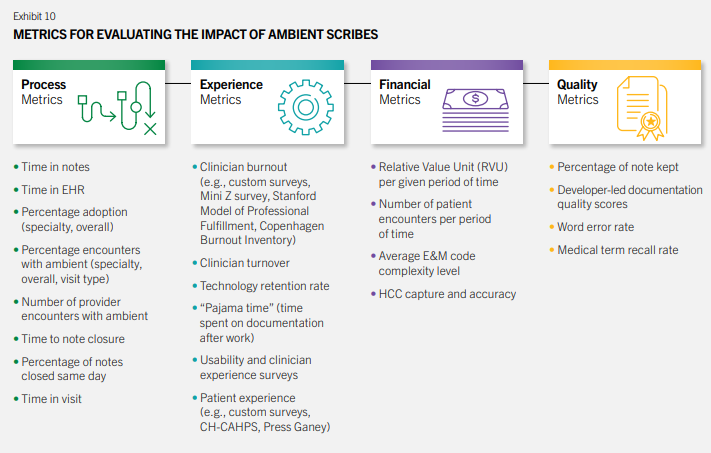

source: Exhibit 10 from PHTI’s AI Adoption report. Page 23

Early AI Adoption in Health Systems, and AI Scribes: The Peterson Health Technology Institute delivered another report on early adoption of AI in healthcare and its impact, putting a particular emphasis on AI scribes given widespread pickup of the tech in hospitals & health systems nationwide. It’s a good read both to understand what health systems are after in implementing a new technology (compliance / acceptable level of risk and seamless integration, addressing a core operating issue like burnout). The PHTI report also gives an inside look at the ambient documentation market, noting potential downstream use cases and tie-in’s into areas like revenue cycle, quality reporting, and deeper integration into ancillary workflows (labs, referral management, engagement) as well as key players, funding histories, and more things analysts would want to understand about the space. Great work by the PHTI team.

Medicaid Coverage Cuts: Millions lose Medicaid coverage due to states’ tightening eligibility post-pandemic, disproportionately impacting children and low-income adults. The resulting rise in uninsured rates threatens hospitals financially, potentially leading to increased uncompensated care and highlighting systemic vulnerability within Medicaid-dependent regions.

Hospital Credit Outlook: Kaufman Hall’s rating agency update highlights continued negative outlooks for many hospitals amid rising expenses, declining inpatient volumes, and pressure from payer mix deterioration.

Private Equity and Physician Turnover: A recent Health Affairs article dove into the effects of private equity roll-ups in PPMs on subsequent physician retention and turnover.

- Relative to matched controls, PE-acquired practices increased the total number of clinicians by 46.8 percent through three years after acquisition. This growth was driven by increases in the numbers of both ophthalmologists and optometrists (30.7 percent and 36.2 percent, respectively). PE acquisitions also increased physician turnover, with the share of physicians leaving PE-acquired practices from one year to another increasing by 13 percentage points, or 265 percent, after acquisition, relative to non-PE-acquired practices.

Interesting Reads / Opinion Pieces:

- Autism Diagnosis Debate: Rising autism diagnoses may stem from financial incentives tied to special education funding rather than actual increases in cases, argues a Wall Street Journal opinion piece. The authors suggest educational systems are incentivized to inflate autism rates, diverting attention from environmental factors or vaccines.

- PBM Transparency Challenges: Pharmacy benefit manager (PBM) transparency efforts face significant challenges as new data reveals hidden costs and complexities persist despite regulatory scrutiny. Drug Channels had a good piece highlighting ongoing concerns around opaque PBM practices and minimal impacts of recent transparency regulations, arguing structural reform is necessary to control drug prices rather than just throwing the word ‘transparency’ around.

Venture Spotlight

Notable Startups and Fundings

- Arlo raised $4M in Seed funding. Arlo is an AI-powered health insurance underwriter for small businesses. Shout out Jan-Felix!! Great stuff man.

- Aura raised $140M in a Series G round. Aura provides AI-enabled online protection against identity theft, scams, and online threats, focusing on family and child protection.

- As mentioned above, Navina raised $55M in a Series C round. Navina uses AI to assist in value-based and primary care, with the investment led by Growth Equity at Goldman Sachs

- Proscia raised $50M in a Series D round. Proscia supports pharmaceutical companies by processing patient diagnostics daily with its Concentriq® software platform.

- Sibel Health raised $30M in a Series C round. Sibel Health offers advanced monitoring solutions for various patient demographics and novel digital health technologies for pharmaceutical and clinical research markets.

- Brainomix raised $18M in a Series C round. Brainomix specializes in AI-powered imaging tools, focusing on critical health areas like stroke and lung fibrosis.

- brain.space raised $11M in a Series A round. brain.space is pioneering Brain-Data-as-a-Service for Generative AI Mental Modeling.