Happy Thursday Hospitalogists!

If you’ve missed any of my recent content, they are ready for your perusal at the following links. I publish past newsletters onto my new site, hospitalogy.com – but on a trailing basis. Subscribers get them far in advance to keep you guys opening the newsletter and getting timely, accessible healthcare news!

If you’re not opening these newsletters, you’re gonna get scrubbed from the list. You’ve been warned!

P.S. – I am starting a new section in my Thursday newsletter below, called Startup Spotlight, where I briefly share an interesting startup in healthcare with the caveat that you will have to submit it in plain language and provide more transparent items. If interested, Submit your startup here.

1. Blake’s Breakdown: Oscar Health is Profitable

Going a bit deeper on an interesting topic, theme, or resource

Oscar Health is profitable.

Yes. In 2024, an insurtech turned a profit. A significant profit!

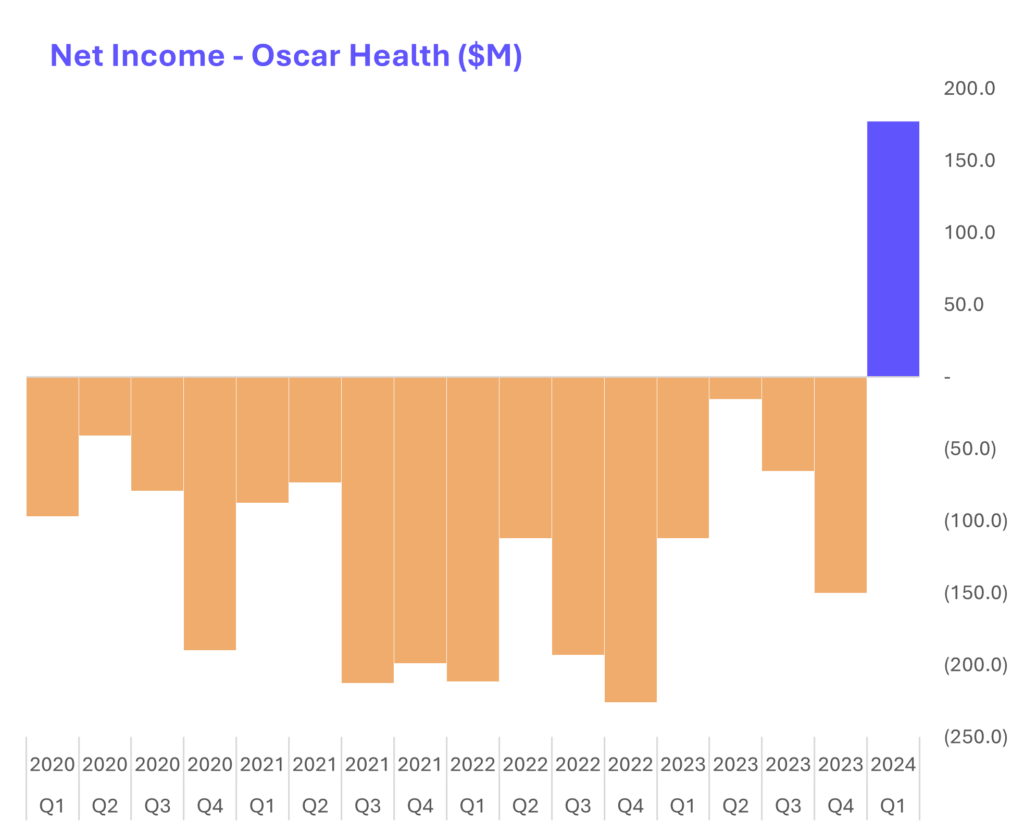

Look at this insane chart:

I posted this chart on both Twitter (X) and LinkedIn as I always do (given part of my job is maintaining a social presence), and to my surprise, my tweet performed better than my LinkedIn post – the first time I’ve ever had this phenomenon happen. Usually, my content pops off on LinkedIn and hardly gets a sniff on Twitter, but hey, I’m probably not catering to the algorithm correctly or something.

Back to Oscar – the insurtech ACA exchange player generated $177.4 million in net income. GAAP net income – a $217.1M improvement over Q1 2023.

I’ve come full circle on insurtechs. Well, at least in Oscar’s case. In October 2022 I wrote this essay on why startups struggle and are structurally disadvantaged vs. larger incumbents in health insurance.

But then Oscar actually decided to dig in and make some leadership changes. It leaned up by exiting some markets and MA. Interest rates bumped up, bolstering cash flows in a big way (let’s not kid ourselves – this is a big reason why they’re profitable). The growth in ACA enrollment is unprecedented given subsidy support and Medicaid redeterminations. I detailed it all here.

If any of you follow Ari Gottlieb on LinkedIn, he has basically become the voice of reason and rationality in the insurtech market, calling things like he sees them. It’s great, and we need more voices like that in healthcare. And he’s pretty much always spot on. Anyway, I think Ari may have given Oscar the rosiest review yet for an insurtech in his most recent overview, even going so far as to say Oscar has evolved into a viable business!! If there’s ever a signal that Oscar is headed down the right path, it’s this. Trust me.

While the Oscar pirate ship has right-sized, a viable insurance business is the first step in a long journey. Investors will soon ask – or already are asking – what’s next? What other levers does Oscar have to pull for long-term growth? And to that end, Oscar has mentioned some unique long-term positioning in areas like ICHRA, and its +Oscar platform.

2. What’s Trending:

Social discourse and conversations from around healthcare

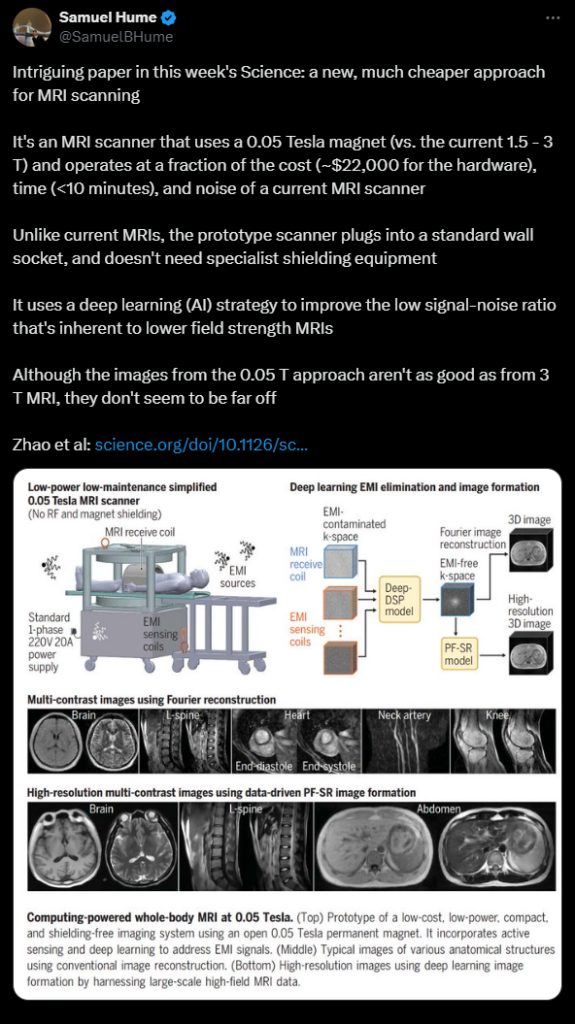

A promising potential innovation in MRIs, which could drastically increase access to the advanced imaging scan:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

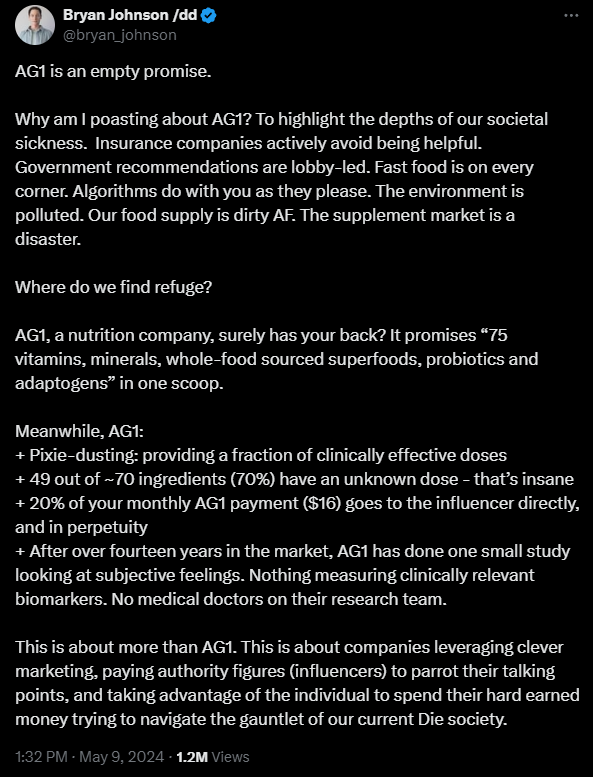

The debate around Athletic Greens – what’s actually in their proprietary formula – and the unregulated world of wellness – ironically, posted by the ‘immortal’ Bryan Johnson:

3. Community Update

The latest from inside my community of healthcare thinkers

This week I released an analysis of Kaiser Permanente, including the health system’s recent strategic moves, a thorough financial analysis of Q1 and annual performance, and parting thoughts on where Risant is headed next in delivering population health at scale to new health systems. This analysis and lots of other perks are exclusively available to my great group of community members, and I pour a lot of extra effort into it!

Dollars and Deals

Finance and M&A updates

- CareMax reports its first quarter 2024 results.

- Kaiser Permanente posts a 3.4% operating margin and billions in net income for Q1 2024.

- Augmedix sees its stock fall 41% after it lowers FY24 revenue guidance. Thoughts on the implications of this coming, as it’s an interesting development for the AI and ambient space!

- Invitae receives court approval for its sale to Labcorp.

Venture Spotlight

Notable Startups and Fundings

- Lycia Therapeutics lands $106M for protein degraders that treat autoimmune & inflammatory diseases.

- Rad AI clinches $50M to scale generative AI tech for radiologists.

- SmarterDx raises $50M to bolster hospital revenue integrity and quality with its clinical AI solution.

- Sift Healthcare raises $20M Series B funding round to enhance AI-powered payment solutions.

- Truveris raises $15M for its employer-focused pharmacy benefits management.

- Blackwell Security raises $13M co-led by General Catalyst and Rally Ventures to empower healthcare cybersecurity operations.

- Hamilton Health Box raises $10 Million in Series A funding to accelerate rural market expansion.

Submit your Startup: Thanks for those of you who have submitted your startups so far. I’m really looking forward to sharing them!! The Startup Spotlight will start next week.

Each week, I want to start highlighting a cool startup doing innovative things in healthcare – with the caveat that I’m asking you to be a bit more transparent. All answers submitted confidentially to me. Submit your startup here.

Thanks for reading! Subscribe to Hospitalogy, my newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!