Happy Tuesday, Hospitalogists,

I’m in Austin for the Workweek retreat (Hospitalogy is affiliated with Workweek) and having a grand old time first with my wife over the weekend (and taking some great baby pics in front of the UT tower) and now doing #companyculture things.

Onward!

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 32,000+ executives and investors from leading healthcare organizations by subscribing here!

Healthcare IPOs return – Tempus AI and Waystar

After BrightSpring’s debut on the public markets in January, two health IT / life sciences related companies have announced plans to IPO (no more SPACs ever, please) – potentially signaling the start of thawing investor sentiment. The two firms include Waystar, an end-to-end revenue cycle management company, which plans to raise around $1 billion in an upcoming IPO; and Tempus AI, which – you probably guessed it – leverages AI to enable drug discovery and genomic sequencing. Privately, Waystar and Tempus have been valued as high as $6B and $8.1B, respectively, but the public markets have a way of shaking down new healthcare IPOs – to put it mildly:

Is this time different? Healthcare IPOs and SPACs have performed terribly in recent memory. Most SPACs are either down 90+% or bankrupt at this point – an unfortunate byproduct of the low-interest rate, cash-grab environment. You’d like to think this next batch of innovative companies hitting the public markets will be a bit different.

Hospital financial performance diverges further in April

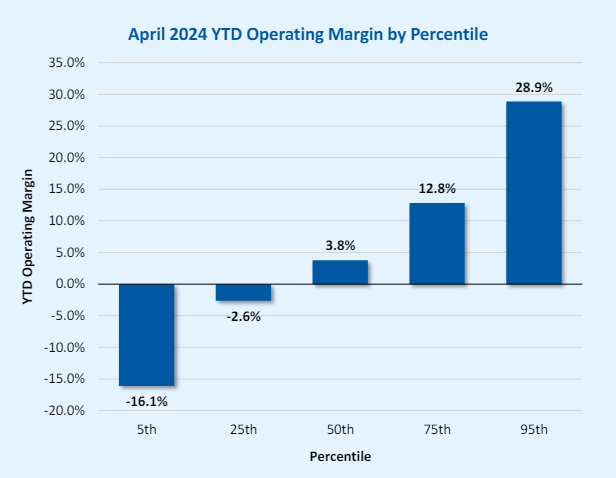

Kaufman Hall’s latest Hospital Flash Report shows a key trend unfolding among hospitals and health systems: financial performance is diverging among the top 95% of performing hospitals and the bottom 5%. While median margin as a whole looks ‘healthy,’ in reality, there is more performance inequality than ever.

Strategy Spotlight

Key considerations for decision makers. Notable moves, policies, and strategies.

- Karoo Health and Heartbeat Health team up to create the first national, scalable, end-to-end cardiac value-based care solution.

- 2024 Milliman Medical Index provides insights into healthcare cost trends with some nice data around employer and employee cost sharing, including $32,066 in healthcare costs for an average family of four. Crazy.

- Kansas Medicaid selects UnitedHealth, Blue Cross, and Centene.

- California’s $12 Billion Medicaid Makeover banks on nonprofits’ buy-in.

- UnitedHealth’s Optum Rx unveils a new drug pricing model.

- Prime Healthcare is transitioning Pennsylvania hospitals to nonprofit status.

- Louisiana Republicans vote to criminalize possession of abortion pills.

- Cue Health to shut down operations and lay off staff.

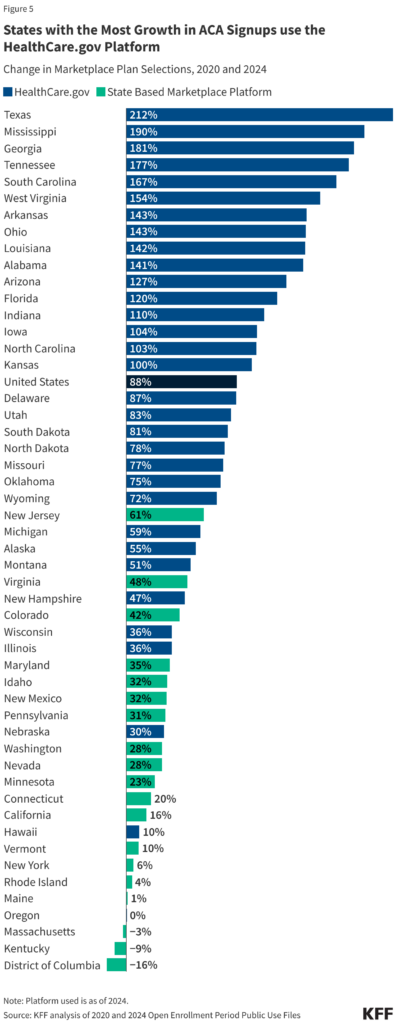

- KFF explores where ACA marketplace enrollment is growing the fastest after record growth up to 21.4M members in the marketplace.

- Kodiak Solutions reports that the final denial rate for inpatient claims in 2023 was more than 50 percent above the same rate in 2021.

- Sanford Health Plan CEO eyes growth for government plans.

- UnitedHealth argues an algorithm lawsuit should be dismissed because patients didn’t spend years appealing denials.

- Latest 340B ruling delivers a blow to providers.

- Enhabit provides additional details on a robust strategic review process.

- Doximity releases a new study on physician compensation, overwork, and shortage.

- UPMC’s layoffs were the start of a McKinsey-guided ‘transformation’, documents show.

- McKinsey highlights new trends in consumer wellness.

- Florida allows doctors to perform C-sections outside of hospitals.

- Nursing homes sue to block HHS staffing mandate.

- House committee takes aim at healthcare consolidation, eyes site-neutral payments.

- Veradigm announces leadership updates.

- Amazon Business discusses supply management in healthcare.

- Hospital orgs join a cross-industry appeal for the FTC to delay noncompete ban implementation.

- House Republicans’ new 340B bill is seen as a pharmaceutical industry wish list, hospitals say.

- Minnesota’s Medicaid program to block for-profit insurers from participation.

- Third-Party Analysis finds Imagine360 saves employers 19.8% more than other commercial health plans.

- Dollar General and DocGo end pilot program for mobile health clinics.

- Ozempic prevents kidney disease.

- Kaiser doctors in Northern California vote to unionize.

- Waystar plans a $950 million IPO launch as soon as Tuesday.

- Safety-net health clinics cut services and staff amid Medicaid unwinding.

- Bain discusses the private equity outlook for 2024 and the liquidity imperative.

Partnership Pulse

Collaborations and launches to keep a pulse on.

- Regard and WakeMed launch an initiative to improve clinical documentation and drive patient safety across the enterprise.

- Story Health and Saint Luke’s team up for a virtual afib care program.

- WellSpan Health taps Concert Health to expand same-day access to behavioral health services.

- Uber Health announces a caregiver-focused offering with health benefits insights.

- Concert Health and WellSpan Health partner to support PCPs in Pennsylvania.

- Zipline partners with Mayo Clinic’s hospital-at-home program to deliver medications and other home-based care needs.

- Salvo Health partners with Pinnacle GI Partners to revolutionize wraparound patient care.

- Cigna Group’s PBM partners with independent pharmacy network.

- Vanta announces an industry-first partnership to automate HITRUST e1.

- Lyra Health introduces Lyra Care for Teens.

- Health Data Movers announces a new partnership with MEDITECH.

- TALON and EMI Health announce a strategic partnership for a cost-comparison shopping tool.

- Redox partners with Snowflake to power healthcare data interoperability.

- Summit Surgery Center expands access to orthopedic surgical care through a new partnership with Regent Surgical.

- Nabla & Stratum Med partner to bring ambient AI within reach of 12,000+ physicians.

- Curve Health propels healthcare innovation with a recent expansion surge.

- L.A. Care and Blue Shield of California Promise Health Plans unveil a new community resource center in Panorama City.

- Orion Health awarded Panda Health Partner status for its Orchestral Health Intelligence Platform.

- Syra Health expands its nationwide footprint with another state contract.

- Carallel rolls out a new app to support family caregivers.

- Haven of Hope introduces Memphis’ new eating disorder and trauma treatment facility.

- Clover Assistant AI tool is now available to payers and providers.

SPONSORED BY NEUROFLOW

Mental health conditions are the leading cause of pregnancy-related deaths. Although maternal mental health statistics in the U.S. are alarming, these trends are reversible. Early identification of behavioral health needs and support at every stage of pregnancy can make all of the difference.

NeuroFlow will be hosting a special webinar on June 18th at 2pm ET that covers this urgent issue in detail.

This session will feature insights from Dr. Kristin Tugman of Prudential, Megan Moore of Presbyterian Healthcare Services, and Julia Kastner from NeuroFlow.

They’ll discuss proactive screening and resource delivery tailored for every pregnancy stage.

Tune in and let’s help bridge the gap in maternal mental health care together.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Hospitalogy Top Reads

My favorite healthcare essays from the week

- The Mental Health Tech Ecosystem – a primer on navigating its complexities.

- Paternalism, Autonomy, and Healthcare Consumerism

- The State of Payer Patient Access APIs – Health API Guy

- A quick breakdown of Brand-Name Prescription Drug Contracting – primer by Healthcare Economist.

- Food as Medicine trends, solutions, and business models are analyzed in this Rock Health primer.

- AI’s Impact on Operational Expenses

- The Women’s Health Gap – country-level exploration by McKinsey.