Happy Thursday, Hospitalogists,

For those who partake, it’s the best weekend of the year for golfers – Masters weekend. Who ya got? I think Scottie’s the one to beat (obviously) but pulling for Xander to finally get one.

If you’re new to Hospitalogy, welcome! My name is Blake Madden and I write a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 50,000+ executives and investors from leading healthcare organizations by subscribing here!

113 of the Largest Health Systems Ranked by Revenue as of 2023

How do some of the biggest health systems across the U.S. rank on total net operating revenue?

This post is visual-heavy, and a high level analysis of major health systems in the U.S. and how they rank on a revenue basis.

All of the back-end analysis including the excel data book and links to all 113 audited health system financial statements will be shared exclusively with my community next Wednesday. Join here.

Quick caveats and notes on methodology:

Now of course, this list is a work in progress with full acknowledgment that I probably missed some very obvious names, and/or couldn’t find financials for certain systems (if that’s your system feel free to reach out). As I find ones I missed, they’ll be added later, and this post will be updated.

There’s also no distinction between type of system or anything more nuanced/intricate, nor are the revenues same-store, so any sort of material M&A muddies the water. I also have no publicly available information for a number of privately held, for-profit health systems (LifePoint, Steward, Ardent, Prime Healthcare Services to name a few), all of which would assuredly be on this list. If they wanted to share that info with me or if you know someone who does, that’d be phenomenal. LifePoint would almost definitely be in the top 10 health systems.

For the ones I DID include and COULD find financials for, I took those health systems and ranked them on total net operating revenue. Unless otherwise indicated, all of these revenue figures are through the trailing twelve months ended December 31, 2023. They should all be comparable except for a few that haven’t released full calendar year financials yet. Children’s health systems have been excluded.

I also purposefully excluded OU Health.

Kidding. But I wish.

Note: health systems are ranked by total net operating revenue – not patient revenue. So there’s a bit of noise given it’s not just reimbursement for patient care services rendered in there. For almost all of these systems, things like supplemental payments, settlements, tuition, research, premium dollars, and plenty of other revenues are flowing through total net operating revenue as opposed to net patient revenues.

And final point: This is pure revenue – not profitability/margin. I’ll probably do profitability next, and it’ll be pretty telling to see how the list changes, along with the characteristics of those health systems with better margins.

The top 10 health systems ranked by revenue

Most of you have probably heard of the top 10 names on this list. Kaiser is kind of cheating since it’s a health plan and collects significant premium dollars, but hey, they own hospitals too and run an integrated model. HCA is the largest pure-play true ‘health system’ and a unicorn at that, for reasons I covered when I wrote about the investor day. It’s possible you see Tenet slip off this list as the ASC-focused operator pumps more capital into USPI and divests more and more hospitals out of its portfolio.

You can see many of the major publicly traded and nonprofit juggernauts on this list. The newest entrant is Advocate Health, which recently formed from the cross-market megamerger between Advocate Aurora and Atrium Health:

At the time the combined enterprise was approaching $27B in revenue. Now its revenue is trending toward $31B+.

The Full List – 113 of the Largest Health Systems in the U.S. ranked by Revenue

Note: the background data – excel data book – on this information is available to Hospitalogy plus members here. You can apply (for free) to join my membership here!

Shakeups in this ranking as health systems have merged over the past several years post-Covid, many out of necessity, some opportunistically, and a few creatively.

For instance, we’ve seen a number of mergers in the Pennsylvania area, Michigan Health-Sparrow Health, Jefferson Health-Lehigh Valley Health Network, and plenty of failed deals as well. Froedtert and ThedaCare will create a $5B+ revenue system. Northwell and Nuvance, if passed, will generate $19.2B+ annually. Then of course you have Kaiser and Risant Health.

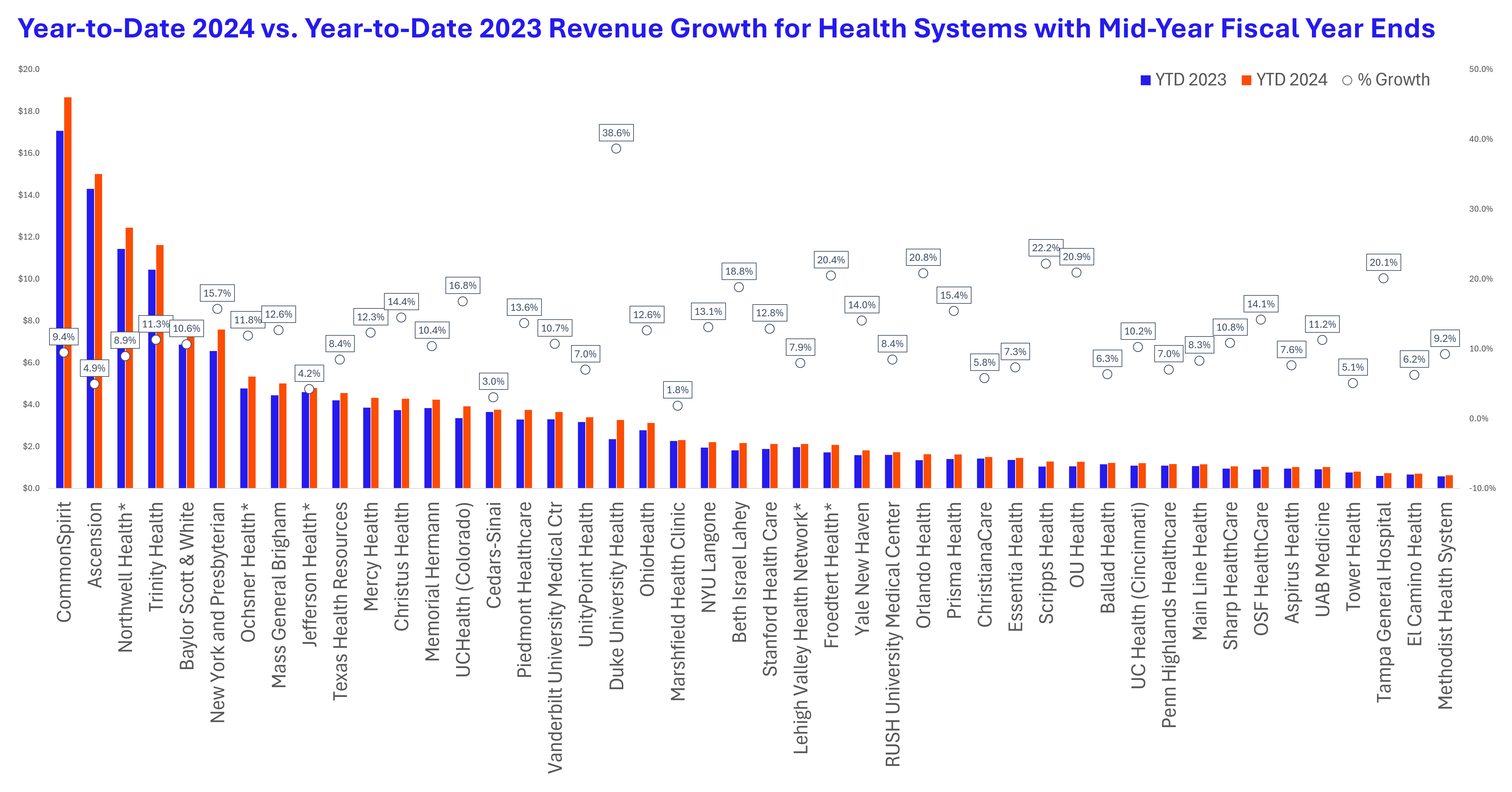

Comparing Partial Periods for health systems with June Fiscal Year Ends

Here was one more quick, fun little analysis I did. For health systems with fiscal years ending during the year (June), I wanted to compare their most recently reported partial years to see how revenues are trending – E.g., comparing the back half of the year from a pure revenue perspective when utilization ‘returned’ to health systmes (7/1 – 12/31) – 2022 vs 2023.

When comparing these two periods, 100% of health systems experienced positive growth during the 6 month periods studied:

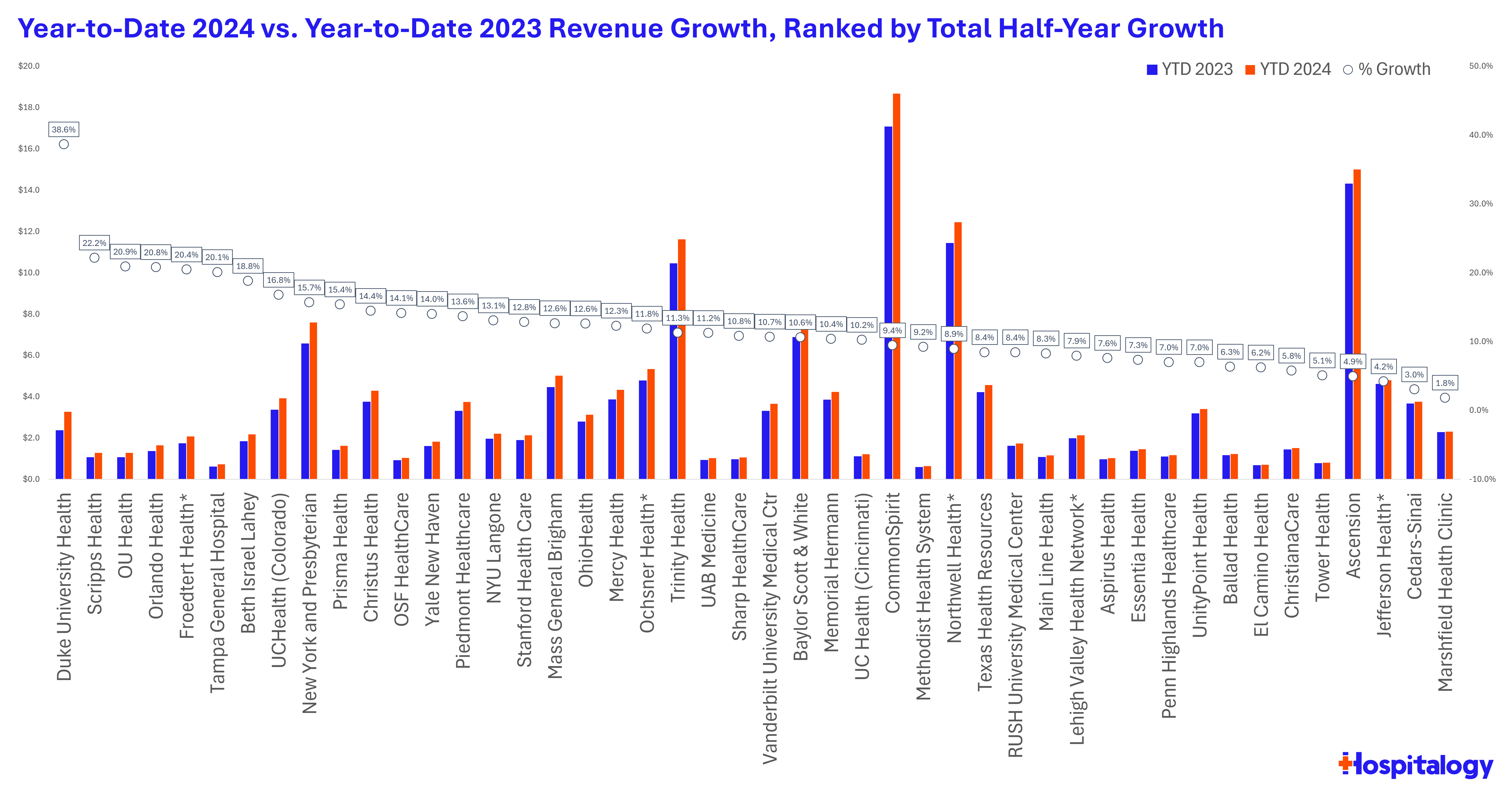

When ranking the health systems on year-over-year growth, you can see a clear recovery in topline revenues happened in the back half of calendar year 2023, but it remains to be seen what happened on the expense side:

What would also be interesting to see might be to overlay revenue growth among large health systems against utilization commentary suggested by payors and other risk-bearing organizations – to glean insights into how utilization was trending headed into 2024.

Links to other resources:

- Beckers: 48 health systems ranked by annual revenue

- Fierce Healthcare: top 10 nonprofit health systems by 2022 operating revenue

- Beckers: 100 largest hospitals and health systems in the US

Thanks for reading! Subscribe to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 50,000+ executives and investors from leading healthcare organizations by subscribing here!