With this newsletter being the third send this week, I didn’t want to overwhelm you guys so this post is visually heavy, and short and sweet on the text side!

Today’s essay is a high level overview of the Northwell-Nuvance merger from a financial and operating point of view, and some speculation on where they’re headed next.

Thanks so much to Medallion and Care Continuity for sponsoring today’s send!

SPONSORED BY MEDALLION

Interested in improving your credentialing process?

Join Medallion on March 20th for a webinar that promises to do just that.

Unlike the usual offerings that prioritize speed at the expense of accuracy, Medallion introduces a platform that achieves both, seamlessly.

This innovation is designed to not only expedite the credentialing process but also to maintain the highest standards of accuracy and reliability, enhancing your provider network without ever compromising quality.

Learn how Medallion’s approach can streamline your operations and elevate your credentialing standards.

It’s a chance to learn from the experts and see firsthand the difference precision can make.

Northwell-Nuvance $19.2B merger: Key Takeaways

Northwell has a history of partnerships, affiliations, and M&A. The health system seems to be doing everything everywhere around New York and wants to expand its coordinated care presence across a wider, connected geographic base.

Nuvance received several downgrades recently (S&P here, Moody’s here). For them, this merger is about survival and capital needs as Northwell can invest into its service lines.

In typical merger fashion of any two businesses, the two health systems would be in a better position of strength to negotiate more favorable rates, share clinical talent, and combine purchasing power.

Health systems in positions of strength to take over markets and build out ambulatory networks will continue to do so. Both Northwell and Nuvance generate more revenue on outpatient services than they do on inpatient.

As always, the business case for a move like this is strong, but the effects on quality of care remains to be seen. For that reason, mergers of this magnitude will continue to receive evergreen criticism from policymakers.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Overview

Announced February 28, New York based Northwell Health is merging with Nuvance Health, which would create a 28-hospital, 14,500 clinician, 1,000 outpatient sites of care footprint across New York and Connecticut.

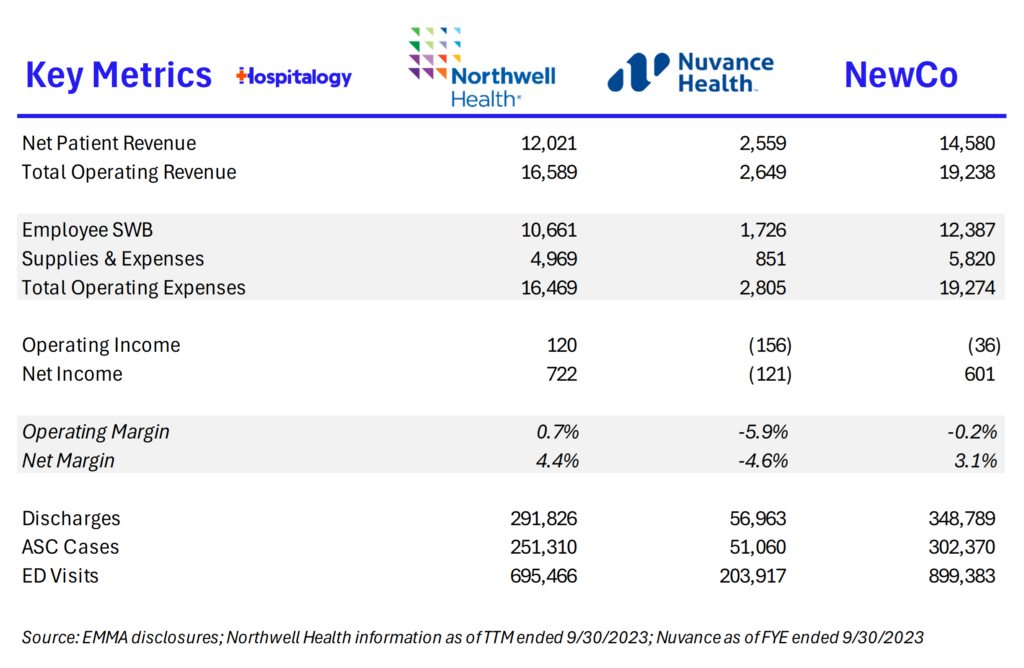

The two have held longstanding partnerships and also much of their revenue is in outpatient footprints. Here are some high level, overlapping metrics I put together between the two health systems:

Nuvance’s State of Affairs is Worrisome

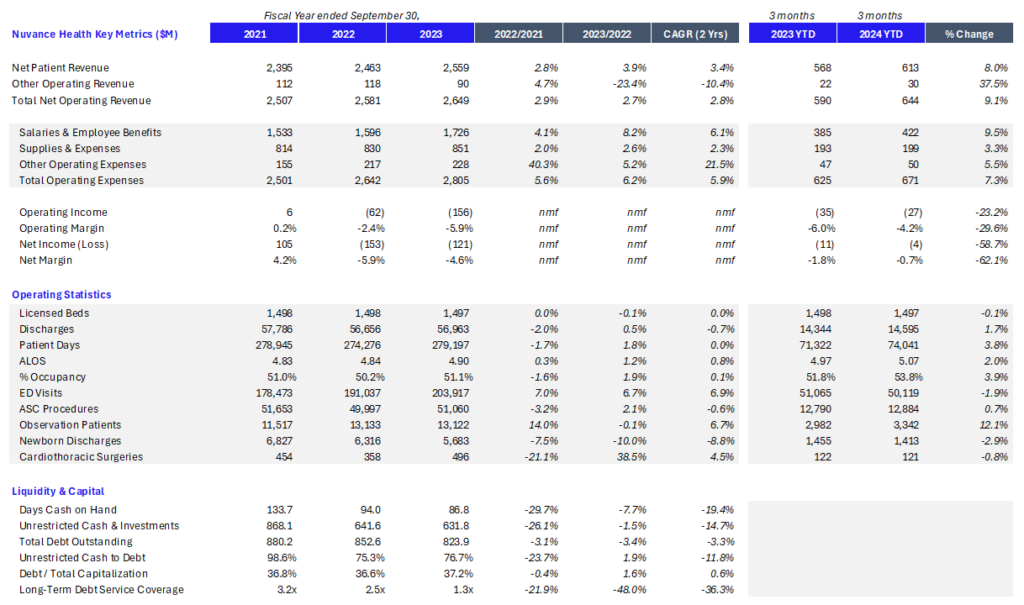

The problems facing Nuvance are pretty simple, but pervasive among health systems with worsening outlooks: utilization trends and clinical demand are low. Labor and supply cost inflation is unsustainable. Liquidity challenges are mounting. Of course, the best part of Nuvance’s business in 2023 was its investment portfolio.

Diving into the Nuvance Health operations, you can clearly see expense inflation outstripping revenue growth. Total revenues grew 2.7% from 2022 to 2023, while expenses grew 6.2% over that same time horizon. In its most recent quarterly update to bondholders, Nuvance experienced a 12.1% increase in observation patients, an increase in average length of stay from 4.97 to 5.07 days, and a decrease in ED visits.

In 2023, Nuvance’s operating margin was (5.9%). For a nonprofit health system to be ‘healthy’ you’d prefer to see that number around 3%-5%.

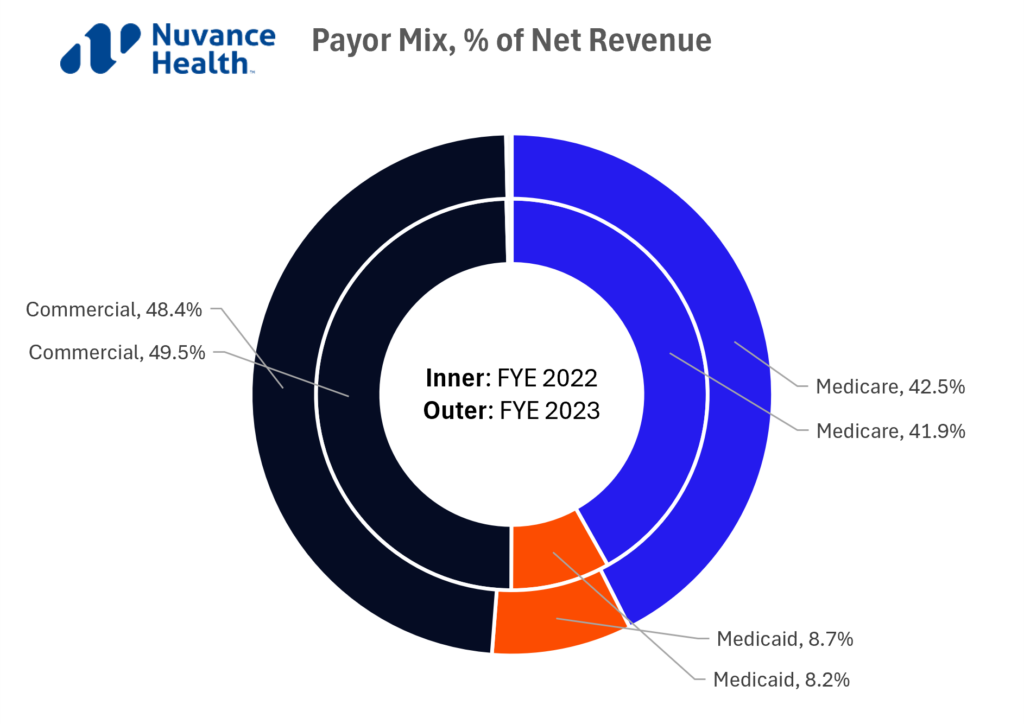

On the payor mix side, revenues from Medicare grew 5.6% from 1.030B to $1.089B, revenues from Medicaid grew 10% from $202M to $222M, and revenues from commercial payors (Blue Cross) grew just 1.6%. Its commercial population is shrinking:

These factors, combined with reduced liquidity measures on debt coverage (and $1B+ in outstanding debt), resulted in credit ratings downgrades from the major agencies. As you get downgraded, your cost of borrowing goes up. That compounds the problem for Nuvance in a high interest rate environment. Nuvance’s days cash on hand sits at 78 (side note, I wonder how this number is being affected by the Change Healthcare stuff – most physician practices are a lot worse off than this) while its annual Debt Service Coverage Ratio is around 1.2x, and Nuvance was expected to breach its debt service coverage covenant of 1.1x at the end of 2023, but it appears to have squeaked by. Credit agencies use metrics like these to determine credit worthiness. And the state of Nuvance’s operation is not up to snuff, a reality for many similarly sized health systems.

In general, Nuvance seems to have been struggling for a number of years, embarking on several strategic reviews to cut expenses, improve revenue cycle operations, and optimize other leaky functions internally.

Still, Nuvance holds strategic advantages. It has significant scale in Connecticut and New York and an impressive ambulatory footprint.

So what’s the easiest way to solve for these problems while doubling down on strengths?

Merge.

But in today’s hospital M&A environment, and the declining policymaker trust in nonprofit facilities coupled with an election year crackdown…can they?

Northwell is in a position of relative strength

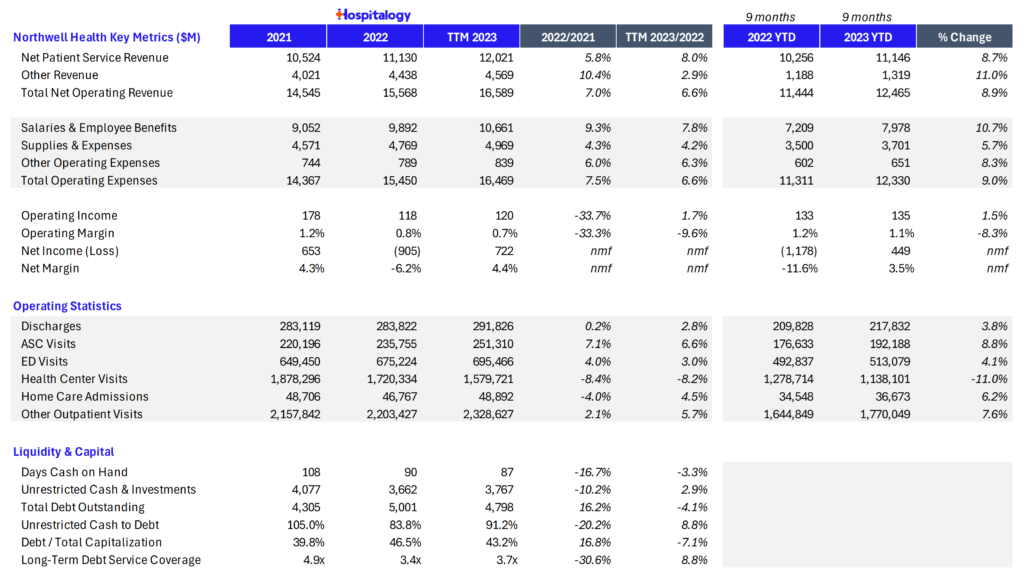

Northwell, on the other hand, is doing pretty well, largely rebounding in 2023. Comparing YTD 2023 vs. 2022 utilization metrics, growth highlights include a rebound in discharges (3.8% growth), ASC visits (8.8% growth) and other outpatient visits (7.6%).

Still, expense inflation is a major concern for Northwell, especially in that salaries & benefits line. I imagine it thinks it can gain some purchasing power with a bit of increased scale.

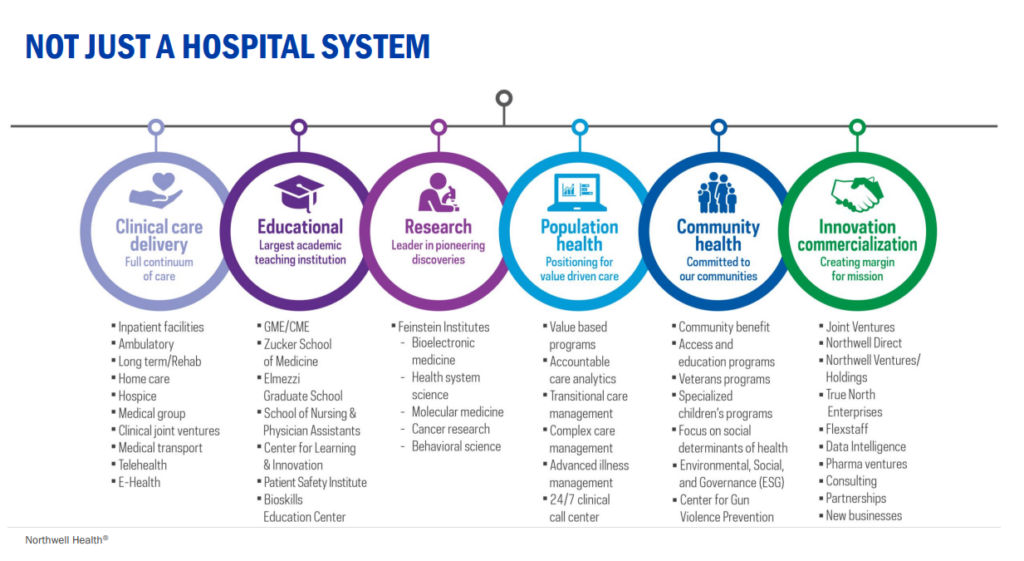

From a 10,000 foot view let’s dive into Northwell’s strategy a bit. Looking back at Northwell’s 2023 JP Morgan presentation, you can peel back what the integrated delivery system is trying to achieve:

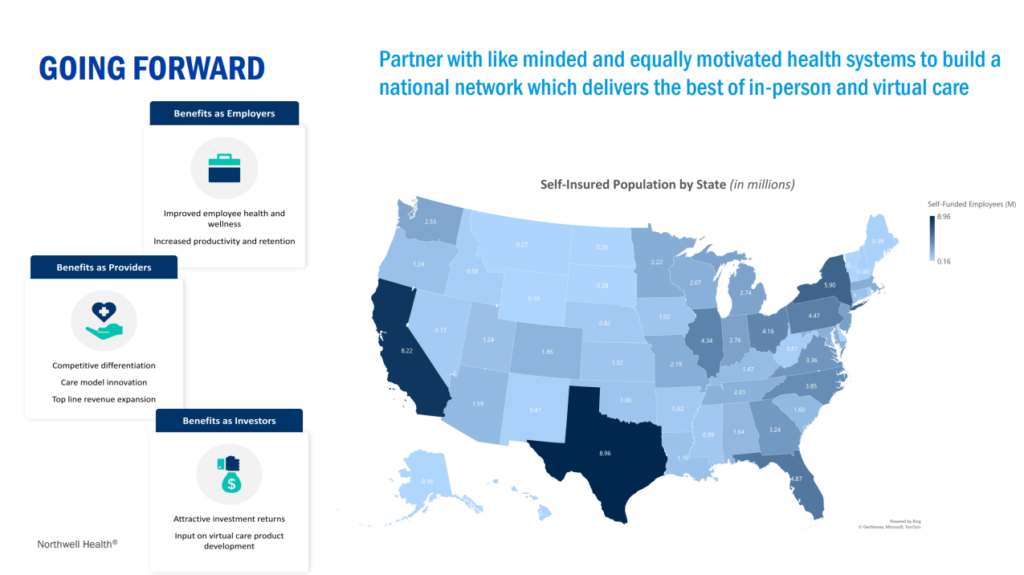

This slide pretty much hits the nail on the head for what you’d probably expect to see Northwell-Nuvance prioritize growth-wise moving forward – hybrid care delivery, competitively differentiated care delivery models selling into self-insured employers across New York and CT. They already hold some partnerships together, so it seems natural to go all the way at this point.

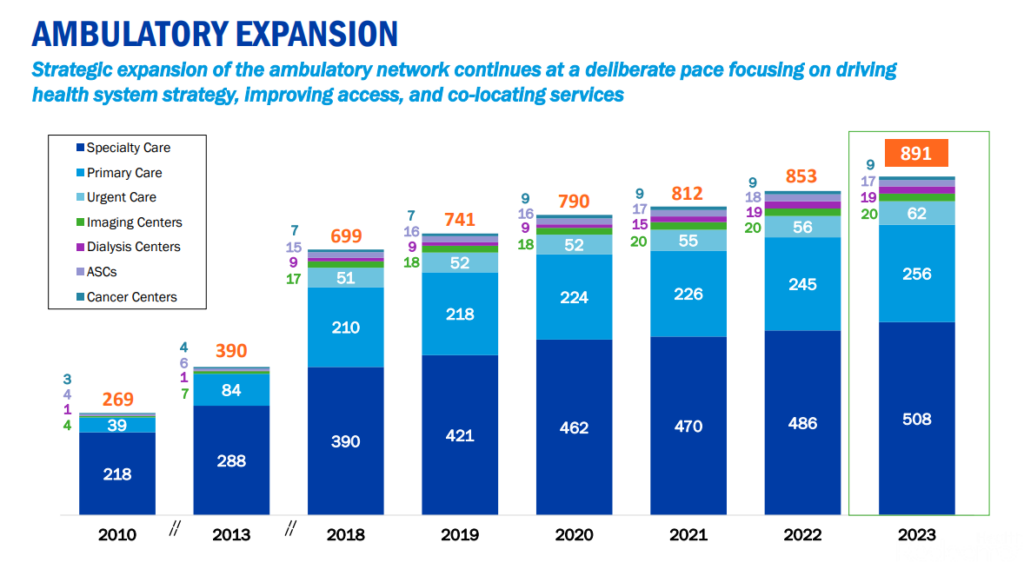

And of course Northwell wants to continue to prioritize ambulatory expansion, a position of relative strength for both health systems:

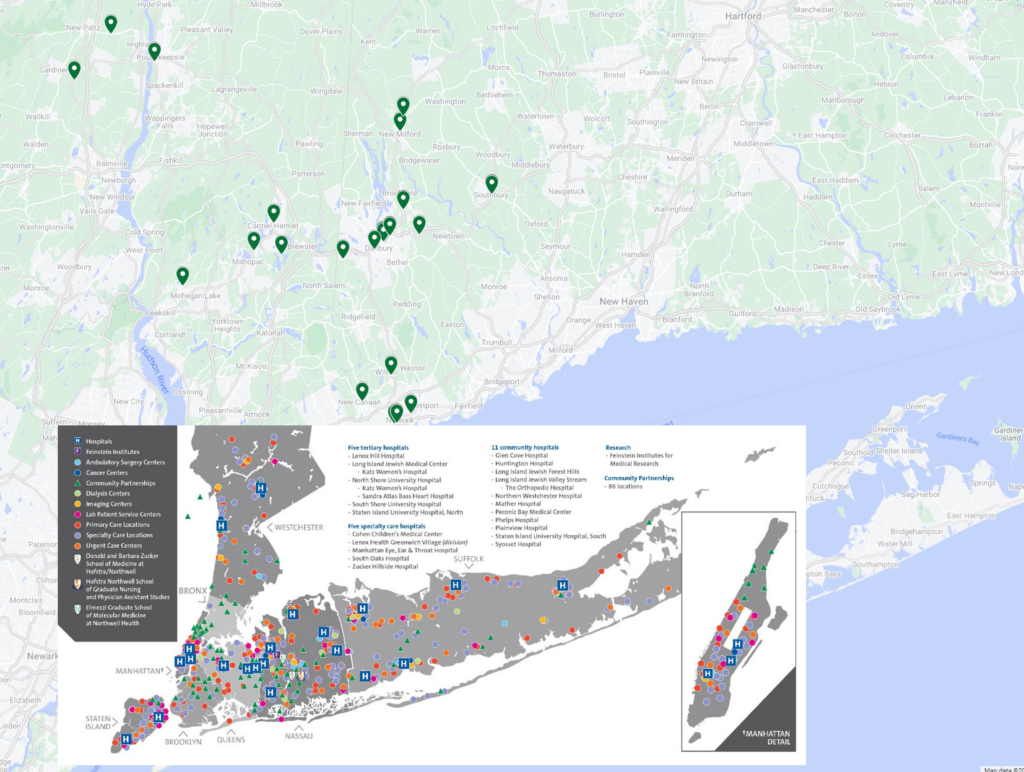

Combining the two health systems, you have a pretty formidable, connected footprint across New York and Connecticut.

Look at this amazing continuous footprint I slapped together for this (Nuvance HUBs in green). Some of my finer work here:

Conclusion

Bigger picture, this merger is a market share play across New York and Connecticut. While Nuvance seems to be merging from a perspective of survival, Northwell can leverage Nuvance’s footprint to inject some capital into Nuvance and gain on everything it has laid out for itself in its strategic vision: grow its existing service lines, layer on what I imagine to be better rates, and create a more attractive offering for self-insured employers. It’ll have a dense footprint of services across NY and CT, and I’d expect that density to swell from here.

Of course, the question we’re all asking is whether or not a merger like this is allowed to go through in 2024, and from a policy and patient perspective, what the downstream effects of the merger might be on quality, access, price, and clinical labor markets.

Like I mentioned before, we’re in the Russian winter of mega mergers, and this type of deal seems to hit on everything the FTC along with certain states are fighting against.

SPONSORED BY CARE CONTINUITY

Helping patients navigate your network requires great people and great tech.

You have leverage tech to maximize in-network utilization and reduce the number of patients leaking out of your network.

With Care Continuity, 71% of patients secure a follow-up within 7 days of their ED visit, 87% remain in-network for their care, and there’s a whopping 32% decrease in ED return visits.

Ready to see the difference that AI-enabled navigation technology can make in your bottom-line?

Click below to get additional insights.

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 28,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)