BUSINESS

“The Golden Age of Older Rectums”

Private equity-backed firms are buying out gastroenterology practices left and right. There are no signs of slowing down. As one investment manager said:

We are in the Golden Age of older rectums.

The Deets

Around 10% of all 14,000 gastroenterologists in the U.S. are currently partners or employed by a private equity-backed firm. The three largest PE-backed GI groups include:

- GI Alliance: 650+ physicians, 400+ locations

- PE GI Solutions: 600+ physicians, 60+ clinical partner locations

- Gastro Health: 300+ physicians, 100+ locations

GI Alliance is on an acquisition spree, having acquired seven GI groups since January. GI Alliance mainly acquires practices in the south, where they already have a prominent presence. In Austin, for example, they have 16 locations.

#Trending

Gastroenterology practices are attracting PE firms for one main reason: we’re entering the golden age of colonoscopies, baby!

Think about it… the population is aging. The number of adults 65 and older is expected to double within 20 years to 80 million. And the newest USPTF guidelines recommend colonoscopy starting at 45 (versus 50). Suffice it to say: there will be a lot of people needing a lot of colonoscopies.

My Thoughts

I like to view private equity in general from three perspectives:

- The doctor

- The patient

- The corporation (PE firm, PE-backed firm, hospital, etc)

From the doctor’s perspective, running an independent gastroenterology practice is becoming ever-so challenging. Reimbursements are declining, payers are consolidating, hospital competition is increasing and administrative burden is exhausting. As a result, the business components of running such a practice are cumbersome to manage efficiently.

So, PE firms—or PE-backed firms—may be attractive to physician groups struggling with day-to-day business operations. The PE firm manages the business of things; the physician manages the medicine of things. It’s nice. But, there are downsides, now that the physician is operating under a profit-motivated business.

As for patients, they’re always left out of the conversation despite being the “end-user” who’s left paying the costs of care. Robust data is lacking on patient outcomes under PE-backed health care—but data from PE-backed nursing homes suggests outcomes aren’t the best. Patients may be left paying hefty bills for the same amount—or less—care they would’ve received somewhere else not PE-backed. For example, one patient reported paying $1,100 for a colonoscopy (3x more than what she paid in a different state) at a PE-backed GI practice.

Again, PE firms are profit-focused. There’s inherently nothing wrong with this and it makes sense PE firms are after GI practices, given their lucrative colonoscopy reimbursements. These firms are just following the money.

As for my overall assessment of PE in healthcare, I agree with Dr. Diane Meier in her response to a JAMA article on private equity and healthcare:

Profit-seeking [is] a poor fit for any health care system.

Madden’s Musing: I’ve touched on the increased employment of physicians nationwide – almost 75% of physicians are employed by a corporate interest or hospital these days. Employment by a larger group or hospital increases the chances for care collaboration but decreases the independence & referral patterns of those physicians.

Private equity players see the writing on the wall for the future of healthcare. With Medicare beneficiaries increasing every day, there will be a growing need and expansion in demand utilization for GI (as mentioned above), ophthalmology, post-acute care, and plenty of other services that aging seniors will require.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

HOSPITALOGY THIS WEEK

Hospitalogy’s Week Ahead

There’s been a lot of chatter lately about the parallels between fintech & health tech, which fascinates me considering most of the people I’ve spoken to seem to agree that healthcare is ~10 years behind the financial industry.

This week I (Blake) will be doing a cool little crossover send with fellow Workweek creator, Nicole Casperson, on the current problems with the financial side of healthcare, and the massive opportunities healthcare-focused fintech companies have to implement solutions.

Of course, Tuesday’s 8am send will cover all of the relevant healthcare business news from the week – digital health layoffs, Steward’s major deal with CareMax, and more.

See ya Tuesday morning at 8am ET & Thursdays at 12pm ET as always, Hospitalogy fam.

INSURANCE

Fast-track Too Fast?

Medicare Part B premiums will remain the highest they’ve ever been for the rest of 2022. CMS made efforts to reduce Part B premiums in response to the drama surrounding Biogen’s Alzheimer’s Disease drug Aduhelm, but operational and legal barriers prevented such efforts from succeeding.

Biogen’s Timeline

Within the past year:

- Jun ’21: The FDA granted Aduhlem accelerated approval despite its shaky efficacy and strong recommendation from an independent review board not to approve it.

- Jul ’21: FDA calls for a federal investigation into Aduhlem’s approval. FDA narrows drug’s target population to those with mild cognitive impairment. Prestigious medical centers like Mount Sinai and Cleveland Clinic announce they’ll not have Aduhelm on their formulary.

- Nov ’21: CMS increased Medicare Part B premiums by 15% from $148.50 to $170.10, the largest increase in history. This was done to proactively set aside money to pay for Aduhelm, previously set at $56,000 per year.

- Dec ’21: Biogen slashes drug price in half from $56,000/year to $28,000/year after continuous complaints from hospitals (and much of the medical society) that the drug’s high cost was not worth its benefits.

- Jan ’22: Medicare restricts coverage of Aduhelm to patients in clinical trials (read: this drug isn’t for everyone with Alzheimer’s). HHS Secretary Xavier Bercera says CMS will review reducing Part B premiums, given the drug’s price was slashed in half and the treatment population restricted.

- May ’22: Medicare Part B premiums will remain unchanged for the rest of the year and any savings will be applied to 2023 premiums. Legal and operational hurdles (as you’d expect) prevented CMS from reducing premiums mid-year.

My Thoughts

The FDA’s accelerated approval of Aduhelm has caused so much drama on the insurance side of things. It makes you wonder if the accelerated approval track needs a second look or a revamp. I say, “it does.”

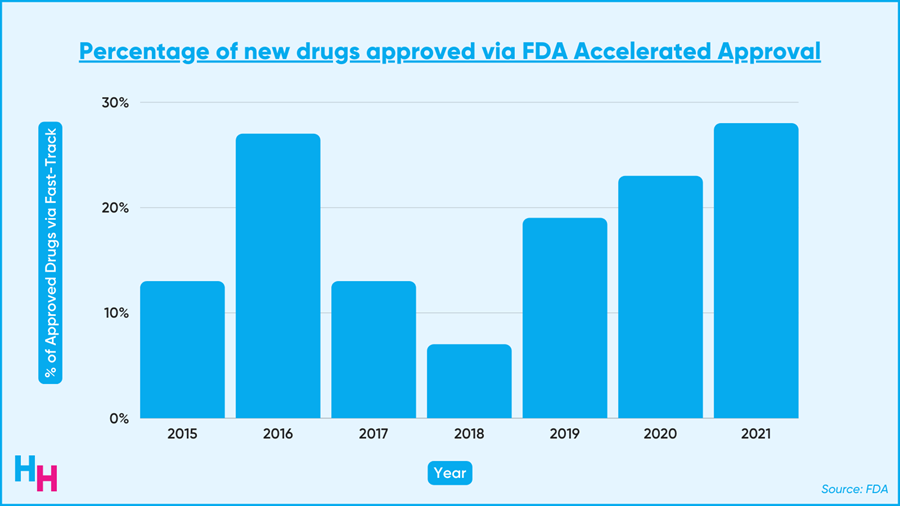

The accelerated approval program fast-tracks drugs that meet unfulfilled needs for hard-to-treat diseases like cancer and Alzheimer’s. These drugs get to the market faster than if they followed the regular approval route. As a result, the accelerated approval program is becoming increasingly popular. Last year, over 20% of the 50 new drugs approved came from this program.

The fast track works by allowing the drug’s approval to be based on surrogate endpoints. These are endpoints that, by proxy, are likely to show the drug works clinically, avoiding the need for clinical results right away (but you still have to run a confirmatory trial after approval to show the drug actually has clinical benefits).

For Aduhlem, the decrease in amyloid-beta plaque was a surrogate for improved cognitive function. The amyloid-beta plaque alone is not itself a measure of clinical benefit. But, studies actually showed that there was minimal cognitive benefit. The FDA ended up granting Biogen nine years to run confirmatory trials that their drug works in the clinical setting.

Nine years is a long time for a drug to be on the market without confirmatory results showing that the drug works clinically. The timeline needs to be shortened to raise the standards of the fast-track program. At the end of the day, it’s not the doctor taking the drug—it’s the patient. Patients deserve to know that what they’re taking is safe and clinically effective.

While the fast-track program needs to be more exclusive, it’ll be difficult for the FDA to add stricter requirements for the program. From my experience researching healthcare, once stakeholders get a taste of something sweet (fast-track approval with long confirmatory trial timelines), it’s extremely difficult to take that sweetness away, whether due to operational barriers or hard-core lobbying (which Pharma does well at).

Lastly, Eli Lilly’s Alzheimer’s drug donanemab functions similarly to Aduhelm. Lilly will also apply for fast track approval, given the reduction in amyloid-beta plaques (surrogate endpoint). I think it’s highly likely the FDA will approve it, given it approved Aduhlem. It’s the surrogate endpoint that matters in these cases, according to the “rules,” not if there’s a clinical benefit (yet). Either way, the precedent for how the FDA approves these fast-tracked drugs needs to be updated.

OUTSIDE THE HUDDLE

- Carbon Health, a virtual healthcare company with a recent $3.3 billion valuation, laid off 250 employees (8% of the company). They cite declining Covid-19 related operations and a shift to focus on profitability as the primary reasons. Carbon Health joins a long list of tech companies beyond just health tech that have had to let employees go and decrease spending overall, with the current market volatility and fear of a downturn largely to blame.

- Fairtility, a company using AI to analyze pictures of embryos and predict the best ones for IVF, received $15 million in funding. IVF still has a low success rate and can often take many attempts, so technology like this could not only make IVF quicker and more reliable, but also more cost-effective.

- Verily, Alphabet’s life sciences offshoot, just published a study showing the effectiveness of a smartwatch in monitoring the effects of Parkinson’s disease treatments. Such technology can better guide treatment for Parkinson’s disease patients and reduce the need for in-person visits.

- Continuing on the wearables theme, a UC San Diego study found that temperatures recorded by an Oura ring were elevated following conceptive sex, with a hypothetical ability to detect pregnancy nine days earlier than existing pregnancy tests. With abortion bans being introduced in many states, and federal protections potentially being removed, the ability to detect pregnancy earlier can give women more legal options.