I got some great feedback on my direct contracting one-pager & brief analysis so I figured – why not dive into the NGACO results as well? Today will be all about NGACO performance, context for results, and interesting data points from the analysis. Hopefully it’s as helpful as I’m writing Hospitalogy to be a resource to operators and investors alike!

Join 12,300+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Key Takeaways from 2021 Next Generation ACO Results

Stuffy acronyms to know:

- CMMI: Centers for Medicare and Medicaid Innovation Center (context)

- NGACO: Next Generation ACO Model (context)

- MSSP: Medicare Shared Savings Program (context)

- ACO REACH: ACO Realizing Equity, Access, and Community Health (context) – the next evolution of direct contracting starting in 2023

Next Generation ACO 2021 Analysis:

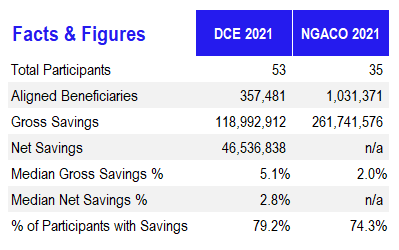

- CMMI launched the NGACO model intended to be the next evolution of the Pioneer ACO model and MSSP. It ran from 2016 and was supposed to end in 2020, but CMMI extended the program an extra year through 2021. This post dives into the results from performance year 2021, which held 35 participants.

- Since CMMI discontinued the NGACO model, these 35 participants for 2022 have since either entered the MSSP or direct contracting / ACO REACH programs.

- While certain industry operators believed the program to be successful in generating savings (against the expense benchmarks), CMS did not consider NGACO to be successful based on its evaluation (against pure fee-for-service care), and most years, NGACO did not generate net savings for CMS.

- Optum has acquired three participants in the NGACO program since 2018: Reliant Medical Group (2018), Atrius (2021), and CareMount (late 2021) but outside of these recent acquisitions, corporate Optum notably departed from NGACO.

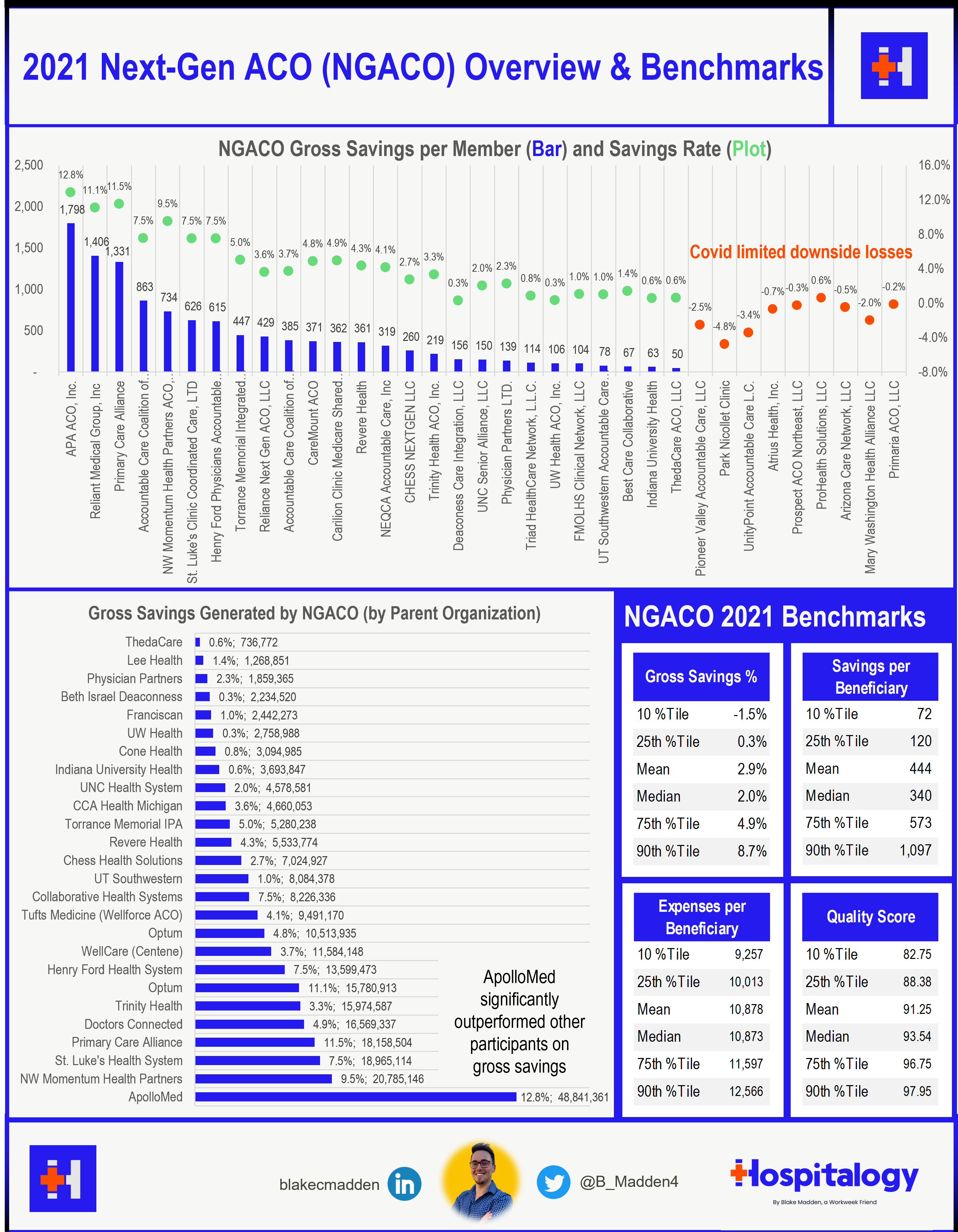

- ApolloMed (APA ACO) quite literally blew every other participant out of the water in this program in 2021.

Highlights from the NGACO Program

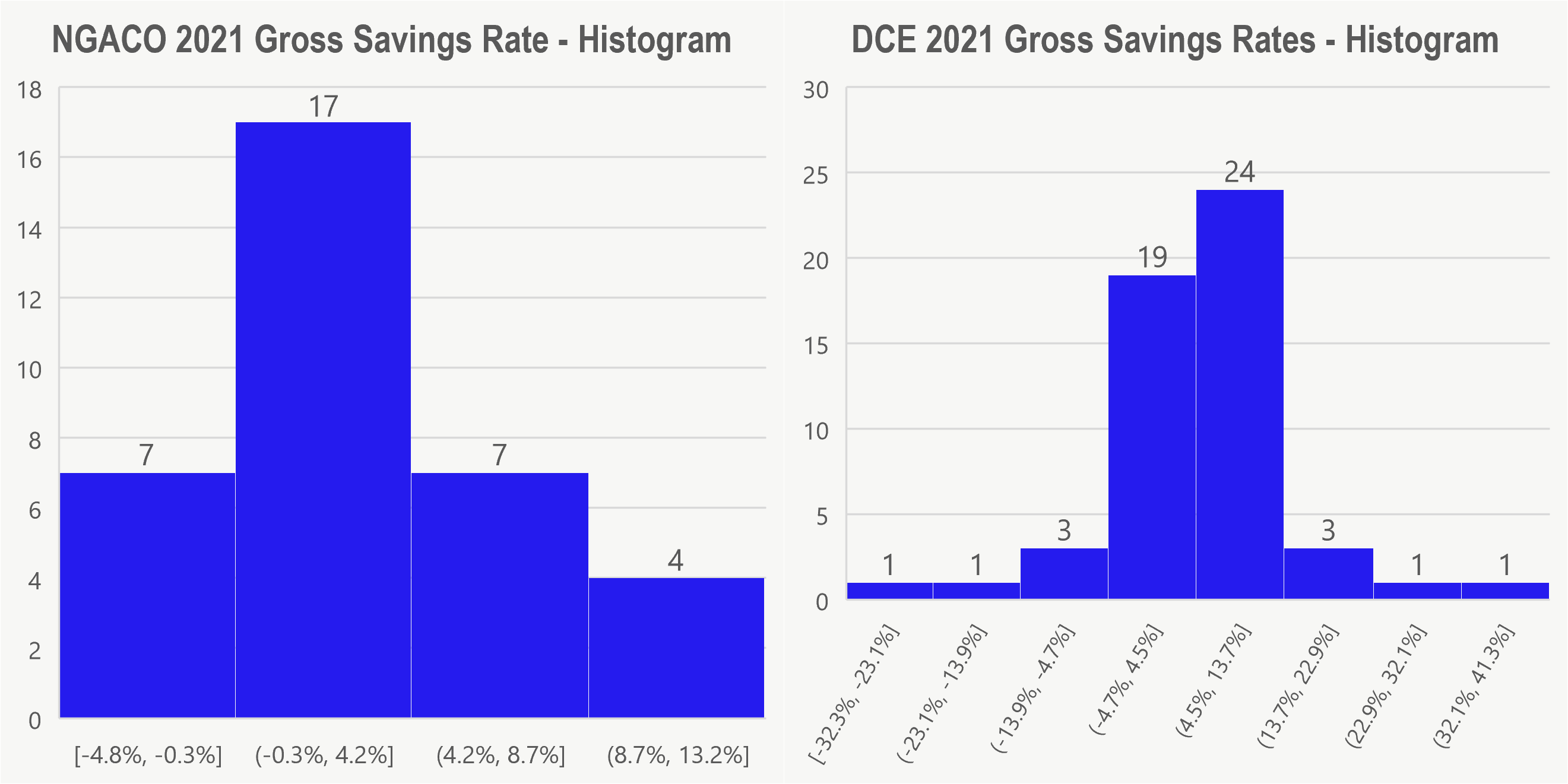

In 2021, 26 out of 35 participants (around 75%) achieved total gross savings of almost $262 million (compared to 42 out of 53 in DCE for gross savings of $118M – fewer aligned beneficiaries). Since CMS limited and protected against downside losses for 2021 (Covid protections), the overall savings rate for NGACO is somewhat inflated. When discussing the results with some industry representatives, it was pointed out that some selection bias has occurred in the NGACO program. For instance, since it ran for an extra year concurrently with direct contracting, really many of the NGACO participants that had achieved positive results in past years stayed in the NGACO program while the participants who didn’t do as well dropped out.

It’s interesting to note that most publicly traded and venture-backed companies moved into DCE as quickly as they could (Clover, Oak Street, Iora), and I’d love to hear theories or reasons why that occurred – speculation as to the ability to recognize revenue in DCE?

The top performer by a landslide in the NGACO program included ApolloMed (APA ACO) with a whopping $49 million in gross savings through 27,162 aligned beneficiaries and a 12.8% savings rate. Other notables included NW Momentum Health Partners ($21M in savings; 9.5% rate) and St. Luke’s ($19M in saving; 7.5% rate).

Overall, the top 10 performers accounted for $191M, or 73%, of total gross savings generated (somewhat playing into that selection bias factor I mentioned earlier). The bottom 10 performers generated next to nothing in savings Among the worst included UnityPoint and HealthPartners. Median savings rate totaled 2.0%.

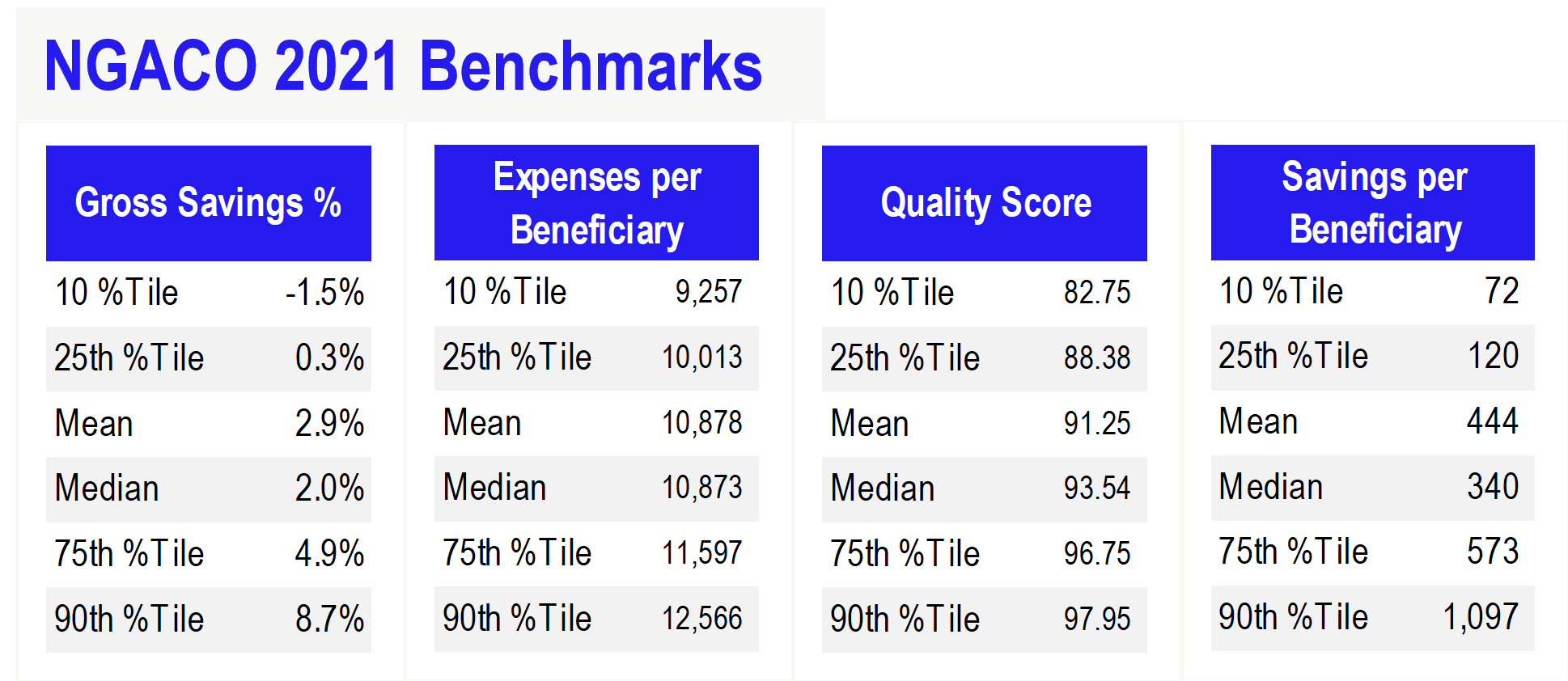

Other notable benchmarks:

Notes on NGACO Quality + Financial Performance and Savings

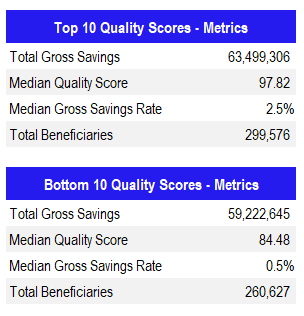

Moving on to a brief note on quality – it’s notable to mention that higher quality scores for NGACO in 2021, while maintaining higher gross savings rate, did not necessarily translate to a huge gap in savings over lower quality scores. Take, for instance, the top 10 and bottom 10 participants from a quality perspective:

Some or most of this can likely be attributed to the upside-only nature of the program in 2021, and it’s possible that other factors played in (e.g., proportion of skilled nursing facility spend, etc.). To understand the nuances, I would need to dive into the individual quality scores and the various expense breakdown, but perhaps that’s for a different day!

Conclusion

I’d love to hear from subscribers other notable observations you might have about the NGACO program and how things will shift for these participants entering MSSP or ACO REACH. It’s an interesting time for the land of ACOs and VBC, especially in light of new potential MA risk adjustment headwinds for payors.

Join 12,300+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!