5 days til Christmas – which healthcare organization deserves coal this year? My vote’s for Cerebral.

More on that in a sec.

Let’s dive in!

Join 12,400+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Truepill, Cerebral, and the Virtual Mental Health Swamp

The Drug Enforcement Administration issued an Order to Show Cause on Truepill’s pharmacy operation, putting Truepill’s DEA Certificate in jeopardy.

Context: the DEA alleges that “between September 2020 and September 2022, Truepill filled more than 72,000 controlled substance prescriptions, 60 percent of which were for stimulants, including generic forms of Adderall. In numerous instances, Truepill dispensed controlled substances pursuant to prescriptions that were not issued for a legitimate medical purpose in the usual course of professional practice.”

“An investigation into Truepill’s operations revealed that the pharmacy filled prescriptions that were: unlawful by exceeding the 90-day supply limits; and/or written by prescribers who did not possess the proper state licensing.”

Madden’s Musing: I’m sure there are a number of therapists who have a much more nuanced opinion of what’s going on here than I do. But what should have been prevented via seemingly basic safety check between Truepill and Cerebral has turned into the potential for the DEA to pull Truepill’s DEA Certificate. At the very core of this whole ADHD pill mill debacle sits the role of financial incentives. The current state of virtual mental healthcare in the U.S. is a damning indictment of perverse venture-backed investing and with it, the pressures of growing at all costs.

Truepill hit $300 million in revenue and raised $142 million at a $1.6 billion valuation in October 2021. It’s a rapidly scaling, well-known unicorn that seems to have failed basic pharmaceutical professional functions.

- If you have an WSJ subscription, this was a great overview of the failures of online mental health providers like Cerebral, BetterHelp, Done, and Workit. The online mental health scene is an actual mess:

- Cerebral now faces two federal investigations

- Done, which is apparently run by a Facebook product manager (???) also faces a Justice Department investigation

- Ahead (not accused of wrongdoing) was shut down by Truepill in April 2022 despite the digital health player dropping a $9 million investment into the company in 2020 (Truepill pivoted away from DTC)

- In the WSJ article, Workit has been accused of building a “Suboxone vending machine”

- Similarly, Talkspace “grew too quickly, and in growing so quickly they sacrificed quality”

- BetterHelp has seen its share of poor patient care and had a paid affiliate controversy in 2018

The incentives between growth at all costs, and actual provision of healthcare in many virtual mental health cap tables are misaligned. In general, VCs are well-intentioned with the goal of improving the patient experience while being rewarded for taking on investment risk. But we have to be thoughtful about the financial incentives and risk-taking behavior that venture might instill into founders. I hope that the bad actors don’t crowd out the best players and scare off investment dollars from the space, because the need is there – and that goes for all of healthcare.

There is a silent majority of therapist clinicians who are doing a great job at providing mental health services. The demand and need for behavioral health is extreme in the U.S. But the current models of online therapy provision deserve scrutiny, and accountability. That should include ALL parties involved.

If you have any thoughts, musings, or disagreements with the above, I’d love to hear your take! Lots to talk about here and I’m sure there’s plenty of nuance to be had with the issues at hand.

Komodo Health’s CFO departs amid $200M fundraise

Just 9 months since enterprise analytics and data unicorn Komodo Health had planned to go public, there have been some interesting developments at the health tech firm. Opting to stay private, Komodo decided to raise $200 million from Dragoneer (anyone else find that ironic haha…Komodo Dragoneer get it) and Coatue, in a structured equity infusion. Along with the raise, Komodo laid off 9% of its workforce. Totally fine and justifiable in current macro conditions. Maybe even prepping and fine tuning with one more capital raise to get ready for the public markets?

But then the kicker: along with the announcement, Komodo’s CFO left. Big eyebrows raised red flag for most organizations. Now, I obviously have no inside knowledge here, but the CFO is usually the first guy or gal to know terms of capital raises, achievability of financial projections, etc…so if that key position departs right before a potential IPO – a big payday for most execs – it leads me to question what’s going on over there?

Market Movers

Partnerships and Strategy Updates:

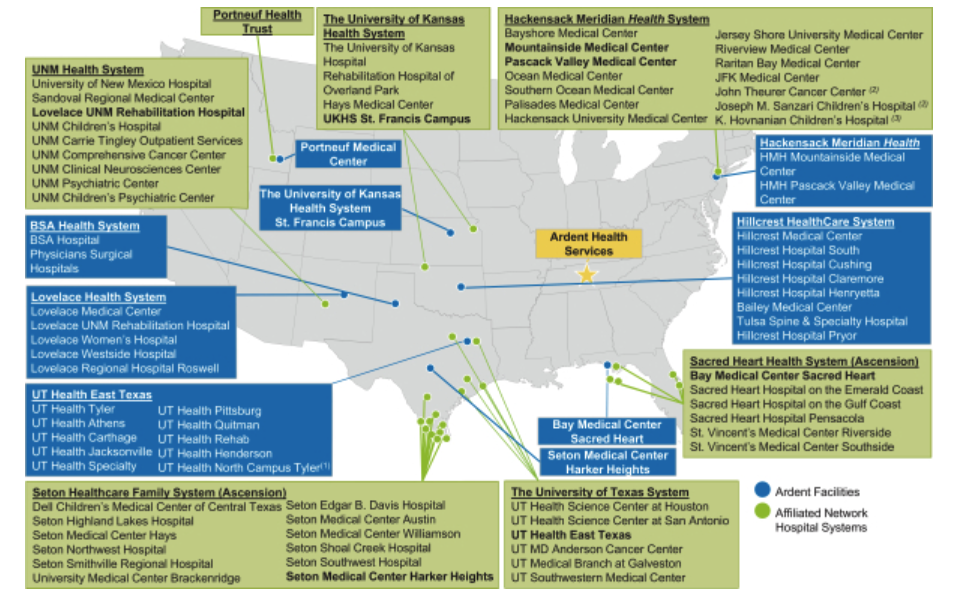

Newly minted CVS subsidiary Signify Health expanded its partnership with private for-profit health system Ardent Health. As part of the JV, Ardent is joining one of Signify’s 2023 ACOs in the Medicare Shared Savings Program (with $138M in 2021 gross savings) with its footprint throughout New Mexico, Oklahoma, Texas, and Kansas. Unclear as to how many members this might add. This was Ardent’s footprint in 2019 in those areas when they were considering going public (Read more):

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Cooper University and Cape Regional Health announce their intent to merge into a 2-hospital, $2.2 billion system in New Jersey. “The combined health system will have more than 10,000 team members, 900 employed physicians in three physician groups, 45o advanced practice providers, 900 licensed beds, over 130 ambulatory locations and six urgent care centers.” (Read more)

Scan Group and CareOregon are merging to create an almost 800,000 member, 5-state nonprofit focused on government-sponsored health plans. It’ll be called HealthRight Group and well-known healthcare leader Sachin Jain will be at the helm. As a nonprofit, they’ll focus on underserved populations (Read more)

Hospital-at-home and at-home care provider Dispatch Health formed a partnership with Blue Shield of California and separately, Saint Francis Health System, in Oklahoma. (Read more)

Baptist Health and Einstein Healthcare joined Nuance (Microsoft)’s precision imaging network, an AI enabled tool for diagnostics. (Read more)

Amedisys along with its subsidiary Contessa (hospital at home) completed its home health joint venture with the University of Arkansas for Medical Services. (Read more)

Superior HealthPlan, MedArrive, and Brave Health all partnered to create a new home health program. (Read more)

Finance and M&A Updates:

GE Healthcare is spinning off from GE ParentCo soon, and this Fortune article was a great look into the company. Its imaging biz does around $10B a year in revenue! (Read more)

Moody’s is downgrading healthcare companies, many of which are private equity backed. Per the report, 18% of 193 rated healthcare companies are rated B3 negative or lower. Meanwhile, 90% of these companies are backed by private equity. “Two of the largest healthcare companies on the B3N List are owned by private equity: physician staffing companies Envision Healthcare, which has defaulted on its debt twice since January 2020, and Team Health, which we downgraded to Caa3 in October, Moody’s noted.” Who’s surprised! (Read more)

P3 Health Partners seems to be on the brink of financial distress after disclosing a $40M loan with its founders (at a 14% interest rate!!) (Read more)

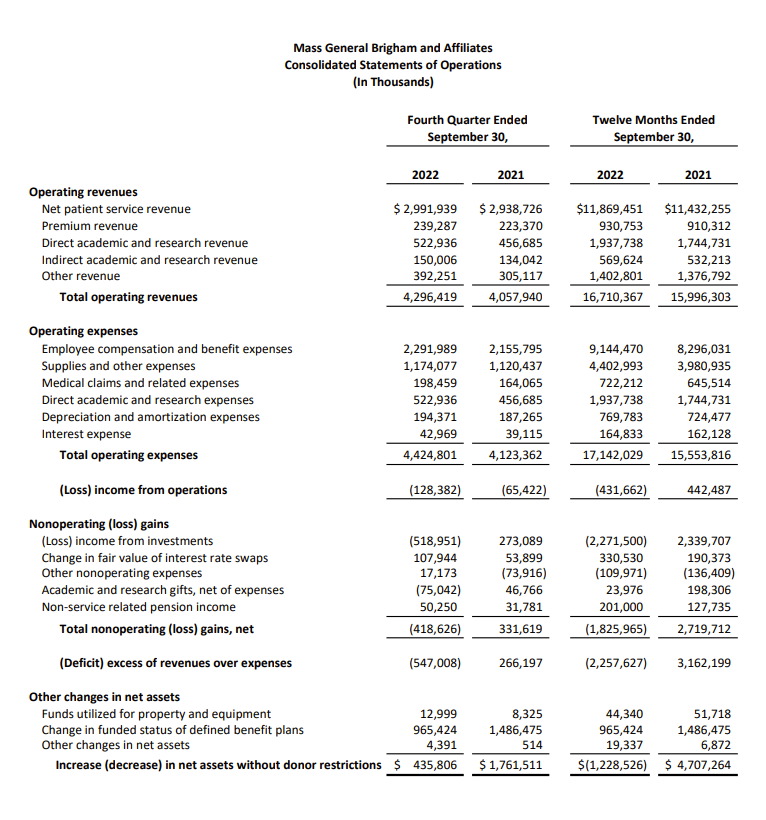

Mass General Brigham reported its 2022 financials, noting a -2.6% operating margin and $2.3B loss when accounting for investment losses. Excluding losses, MGB was more or less breakeven on the year (the actual financial statements were found on EMMA):

Digital Health and Startup Updates:

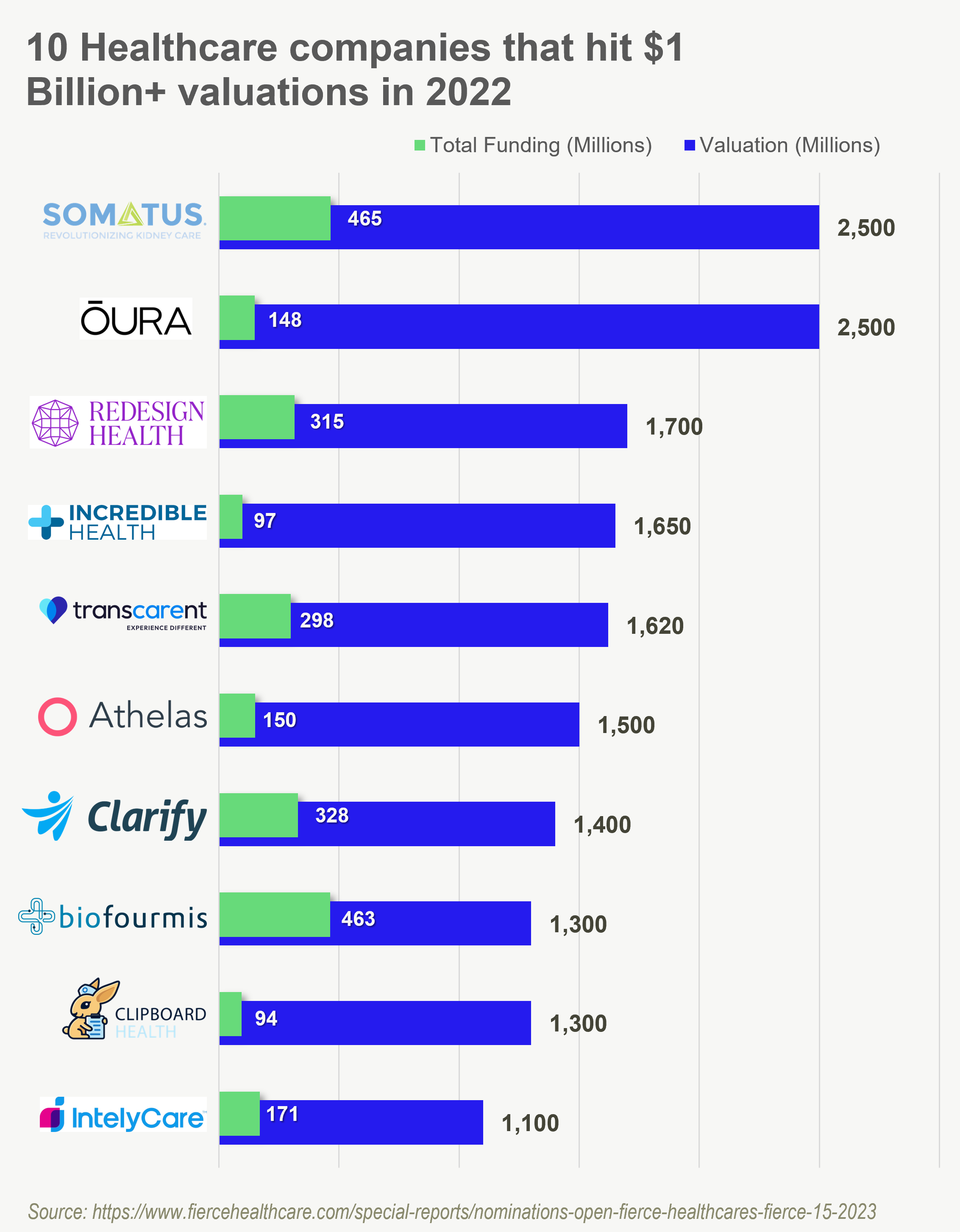

10 digital health orgs that hit $1B in value in 2022 according to Fierce. 3 out of 10 operate in staffing while Somatus, operating in the risk-taking chronic kidney disease space, tops the list in 2022.

Yale New Haven partnered with virtual MSK provider IncludeHealth to expand care for patients with MSK conditions. (Read more)

Turquoise Health partnered with cost and quality data provider CareJourney to integrate CareJourney’s metrics into Turquoise’s platform. (Read more)

Juno Medical announced a $12M Series A fundraise led by Next Ventures and Serena Ventures, which seems to be the next level-up of One Medical focused on growing, rejuvenating markets. (Read more) (Next Ventures Breakdown)

Weight care program Found partnered with BetterHelp, which will offer a free month of therapy to Found members. (Read more)

Greater Good Health is fully leaning into the nurse practitioner care model in California in a model physicians are sure to hate. GG works with 13k patients to date in an area I’m expecting to grow. (Read more)

KAID Health partnered with OPN Healthcare to find ways to improve oncology care delivery through AI workflows and better data analysis, engagement for providers. (Read more)

Policy and Payment Updates:

A recent CMMI report noted the 6 most successful programs to date that have delivered statistically significant savings: the Pioneer ACO Model, the ACO Investment Model (AIM), the Medicare prior authorization model (RSNAT), the Home Health value-based purchasing model (HHVBP), the Medicare Care choices model (MCCM), and the Maryland All-Payer model (MDAPM)

New numbers indicate that 18 million people could lose Medicaid coverage when the COVID-19 public health emergency ends. (Read more)

Quick update on looming Medicare cuts – lots of lobbying involved here, and Congress might move relief dollars to end some PAYGO provisions that cut Medicare reimbursement. (Read more)

Costs, Data, and Other Updates:

Healthcare spending hit $4.3 trillion in 2021 – just 18.3% of GDP, so I had to update my Twitter bio accordingly. (Read more)

Here’s a contentious one between docs and mid-levels: Stanford researchers found that nurse practitioner care in the ED increases length of stay in hospitals by 11%, increases utilization, and accounts for 20% more hospitalizations than do emergency department physicians. (Read more)

A study found that maternal death rates were 62% higher in states that passed or created abortion restrictions. “States that have banned, are planning to ban, or have otherwise restricted abortion have fewer maternity care providers; more maternity care “deserts”; higher rates of maternal mortality and infant death, especially among women of color; higher overall death rates for women of reproductive age; and greater racial inequities across their health care systems.” (Read more)

A dude in Georgia was convicted for $463M in Medicare fraud through a genetics testing facility. I mean come on fam, you really thought you wouldn’t get caught? (Read more)

Miscellaneous Maddenings

In case you missed it, the Patriots had perhaps the worst ever play of all time this Sunday. Here it is in all its glory.

Lots of big things planned for Hospitalogy in 2023. Stay tuned for the Hospitalogy Wrapped coming 12/29, where I’ll dive into how things went this year, the roadmap for 2023, and everything in between!

Hospitalogy Top Reads

Stat News dropped a report this week on telehealth companies sharing sensitive patient information with social media platforms. (Read more – paywalled) Health systems have also been dealing with sensitive patient info and the pesky Meta Pixel. (Read more)

This Advisory Board piece on the dynamics between health tech vendors and health systems is a must-read. Some pretty insane quotes here. Maybe we should create an anonymized message board where system and health tech execs can interact like this lmao. (Read more)

Gist Healthcare had some nice thoughts on the NY Times latest piece on Ascension: “Yet again, the New York Times is shining a harsh light on a health system that has been engaged in management practices common across the industry. While the piece omits some relevant information, such as the recent spike in labor costs, it’s useful to point out that many hospitals were so thinly staffed prior to COVID that they had virtually no slack in their labor pools, hindering their response to the crisis. In our experience, the reasons for this have less to do with lining executives’ pockets, and more to do with the realities of dealing with a worsening payer mix and rising input costs. While future hospital workforce strategy is going to have to focus on reducing dependency on nurses—especially in the inpatient setting—any effort to that end must augment nurses with team-based care models and technology solutions, rather than pushing further on already-tight nurse-to-patient ratios.” (Read more)

That’s it for this week! Join 12,400+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!