With UConn winning the ship last night, that puts an end to a crazy March Madness tournament. It’s crazy how healthcare is almost as much fun. Right…right??

I’m back from ViVE and ready to catch you up on the things going on across healthcare. If you appreciate these, support me by passing it along to a friend!

Join 20,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Correction on my 3/28 newsletter: Notable announced its partnership with Marshfield Clinic Health System and while they help to automate and streamline processes across a number of administrative tasks (patient intake, registration, scheduling, prior authorization, and referrals), they do not operate in the medical AI scribe space.

Digital Health Funding Continues along 2019 Trendline

Rock Health released its update on digital health funding for Q1 with some notable tidbits, as funding has slowed down over the past few quarters when compared with the Covid bubble. As the advisory firm points out, 2023 funding is trending closer to 2019 levels assuming a steady run-rate in line with the last few quarters.

Further, 6 mega deals accounted for 40% of total digital health funding in Q1:

- Monogram Health: $375M

- ShiftKey: $300M

- Paradigm: $203M

- ShiftMed: $200M

- Gravie: $179M

- Vytalize: $100M

Q1 2023 U.S. digital health funding closed with $3.4B across 132 deals, with an average deal size of $25.9M.

The collapse of Silicon Valley Bank (SVB) nearly precipitated a liquidity crisis in the sector, killing much of the funding momentum for digital health, likely resulting in a few more months of funding conservatism.

The IPO market is still closed and there were zero digital health IPOs in Q1 2023. Later stage firms are having to get creative with financing and valuation.

Finally, upcoming regulatory changes are expected to impact digital health startups. These changes include the wind-down of the public health emergency, subsequent changes to telehealth through the Ryan Haight Act as proposed by the DEA, and more.

ACA’s Preventive Services Mandate Overturned…for now

A U.S. District Court judge has overturned the section of the Affordable Care Act (ACA) that makes preventive health services available at no cost.

Some backstory – through preventive care mandates, the ACA determines what services are considered ‘preventive’ through recommendations from expert panels. Health insurers then must cover all of those services for no out of pocket cost to patients.

But the latest decision found that one of these panels, the US Preventive Services Task Force, doesn’t have authority to compel what insurers must cover. And as a result, the decision goes much broader in scope.

The ruling now blocks enforcement of preventive mandates nationwide and jeopardizes free coverage of a wide range of preventive care services including mammograms, colonoscopies and mental health screenings for 168 million people on employer insurance and the individual market. That means that you and I – and anyone else not on Medicaid or Medicare – could be on the hook for paying out of pocket for preventive services. (Politico)

Blake’s Take: Can we move past the ACA legal challenges? To attempt to strike down preventive services is nonsensical. I can’t think of any party – payor, provider, politician – that wants this outside of some fringe propaganda group that thinks investing in primary care is somehow a bad thing. There are already plenty of roadblocks for access to care. Let’s not keep adding more to one of the most chronically underfunded areas of healthcare.

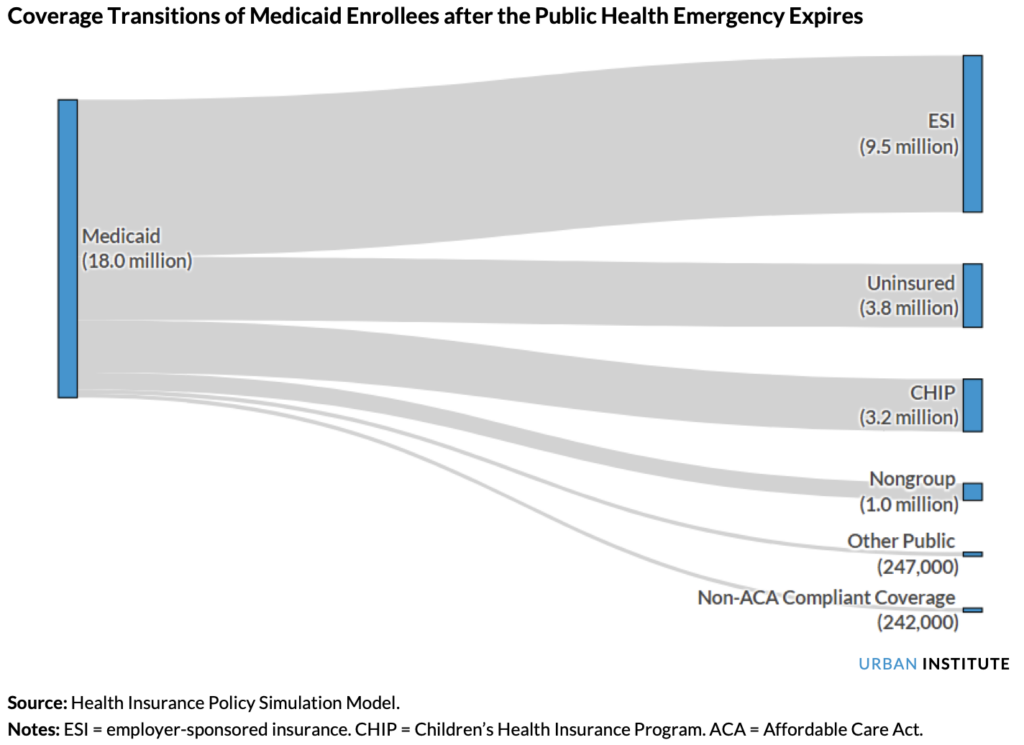

Medicaid Redeterminations start

Starting April 1, states will begin the process of redetermining Medicaid eligibility for existing beneficiaries. An estimated 18 million individuals are about to lose Medicaid eligibility, and it’s likely going to be tough for insurers and state healthcare officials to track them down for re-enrollment. That’s the bad news.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

The somewhat good news is that many of these individuals will be eligible for coverage under either their employer health plans OR the ACA subsidies that Biden extended through the Inflation Reduction Act.

Still, the impact will be felt nationwide as each state implements its own way to determine updated Medicaid eligibility. Expect most state redeterminations to happen over the course of 2023. In Florida, for instance, redetermination screens are happening based on the month of the individual’s enrollment.

While redeterminations overall will create a massive upheaval for both patients – who will lose coverage – and Medicaid managed care players trying to do damage control on churn and lost members, the event could be net positive for hospitals and providers who might swap two low-reimbursing Medicaid members for higher reimbursing individual ACA/commercial members. Of course this varies by provider and region, though.

Cano Health’s Rough 2023 gets worse

“I have never witnessed such poor corporate governance at any company, let alone a public company, and I have been involved in at least nine and served as Chairman or CEO of six.”

There’s some major drama that has been brewing in Cano Health land over the past several months.

First, recall the rumors that CVS walked away from a potential acquisition of Cano Health in mid October 2022.

Now, three of Cano’s Board of Directors including Starwood’s Barry Sternlicht has resigned and issued an incredible, scathing press release.

Along with condemning the actions of the Board, Sternlicht voiced a vote of no confidence for Cano’s physician CEO Marlow Hernandez. He claims that Cano Health withheld or obfuscated information from the board and is bewildered by the fact that Cano raised $1.4B in a SPAC, yet doesn’t have much to show for that capital other than a crippling debt load and a 90% drop in stock price. I mean…yeah, fair point.

- Plus, there was this quite interesting tidbit dropped on related party transactions: “The number and nature of related party transactions, together with what I consider poor governance (demonstrated by transactions such as MSP Recovery), is highly concerning to me as it should be to the rest of the Board.”

Given the publicity of the release and Sternlicht’s skin in the game, the press release is a shocking indictment of Cano Health. Any time you have a former board member openly calling for the CEO’s head, things are likely not going well.

And surely Cano’s physicians are seeing this fiasco unfold. On top of being a penny stock at this point, I wonder what they think? Keep in mind that Cano Health took out a $150M loan in February at a 14% interest rate (which was considered favorable at the time). It’s not in any sort of position to negotiate. At this point, expect an activist shareholder battle as the once high flying Medicare Advantage player gets sold off for scraps to someone like Humana.

As a major investor airs out the company’s dirty laundry, this is as spicy as it gets in healthcare.

Partnerships and Strategy Updates:

The state of Texas has liquidated Friday Health’s operations after the health insur-tech declared insolvency in the state. (MH)

Sutter Health has plans to build 20+ ambulatory surgery centers in and around Northern California over the next four years as part of a multi-year strategy. (Link)

Evolent Health is expanding the use of its oncology services solution across all of Centene and WellCare’s members nationally in what seems like a great win for Evolent. (Link)

Finance and M&A Updates:

Merakey and Elwyn, two major providers of intellectual and developmental disability (IDD) services, have plans to merge to create a $1 billion company. According to Behavioral Health Business, Merakey and Elwyn reported revenues of $618M and $385M respectively. The merger shows that the IDD space is growing, which lines up with Parth and mine’s predictions piece from early 2022. You’ll continue to see care providers diversify their service offerings and invest in specialized services for more complex patient populations (serious mental illness, neurodivergent populations, seniors). Post-merger as a nonprofit, the two will provide IDD services in 16 states. (BHB)

Morgan Stanley Capital Partners sold Ovation Fertility to US Fertility for an undisclosed sum. US Fertility is an MSO backed by Amulet Capital Partners. It’s one of the largest partnerships of physician-owned and physician-led fertility practices in the US.

P3 Health Partners, the forgotten population health platform, managed to secure a $90M private placement from investors after borrowing $40M at a 14% rate in December. (Link)

Digital Health and Startup Updates:

Transcarent’s Glen Tullman (know of him?) penned an essay on their recent acquisition of 98point6. (Link)

Uber Health has partnered with Script Drop and is now offering same-day prescription delivery alongside its non-emergent medical transportation care platform. (Link)

Pager, a care navigation and collaboration platform, partnered with Google Cloud, becoming an integrated service provider on Google’s healthcare cloud services. It’s somewhat interesting to look at the healthcare cloud arms race happening Google, Microsoft, Amazon, and Oracle. (Link)

VBC enabler Wellvana raised a whopping $84M from Valtruis, Heritage Group, and others to help physicians transition to value-based care. Wellvana currently serves over 100k lives across all payors and ACO REACH in 22 states. (Link)

Raihan Faroqui noted some interesting seed investments and activity across health tech in a recent LinkedIn Post. “What’s hot: Sexual health/wellness, Women’s health, Hybrid care (in-person + virtual), Niche mental health, Provider tooling, Benefits navigation, Elder-tech.”

Policy and Payment Updates:

Here’s an interesting little development in private equity and real estate land. Pennsylvania lawmakers might ban for-profit players from owning hospitals and limit sale-leaseback transactions on hospital-owned real estate (e.g., hospital sells the real estate it owns to get cash, then rents/leases back the hospital from the new buyer). A ban like this could have implications on hospitals’ abilities to unlock capital through their owned real estate. At the same time, this sale-leaseback provision has been exploited between related parties to extract value for PE funds. (Beckers)

Costs, Data, and Other Updates:

CMS issued its final rate notice for Medicare Advantage (on a Friday no less; classic) and the news is a welcome reprieve for insurers. The final rate of -1.12% (after patient illness adjustments) is slightly better than the advance notice (-2.3%), and CMS will also phase in v28 model changes over 3 years instead of next year, giving payors visibility into what MA changes to expect in the next few years for payment policy (especially with the election year upcoming).

- Of course, based on the news, the biggest players including Humana, UnitedHealth Group, and Elevance are best positioned to continue to succeed in MA. MA is very much so alive and well.

Whitepapers and Resources

Agilon’s investor day (agilon)

Miscellaneous Maddenings

- The Hospitalogy bracket challenge has concluded! Somehow I didn’t completely embarrass myself and finished second in the group. But first place goes to… ESPNFAN2435400165, with the bracket name “Picks are FHIR ” and a 96th percentile bracket! If you are ESPNFAN2435400165 please let me know hahaha.

- It’s Masters week! I’m feeling good about Rory headed into the weekend (we’ll see if they finish with all the rain) and really want to see him finish the major grand slam. Besides Rory, I’m bullish on Max Homa, Scheffler (sigh), and Corey Conners is coming in hot as my dark horse. Should be a great weekend especially with the LIV guys involved and Brooksy winning a tournament last week.

- For all of the golf fans that read this (I know there are quite a few), Golf Digest posted an amazing overview of changes that Augusta National has made to the Masters-hosted golf course over the years. Check it out here.

Hospitalogy Top Reads

- Like I’ve written about, obesity drugs are all the rage today with players like Ro plastering NYC’s subways with ads. The WSJ dove into Eli Lilly’s upcoming drug Mounjaro (known as tirzepatide), which holds some insane, powerful weight-losing potential. We’re talking a 230 pound person losing 50 pounds in 17 months. “Mounjaro could be one of the highest-selling drugs of all time with annual sales exceeding $25 billion. Novo’s Ozempic and Wegovy brought in close to $10 billion last year, with prescriptions rapidly growing.” When 1 in 4 healthcare dollars are spent on diabetes and you produce the strongest weight loss drug around town…look out, payors? The article is also a great overview of Lilly’s R&D process and history. (WSJ)

- Jared and I had the privilege to join Affirm Health’s Katila Farley on the first episode of the company’s new podcast The Business of Primary Care. In the podcast, Katila, Jared, and I discuss how money drives change in healthcare and the importance of aligning incentives, the corporatization of primary care, and the shortage of primary care physicians. Give the episode a listen!

- I also enjoyed Nikhil’s recent post on screening healthy people and the unforeseen, nuanced issues that doing so creates. (OOP)

That’s it for this week! Join 20,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!