Welcome back to another edition of Hospitalogy, where I break down the latest in the business of healthcare across M&A, finance, strategy, and innovation twice a week!

Join 21,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Also…be on the lookout for a major announcement from me at 9am ET. It’ll be coming on both Twitter and LinkedIn!

Froedtert and ThedaCare announce $5B merger

On April 11, Wisconsin-based health systems Froedtert and ThedaCare announced their intention to merge into what would create an 18-hospital, $4.5-billion in revenue health system called FroedTheda.

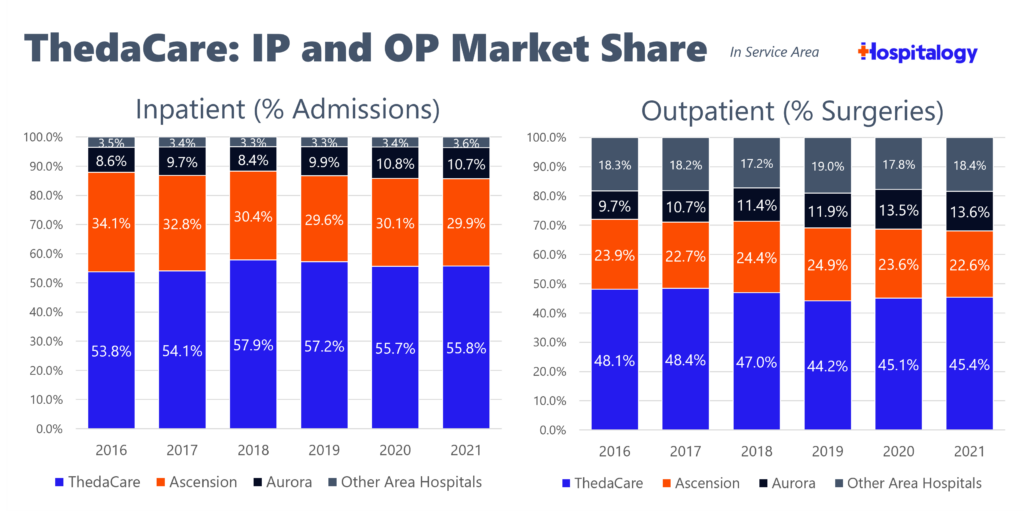

Alright. I’m kidding about the name (aha…unless?). But the merger WAS announced. What’s interesting though, is that both systems appear be merging from a position of relative strength. Which piques my curiosity. FroedTheda both have held and maintained inpatient market share despite much larger competitive threats lurking (Advocate and Ascension), and Froedtert holds a solid AA, stable rating from Fitch.

My speculation: This move is a response by both organizations to the growing thread of Advocate Health, now bolstered by Atrium Health on the east coast. But if we peel back the onion a bit further, this merger could be a compelling market opportunity for FroedTheda.

Ascension is floundering in Wisconsin.

In late March, the Ascension mothership gave Ascension Wisconsin’s CEO the boot. Then the COO, CNO, and several other executives departed.

Amid broader staffing struggles by health systems and hospitals, Ascension has been under major fire in Wisconsin for patient safety and staffing reasons outlined in this article.

All of this to say that this merger may be an opportunistic one to capture some market share, get a bit bigger, and insulate from competitive or strategic threats.

From Kaufman Hall’s Q1 M&A review: “…a new type of post-pandemic activity is taking shape, as mid-sized regional health systems seek partners while they remain in a position of financial strength, with some looking to balance their desire to influence local healthcare delivery with utilizing the capabilities and resources of larger health systems.”

Bigger picture: Performing well financially or not, these mid-sized health systems see the writing on the wall, and we’re just getting started with M&A.

UnitedHealth Group: Diversified Healthcare Behemoth does Diversified Healthcare Behemoth Things

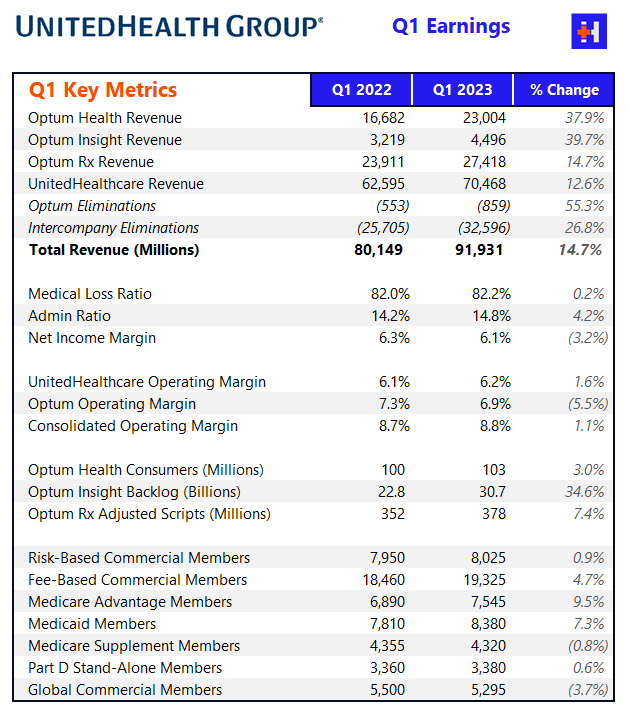

Everyone’s favorite diversified healthcare behemoth UnitedHealth Group posted its first quarter earnings on April 14. Given the amount of attention payors saw during the quarter and my very deep dive on its investor day in December, I was looking for commentary on a few topics – implications of the Medicare Advantage final ruling, how they’re thinking about Medicaid redeterminations, and other potential headwinds including obesity drug spend (GLP-1s).

UNH is truly unbothered by MA rate changes: Andrew Witty got the MA commentary out of the way quickly. Since the insurance lobby strangled CMS CMS decided to phase in the MA risk adjustment changes over 3 years, UNH feels it’s in a position with more clarity over MA changes, even feeling ‘encouraged and optimistic’ about marketplace growth in 2024.

Larger payors in general are in a much better position to handle payment and regulatory change. Most analysis agrees that the big (Humana, United) will continue to get bigger in MA. Take a peek at 2023 expected MA enrollment numbers by the big 5:

No damage from GLP-1’s: “We have seen an increase in trend in GLP-1s. The overwhelming majority of that is in diabetic care and it is as we had expected, low single digits in terms of weight loss use.” – Brian Thompson

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- “We need to really be clear about which patients really do benefit from these medicines and make sure we properly understand how they’re going to use those medicines. So there’s a lot still to learn, I think, as these things progress through their final phases.” – Andrew Witty

Other tidbits from Q1:

- Revenue per Optum Health consumer (a key performance indicator nowadays) grew 34% year-over-year. UnitedHealth continues to cash in on its consumer base, converting 700,000 more patients to capitated models over the past quarter. In total, Optum Health holds around 4 million fully capitated lives (most of which are UnitedHealthcare beneficiaries).

- Health systems are dumping their revenue cycle management (RCM) teams onto Optum (Owensboro Health, Northern Light Health, SSM Health), joining a growing number of hospitals that are outsourcing RCM.

- As a whole, UNH saw 152M unique consumers across all service lines.

- Optum now employs 70,000+ physicians – 7% of the total workforce – including a recent acquisition of Crystal Run Health. Overall Optum wants to add 10,000 physician a year to its growing base.

- On the insurance side, big areas of growth continue to flow from Medicare Advantage (9.5%) and Medicaid (7.3%). United’s Surest platform is driving outperformance among employer plans. 1 in 9 commercial plans nationally are choosing Surest as a commercial option.

- This was a key quote on the popularity of enablement and value-based care: “I’d also say that the experience we’ve seen in Optum, the popularity of value-based care for physicians, the way in which they like to be able to concentrate and focus on patients longitudinally…that’s a sustaining popular thing.”

- UNH spent the most on M&A in company history in 2022 totaling ~$21B. That’s a lot of deals to integrate. Most notable transactions included:

- Physician acquisitions (Kelsey-Seybold, Healthcare Associates of Texas, Atrius Health closed in 2022, tuck-in’s)

- Refresh Mental Health: ~$1.2B

- LHC Group: ~$5.4B

- Change Healthcare: ~$13B (less the ClaimsXten divestiture)

- Based on Q1 results, UNH bumped up its earnings per share by $0.10 / share.

And not one question on generative AI!!

Partnerships and Strategy Updates:

Microsoft and Epic announced a VERY notable collaboration hitting on all of the major healthcare buzzwords with one go! The two industry leaders will expand their longstanding partnership to develop and integrate generative AI into Epic environments on Microsoft’s Azure cloud platform. This…seems like a BFD. (Microsoft)

Huge deal in anesthesia, apparently – National Partners in Healthcare joined forces with Medstream Anesthesia, adding 700+ providers, 216,000 cases, and 61 facilities across 12 states, alongside 59 Chief CRNAs, 59 Medical Directors, and 90 practice management personnel. This partnership establishes NPH as a top anesthesia company in the U.S., now serving nearly 500,000 cases in over 220 facilities across 17 states with 1,200+ providers. I mean sheesh. (Link)

The Cano Health Saga continues, and this whole debacle is going to be a case study very soon. Expect to see continued activist investor activity in this value-based care name. As the rest of the sector seems to be performing quite well, Cano Health is getting dragged down to penny stock levels by an incompetent leadership team. (Cano) (Summary)

KeyCare notched another health system win by partnering with Allina Health Partners through its Epic-based telehealth platform for specialist and primary care support. (Link)

Clover Health is undergoing some cost restructuring on a winding road toward profitability…perhaps someday. (Link)

Finance and M&A Updates:

Optum merged Prospero Health with Landmark Health into a single palliative care unit in March. (Link)

The $11B Presbyterian Health Services and UnityPoint Health Merger is moving closer to closing time. (ModernHealthcare)

The Carlyle Group pulled out of a $15B deal to acquire Cotiviti – “The decision is also a setback for Veritas, which has been seeking a buyer for Cotiviti since late 2021, Bloomberg reported. The owner had also considered an IPO at that point.” (Pitchbook)

Fresh off raising $100M in February, Vytalize acquired IPA of New York through investing in its related MSO – Practice Management of America. IPA NY is one of the largest multispecialty IPAs in the country, holding more than 3,000 providers.

“M&A activity in the Physician Medical Group (PMG) sector fell in the first quarter of 2023 to 135 publicly announced deals. This drop represents a 14% decrease from Q4:22 and an approximate 4% decline from Q1:22” (Link)

Digital Health and Startup Updates:

Virtual mental health startup Spring Health raised $71M at a $2.5B valuation. Oddly, investors weren’t disclosed for the round. Spring evidently covers 5 million lives across both health plans and employers leading to 270% revenue growth in 2022. It previously raised $190M at a $2B valuation in a Series C in September 2021. (Fierce)

Data analytics platform Arcadia received $125M in financing from Vista Credit Partners. (Link)

MedArrive raised $8M, an add-on from its $25M Series A to enable care delivery in the home. (Link)

Notable launched a new product called Patient AI, using longitudinal patient datapoints to develop a comprehensive clinical and social understanding of each patient. Sounds like some pretty cool capabilities. (Link)

Flume Health launched Flume Relay in late March to help payors with vendor integration. The new product aims to cut down on both time and cost to integrate solutions between plan and vendor. (Link)

CTRL Therapeutics – a biotech firm working on a cell therapy for solid tumors – launched this week with $10M in funding including backers like Intermountain and General Catalyst. (Source)

Olive is narrowing its focus to revenue cycle management after its divestiture of noncore utilization management assets to Availity (Olive)

Scene Health – a medication adherence platform – raised a $17.7M Series B (Scene)

Policy and Payment Updates:

The Supreme Court issued a temporary pause on recent abortion pill rulings surrounding mifepristone. (TheHill)

As par for the course, hospital lobbyists are calling CMS’ inpatient rule update of 2.8% ‘woefully inadequate’ (Beckers)

Costs, Data, and Other Updates:

Medscape published a survey of 10,000+ physicians in 29+ specialties disclosing total compensation and year over year growth, among other interesting insights.

Miscellaneous Maddenings

- HBO officially announced a Harry Potter television series and I AM HERE FOR IT

- If you’re at HMPS in Austin today or tomorrow, let me know – I’m speaking on a panel (a first for me lol) on generative AI in healthcare with people well out of my league!

- I had an absolute travesty of a hole at Luna Vista golf course this past Friday. My wife and I were goofing around playing 9 holes – I was sitting at +1 going into the Par 5 9th hole and was playing well. It was a super downwind hole and really attackable. I cranked a drive and rode the wind. Finding myself just 150 yards out after a massive 350 yard drive, I pulled out a P wedge but just couldn’t commit to the shot thinking I’d hit it over the green. Unfortunately I found myself in a massive greenside bunker, which took me 2 hacks to get out of. I settled for a bogey. Utterly devastating after being just 150 out lying one on a par 5. Better luck next time fam.

Hospitalogy Top Reads

- Ro wrote an incredibly comprehensive overview of the obesity problem, GLP-1s, common questions, getting into the obesity debate, and more. Really impressive not only from a content marketing standpoint but from an education standpoint. (Link)

- GettingClinical wrote an informative piece on Large Language Models in Healthcare (Link)