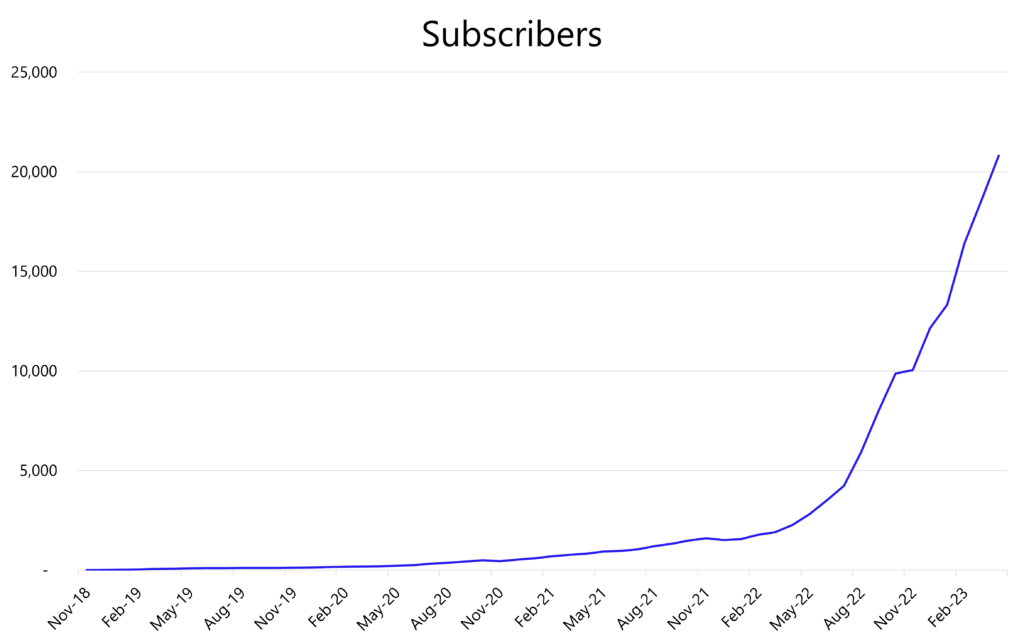

Hospitalogy is celebrating its 1-year anniversary this week! On April 27, I published my first post to around 2,000 subscribers. We’re at 22,000 now and counting, which is insane to think about. If you’ve been along for the ride, I deeply appreciate you, and would appreciate your continued support and feedback as I strive to deliver the most value I can possibly muster to healthcare operators from all over the ecosystem.

Two things to keep on your radar:

- Sign up for our upcoming Twitter spaces about everything AI in healthcare & use cases in clinical workflows. Thursday 4/27 at 6pm CT! (Link)

- On Thursday I’ll be taking a deeper dive into the HCA-Augmedix partnership (see below) alongside the Founder of Augmedix, Ian Shakil.

Join 22,000+ executives and investors from leading healthcare organizations by subscribing here!

TPG, AmerisourceBergen acquire OneOncology for $2.1 Billion

The biggest M&A news of the week comes out of Nashville, Tennessee after TPG and Amerisource Bergen (ABC) announced the acquisition of OneOncology from General Atlantic for $2.1B.

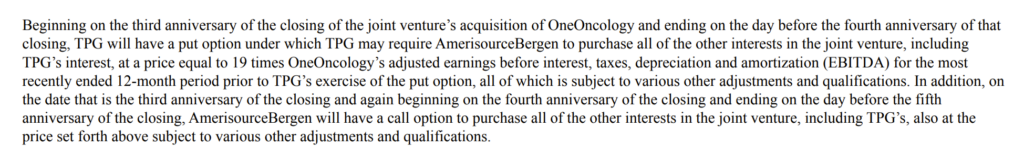

The put/call deal structure reminds me of Humana’s bid for Kindred back in 2017, which also involved TPG along with Welsh, Carson, Anderson, & Stowe (Humana then acquired the remaining 60% four years later in April 2021). In this case, ABC is playing the role of Humana. It purchased a 35% minority stake ($685M) in OneOncology while TPG holds the remaining 65% in a joint venture.

4 years from now, ABC will buy the remaining 65% of OneOncology at a 19x multiple. What a payday for TPG. And using 19x as a ballpark multiple for the transaction today, that roughly implies around ~$110M in EBITDA for OneOncology today.

On ABC’s front, the strategic acquisition gives the drug distributor a major asset in the oncology space after watching McKesson dominate the market with its own practice management company, the U.S. Oncology Network, over the past 13 or so years. Since acquiring the USON in 2010, McKesson has expanded the practice into 2,300 total clinicians.

As for General Atlantic, the growth equity investment firm exits its ~5-year investment in OneOncology. It made the initial $200M investment in 2018 and formed the oncology practice management company alongside Tennessee Oncology.

Since that initial investment, One Oncology has grown into a sizable footprint:

- 15 practices

- 300 sites of care

- 560+ oncologists

- 940+ total clinicians

In 2022, OneOncology tacked on another 86 physicians and holds an impressive retention rate with docs (an important metric in practice management).

It’s also worth noting TPG’s track record around recent investments including:

- Kindred Healthcare buyout (sold to Humana),

- TPG’s stake in Kelsey-Seybold (sold to Optum),

- Chronic kidney care provider Monogram Health (CVS, Cigna, Humana backing, recently raised $375M),

- Stake in Lifestance Health

- Taking Convey Health Solutions private in October 2022

What’s next: Stay tuned for ABC’s Q2 earnings call on 5/2, where analysts and management are sure to dive into the deal.

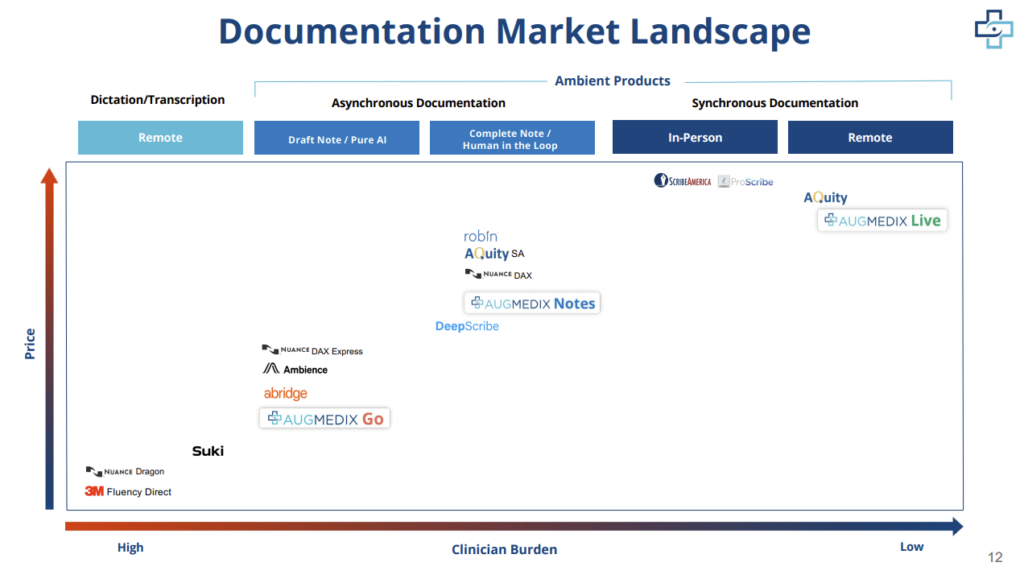

HCA steps toes into AI with Augmedix Investment, Partnership

On April 20, Augmedix and HCA announced a partnership to pilot Augmedix’s ambient documentation solution at two HCA hospitals, specifically in the emergency room. Augmedix will work with HCA to develop the solution in the acute care setting, capture direct feedback from clinicians with the aim of driving better, more efficient outcomes.

More interesting to me, however, is HCA’s decision to invest into Augmedix alongside investment firm Redmile. By dropping a combined $12M, The largest for-profit operator signals that ambient documentation is a space to look at, and something with the potential to scale throughout HCA’s 180-hospital portfolio.

I’ll be diving deeper into why this is a partnership to watch on Thursday alongside Augmedix Founder Ian Shakil. And if you want to join us live, we’ll be chatting more about it on Twitter Spaces at 6pm CT on Thursday. Join us then!

Partnerships and Strategy Updates:

US Heart & Vascular partnered with HeartPlace, one of the largest cardiovascular groups in Texas. The partnership will add 70+ clinicians across DFW to USHV’s MSO platform for cardiologists. USHV is backed by PE player Ares Management (Link)

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

On the heels of CVS’ ACO deal with RUSH in greater Chicago, CVS also announced a partnership with Catholic Health in New York. The two will form a JV to assume accountability for 40k ACO REACH members. Don’t forget that CVS-owned Signify Health also partnered with Ardent Health back in December, so all of a sudden, CVS is notching health system partnerships in MSSP and ACO REACH across the US. (Link)

Cone Health’s CEO pushed back on Atrium Health’s hospital proposal in its service area, raising concerns about potential negative impacts on the community and existing healthcare services. (Link)

Finance and M&A Updates:

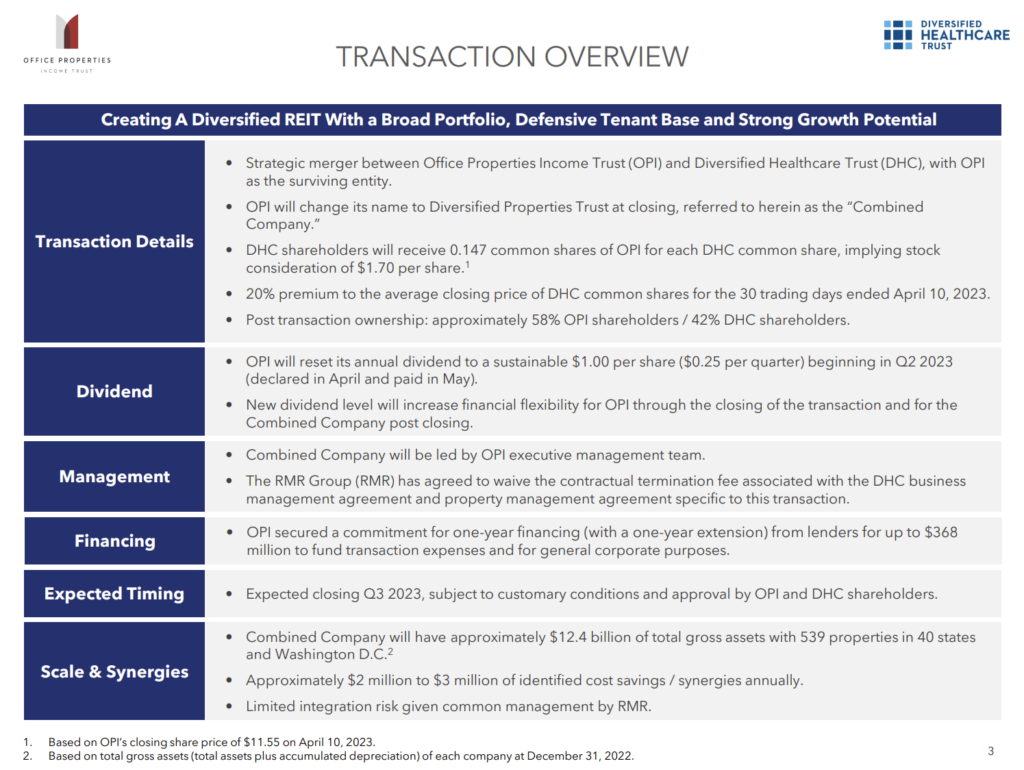

Office Properties Income Trust and Diversified Healthcare Trust have announced plans to merge in an all-stock transaction valued at around $17.7 billion, creating a new powerhouse in the healthcare real estate sector and solving some short-term liquidity crunches. (Link) (Link to Presentation Site)

LCMC Health is facing an antitrust suit over its $150M acquisition of HCA’s 3 Tulane hospitals. The FTC and Louisiana Attorney General just challenged the deal, in a legal battle that will have significant ramifications on hospital M&A and the ability to enter/exit markets. As part of the challenge, a federal judge barred LCMC from closing any of the three acquired hospitals or associated service lines. (Link)

Healthcare staffing firm M&A hit 40 deals, highlighting the industry’s adaptation to the evolving healthcare landscape and increased demand for staffing solutions 4 deals in the space totaled $1.5B in deal value. (Link)

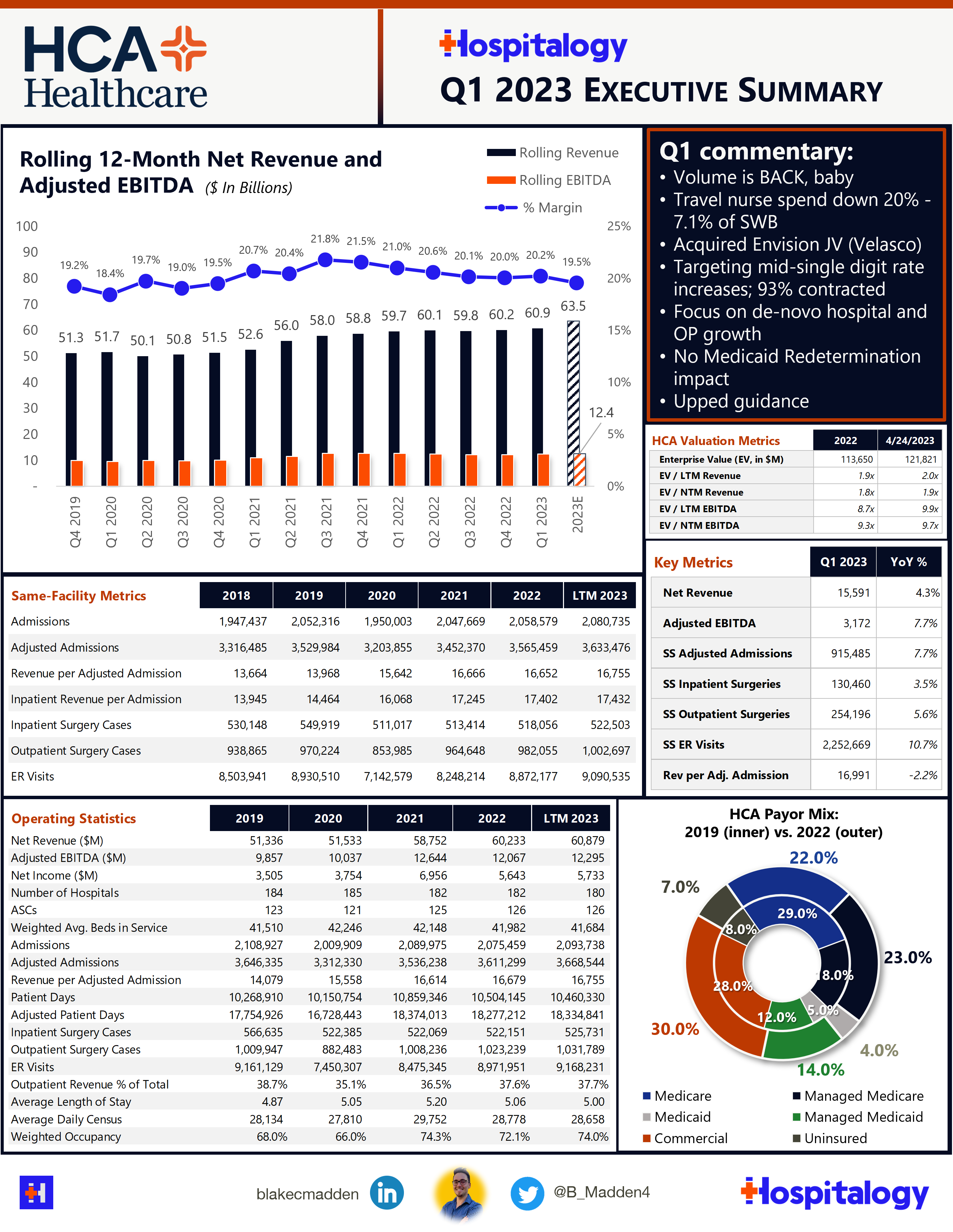

HCA, JnJ, and Intuititive Surgical’s Q1 results / commentary provided some major leading indicators for how surgical volumes are shaping up in 2023. If their results are anything to go by, expect a bounce-back. HCA’s Q1 results were impressive, beating expectations across all volume metrics, upping guidance for 2023, improvement in turnover rates, and strong market demand:

- Interesting little tidbit here: HCA increased its ownership stake in its joint venture with Envision Healthcare, which will generate about $1B in revenue to the topline but nothing additional to the bottom line. What I’ve heard rumors of though, is a larger transaction potentially happening between HCA and Envision. I mean, I have no idea if this actually happens. But at the same time I could see KKR offloading the dumpster fire to HCA, which can strategically leverage Envision / AmSurg assets throughout its portfolio as ED and outpatient volumes rebound.

Digital Health and Startup Updates:

Defying the times, Define Ventures just raised $460M to back early-stage digital health startups. Notable past startups that the firm backed includes (Link)

Autism care startup Cortica just bagged a whopping $75 million to grow its cutting-edge, AI-powered treatment for folks with autism spectrum disorder. This cash injection will help expand their clinic network across the nation, making personalized care more accessible for patients. (Link)

Third Way Health just scored $1.55 million in pre-seed funding – led by ApolloMed – to create a game-changing, all-in-one solution for medical practice front office needs. This platform is set to make life easier for healthcare providers by simplifying admin tasks, cutting costs, and boosting patient interaction. (Link)

Who’s surprised that Teladoc is expanding its weight management and prediabetes product to hop on the GLP-1 trend? Not me. I mean, it’s a no brainer. (Link)

Memora Health nabbed $30M to scale its complex care management solution, helping healthcare providers streamline communication, coordination, and care for patients with multiple chronic conditions through an AI-enabled platform. Ha! They snuck the buzz word in. (Link)

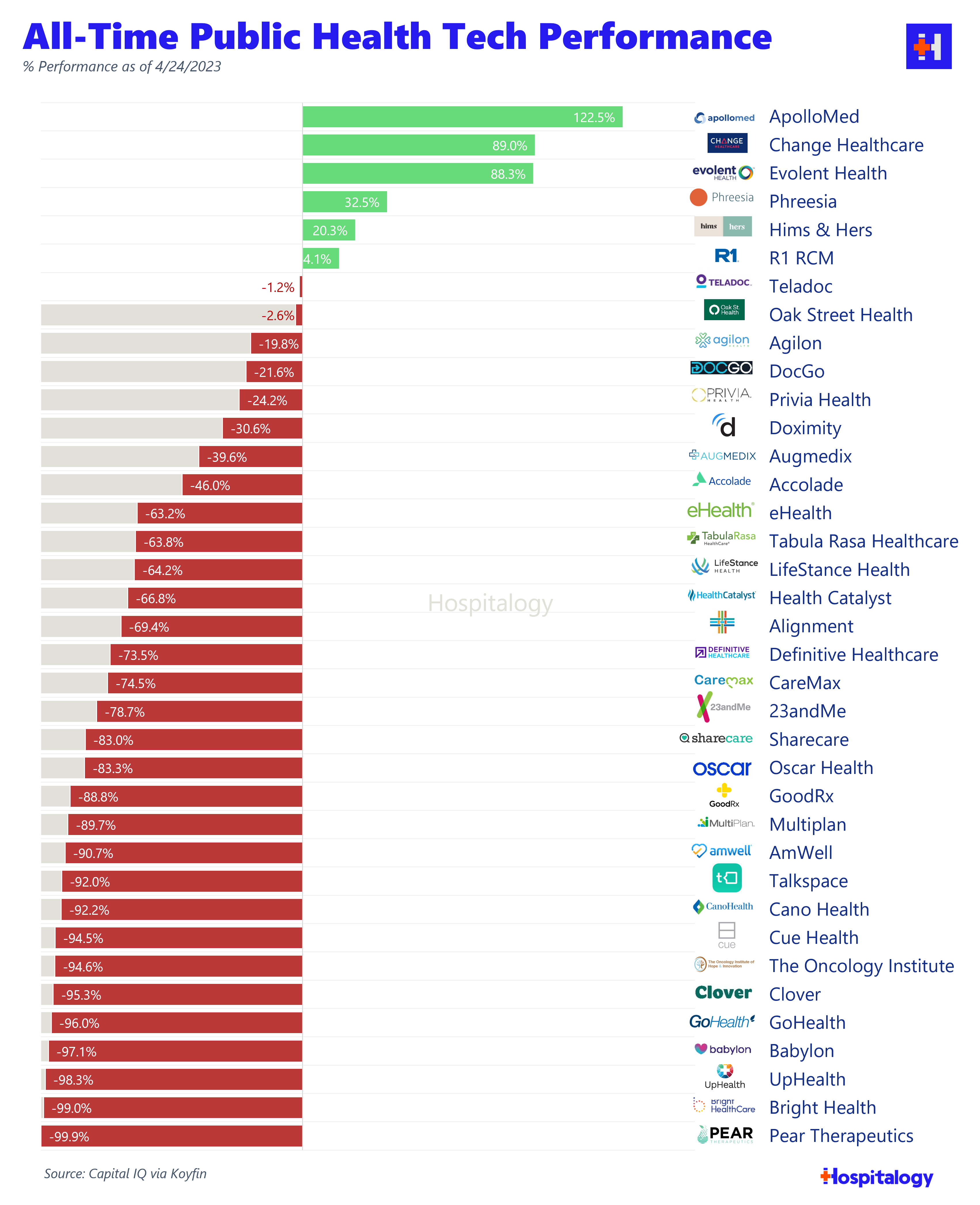

I made the chart below as a request from a friend. So instead of letting it sit on my desktop, I figured I’d share the all-time health tech performance of most of the health tech ecosystem. Now, there are some names missing below, but overall the performance of this cohort of recent gone-public’s has been pretty dismal:

Policy and Payment Updates:

CMS just made ownership data for all home health and hospice providers available for more than 6k hospices and 11k home health agencies. Through the data, you can view key information including organization name, type, NPI, CCN, and practice locations. Strategy consultants everywhere rejoice! (Link)

UnitedHealth Group is suing PE-backed Radiology Partners, claiming (ha! get it) that Radiology Partners billed a ton of claims through an RP subsidiary based in Houston that held extremely favorable reimbursement rates. UHG claims (alright I’m done sorry) that Rad Partners used that subsidiary – Singleton Associates – as a pass thru billing front for a ton of other subsidiaries, even some outside of the state of Texas. Absolutely wild. (Link)

Costs, Data, and Other Updates:

Oracle appointed Seema Verma to head Oracle Life Sciences, which is sure to leverage her extensive healthcare policy experience as the past administrator of CMS to drive growth and innovation in the company’s life sciences division. (Link)

The VA halted rollout of Oracle-Cerner’s electronic health record system as part of a major “reset” aimed at addressing concerns and improving system functionality. What an absolute mess. (Link)

Hospitalogy Top Reads

If you haven’t read our overview of AI in healthcare, you should. It’s one of the better pieces out there right now in healthcare. Read it here! (Link)

This WSJ (paywall) feature on hospitals embracing the new wave of staffing firms and the nursing gig economy was a really great read and compelling look at the potential workforce makeup of tomorrow. (Link)

That’s it for this week! Join 22,000+ executives and investors from leading healthcare organizations including VillageMD, Privia, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!