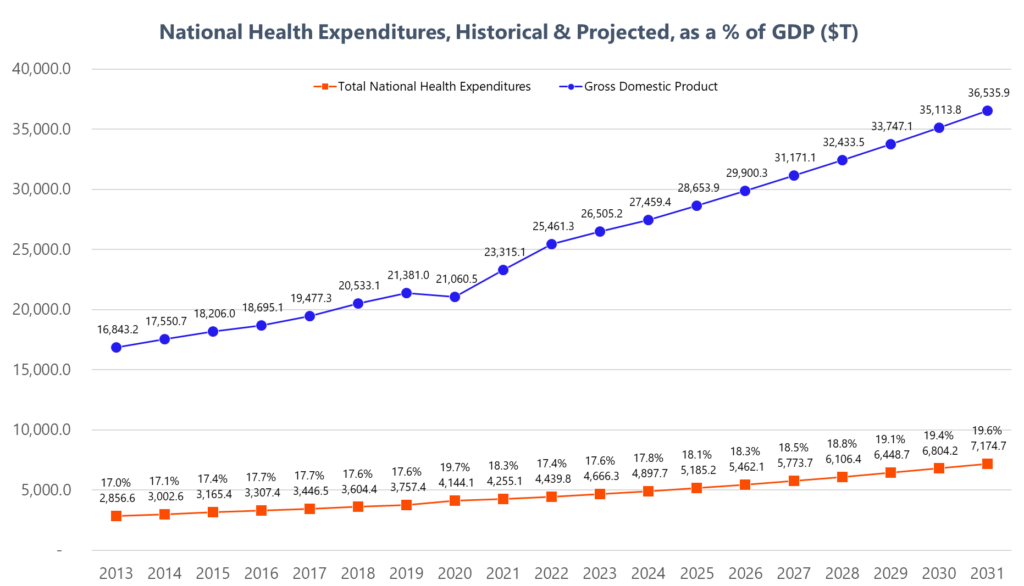

1. Healthcare Spending as a % of GDP to hit 19.6% by 2031

In June, CMS released its annual projection of national health expenditures, containing historical data through 2021. Driven by strong 65+ demographics growth, healthcare spending will outstrip broader GDP growth.

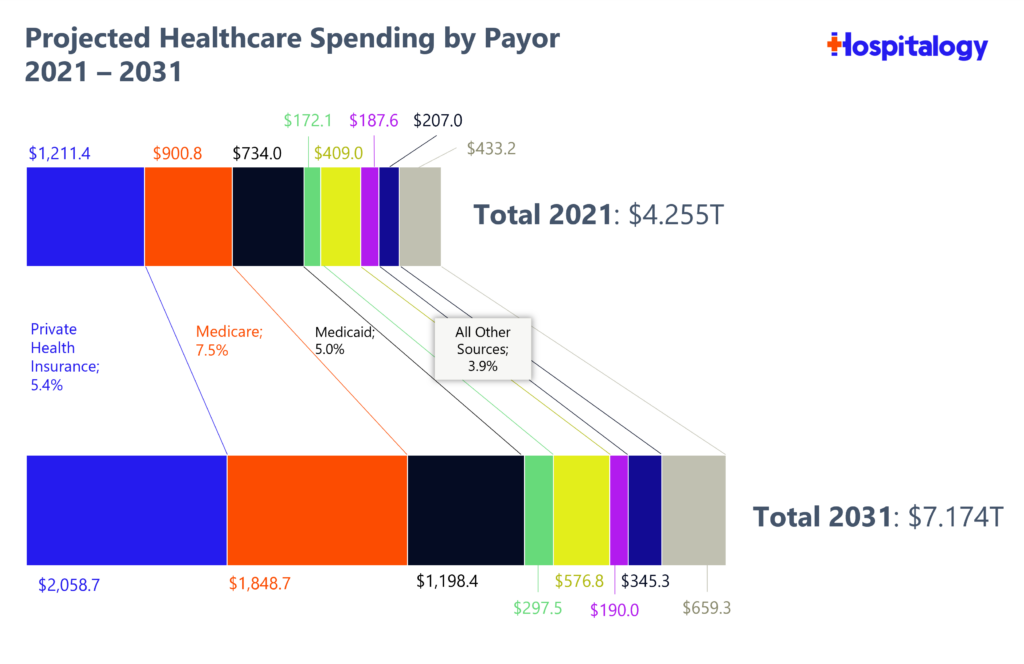

As a percentage, spending is projected to rise from 18.3% in 2021 to 19.6% by 2031. Total healthcare spending is projected to hit $7.174 Trillion by 2031, an annual growth rate of 4.7% (vs. overall GDP annual growth of 4.0%).

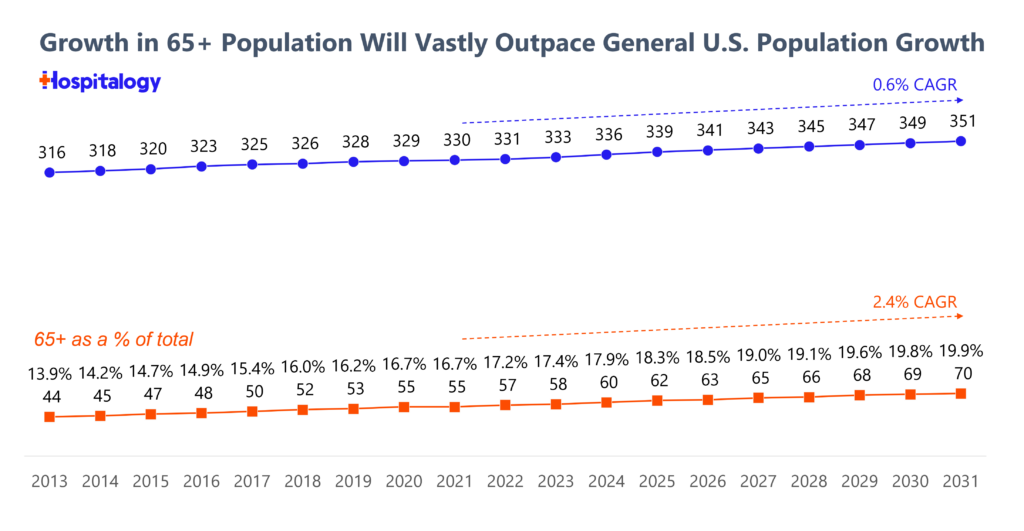

2. 65+ Population Projected to Hit 20% of the Total U.S. Population by 2031

The U.S. population is getting older. Recent published Census data indicates that the median age in the U.S. hit a record high at 38.9 years old. It’s a double whammy – the birth rate is declining while the Baby Boomer generation ages.

Of course, this demographic dynamic is why you’re seeing so much activity in healthcare. An aging, growing population is a sure bet for demand and higher utilization of services. Multiple stakeholders are enjoying the tailwind, including managed care (growth in Medicare Advantage) and physician practice specialty rollups (ophthalmology, gastro, orthopedics, etc.)

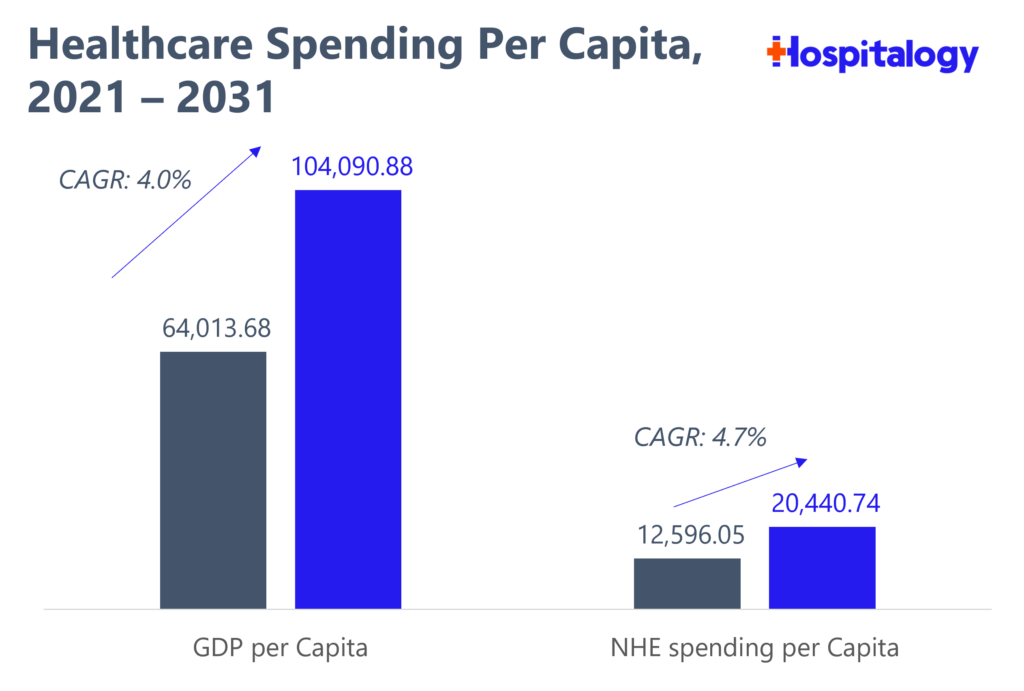

3. Per Capita Spending Projected to Increase from $12,894 in 2021 to $20,441 in 2031

On a per capita spending basis, similar to overall growth projections, national health spending per capita is expected to outstrip GDP per capita over the next decade. It’d be interesting to look at this chart while also including projected wage growth over the next decade. Stated otherwise, how much more will our healthcare costs continue to eat into wages and what percentage of salaries, wages, and benefits will healthcare spending comprise at businesses?

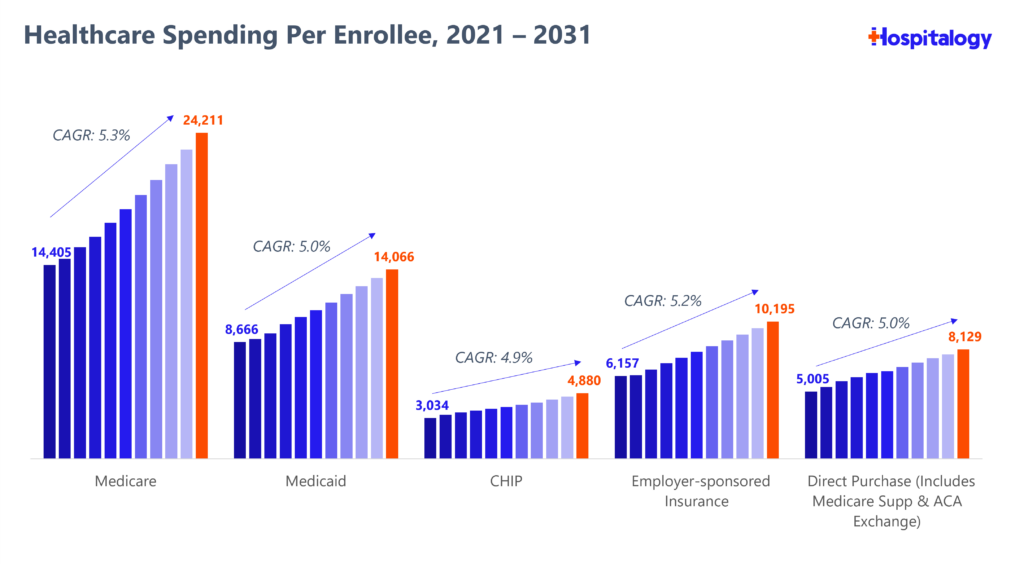

Meanwhile, spending per Medicare enrollee will hit $24,211 in 2031, as 10,000 beneficiaries age into Medicare every day and the aforementioned 65+ population trend continues to blossom over the next decade. Note that per capita spend overall is $20,440, which really illustrates how the rest of the population foots the bill for the heavy-utilizing Medicare beneficiaries.

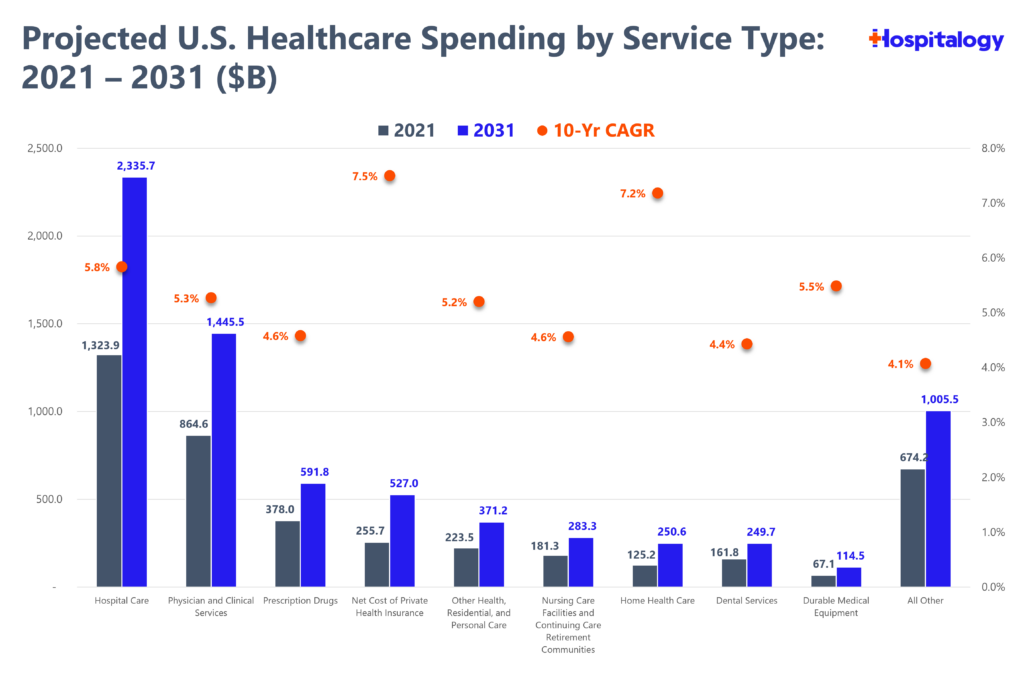

4. Fastest Projected Services Growth Segment: Home Health

Over the next 10 years, the fastest growing segments of healthcare services (excluding the net cost of private health insurance) is projected to be home health (growing at a 7.2% clip annually) and hospital care (growing at a 5.8% clip annually).

As I’ve well noted in this newsletter, Home health holds massive tailwinds as care shifts into the home and payors incentivize the move toward lower-cost, at-home settings. Consequently, this dynamic results in payors purchasing home health, home care, and post-acute assets (Optum-LHC, Humana-Kindred, CVS-Signify, Optum-Amedisys proposal, Optum-Landmark)

5. Medicare Spending Projected to Increase by 7.5% Annually from 2021 – 2031, Outstripping Medicaid and Private Health Insurance

As illustrated above, Medicare will continue to comprise a higher proportion of total healthcare expenditures in the U.S.

On a hospital expenditure level, Medicare as a percentage of total hospital expenses is expected to increase from 26.5% in 2021 to almost 30% by 2030.