Happy Thursday Hospitalogists,

Avalere published its latest study on physician employment trends this week, so you know I had to dive in. Next Tuesday I’ll be diving into UnitedHealth’s Q1 as earnings season kicks off for the public markets along with other ongoing healthcare stories of course.

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!

The Latest Numbers on Physician Employment

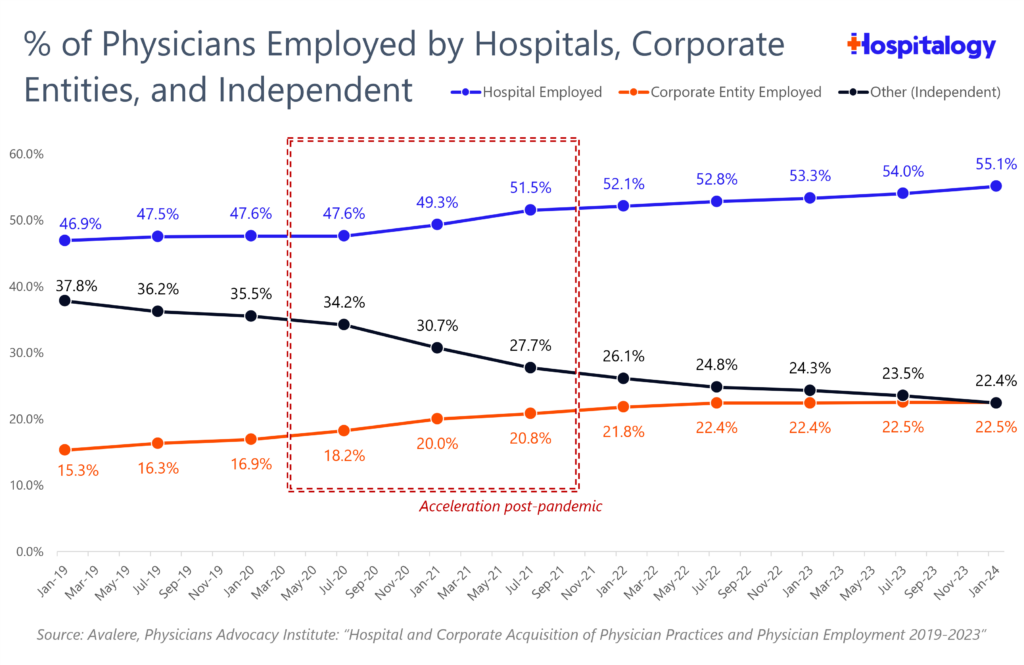

Avalere’s latest study sponsored by the Physicians Advocacy Institute shows an accelerated trend of physician employment by hospitals and ‘corporate’ (health insurers, private equity, etc.) entities. Full report at the bottom of this page.

Here are some high level takeaways, according to this study’s findings (though I have some questions about the underlying data and methodologies, this study will be widely shared, so it’s probably important you understand the findings and implications):

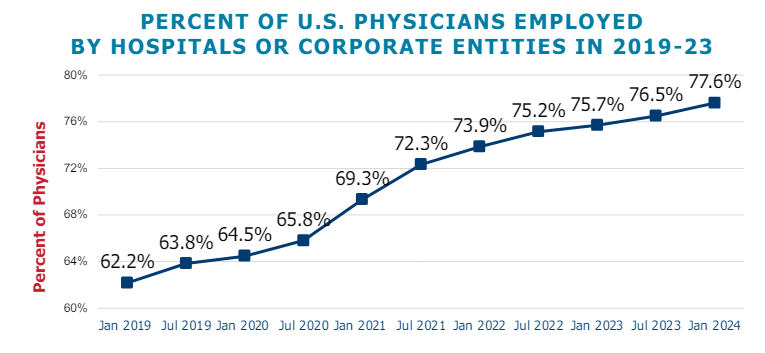

- 77.6% of physicians are employed by hospitals or corporate entities

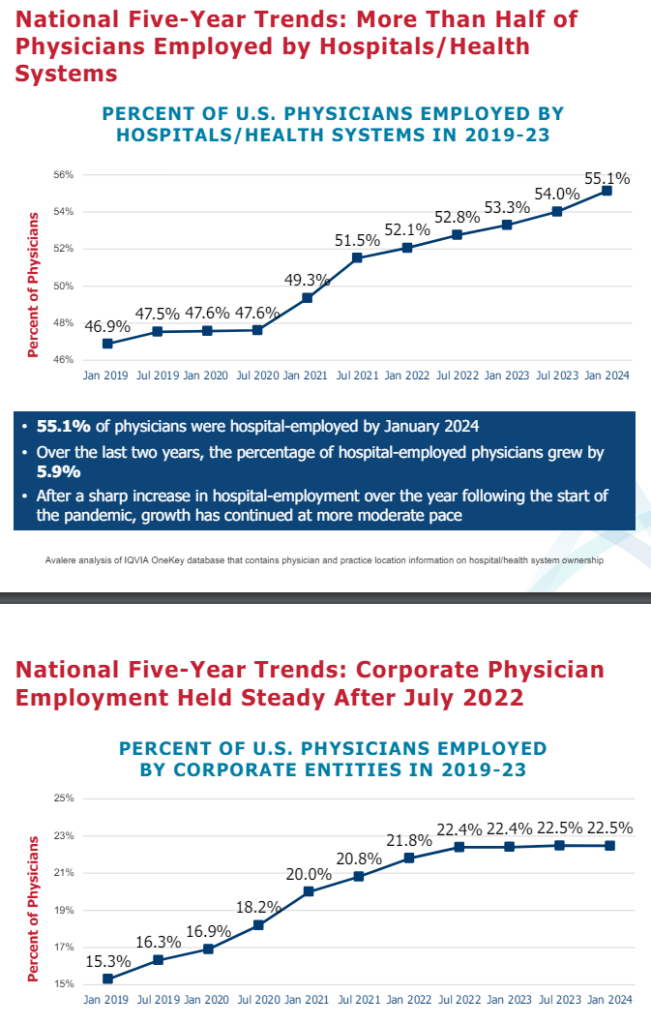

- Hospital employment of physicians accelerated post-pandemic

- Corporate ownership stagnated post-pandemic

Employment by hospitals and corporate entities accelerated post-pandemic and is nearly 80%:

Most of this acceleration was driven by hospital employment and/or acquisition of physician practices as corporate entities seem to have leveled off based on this study (maybe stemming from a rise in interest rates?). Key takeaways here being more physicians seem to be opting for hospital employment:

While the typical dynamics are at play driving the trends here (physician retirement, younger residents opting for physician employment, general hospital market consolidation, untenable nature of owning and operating an independent physician practice in today’s environment) I also want to address the study’s underlying methodology.

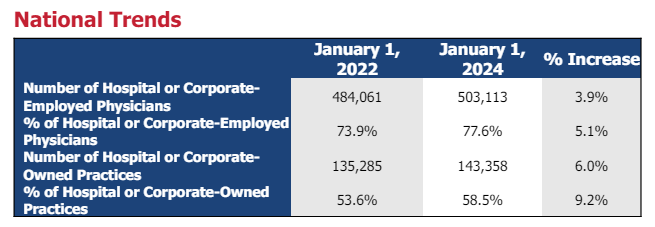

Unless my math is wrong or I’m missing something, based on this table and the implied math, this study only identifies ~650,000 physicians in aggregate. If someone happens to be closer to this data (the study is based on IQVIA OneKey data) I’d love an answer here and will update this post accordingly!

But assuming there are 1 million-plus active physicians in the U.S., that’s a pretty big delta and I’d like to verify this information is reliable before we start drawing conclusions from it. Plus, if the study is classifying Optum as a corporate entity, then Optum is nearly half of that entire number at 90,000 physicians. Based on that number alone I’d expect corporate % to be higher, but I could be missing something. Finally, I’d be interested to know the true definition of ‘corporate’ considering there are MSO models backed by PE and others but physicians consider themselves to be independent (and/or they are marketed as such and aren’t really – that could be the case). Comments from readers welcome here!

The Big Picture around Corporatization

Regardless of the study methodologies here, there’s no doubt at all about the broader picture in healthcare: physicians are feeling more and more corporatized by the day – cogs in the machine. Prior authorization, broader utilization management, the feeling of ‘encroachment’ onto their turf by APPs and full practice authority (a debate for another day!), and declining professional reimbursement all are trends causing some of the most qualified people in healthcare to feel marginalized.

Moving forward, it’ll be extremely important to give physicians (and clinicians!) agency within larger organizations or as standalone practices, assuming this consolidated environment is one we’ll be dealing with moving forward.

When this study was last updated, I postulated that peak physician employment was nigh. And I have to wonder when we reach that point. I think it’s soon, but I’d be curious for readers’ perspectives on this entire dynamic, as it’s an important one.