Big news – we’ve crossed 30,000 Hospitalogists! That’s about 30% of Texas’ DKR Memorial Stadium, so we’re getting there, fam.

In all seriousness, thanks for all of your support. I love what I do, and I can do it thanks to you guys engaging with my newsletter ads with reckless abandon and joining my community reading all of my content!

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!

Healthcare Headlines:

The big stories from the week

The FTC Bans Non-Competes

Today on April 24, the FTC voted to ban non-competes – a significant act the FTC claims will unlock the following:

- higher wages

- more businesses created

- lower healthcare costs (by an estimated $194B over the next decade??), and

- boosted innovation (more patents).

Interestingly, within the final rule, the FTC argued it in fact DOES hold jurisdiction over nonprofits too!

- “The Commission stresses, however, that both judicial decisions and Commission precedent recognize that not all entities claiming tax-exempt status as nonprofits fall outside the Commission’s jurisdiction.”

What’s your take on non-competes? I have plenty of thoughts around how this is great for healthcare and physician flexibilities, but I’d love to hear from you and your organizations and how you’re thinking about the potential ramifications of a lift on non-competes given that 40+% of physicians are restricted by one today. Reply with your thoughts!

This issue of a non-compete ban will be one discussed at length in my community at an upcoming briefing and I’m sure we’ll see plenty of hot takes and good perspectives thrown out.

UnitedHealth Group’s Q1 Analysis & Commentary on Cyber Attack

TL;DR: The Change Healthcare cyber attack fiasco has everyone’s attention (and for good reason). Utilization stabilized. Back to business after the disruption.

First of all, the hackers who attacked our healthcare system are deplorable. I think that point is largely missed here given all the hubbub around UnitedHealth Group (UHG) and Change Healthcare.

But has UHG’s response been adequate given the circumstances? The jury is out.

What’s next: UHG CEO Andrew Witty will testify before Congress related to the cyber attack. The firm, after finally admitting to paying the ransom and assessing damages, also announced a breach of a large swath of patient health information. To slap a band-aid on a hysterectomy, UHG is offering 2 years of free credit checking for those affected.

Luckily for them, UHG can easily adjust the one-time charges (estimated at $1.6B for the year) out of their financials. Unluckily for physician practices with no float, it’s possible we see irreparable harm.

My favorite quote from the earnings call was UHG leadership saying they’re a small part of the $5T healthcare system – which isn’t technically wrong, but c’mon guys, let’s be real.

- “While we’re a comparatively small part of the $5 trillion U.S. health system, UnitedHealth Group’s strategy is focused on helping to meet those very needs, and we’re well positioned to do so.” (somebody add this to Reddit’s r/technicallythetruth page)

Translation: Hey FTC, we’re really actually pretty small but at the same time earlier in our prepared remarks we talked about how good it was for Change Healthcare to be a part of such a large entity that we could help them weather the cyber attack storm!! As the FTC slowly builds its case (an extremely tough one to bring forward), it’ll also start to consider cybersecurity in mergers.

Meanwhile, UHG decides to drop this quote in their press release yesterday: “Based on initial targeted data sampling to date, the company has found files containing protected health information (PHI) or personally identifiable information (PII), which could cover a substantial proportion of people in America. To date, the company has not seen evidence of exfiltration of materials such as doctors’ charts or full medical histories among the data.”

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

I know UHG is the ‘devil’ we all poke fun at (some with real understandable animosity, just like private equity), but c’mon guys, you’re not really doing yourselves any favors here either with the comms.

Onto actual analysis for UnitedHealth’s Q1 and what it means as far as utilization, Medicare Advantage, and other ongoing trends are concerned!

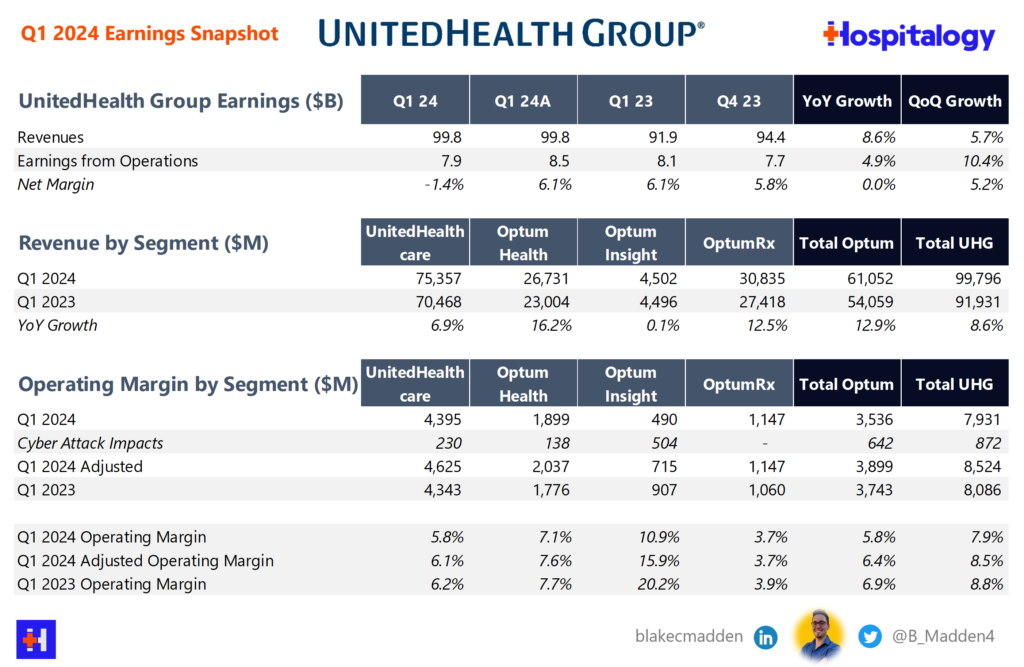

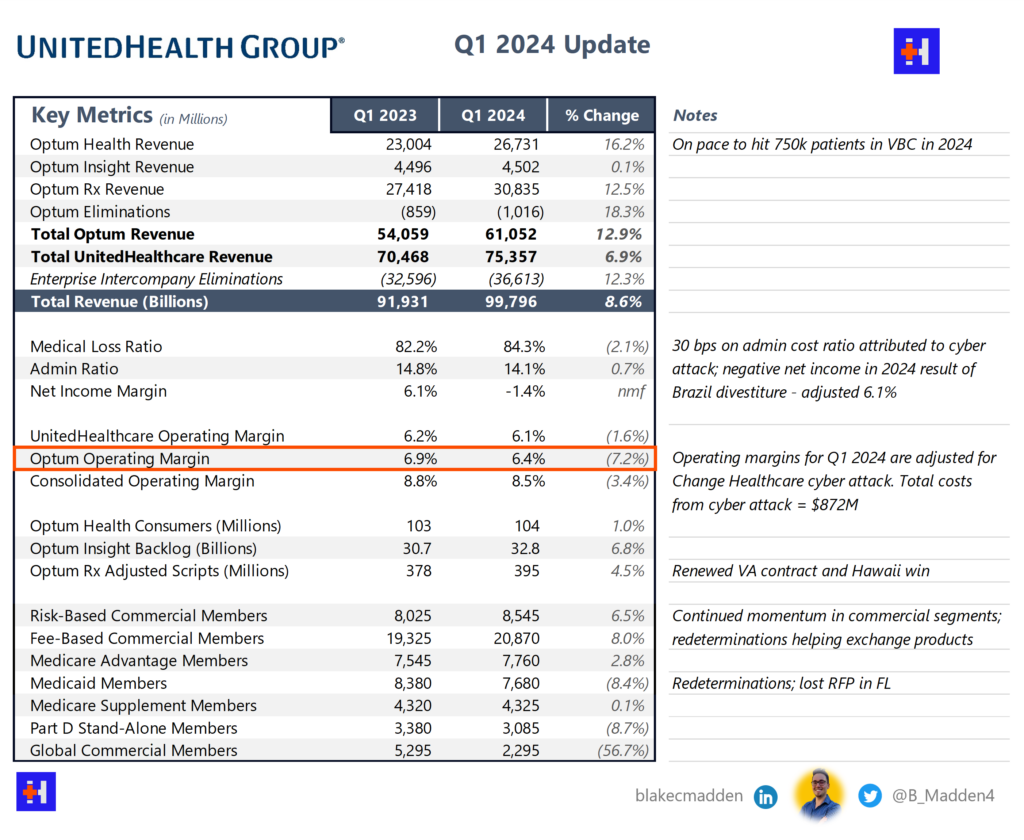

Visuals for you guys – UHG enterprise-wide results, Q1 2023 vs. Q1 2024:

UHG by segment:

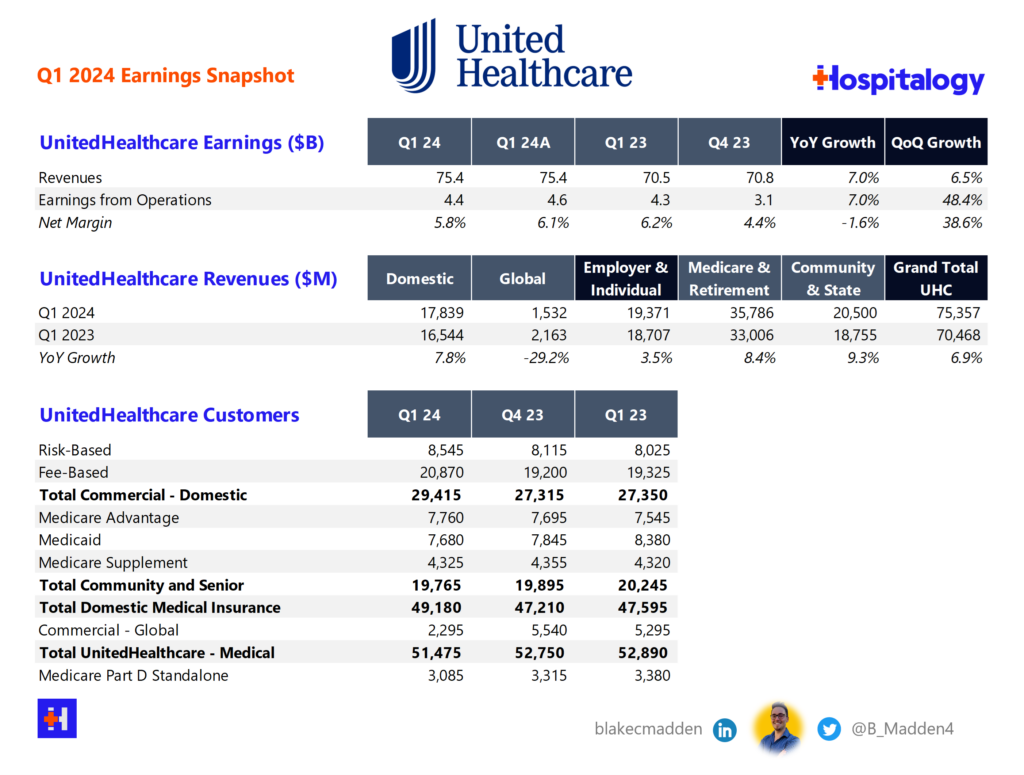

UnitedHealthcare (Insurance segment) key metrics:

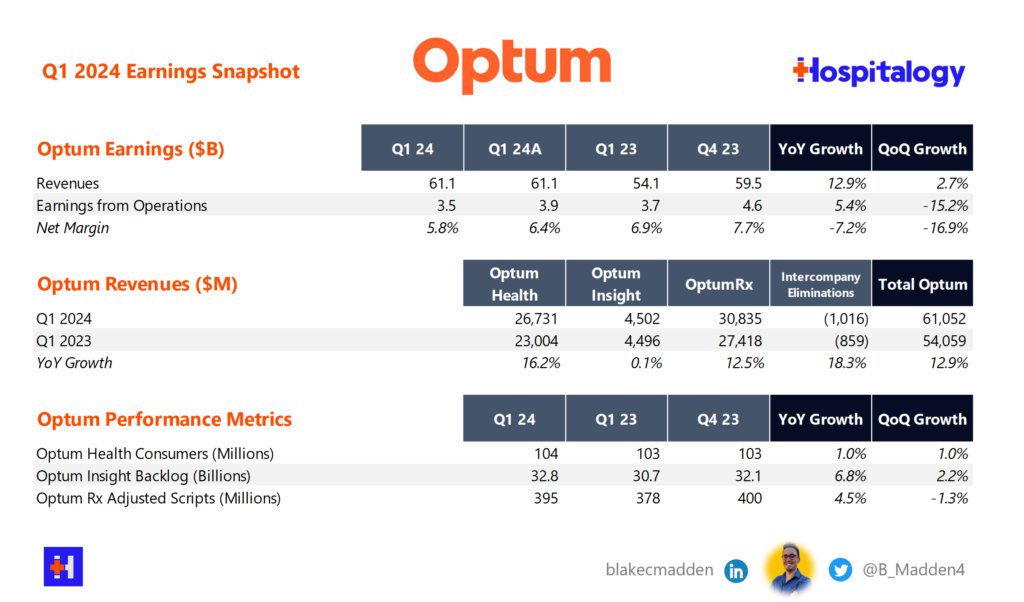

Optum key metrics:

Key themes UHG wanted to get across in its Q1 call:

- Change Healthcare incident was ‘not as bad as it could have been’ since it was a part of the larger UHG enterprise.

- Medicare Advantage needs to be preserved and supported and they’re taking a long-term approach given short-term headwinds.

- Utilization patterns are as expected based on prior UHG commentary late last year – meaning no acceleration from this point, but stabilization at current levels expected moving forward

Optum:

- Optum Health revenues grew 16.2% to $26.7B

- Optum Insight revenues stayed flat at around $4.5B (most impacted by Change incident – $500M of quantified impact)

- OptumRx revenues grew 12.5% to $30.8B

- Overall operating margin is down and has declined sequentially since Q4.

- Robust M&A environment for Optum Health (clearly)

- Rumors around Optum layoffs

- Cardinal Health loses its OptumRx contract, resulting in a big expected loss – 15%+ of Cardinal’s total book of business.

Ongoing Medicare Advantage Headwinds:

- Utilization trends are tracking as expected given UHG’s update from late last year. UHG also thinks the firm priced MA bids appropriately, and while not enthused by the whole MA v28 risk adjustment changes, thinks they’ll be mostly fine.

Other notable tidbits:

- UnitedHealth’s non-cash Brazil operation divestiture resulted in a ~$7B paper loss and knocked down unadjusted net income to ($1.4B). Adjusted net income stayed flat at $5.6B, or 6.1% of revenue.

- Continued strong growth in the commercial book of business

Strategy Spotlight

Key considerations for decision makers. Notable moves, policies, and strategies.

23andMe’s founder Anne Wojcicki is considering taking the company private after dismal declines on the public market.

Multiple ongoing lawsuits to keep an eye on that hold big ramifications for healthcare (yeah, big policy-focused newsletter today! Crazy):

- You should be paying attention to what’s happening with recent ERISA lawsuits (STAT paywall) asking the question – “Are employers liable if they overpay for drugs/healthcare as fiduciaries?”

- Another key point of convergence is happening between EMTALA & abortion and whether federal EMTALA rules trump state abortion bans – along with questions and debate around data associated with abortions. Opinions aside, this issue could have a material impact on the 2024 election.

- Large-scale broker fraud in the ACA marketplace

- Finally, a lawsuit (ModernHealthcare paywall) between Aetna and four Pennsylvania health systems could materially change supplemental benefits plan administration.

Speaking of the FTC, Novant and CHS issued a rebuttal to the FTC’s challenge of the 3-hospital sale to Novant. Meanwhile, the North Carolina AG (governor? Fact check) has joined the FTC in the suit. Unfortunately they won’t have much of a case. Based on my understanding and talking with folks in the state, the FTC in its suit appears to have made up its own market to conclude the entire deal is anti-competitive and creates undesirable market concentration. They’re fighting an uphill battle to win this one, but perhaps the suit is simply a signal to other hospitals and health systems – “We’re coming after you, too and anything smelling like an intra-market sale won’t be easy.”

CMS released its final rule related to requiring minimum staffing ratios, phasing in over a 3-stage, 3-year period:

- CMS is finalizing a total nurse staffing standard of 3.48 hours per resident day (HPRD), which must include at least 0.55 HPRD of direct registered nurse (RN) care and 2.45 HPRD of direct nurse aide care. Facilities may use any combination of nurse staff (RN, licensed practical nurse [LPN] and licensed vocational nurse [LVN], or nurse aide) to account for the additional 0.48 HPRD needed to comply with the total nurse staffing standard.

- CMS is also finalizing enhanced facility assessment requirements and a requirement to have an RN onsite 24 hours a day, seven days a week, to provide skilled nursing care.

- More coverage from HFMA

Partnership Pulse

Collaborations and launches to keep a pulse on

Included Health launches the Specialty Care Clinic, a ‘multicenter, virtual-first clinic that will provide rapid access to medical specialists and comprehensive support for the most prevalent and costly specialty care needs.’

Cedars-Sinai expands virtual healthcare for children & Spanish speakers.

CVS creating new ACO in South Carolina through REACH program through partnership with inVio Health Network (Prisma Health) – moving from MSSP to REACH.

Augmedix, Andor Health collaborate for ambulatory virtual care.

Community Health Network selects Biofourmis to help drive care-at-home outcomes across the continuum.

Hospitalogy Top Reads

My favorite healthcare essays from the week

Tim Fitzpatrick’s roundup from Across the Kidneyverse is a monthly must-read.

MedPAC’s recent report on 340B