Today is day 1 of the new Thursday format. Let me know what you guys think!

As a reminder, the new format for Hospitalogy is as follows:

Tuesdays:

- 1-3 biggest healthcare headlines from the week and associated commentary from me

- Strategy Spotlight (breakdowns of developing trends to keep a pulse on)

- Partnerships Pulse (link roundup of important partnerships & collaborations)

- My favorite healthcare reads

Every other Wednesday:

- Community exclusive deep dive along with upcoming community-only events

- Join the community here!

Thursdays:

- Visual-forward breakdown of a key trend, report, or story

- One trending healthcare topic from the week (social discourse)

- Dollars and Deals (Breakdowns of notable finance and M&A happenings)

- Venture spotlight (all things fundraising, venture, and startups)

Blake’s Breakdown: HCA, Tenet off to Strong 2024

Going a bit deeper on an interesting topic, theme, or resource

We’re all seeing the headlines emerging from UnitedHealth, Humana, and CVS (particularly Humana and CVS, which posted one of the biggest stock declines in its company history, sheesh) around MA struggles along with commentary around utilization stabilizing at current levels:

- “What we’ve seen in orthopedic, cardiac, those kind of categories primarily have been the big factors…So the percentage growth in those was much bigger last year. You’re coming off an environment where both the supply side had been constrained and the willingness of seniors, in particular, consumers to access that environment had been constrained for a couple of years. So those percentage factors were quite significant. You heard us talk about very significant levels on those double-digit levels of last year as we looked at those. The way we look at those really, though, is because you would expect that to start normalizing in terms of the percentage change.” UnitedHealth Group Q1 2024 earnings call

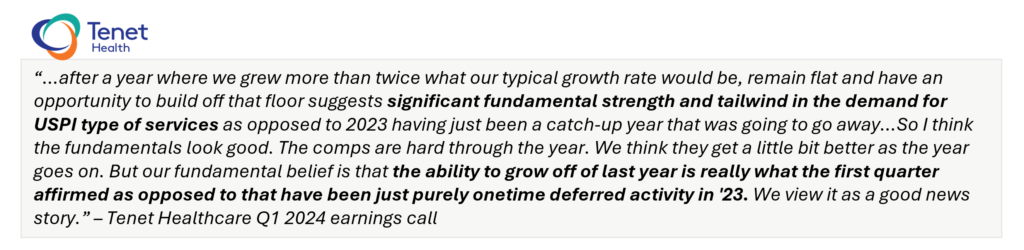

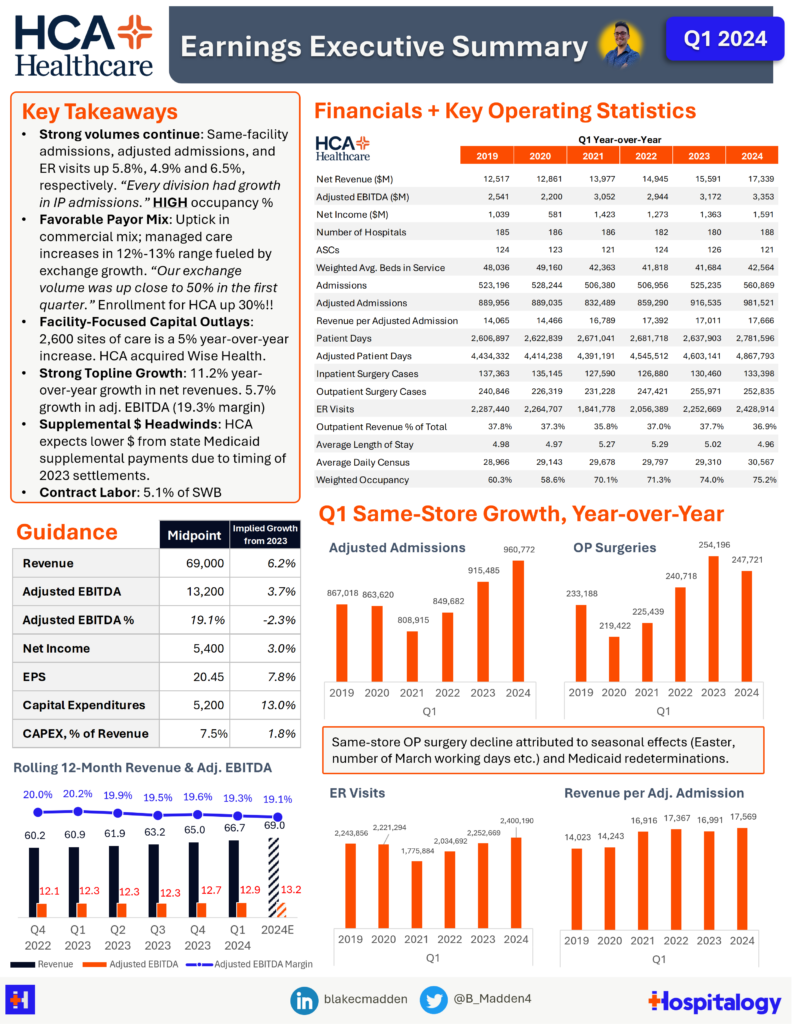

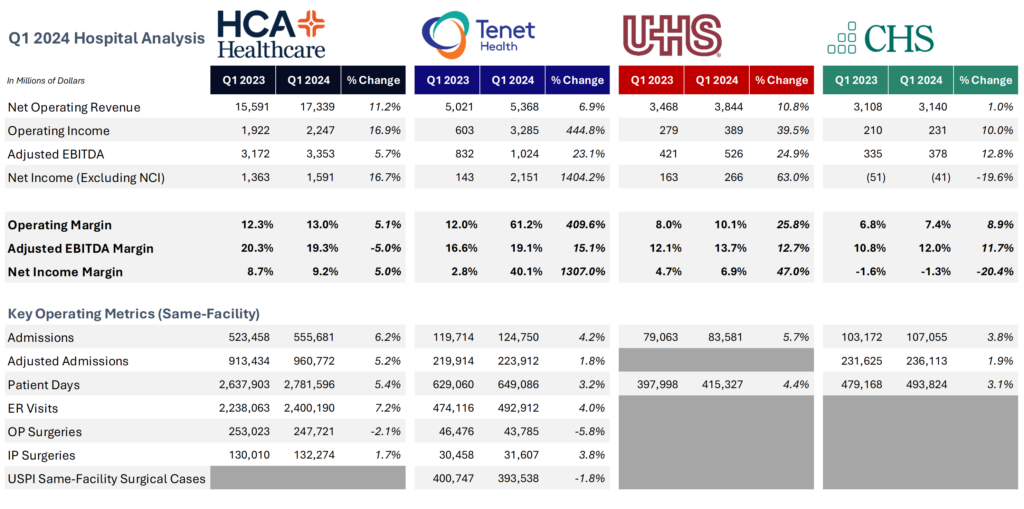

Naturally, the other side of that utilization equation means health systems and organizations positioned to capture volumes and continue their recovery…will do so. So, HCA and Tenet are two obvious outsized beneficiaries and we saw that effect play out on Q1 results. Tenet in particular way outperformed expectations in Q1 and is excited about the current operating environment with rising volumes.

Interestingly, while HCA outperformed financially, the hospital giant DID see a small decline in outpatient surgeries. Management attributed that trend to lost volumes from self-pay and Medicaid redeterminations along with some calendar dynamics with Easter falling in Q1. But I do think the outpatient book of business is a key area to watch moving forward given intensity of competition in the outpatient setting.

Moving forward, from Q2 onward, we should see growth (in percentage terms) taper off, given elevated utilization trends started in Q2 of 2023. That dynamic is reflected in UnitedHealth Group’s commentary above.

“USPI’s first quarter adjusted EBITDA grew 16% compared to last year, and its adjusted EBITDA margin continues to be very strong at 39.6%. USPI delivered a 6.4% increase in same-facility system-wide revenues compared to first quarter of 2023, with same-facility system-wide net revenue per case, up 6.8%, driven by high levels of acuity. This was partially offset by a modest decrease in surgical case volume of 0.4%, in line with our expectations. As we noted last quarter, we are expecting growth in cases to build over the year, due to the significant volume performance we saw in the first quarter of 2023.” – Tenet Healthcare Q1 2024 earnings call.

Tenet also sold a boat load of hospitals for a pretax $3.9B – 9 hospitals to 3 systems for exceedingly favorable valuations, and $2.5B of that operating income recognized in Q1 stems from that.

Here’s an extra comparative table, just because I like you guys:

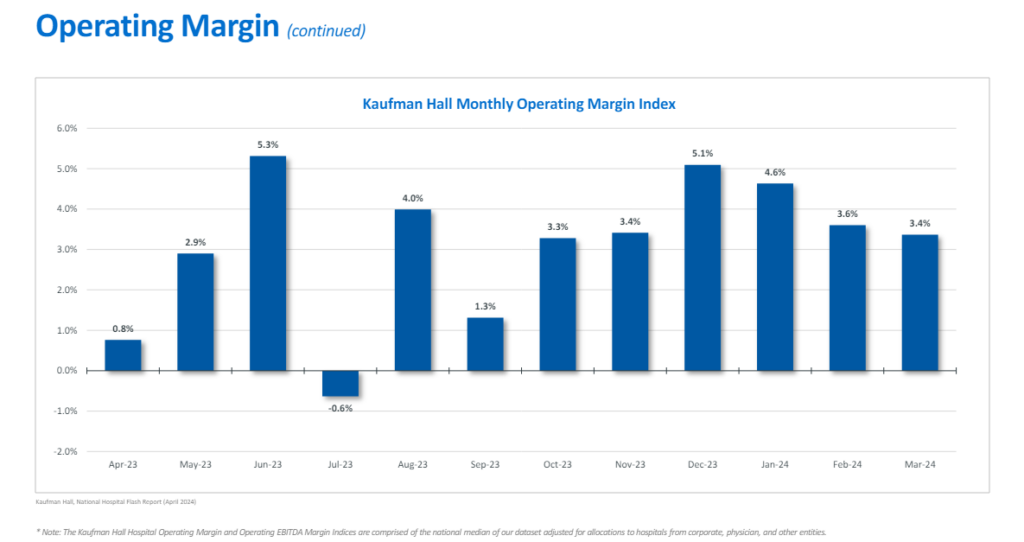

From a broader hospital perspective, financial recovery post-pandemic continues to see a positive trend despite a recent dip in March, per Kaufman Hall’s latest hospital flash report:

What’s Trending in Healthcare

Social discourse and conversations from around healthcare

Dan Diamond’s thread on UnitedHealth Group’s CEO Andrew Witty testifying related to the Change Healthcare hack and antitrust. Can you believe Change Healthcare didn’t have multi-factor authentication set up?

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Aledade’s Farzad Mostashari’s tweet storm on Walmart Health and primary care.

3. Community Update

The latest from inside my community of healthcare thinkers

Yesterday, I released the first official Hospitalogy quarterly industry update, hitting on major themes and strategies for payors, health systems, and more including all the big headlines and stories from Q1. It’s a ~30 or so page report sent exclusively to Hospitalogy community members, and given the amount of hours I put into it, probably worth the cost of annual membership by itself! You can get it by signing up for the community here, which gets you access to reports like these along with networking opportunities, monthly masterminds, and fireside conversations with interesting professionals across healthcare.

Dollars and Deals

- Podcast: The state of mergers & acquisitions in healthcare, from Baker Tilly

- For-profit health systems’ selling spree continues.

- Healthcare M&A and Financing Trends and Predictions for 2024 outlined | Goodwin

- Healthcare Trends & Transactions Q1 2024 examined | Bass Berry & Sims

- Health Care Valuation Effects of Buyer Concentration explored | Weaver

- CVS scoops up tech-enabled Medicare Advantage broker Hella Health.

- Prime Healthcare Services, Inc. completes real estate purchase of hospitals and medical office buildings from Medical Properties Trust.

- Elevance is acquiring the Centers Plan for Healthy Living in New York.

- CHS sells Tennessee hospital for $160M.

- ShiftMed acquires CareerStaff Unlimited to bolster nursing platform.

- DrFirst acquires Myndshft Technologies to revolutionize medication management by addressing both pharmacy and medical benefits.

- Private Equity HC Bankruptcies are rising.

- UCSF Health breaks ground on $4.3B hospital.

- Advocate sells remote monitoring company it bought for $290M.

- Acadia Healthcare reports first quarter 2024 results, affirms full year 2024 guidance.

- Atria Heart of Scottsdale joins expansive cardiology network, Cardiovascular Associates of America.

SPONSORED BY WELLSKY

Struggling with the efficiency of post-discharge visits?

You’re not alone—we’re seeing this play out across the entire industry.

The introduction of Medicare’s Transitional Care Management (TCM) program has put a spotlight on the need for streamlined post-discharge processes, and WellSky’s platform is here to help!

It fits right into your existing workflow, simplifying the TCM process by automating the tracking and management of patient visits.

With WellSky, providers have captured 49% more encounters, built over 44% more revenue, and reduced readmissions by nearly 3%.

Boost your post-discharge efficiency with WellSky and see the difference it can make in your patient outcomes.

Venture Spotlight

Notable Startups and Fundings

In this week’s iteration of “how many action verbs for fundraising can AI come up with??”

- Innovaccer is in talks to raise $250 million in new funding, backed by Tiger Global per TechCrunch.

- Transcarent raises $126 Million in a Series D valuing the company at $2.2B. The Tullman effect strikes again!

- Lumeris secures $100M for value-based care strategy. I love these guys and they’re doing some great work. $100M is a whopper.

- Avive pockets $57M for portable defibrillator development to speed up cardiac arrest response.

- Midi Health raises $60M in a Series B to address menopause.

- Two Chairs raises $72M Series C in equity and debt to scale its therapist network. Shout out to Jake Powell (Hospitalogy community member) and co!

- Kontakt.io raises $47.5M from Goldman Sachs for healthcare spatial data management.

- AccessHope secures $33 Million in Series B Funding to expand access to leading cancer expertise.

- Amae Health picks up $15M to scale in-person clinics providing care for severe mental illness.

- Clarity Pediatrics announces the expansion of Virtual Pediatric ADHD Platform and $10M in Funding.

- Alaffia Health raises $10M to supercharge health plan operations with generative AI.

- Summer Health raises $11.65M in Series A Funding.

- Dot Compliance scores $17M for its AI-driven eQMS platform.

- LunaJoy Health launches ‘LunaCare’ for women’s mental health and secures funding for expansion (amount not specified).

- Ilant Health extends its seed round to $5.5 million, attracting new investors and accelerating growth.

- Auxa Health secures $5.2 million in funding to drive benefit navigation.

- Handl Health secures $2.5M in Seed Funding to drive innovation for the employer-sponsored benefits ecosystem.

Thanks for reading! Subscribe to Hospitalogy, my newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!