Diverging Payor Performance during Q1 2024 Earnings Season

I broke down HCA and Tenet’s Q1 performance last week here, so I wanted to quickly touch on payors as well now that the major ones have released their earnings reports.

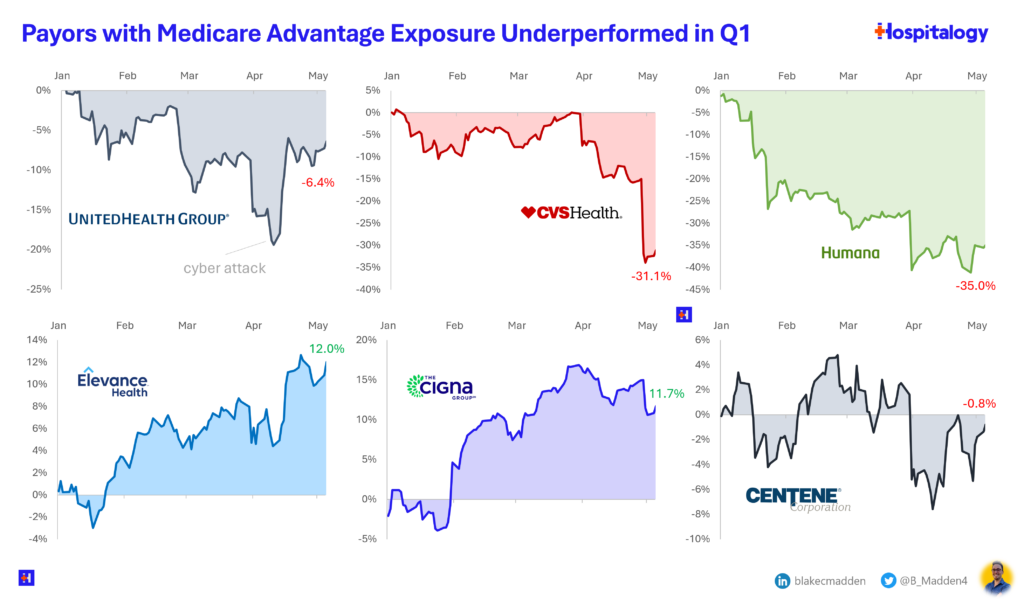

Long story short, payors with exposure to MA in Q1 struggled, unless you’re named Centene or Alignment, and payors with stable commercial books of business have barely outperformed the broader market (~9% or so).

Jeff DelVerne and Jared Strock separately do great jobs of diving into the details and analysis behind payor results. Click on those links for recent summaries and visuals from them.

Side note. I absolutely love the newsletter Chartr, so I took a little bit of inspiration from them for this chart:

I also enjoyed this note from HTN as well on CVS investor expectations: It’s worth remembering that during their Q4 2023 earnings call in February, CVS leadership suggested that its Medicare Advantage book of business would be “marginally profitable” in 2024. So within a three-month period, CVS leadership saw the Medicare Advantage book of business go from a 0% profit margin expectation to a -3% to -4% profit margin expectation for the year. On top of that, given the headwinds the business faces in 2025, CVS doesn’t expect to be able to get to profitability until 2026. Even with a meaningful pricing action in 2025, they expect to improve profitability by up to 2%, meaning they’ll be around -1% in 2025. By my math, that means CVS is looking to at least 2027 before it is back to its profitability target of 4% to 5%. All of that just goes to highlight how big of a miss this was here. – HTN weekly reads 5/5/24, my emphasis added

Oh…and Oscar Health is…profitable. Here’s my breakdown of their comeback. Very cool to see!

Strategy Spotlight

Key considerations for decision makers. Notable moves, policies, and strategies.

UnitedHealth Group’s Andrew Witty shed light on their disclosed 90,000 ‘aligned’ physician breakdown: 10,000 are directly employed, while the other 80,000 I imagine are aligned via MSO-PC relationships under corporate practice of medicine state doctrine.

Steward Health Care files for Chapter 11 bankruptcy and looks to reorganize after driving its hospitals into the ground.

AHA releases a report on rising hospital costs.

UPMC to cut 1,000 roles.

Intermountain Health exits Kansas.

Medicaid redeterminations losses exceeding predicted levels in some states.

Hospitals grapple with an ongoing radiologist shortage.

The list of 25 most popular drugs in healthcare.

National trends in prescription drug expenditures and projections for 2024.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

UnitedHealth, Walmart halt shared Medicare Advantage plan (expected after Walmart Health shutdown).

Final rules look to streamline the prior authorization process, but issues remain | KFF.

Women’s health company Tia restructures leadership as it eyes operational growth.

Nonprofit hospitals aren’t immune to FTC’s noncompete ban, lawyers, Fitch analysts say.

Supreme Court appears skeptical that state abortion bans conflict with federal health care law.

Whatever happened to Biden’s public option? – KFF Health News.

Equinox adds Function Health Lab Tests.

Ro launches ro.OS | Powering quality care at scale.

Partnership Pulse

Collaborations and launches to keep a pulse on.

Thyme Care recruits a palliative care physician from Mount Sinai to launch enhanced supportive care services.

Bon Secours Mercy Health and Compassus finalize hospice and home health partnership.

NuvoAir Medical partners with Privia Medical Group in Georgia to help transform cardiopulmonary care with a virtual-first care model.

Talkspace unveils new brand identity alongside Mental Health Awareness Month.

Healthie and Dock Health integrate to drive operational efficiencies and enable workforce resiliency with its HIPAA-compliant work management platform.

ScionHealth partners with Cost Plus Drugs. Cost Plus Drugs also teams up with Vivid Clear Rx to increase access to low-priced prescriptions.

BrightStar Care dives further into hospital-at-home care, expands partnership with Medically Home.

Talkspace launches a behavioral health consortium of specialized care and treatment programs, expanding in-network offerings for members.

Walgreens launches gene and cell services as part of newly integrated Walgreens Specialty Pharmacy Business.

Atlantic Radiology New Hampshire contracts with Healthcare Administrative Partners for comprehensive revenue cycle and practice management services.

Outset Medical’s TabloCart with Prefiltration receives FDA 510(k) Clearance | Outset Medical, Inc.

GE HealthCare’s MIM Software collaborates with Elekta to help enhance radiation therapy treatments and improve patient outcomes.

NeuroFlow launches perinatal and postpartum care pathways to fill critical gaps in maternal mental health care.

PocketHealth announces free access to medical imaging records for patients across Canada and the U.S.

Big Bend Hospice, Tallahassee Memorial HealthCare partner on a transformative approach to transitional care.

VirtualHealth and MDI Health Technologies announce partnership with AI features to optimize medication management.

Truveta unveils new mother-child data set to support maternal, pediatric health research.

Hospitalogy Top Reads

My favorite healthcare essays from the week

Expanding VBP: Fixing Design Flaws | Health Affairs Forefront.

Navigating the Mental Health Tech Ecosystem: A Primer

VMG Health’s (my old firm!) 2024 Healthcare M&A Report