You guys know I love the enablement space, and the value-based care space at large.

I often follow Privia, agilon, and Astrana closely on the public markets. I wrote about Oak Street Health’s model and financial prospects at length. And, of course, I’m always on the hunt for emerging major players in the space – many of whom are detailed in the sections below and will threaten incumbents or forge new paths as the space continues to evolve.

Finally, you all know I hold blind optimism for health systems to engage!

Overall, I really enjoy writing about value-based care in general given the countless hot takes about its viability, the constant investment into different segments, and business model innovation happening on what seems to be a quarterly basis.

So, here’s an extra special deep dive for Hospitalogists on everything enablement in 2024. I’m covering Privia’s and Astrana’s Q1 and recent conference commentary as well as ongoing trends across private and public markets.

State of Enablement in 2024: Executive Summary

Enablement and other value-based care players are facing headwinds in Medicare Advantage stemming from risk adjustment and elevated utilization trends.

In contrast to Medicare Advantage, investment dollars from both financial and strategic backers continue to flood the enablement space in other arenas. Opportunities are abundant across traditional Medicare (ACO REACH), Medicaid, and new alternative payment models as CMMI continues to churn them out (e.g., ACO Primary Care Flex, Making Care Primary).

Data analytics and increasing use of AI are unlocking strategic insights, allowing for administrative efficiencies and driving down total cost of care.

Value-based care 2.0 will include specialty care in a big way, and mature/emerging specialty areas include kidney care, oncology, MSK, and cardiology.

All players – including health systems – need to keep an eye out for future models requiring mandatory participation (like the currently proposed TEAM model)

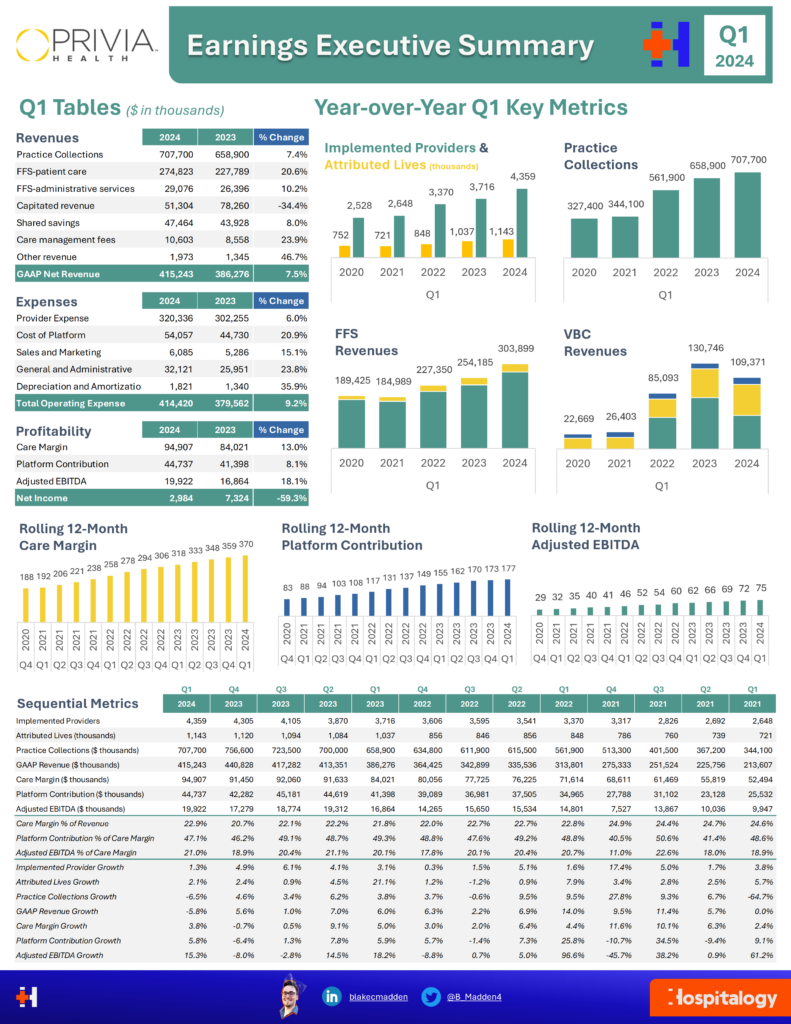

Privia’s Q1 – despite a VBC pullback, Privia continues to hit the singles and doubles

As a stark contrast to most companies that went public during the same low-interest rate environment era, Privia actually knows what it’s doing and how to run a profitable, capital-efficient company.

Still, Privia hit some speed bumps in Q1. During Q1 Privia noted a substantial pullback from some Medicare Advantage (capitated revenue) contracts given the unfavorable environment in the space. Some investors – and plenty of industry analysts – observed this move as a narrative violation perhaps given Privia’s prior rhetoric around value-based care and being an enablement player. While I’m sympathetic to that argument, we also should acknowledge the flexibility of Privia’s business model to do what’s in the best interest financially of both itself and its physician partners.

It’s called risk for a reason, and Privia wants to take downside risk where it holds dense market presence, and in environments when it makes sense to do so. This quote about full downside risk was particularly interesting, and it makes logical sense to me that the provider would want the payor to have some skin in the game:

- We’ve always held a view that 100% capitation is probably not the best way to take risk downstream. We prefer deals where the payer has skin in the game, we as the intermediate entity has skin in the game and the physician performing in those deals have skin in the game. And we split our economics 60-40 with our docs. And we prefer in all instances ideally that the payer also has some skin in the game and economics. And that’s because then you don’t have any irrational factors influencing outcomes. So I think there’s been this notion that 100% capitation is probably the best way to take — assume risk downstream, and we just don’t have that viewpoint here.

Privia CEO Parth Mehrotra’s commentary here leads me to wonder which enablement players are blindly taking on full risk as payors are gladly delegating those premium dollars to lock in their medical loss ratios. I bet we find out in the near future!

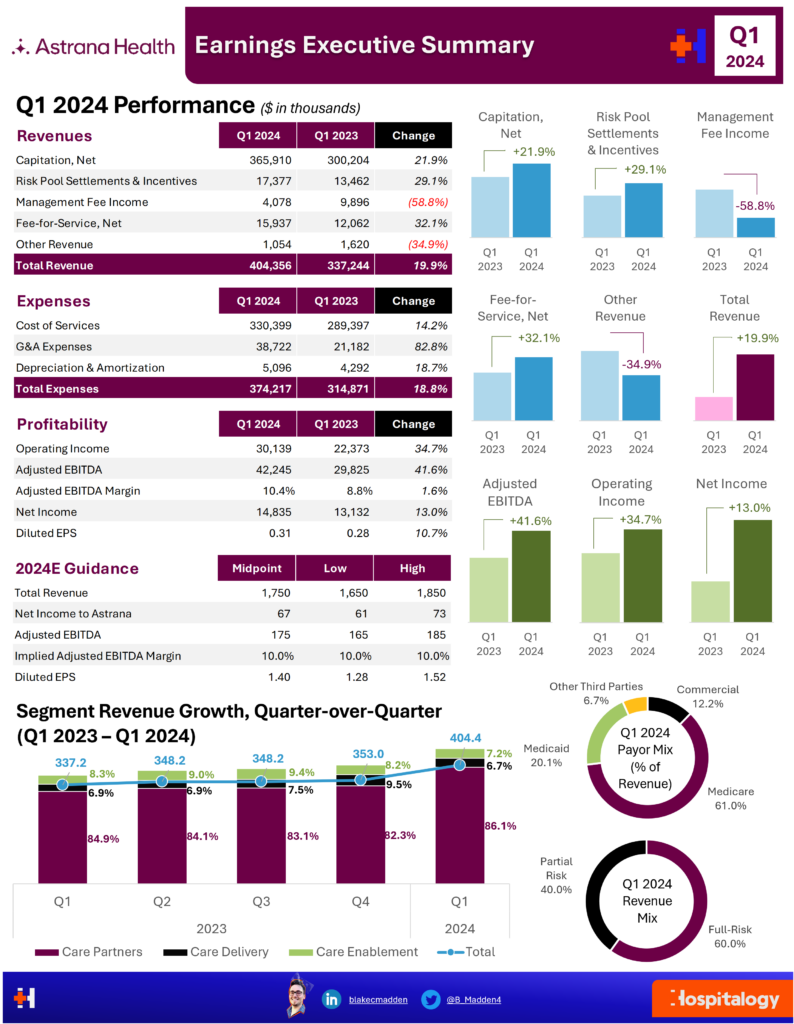

Astrana Health – the company formerly known as ApolloMed

Astrana has had a busy start to the year! Between updating its segment reporting, closing its largest acquisition to date, and posting a great first quarter, Astrana is a fun name in the enablement and value-based care space to watch. You might not know much about Astrana, but their management team is doing everything they can to change that. Astrana has been operating for almost four decades and has a long track record of success in California as a risk-bearing organization. The firm is a well-diversified, stable, and …ahem…profitable player in the emerging enablement & value-based care space, working across all payor types.

In the first quarter alone, Astrana noted 20% topline revenue growth and 42% growth in adjusted EBITDA:

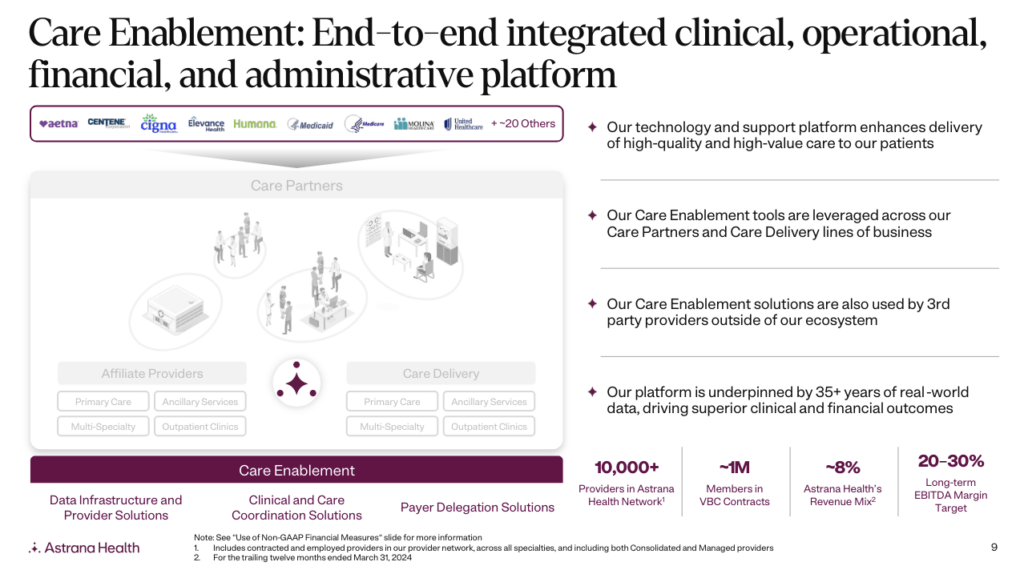

Astrana’s new segmentation: Care Partners, Care Delivery, and Care Enablement.

Along with the strong financial metrics, I’ve noticed Astrana is one of the most forthcoming healthcare companies when it comes company disclosures and transparency. The firm reports on everything I could ask for in its investor presentations and quarterly breakdowns.

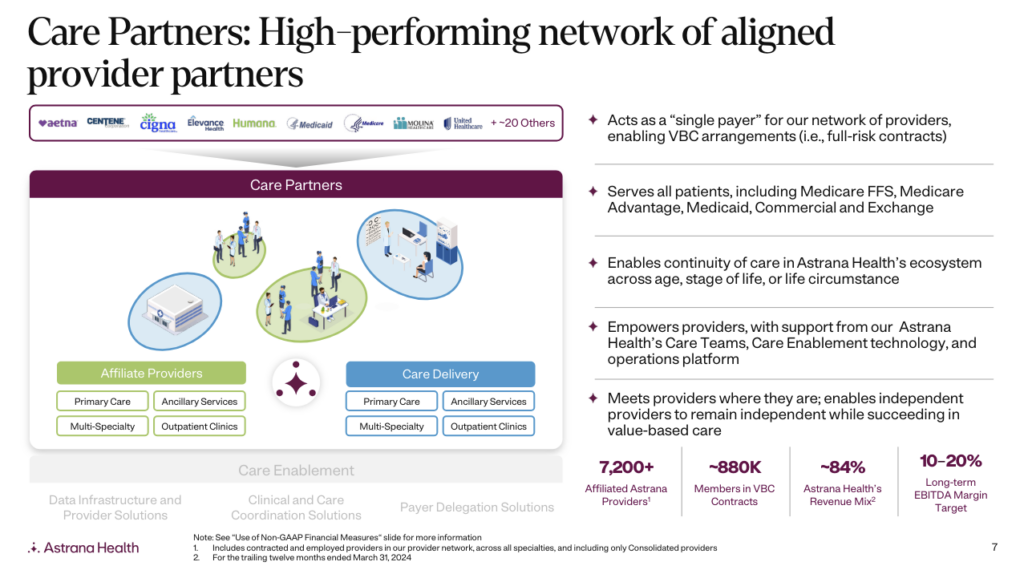

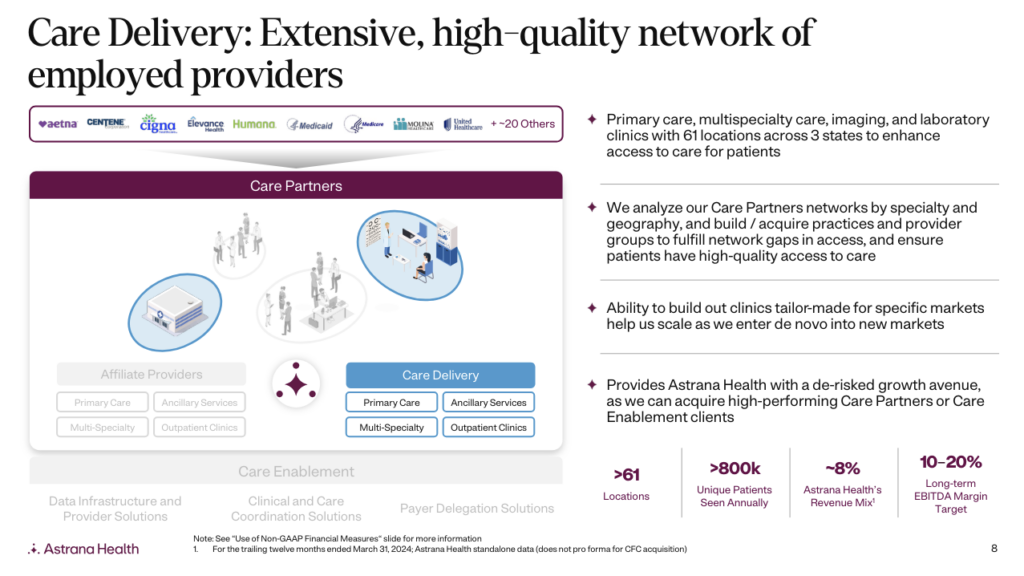

To that end, to help better understand Astrana’s business model, their team did us (and investors) a favor by starting new segment reporting. Here’s a quick layman’s breakdown of their newly identified segments and how you can better understand how Astrana operates through 3 segments:

Care Partners: Astrana’s provider alignment segment – its affiliate network model. Currently 7,200+ providers are affiliated with Astrana-run networks. This segment is Astrana’s largest and has historically been its bread and butter, affiliating with a number of IPAs. From Astrana’s 10-Q:

- The Care Partners segment is focused on building and managing high-quality and high-performance provider networks by partnering with, empowering, and investing in strong provider partners aligned on a shared vision for coordinated care delivery. By leveraging the Company’s unique care enablement platform and ability to recruit, empower, and incentivize physicians to effectively manage total cost of care, the Company is able to organize partnered providers into successful multi-payer risk-bearing organizations that take on varying levels of risk based on total cost of care across membership in all lines of business, including Medicare fee for service (“FFS”), Medicare Advantage, Medicaid, Commercial, and Exchange. Through the Company’s network of “independent practice associations” (“IPAs”), “accountable care organizations” (“ACOs”), and Restricted Knox-Keene licensed health plan, the Company’s healthcare delivery entities are responsible for coordinating and delivering high-quality care to the Company’s patients and ensuring continuity of care in Astrana’s ecosystem across age, stage of life, or life circumstance. Beginning in 2024, in addition to participating in the ACO REACH Model, the Company began participating in the Medicare Shared Savings Program (“MSSP”). The MSSP was created to promote accountability and improve coordination of care for Medicare beneficiaries.

Care Delivery: Astrana’s full-risk segment – owned clinics and employed providers, where Astrana can take on the highest level of risk revenue (capitation). Astrana has noted it wants to continue to move toward the ownership model, believing this path affords it a higher level of levers to maintain care quality and is also more favorable from an economic standpoint. From Astrana’s 10-Q:

The Company’s Care Delivery segment is a patient-centric, data-driven care delivery organization focused on delivering high-quality and accessible care to all patients. The Company’s care delivery organization includes primary care, multi-specialty care, and ancillary care services. This segment includes the following:

- Primary care clinics, including post-acute care services;

- Multi-specialty care clinics and medical groups, including hospitalist, intensivist, and physician advisory services, cardiac care and diagnostic testing, and specialized care for women’s health; and

- Ancillary service providers, such as urgent care centers, outpatient imaging centers, ambulatory surgery centers, and full-service labs.

Care Enablement: Finally, Astrana’s proprietary end-to-end tech stack powers clinical, financial, and admin operations. Astrana’s Care Enablement segment is a lighter, less sticky touchpoint with providers, but also tends to be its highest margin offering. From Astrana’s 10-Q:

The Company’s Care Enablement segment is an integrated, end-to-end clinical, operational, financial, and administrative platform powered by the Company’s proprietary technology suite that enhances the delivery of high-quality, value-based care to patients and leads to superior clinical and financial outcomes. The Company provides solutions to providers, including independent physicians, provider and medical groups, accountable care organizations, and payers, including health plans and other risk-bearing organizations. The Company’s platform meets providers and payers where they are, with a wide spectrum of solutions across the total cost of care risk spectrum, ranging from solutions for fee-for-service entities to hospital-shared risk-bearing entities, and across patient types, including Medicare, Medicaid, Commercial, and Exchange patients. This segment includes the Company’s wholly owned subsidiaries which operate as management services organizations (“MSOs”), which enter into long-term management and/or administrative services agreements with IPAs, ACOs, clinics, or independent providers. By leveraging the Company’s care enablement platform, providers and payers can improve their ability to deliver high-quality care to their patients and achieve better patient outcomes.

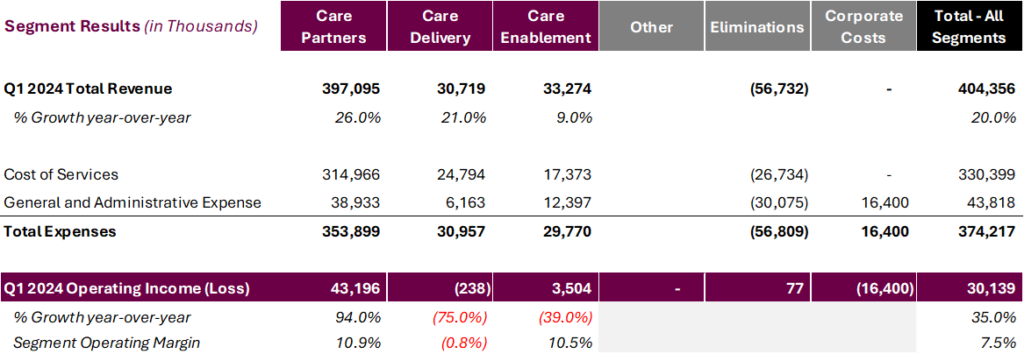

As you can see in the segment table breakdown below for Q1 2024, Astrana’s Care Partners segment is its largest by far – generating $397.1M in revenue in the first quarter of 2024 prior to eliminations, which is a 26% increase year-over-year:

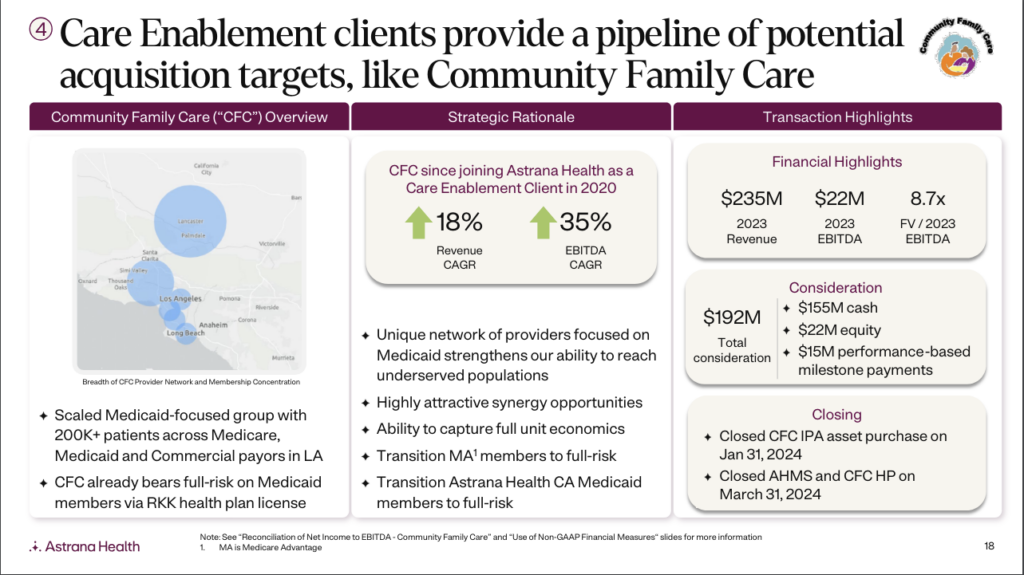

The final interesting point I’ll note about Astrana (and enablement players in general who want to go down this path, too) is its unique M&A strategy – as a natural extension of partnerships with clinics. Astrana’s CEO Brandon Sim mentioned this natural pipeline at a recent investor conference. Community Family Care was a Care Enablement customer for Astrana. Over the course of 3.5 years, Astrana’s tech platform helped the practice grow in sophistication enough to the point where Astrana felt there was a great acquisition opportunity.

So during Q1, Astrana closed on its largest-ever acquisition of Community Family Care – which was already in the Astrana ecosystem and therefore leads to quicker integration and less hassle from the providers’ standpoint.

Astrana has steadily been increasing its M&A pipeline, also noting the close of Prime Community Care of Central Valley to its Care Partners Segment (”PCCCV” – which is quite the acronym)

Public Markets are Chronically Impatient with the Enablement Space

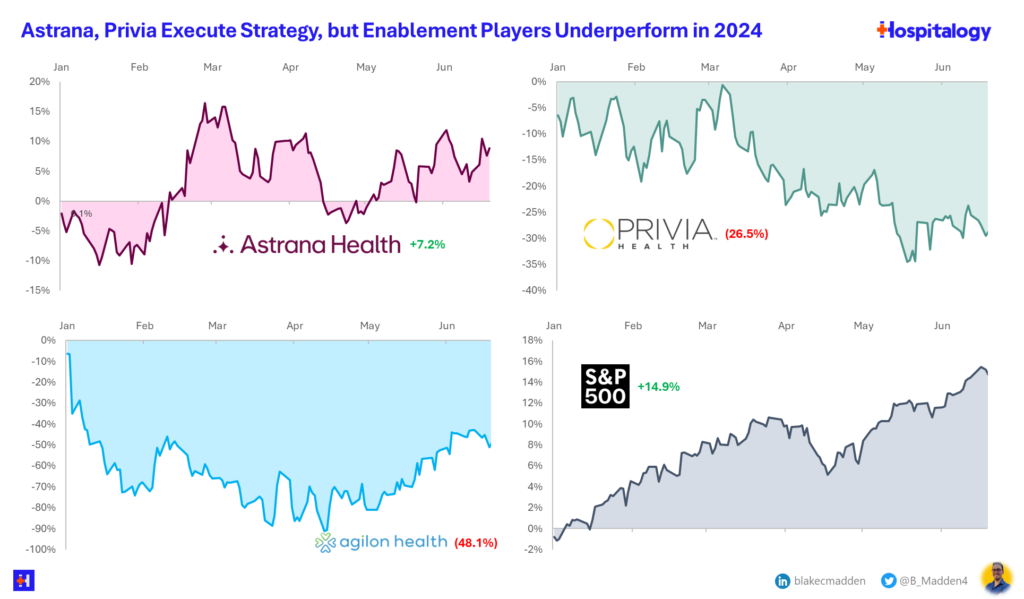

Despite the relative operating success for both Privia and Astrana (at least in my mind – also, we won’t talk about agilon), the public markets are impatient. Both Privia and Astrana, despite executing well in Q1, are underperforming the broader markets. Some theories for this include macro conditions at play, like the Medicare Advantage headwinds affecting payors at the highest level. Even so, given the unit economics and cash efficiency of these businesses, along with their increasing payor-diverse presence, enablement players will continue to execute.

What’s next for the Enablement Space – Recent Investments, and 2024 2H Outlook

What about the private markets, and what’s next in the second half of 2024 and beyond?

The below graphic is a great overview of the enablement space as put together by HMA’s and Leavitt Partners’ Kate de Lisle and colleagues. Download the full report here. What you need to know is that despite perceived headwinds in MA, CMS and CMMI aren’t slowing down new alternative payment model (APM) initiatives, nor are the agencies balking at the 2030 goal of getting every Medicare beneficiary in an accountable care relationship. Over the past year alone, CMMI has announced 8 new APMs. They are throwing a ton of darts at a number of programs across the landscape.

As a result, this setup allows for a robust ecosystem of enablement players – and investment dollars – to enter the space at the large perceived opportunity. For instance, Pearl Health raised a $75M series B in early 2023. In March 2023, Wellvana announced an $84M raise. Then in April 2024, Lumeris raised a whopping $100M growth equity round. Tim Fitzpatrick does a great job covering the kidney care space, and many players there have raised hundreds of millions of dollars. In oncology, Thyme Care secured $60M halfway through 2023. Finally, don’t forget about the move Elevance Health made with CD&R to create an enablement player at scale with 1 million-plus members and intent to purchase the asset in the next 5-7 years. There is an incredible amount of financial and strategic interest in the enablement and value-based care space especially as utilization management and total cost of care initiatives drive the puck for payors in 2024.

Between Medicare Advantage money tightening and as newer APMs demand more from value-based care players, the need for more data insights, and the ability to leverage AI to drive down total cost of care will provide massive benefits to those who can leverage those resources correctly. Gone – or disappearing – are the low-hanging fruit days where a risk-bearing entity could shift site of service (e.g., HOPD → ASC) to generate savings. The market will increasingly favor those who can leverage capital-efficient solutions to drive utilization changes at scale.

Utilization trends among patients are at an all-time high post-pandemic, and this is the new paradigm within value-based care world. Emerging winners in the enablement space will be the ones with the ability to find patterns in patient cohorts to avoid costly ED visits, identify/stratify high-needs patients to shift resources to those individuals, and repeat these steps in multiple markets to scale effectively. Easier said than done!

The Final Frontier: Value-based Specialty Care as Kidney Care Leads the Way, and some roadblocks

Finally, along with the advanced primary care players, the specialty VBC market is vibrant and growing in interest given the outsized spend specialists generate in healthcare. While advanced primary care alone can offer cost savings and preventive services, coordination into the specialty care world will drive significant savings for those who can do it effectively in the value-based care 2.0 ballgame.

The above list of VBC specialty players is a non-comprehensive list, and I’m sure there are countless others I’m missing in areas like behavioral health or hospice (if you are in the space, give me a shout!)

But the most mature segment here lies in the kidney care space, which sees material dollars and holds the potential to generate material downstream savings to help patients with chronic kidney disease. The CKD space has also seen significant commercial traction with payors, including large-scale partnerships and M&A (Interwell). A recent report published by Humana found patients in VBC arrangements avoid the hospital at a 5% lower rate than comparable fee-for-service counterparts. For the CKD cohort study, Humana saw its medical loss ratio drop more than 12%. For an enterprise with that much revenue, percentage changes like these are incredibly significant.

With the amount of excess spend – both administratively and via over-utilization – in a fee-for-service heavy specialist world, there is rampant opportunity to align specialists to value-based care goals while maintaining or even enhancing – high quality patient care. Easier said than done given most physicians operate on wRVU, procedurally-driven productivity compensation models. Physician compensation is an incredibly important issue to resolve when it comes to value-based care arrangements, and I fear we have barely scratched the surface here.

That’s all for this write-up. If there’s any extra stuff you’d like to include, I know I have a lot of Hospitalogy readers who sit in the enablement and value based care space, both from an investor and operator standpoint. Please let me know your viewpoints on the above and more!