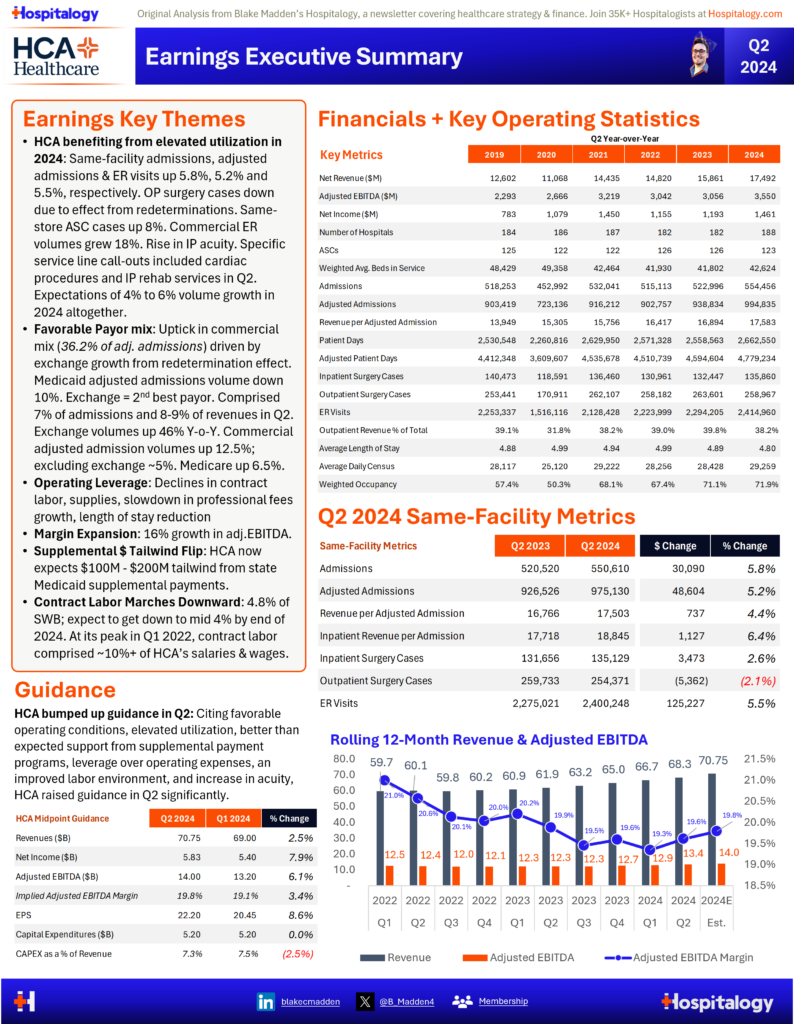

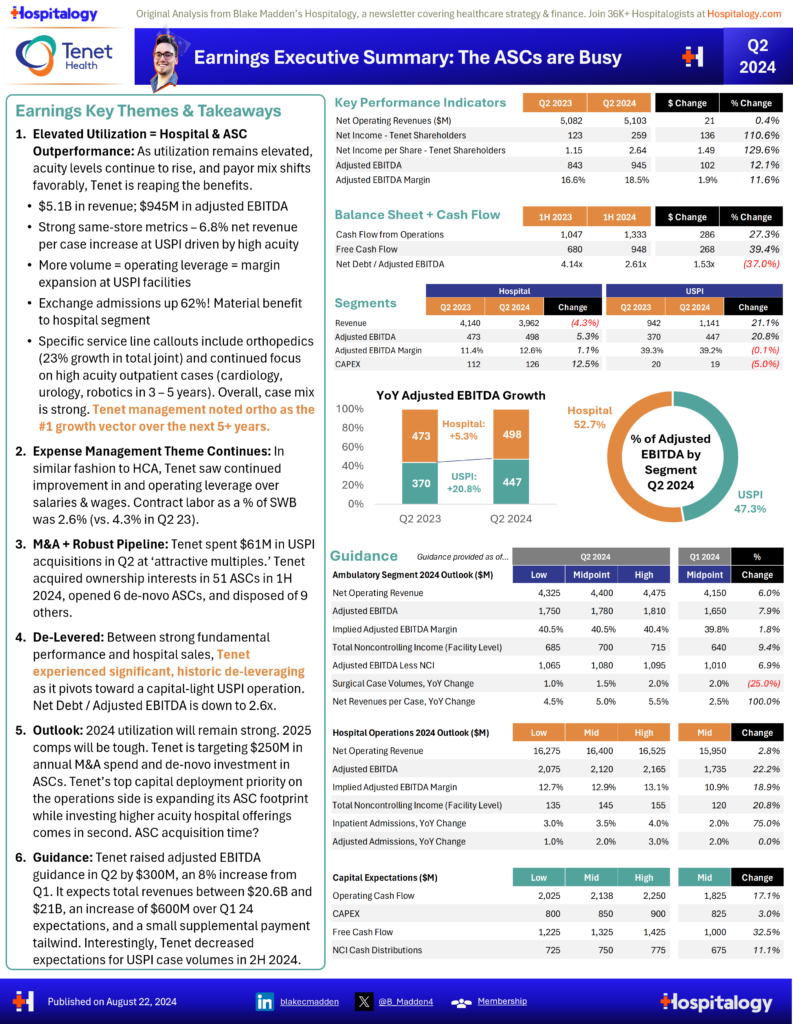

The main themes continue to be the main themes for hospitals: utilization is up, acuity is up, exchange volumes are providing material boosts to hospital margins, and contract labor has hit a trough, leading to significant margin expansion in most large health systems.

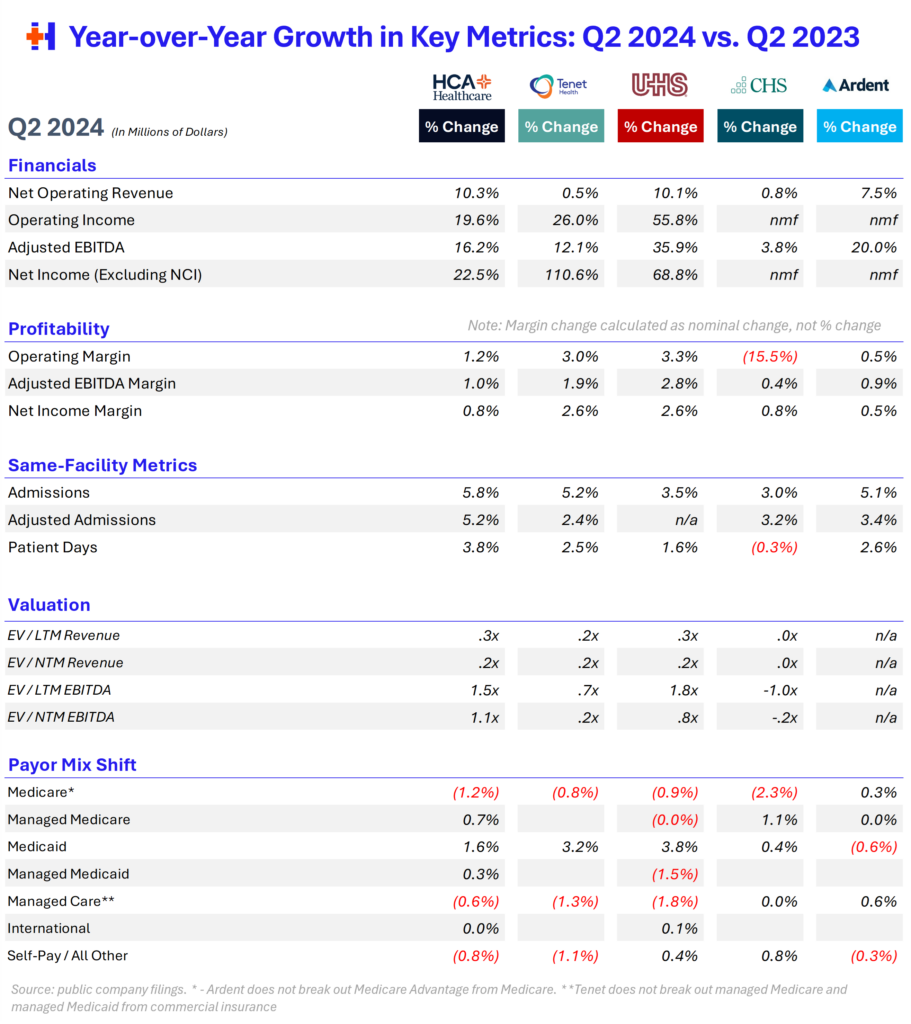

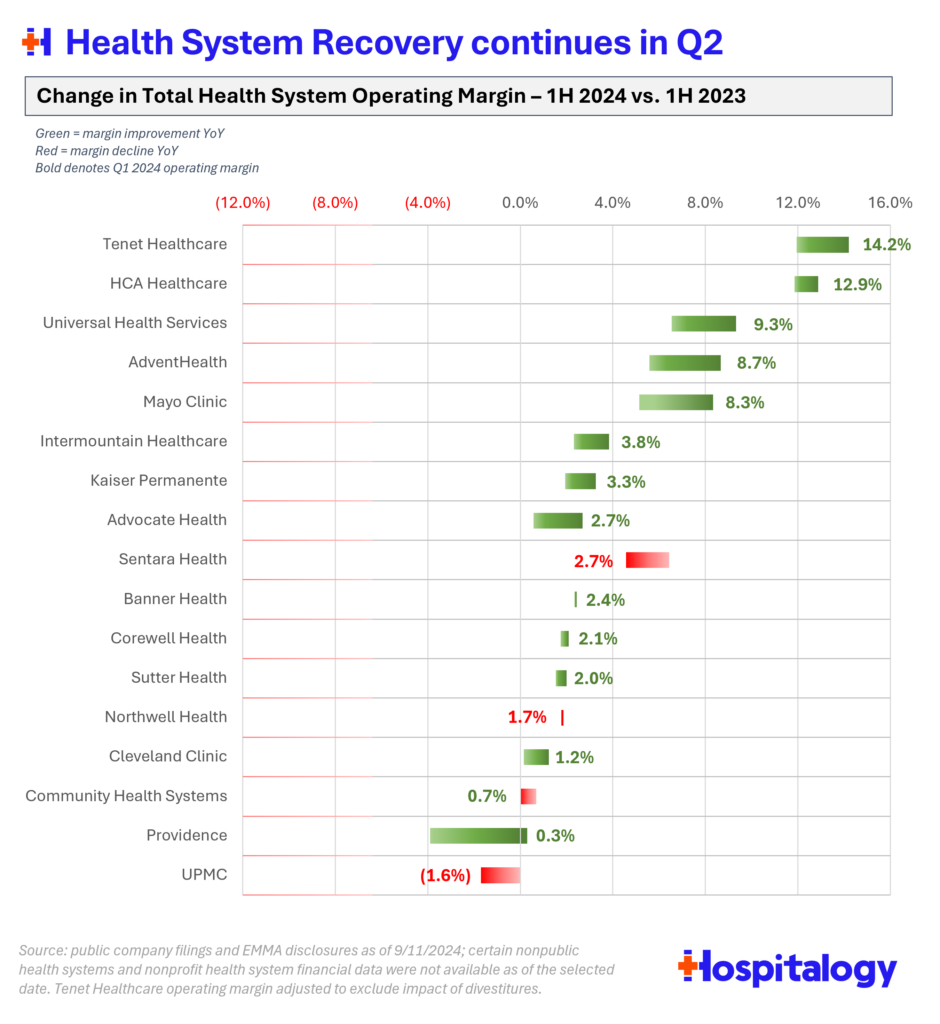

Adding to this thought, the trend in the table below is abundantly clear: publicly traded hospitals (and large regional & academic nonprofit health systems) are enjoying a nice season of margin recovery, as every single hospital operator saw adjusted EBITDA and net income margin expansion. Same-facility metrics continue to hold strong – and remember, Q2 2023 was when the elevated utilization trend really kicked in, so these results are pretty telling. Meanwhile, average length of stay dropped across all operators, signaling more capacity in the post-acute space.

The table below depicts year-over-year growth for various key metrics during Q2 2024 vs. Q2 2023 reported uniformly across operators. Each column represents that hospital operator’s growth/change over the prior period:

Key theme continuation for Hospitals in Q2

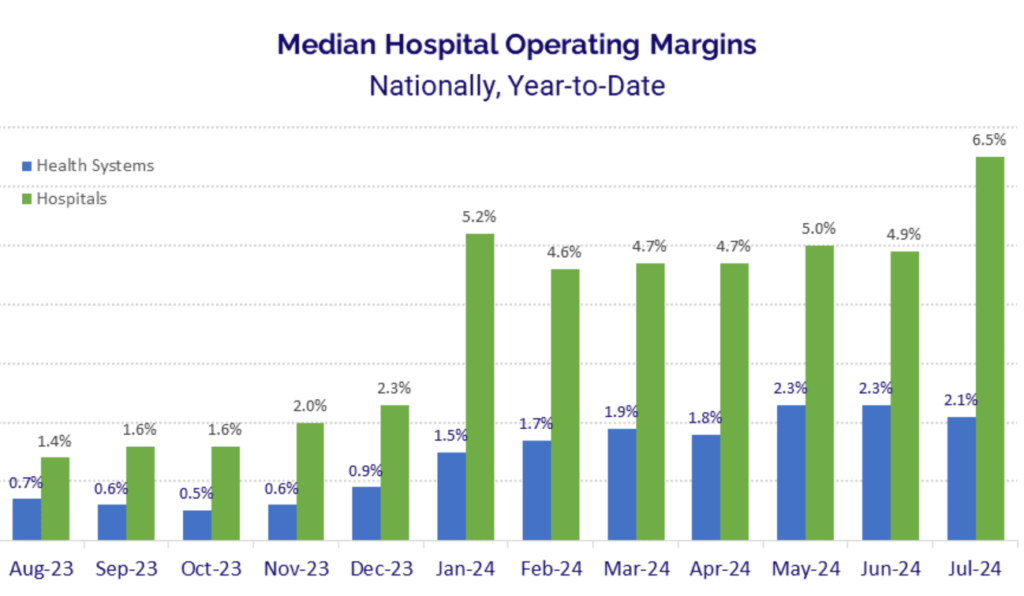

Takeaways for hospitals from Q2 – and today – among outperforming health systems include:

- Strong expense management leading to the strongest margins we’ve seen post-Covid. From Strata’s July benchmarking report:

- Favorable payor mix trends continue as patients move from Medicaid (worst payor) to Exchange plans (2nd best payor)

- Rising acuity levels continue. This affect, compounded by a shift to commercial payors, led to strong revenue per unit of volume growth

- Elevated utilization and demand for healthcare services

- Normalized labor environment and trough in contract labor environment

- Tailwinds from state supplemental payment programs

Despite a much better operating environment in 2024 than any year since the pandemic, this outperformance isn’t the case for everyone. Take for example, Legacy Health and Nuvance Health. Both of these systems are merging out of survival (with OHSU and Northwell Health). They’re struggling financially with margins well in the red – Nuvance at -4.9% and Legacy at -5.9%. By the way – the Northwell-Nuvance merger was approved today. You can read my analysis of the deal here.

These systems are still affected by, but not limited to, the following headwinds:

- Poor demographics in local markets (population growth) leading to little or no growth prospects

- Tougher labor environments

- Inability to negotiate price with payors; and

- Inability to invest capital back into their enterprises

HCA Q2 2024 Tearsheet

Tenet Q2 2024 Tearsheet:

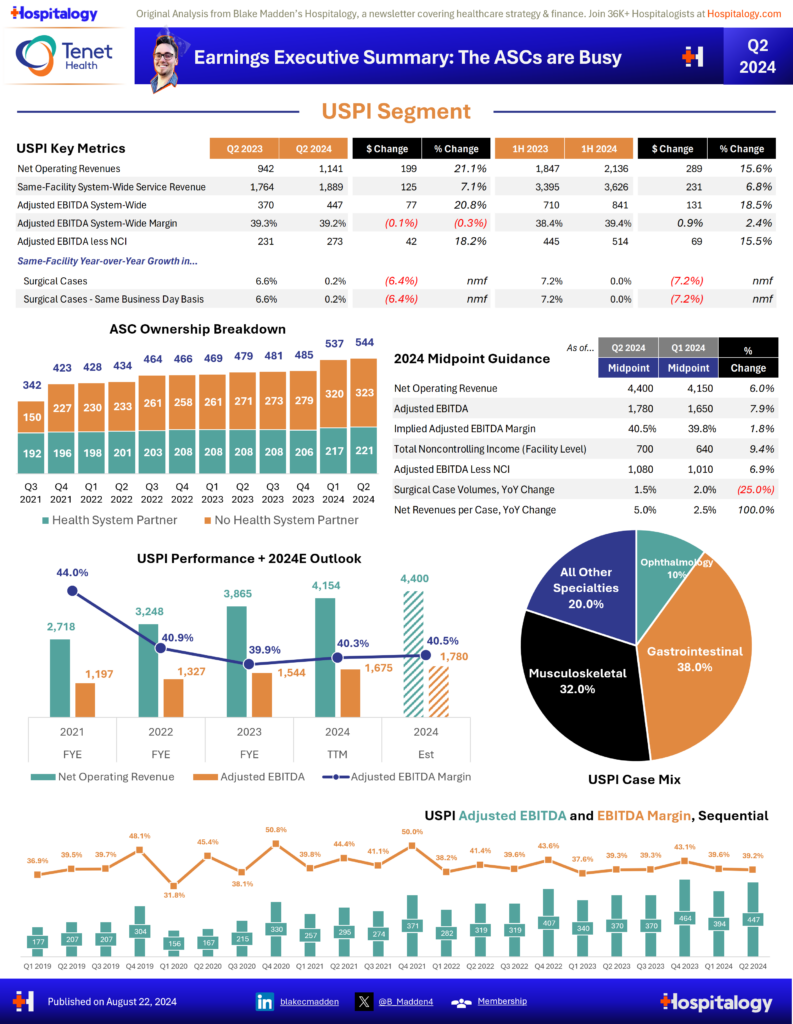

Tenet’s USPI subsidiary Q2 2024 Tearsheet:

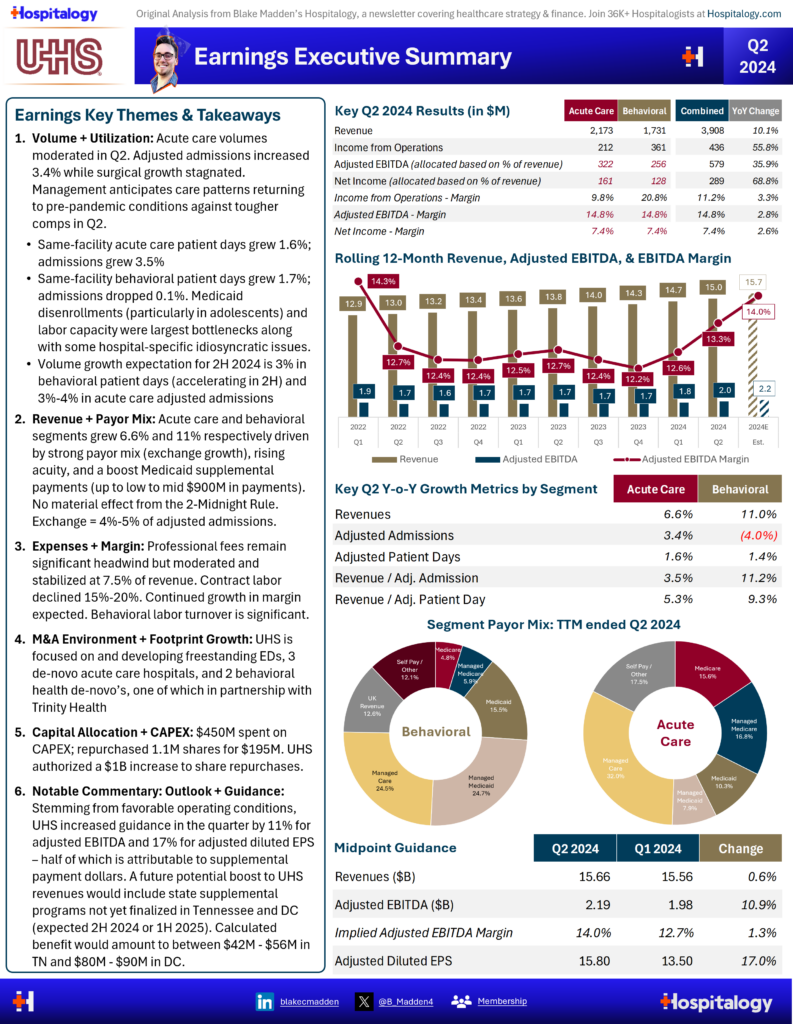

Universal Health Services Q2 2024 Tearsheet:

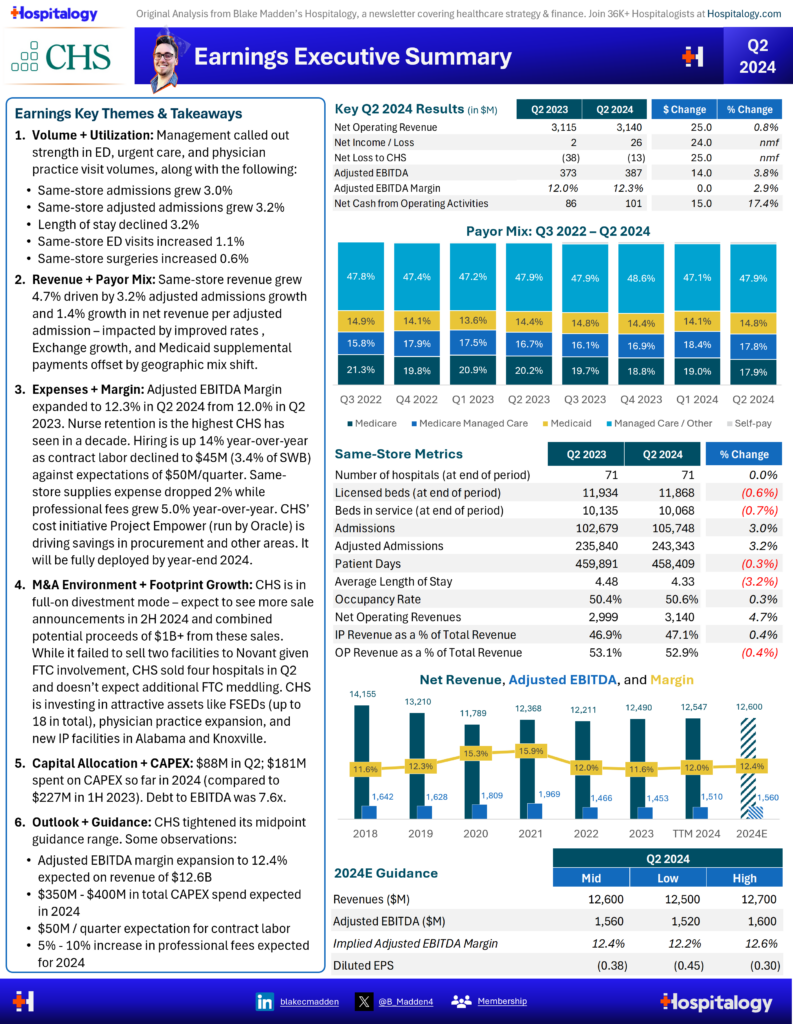

Community Health Systems Q2 2024 Tearsheet:

Meanwhile nonprofit health systems are showing a similar trend boosted by similar dynamics:

Links to my full reports and analysis:

For profit public hospital operator Q2 update: https://boardroom.hospitalogy.com/library/3a4f2f29-b361-4d58-9eaa-070d5f025bb3

Nonprofit health system Q2 2024 update: https://boardroom.hospitalogy.com/library/cb744314-846a-44b3-9404-983bfe9bf513