Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!

Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.

GLP-1 off shortage list and fallout from Hims, DTC Telehealth?

All of the dynamics around GLP-1s, compounding shortage workarounds, and potential for DTC telehealth fallout I described last August seem to be playing out in 2025. This week, the FDA officially removed Novo Nordisk’s popular weight-loss and diabetes medications, Wegovy and Ozempic, from its drug shortage list, indicating that supply now meets or exceeds U.S. demand. This change, effective as of February 21, 2025, impacts compounding pharmacies that had been producing off-brand versions during the shortage. They’re now required to stop producing compounded versions within a few months.

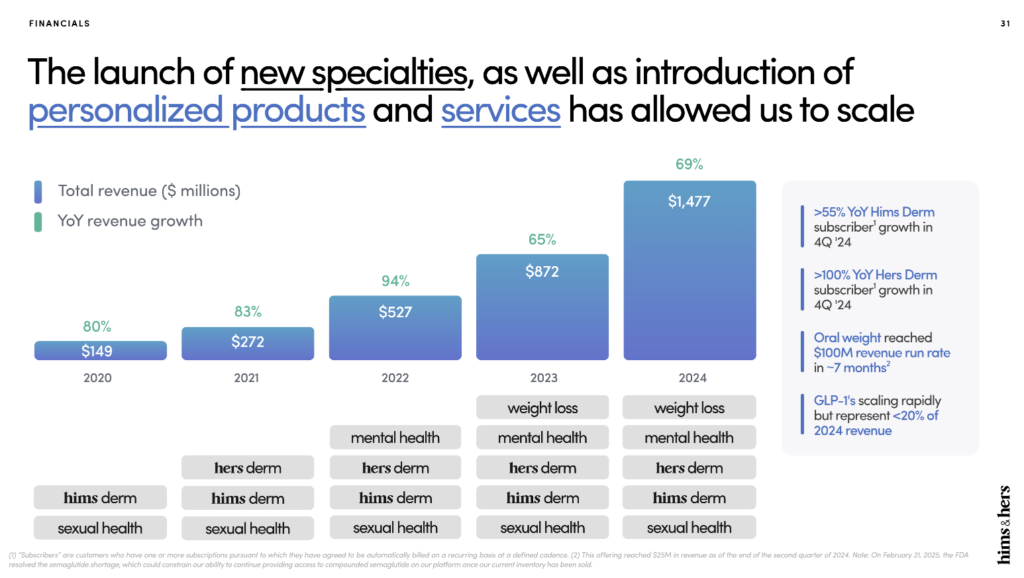

In addition to the end of the shortage, Eli Lilly announced its intent to reduce prices for Zepbound, offering single-dose vials at $499 per month, down from $699, to keep pricing competitive. Over time, net prices of GLP-1s should continue to drop which is great. Finally, the rubber is meeting the road for weight loss segments at DTC telehealth firms like Hims & Hers, because despite short-term rampant business success, they’ve indicated plans to discontinue sales of compounded semaglutide since they obviously have no legal ability to do so. Still, liraglutide is soon to be available as a generic, so that’s something. But I hope for Hims & Hers’ sake it was able to look past the short term cash cow (and it’s very clear they’ve seen tons of growth from the weight loss segment as well as the cross sell potential there into other verticals), as the other segments of the business are doing great, and it’s a solid, growing business. But the folks that were using Hims for the cheaper compounded semaglutide will look for it elsewhere – perhaps through LillyDirect or other services offering the legit brand name version.

Final point – I love this tiny footnote they have about the shortage ending in their investor presentation:

As always, we will continue to monitor and comply with regulatory requirements related to the GLP-1 shortages. And we will continue to primarily focus within our weight loss category on bringing care to individuals that stand to benefit from our oral-based offerings, liraglutide, later this year and clinically necessary personalized dosages of semaglutide. The investments we’ve made on our platform will help ensure that we can effectively help the millions of potential Americans that can benefit from our holistic approach to weight loss treatment. Additionally, these investments position us to be a leader in providing access to high-quality treatment to millions of more Americans as more brand name GLP-1 medications go generic in the coming years. – Andrew Dudum, Hims & Hers Co-Founder, Chairman, and CEO

Healthcare Executive Orders Galore

Some pretty notable executive orders in healthcare happened in February. Side note – I can’t believe February is almost over. It’s been a hell of a month for some (me).

Anyway, here’s what went down across MAHA, price transparency, and potential Medicaid cuts:

On February 13th, after RFK’s nomination, an executive order officially established the MAHA movement. MAHA is mandated to first address the childhood chronic disease crisis. Within 100 days, MAHA will provide an assessment on the state of that crisis across several factors including disease in America vs. other countries, food supply and consumption, mental health and SSRI / stimulant prescription prevalence, and other lifestyle factors. 80 days after that, the Admin will establish a ‘Make Our Children Healthy Again’ strategy. Starting with children makes sense as it hits a core demographic of food supply / toxicity critics – crunchy moms.

Then on February 25th, Trump’s next executive order builds upon his previous transparency in coverage initiative. He signed an executive order mandating that hospitals and insurers disclose actual prices, not just good faith estimates, to empower patients with clear, accurate, and actionable healthcare pricing information. The executive order the transparency rules could save up to $80 billion if fully implemented in 2025 and that employers could save up to 27% on 500 services by ‘shopping for better care,’ both of which would require significant patient/consumer behavior adjustment, if you ask for my 2 cents. Still, more transparency is better than less, and we’re seeing Trump roll out some initiatives we expected (Medicaid cuts, MAHA movement, more price transparency).

On the budget front, House Republicans also narrowly passed a budget resolution proposing $4.5 trillion in tax cuts and $2 trillion in spending reductions over the next decade, with $800 billion specifically targeting cuts to Medicaid. It won’t pass the Senate, but in general, we should take a long hard look in the mirror about cutting Medicaid, which supports quite a few vulnerable populations. I mean, what are we doing here? Is there really $800B in truly wasteful spending in MEDICAID, which reimburses pennies on the dollar as-is? I’m not trying to be a political commentator, and there’s plenty of waste in healthcare, but Medicaid doesn’t seem like the place to start.

Finally, the U.S. government is using MAHA to reevaluate childhood vaccination guidelines. Led by Robert Kennedy Jr., the initiative has raised concerns among public health experts over potential disruptions to existing vaccine protocols. The move reflects broader debates over vaccine policy in the U.S.

Alright, that’s enough political stuff – you guys probably get enough of that elsewhere!!

The Weekly Executive Summary

Notable moves, policies, and strategies from around healthcare.

UnitedHealth Group Probe: The U.S. Department of Justice started an investigation into UnitedHealth Group’s Medicare billing practices. The probe centers on whether UnitedHealth inflated payments by upcoding diagnoses within its MA plans. Allegations suggest the company used software to propose additional diagnoses and offered financial incentives to physicians for documenting conditions that may not have been present, potentially leading to an $8.7 billion increase in federal payments in 2021 alone. UnitedHealth has denied these claims, asserting that their practices align with regulatory standards and aim to enhance patient care. UNH shares dropped 9% after the news.

Humana’s Q4 and recent partnerships: Humana saw its 2024 profit cut in half due to higher-than-expected medical costs in its Medicare Advantage plans. They lost 445,000 Medicare Advantage members and expect to lose up to 550,000 by the end of 2025. Humana and Monogram Health are expanding their in-home kidney care program for Medicare Advantage members into Georgia, now comprising 5 states across the southeast. Nearly 15% of the Medicare population in these states have CKD!! Sheesh. Alongside Monogram and other VBC plays, Humana is also adding up to 30 new primary care centers under its CenterWell and Conviva brands in 2025. The expansion targets 11 states where Humana already operates, planning to add center density in existing markets. Speaking of VBC, Humana published its 11th annual VBC report in late January. Finally, Humana renewed its GPO contract with Express Scripts.

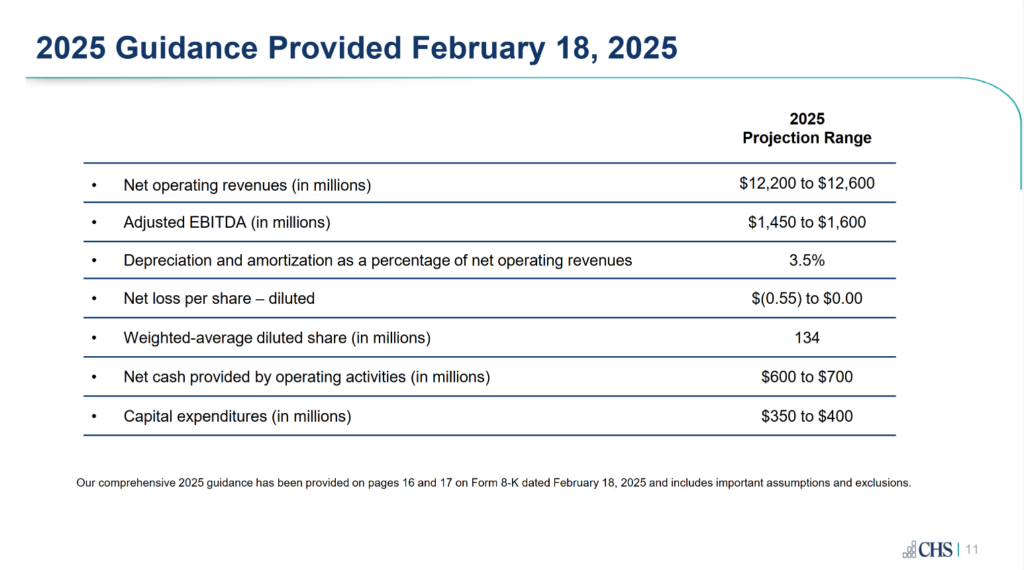

CHS Reports $70M Q4 Loss: Community Health Systems reported a $70 million loss in Q4 2024. The company attributed the shortfall to increased operating expenses and lower patient volumes. CHS continues to underperform its publicly traded peers as an operator. Guidance for 2025 implies an adjusted EBITDA margin of ~12.3% at the midpoint.

FTC Lawsuit Against PBMs Moves Forward: A federal judge rejected an attempt to block the FTC’s lawsuit against major PBMs, including Caremark, Express Scripts, and Optum Rx. The case alleges that these entities have engaged in anticompetitive practices that inflate drug prices. The decision allows the FTC to proceed with its case against pharmacy middlemen.

Cleveland Clinic Rolls Out AI for Documentation: Cleveland Clinic has started deploying Ambience Healthcare’s AI platform to streamline clinical documentation. The tool aims to reduce administrative burdens on physicians and improve efficiency. This initiative aligns with broader efforts to integrate AI into healthcare operations.

CVS Faces Retail Challenges in Q4 2024: CVS reported its Q4 2024 earnings (great analysis here), showing continued struggles in its retail pharmacy segment but overall beat expectations after a dismal 2024. The company is closing more stores in 2025 as part of a strategic realignment.

Longitude FX: Longitude Health, the innovation coalition formed between several large health systems in 2024**,** just launched Longitude FX, an initiative aimed at transforming the financial experience in healthcare for both patients and providers. Led by CEO Jim Lester, Longitude FX focuses on RCM processes – enhancing transparency, streamlining billing, increasing accessibility, and reducing friction in financial processes. It’s Longitude’s third and final company launched from its first cohort, which includes specialty pharmacy, value-based specialty care, and now RCM.

Trump Admin Fires Thousands at HHS: The Trump administration terminated nearly 1,300 probationary employees at HHS, including all 50 first-year officers in the CDC’s Epidemic Intelligence Service as part of current DOGE initiatives.

Quick Notables

Collaborations, launches, and other tidbits to keep on your radar.

- NexBody officially launches its platform for personalized health and wellness solutions (shout out to my buddy Marc – congrats man!)

- Banner Health CEO’s texting initiative gains popularity with patients and employees.

- Rockledge Hospital plans April closure amid financial struggles.

- Palantir and Tampa General partner on innovation to enhance hospital tech.

- Highmark and Sword Health expand pelvic health services with virtual physical therapy.

- Knownwell expands hybrid care in Chicago.

- Kyruus Health partners with Abundant Health to “integrate Kyruus Health’s care access platform with aha”s “low-code/no-code” platform directly within a health system’s digital experience platform.”

- VoiceCare AI pilots with Mayo Clinic for automated documentation.

- CMS cuts ACA navigator funding by $10 million.

- Aledade adds 500 primary care practices to its network.

- Hims & Hers sees 650% traffic spike after Super Bowl ad controversy.

- agilon health partners with Lexington Clinic to expand value-based care.

- MultiCare Connected Care teams up with Tuva Health to optimize patient data.

- Centivo and Premise Health partner on primary care for employer-sponsored health plans.

- UnitedHealth and Amedisys plan divestitures to finalize $3.3B merger.

- AdventHealth’s AI chief aims to clarify AI’s role in healthcare.

- Healthmap Solutions acquires Carium to expand digital engagement.

- UF Health forms Northeast Florida system and names regional presidents.

- Andor Health wins Vizient contract for AI and virtual care.

- Alegeus and Empower partner on health-financial solutions.

- RxStrategies, Hudson Headwaters 340B, and RPh Innovations merge to form Pillr Health.

- Carrot Fertility launches virtual menopause clinic.

- Accolade expands virtual care for Medicare beneficiaries.

- ShiftMed enhances hospital workforce stability with internal float pools.

- Odyssey Behavioral Healthcare quietly sells to JLL Partners.

Hospitalogy Top Reads & Resources

My favorite healthcare essays from the week

- Health Tech Bytes’ piece on heart scans was a fun Valentine’s day read into practical uses of AI and how AI enables new possibilities within radiology.

- DA Wallach’s “Zero Toll Medicine” was an ambitious read into how AI and automation could make healthcare significantly cheaper.