TL;DR

The machine rolls on.

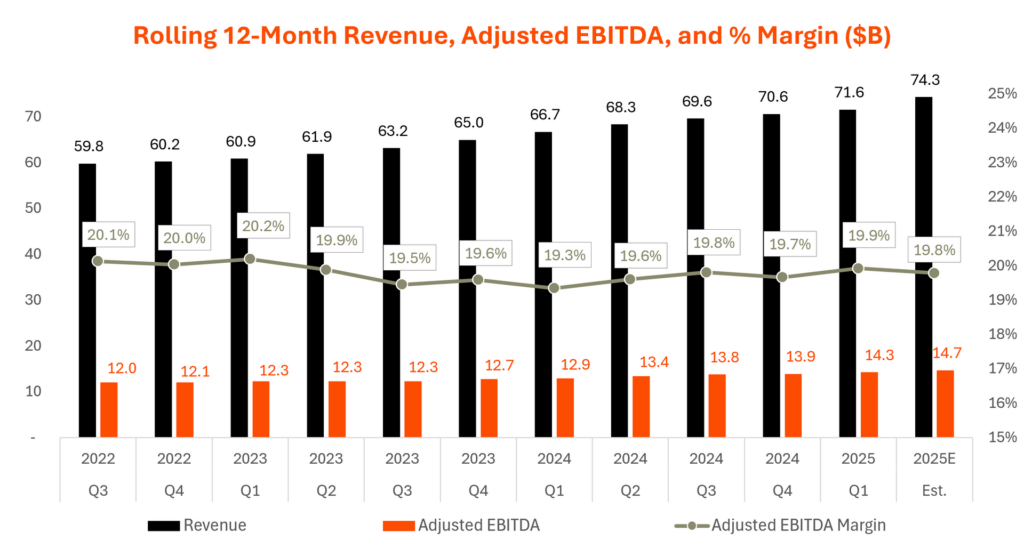

HCA entered 2025 with solid volume growth, a stronger payer mix, and wider margins while funneling cash into new beds, ambulatory nodes, and a fast-developing digital toolkit. Management reaffirmed full year guidance and sees demand remaining resilient even with policy and tariff uncertainty.

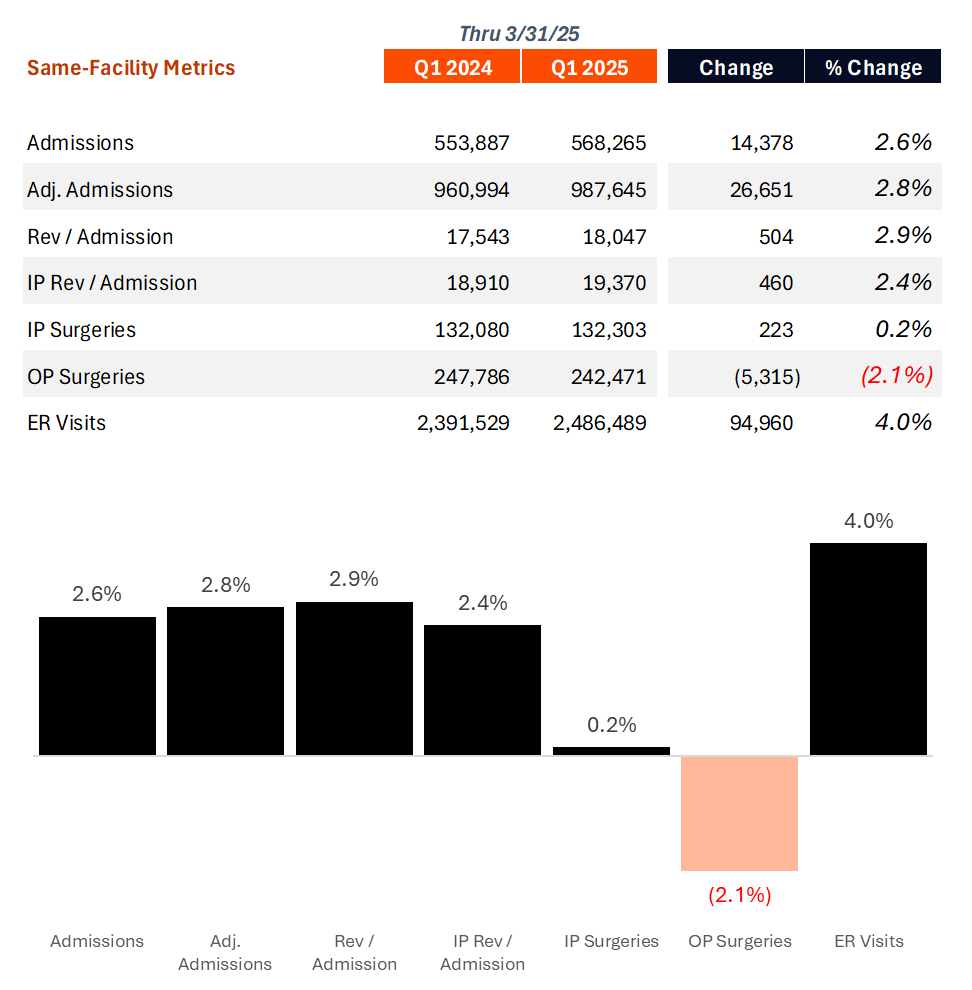

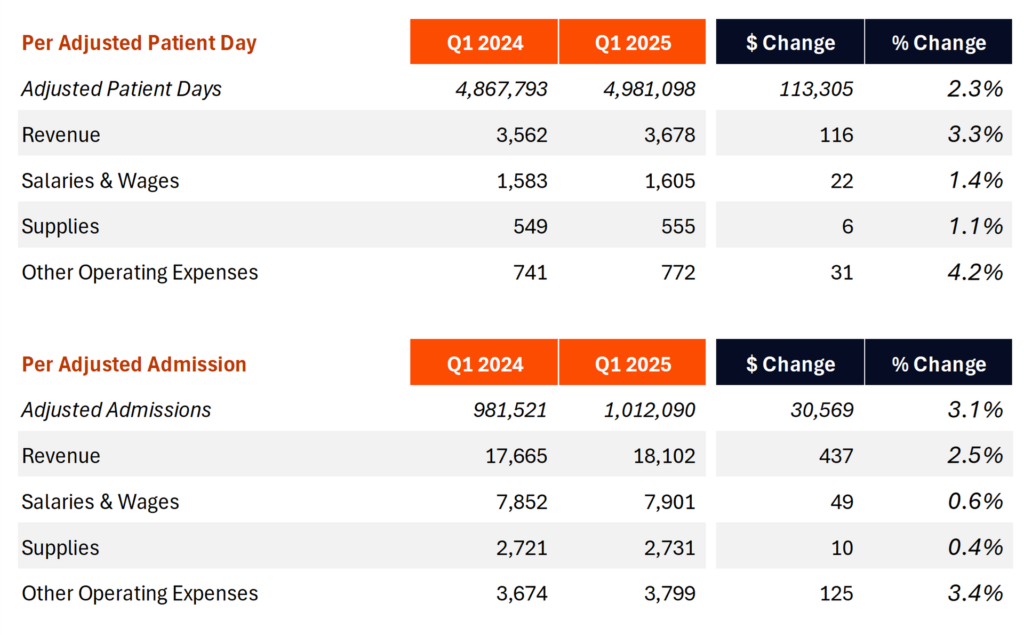

Volume and Utilization Trends

Broad-Based growth continues: Demand is running ahead of plan thanks to what HCA execs describe as broad-based market share gains and healthier macro fundamentals. Much of HCA’s success in 2024 is spilling over into 2025, commensurate with general payor commentary around elevated utilization trends, coupled with HCA continuing to take market share from competitors.

Acuity trends. Acuity continues to rise. Case mix improved modestly resulting from critical care admissions holding steady while lower acuity outpatient procedures eased.

Revenue growth and Payor mix

HCA saw favorable payor mix trends, as is par for the course for the unicorn hospital operator (I mean of course I need to sneak a golf reference in). Same facility revenue increased almost 6.0% on a 3.0% rise in net revenue per equivalent admission – driven more by patient mix (e.g., a rise in critical care admissions) than pure price escalators. Other notable revenue and reimbursement factors:

- Payor tailwinds. Commercial admissions grew a whopping 5.4% and exchange admissions jumped 22.4% as ACA enrollment hit a record 24 million lives. Medicaid admissions fell 1.4% as expected, with redeterminations largely complete.

- “2025 was another year of strong [ACA/exchange] enrollment growth. In our states, the growth was about 12% over prior year, and we’re up across the United States now up to 24 million lives covered. For HCA in the quarter, the exchange volume represented about 8% of equivalent admissions and about 10% of our revenues. So that’s the update for the quarter.”

- Commercial pricing locked in. HCA has already finalized more than 90% of 2025 contracts, about 75% of 2026, and roughly 25% of 2027 at rate increases similar to recent cycles. They’re also ‘pleased’ with the contracting cycle. HCA usually indicates mid-single digit rate escalators on new contracts.

- New access points. Fresh contracts with Kaiser in Denver and an expanded Blue Cross Tennessee product in Chattanooga are bringing incremental commercially insured volume.

- “This year, we have 2 markets where we have added a very important contract to our overall portfolio of participation. In Denver, we are now a participating provider broadly with Kaiser Health Plan in the Denver, Colorado market. That’s a very encouraging development. And then in Chattanooga, Tennessee, with Blue Cross of Tennessee, we have advanced our position with one of their products. So we’ve improved globally our overall positioning for access to lives. And that’s played out in our HICS and exchange relationships as well. And then obviously, with Medicare Advantage, we continue to build capabilities there to support the Medicare Advantage payers as appropriate.”

- Medicare Advantage, Denials, and the 2-midnight rule. MA now comprises 57% of HCA’s total Medicare admissions, and this dynamic plays out in a few ways for HCA. One MA admissions see higher observation days – about 15% higher than traditional Medicare. MA patients stay in the hospital longer. HCA also noted some activity with denials and underpayments in MA, but nothing material to the overall business.

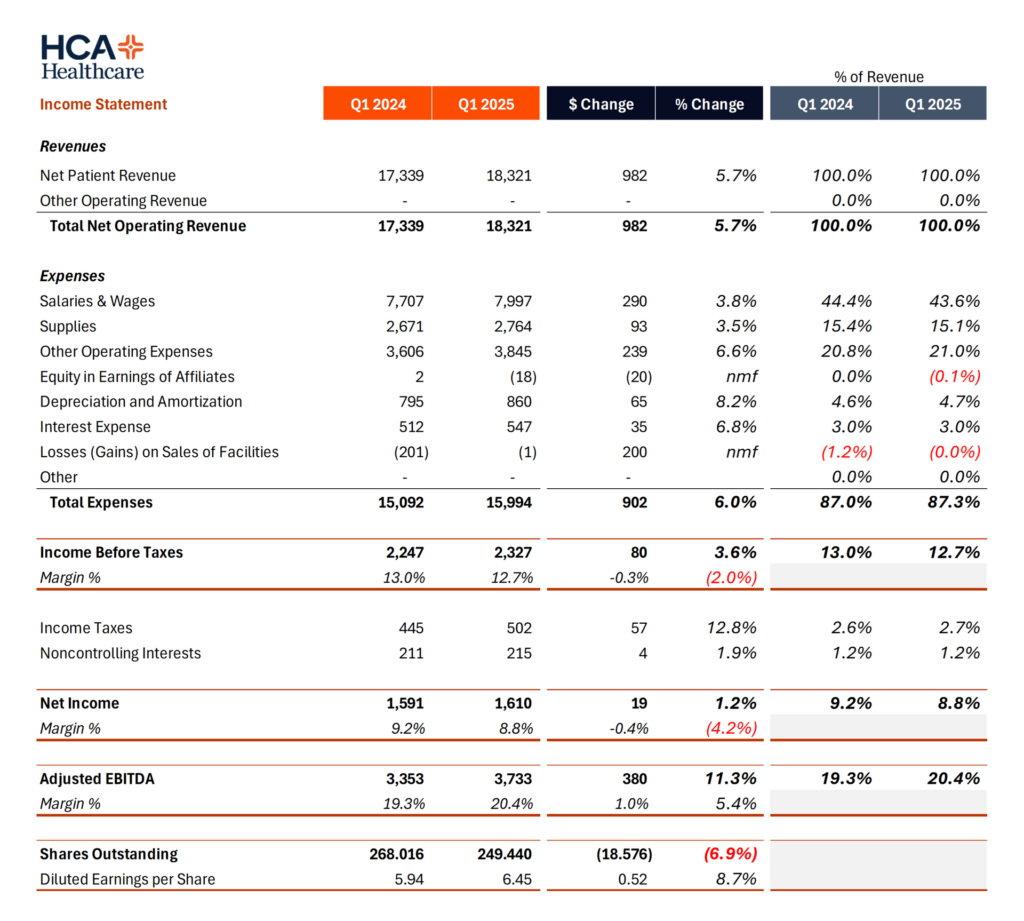

Expenses, Margin, and Profitability

Adjusted EBITDA margin expanded to 20.4%, from 19.3% a year ago, growing 11.3% year over year. Both volume leverage, rate escalators (along with rising acuity) and cost programs contributed to margin expansion in Q1, but the bulk of savings and operating leverage came from salaries and benefits.

- Labor efficiency. Crazy operating leverage on the salaries and benefits line item in Q1. HCA’s SWB dropped to 43.6% of net revenue. Most hospitals sit in the 55%+ range. That’s actually insane, fam. Salaries and benefits ratio improved 80 basis points as turnover eased, Galen nursing school graduates filled openings, and contract labor spend fell 9.3 % to 4.4 % of total labor cost (and down from 5.1% in Q1 a year ago). All of the facts today are positive – retention is up, contract rates are down, and engagement is high. In fact HCA was so efficient here, an analyst asked whether the organization was behind the hiring curve when thinking about capacity management and productivity moving forward. Executives noted that there’s still more room to go here too, with leveraging technology!! I’ll believe it when I see it.

- Sam Hazen also had an interesting note on the labor market during a recession, and how the nursing labor market tends to ease during a recessionary cycle.

- Supply savings. Supplies as a percentage of revenue also fell, to the tune of 30 basis points. Obviously a big question mark in the quarter was around tariffs. HCA’s supply chain group HealthTrust has 70% of 2025 purchases under fixed pricing (60% for 2026) and has shifted 75% of spend to the US, Canada, or Mexico or are otherwise tariff exempt sources (pharmaceuticals for now). HCA noted the fluidity (and, might I personally add, stupidity) of the constantly shifting tariff situation.

- Professional fees plateauing. A significant cost inflator, professional fee expense rose 11% year over year largely from physician subsidies tied to volume – costs were flat sequentially with the fourth quarter.

- Supplemental payments. A reconciliation check added $80M of Medicaid supplemental revenue – better than expected for HCA in Q1, and HCA thinks things are trending positively in the supplemental payments area. Management now expects the full year swing versus 2024 to range from an improvement of $50M to a decline of $200M depending mainly on Tennessee program approval.

All in, HCA saw significant margin expansion in Q1 and an impressive ability to flex its operating leverage muscles over salaries & wages expense given the Galen pipeline, and travel nursing costs at an all-time low. As a result, diluted earnings per share increased more than 20% in Q1 compared to a year ago, to $6.45.

Capital Allocation and Technology

Nothing too notable or exceptional on the capital front in Q1. Here’s a quick overview.

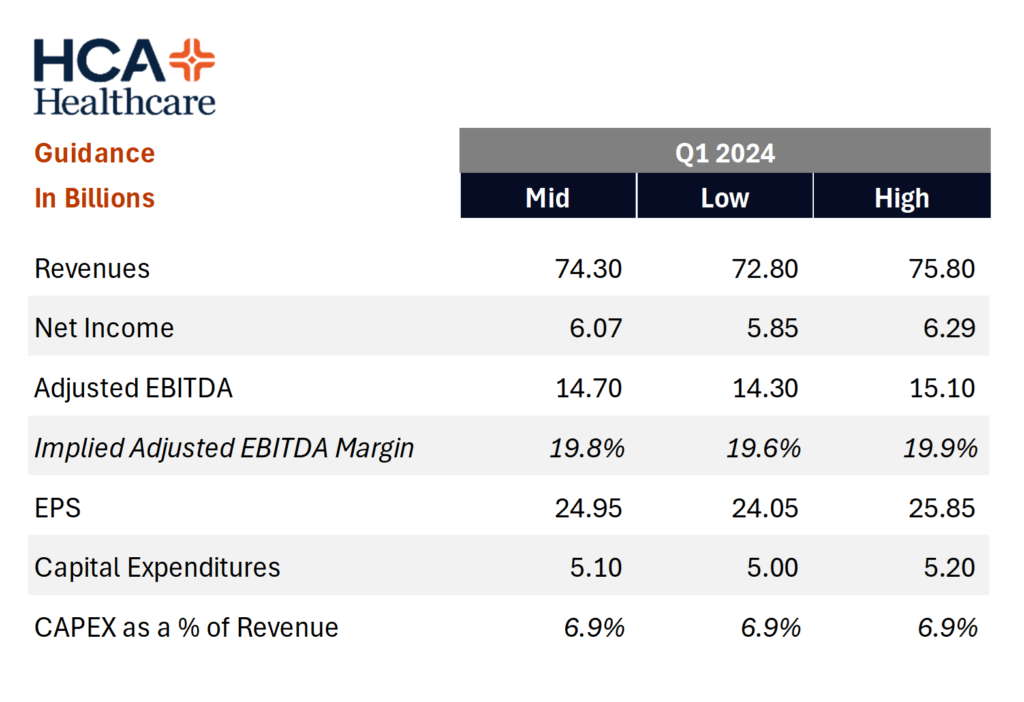

- Capital expenditures totaled $991M in the quarter. Slightly lower than expected CAPEX spend in Q1. The full year target is within HCA’s typical range – around 7% of revenue, or a measly $5.0B to $5.2B. The allocation breakdown there is roughly 70% to inpatient capacity buildout (de-novo) while the rest works toward ambulatory footprint – ASCs, freestanding EDs, imaging, etc.

- Mergers and divestitures. Catholic Medical Center in New Hampshire and Lehigh Medical Center in Florida were acquired for $227M. Regional Medical Center of San Jose was sold for $161M as part of portfolio pruning.

- Share repurchases. HCA bought back $2.5B in the quarter and plans to retire a significant portion of the $10B authorization this year, supported by $1.65 billion of operating cash flow and a balance sheet at the low end of HCA’s leverage targets – which has stayed on the low end for quite some time, if memory serves. HCA also distributed $180M in dividends in Q1.

- Digital roadmap. The Digital Transformation and Innovation Group is rolling out revenue cycle bots inside Parallon, artificial-intelligence staffing tools that match labor to demand, and a clinical decision support pilot in obstetrics that is already cutting adverse events and length of stay.

- “We have 3 areas that we think we can benefit our business using better digital tools, using automation and using AI. The first category is our administrative functioning. When you think about our Parallon services, our supply chain services, human resource functioning and so forth, we have early tools that are being developed and implemented in those areas, which are incrementally adding value. The second category for us is operational. And by that, I mean what goes on in our facilities, primarily our hospitals where we can improve staffing and scheduling and create better tools for our management teams, better tools and insights for our employees as they schedule to meet their needs. Another area in our operational categories is with case management functions as it relates to length of stay management, as it relates to prior authorizations, all of these things that go into the operations at a facility level, we are deploying tools in those areas. And then the holy grail for us is clinical, as you mentioned. We do have some opportunities there. We’re slowly moving into that space where we can use, again, some digital tools. We can use our data to source best practices, and we’re working to create value for our physicians and our caregivers in a way that they have the advantages that come from those insights. We’re early in that space because it’s very important that we be accurate. It’s very important that we be compliant and that the tools that we provide truly add value. And we’ve got some areas, obstetrics, where we’re working with one of our partners where we think we can improve the labor and delivery process with these tools, and we’ve got early signs of success there, but it’s really early in that particular category.”

Outlook and guidance

Management reaffirmed 2025 guidance it issued at the start of the year.The thing about SmarterPrebill is…it simply works, and works simply. 65% of recommendations made by SmarterDx are accepted by CDI teams, proving the AI is making clinically sound suggestions. And again, it’s not just about revenue – hospitals also use SmarterPrebill to catch compliance issues before they go out the door, reducing audit risk.

- Equivalent admissions are expected to rise 3-4% on continued market share wins.

- Hurricanes in North Carolina and Largo Florida are modeled as neutral for the full year.

- Wage inflation is assumed in the low to mid single digits, tariff impact is manageable under current fixed price coverage, and contract labor mix should trend lower through the year.

- Execs described the current policy fiasco we’re in in healthcare as a “fluid” situation. Key watch items include Tennessee supplemental Medicaid approval, renewal of enhanced Affordable Care Act subsidies, site neutral drug payment proposals, and any Medicare Advantage policy shifts on observation status.

- “…there’s still a lot of unknowns here about what could happen if the EPTC, the enhanced premium tax credits do sunset and are not extended in their current form or through some revised form. And so we’re going to have to wait and see exactly how it plays out, and we’re really not in a position to comment on estimates related to how many go back to employee-sponsored insurance, although I think we generally agree that there will be some that would go back to employee-sponsored insurance. I think there’ll be some that would stay on the exchanges and maybe drop a metal tier. And then others that if these enhanced premium tax credits do sunset that would lose coverage and become uninsured. And so we’re not in a position yet until we have a little more clarity around what’s going to happen in the legislative environment, Justin, to specifically size it or comment on others research in this space.”

Wrapping Up

HCA’s performance reflects more than simple volume growth and cost control. Market share gains, disciplined contracting, and the early payoff from a company wide technology push are driving earnings ahead of schedule. Unless policy developments introduce a significant headwind, the core levers of capacity utilization, commercial mix, and operating leverage give HCA a clear runway through 2025.

- “…we think demand for health care is going to be there. Our inpatient surgeries were up on a per business day. So as we normalize calendar effects and we have sort of comparable calendar dynamics, we expect our surgical volumes to recover to levels that we think are in line with market share trends or market share gains that we have expected. So that’s how we’re thinking about it. And we continue to build our medical staff, which are critically important. As I mentioned, we’re adding facilities where we need to adding technology. We’ve got a robust workforce development agenda to support our surgical services and we continue to make inroads into better operations, which are beneficial to our physicians and surgeons and beneficial to our patients. So all that’s sort of converging on our viewpoints that surgical demand is reasonable and we can execute underneath that.”

- “…value-based care, co-pays and deductibles aren’t in any fashion disrupting the demand curve. And that’s sort of our overarching view when we look across our markets and we look at what demand trends suggest. We don’t see those items influencing in any material way our thinking around overall demand.”

Reads & Resources:

HCA’s Q1 2025 earnings press release

HCA Q1 2025 earnings call transcript

Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.