Executive Summary:

- We have entered the era of peak managed care bearishness both from an economic and policy perspective.

- Payors are under intense pressure to justify skyrocketing premiums while booking billions in revenue. Providers will bear the brunt of cost control measures through tighter utilization oversight, more aggressive prior auth, and stricter policy adherence.

- 2026 must be the year providers move from reactivity to preparedness: in contract negotiations, in clearer patient communication, and in strategies that ensure long-term sustainability.

- The organizations that win will be those that show up with discipline, translate complexity into something patients can understand, and stand behind their decisions with consistency rather than defensiveness.

If 2025 exposed the cracks in managed care, 2026 will test whether the system can still defend them.

The team at Unlock Health just dropped their 2026 Managed Care Trends and Predictions report, and it’s the perfect argument for why 2025 was the year the affordability crisis became impossible to ignore. In their ongoing conversations with industry professionals, Unlock Health’s team memorialized five recurring pressure points shaping the year ahead that just may be the tipping point for dramatic proactive change.

The report is a great overview for anyone looking to get caught up on the current state of managed care as well as 2026 outlook. So after a conversation with the fine folks over at Unlock Health, here are my rambling thoughts on the key themes, along with insights from my conversation with their team.

Theme 1: The Great AI Continental Divide

AI adoption exploded in 2025. So did the backlash. The fault line isn’t AI itself. It’s how it’s being used.

On one side, you have payors deploying AI to accelerate denials and utilization management, often without transparency or human oversight. 61% of physicians believe AI is increasing denial rates, not reducing them. One Cigna algorithm allegedly reviewed 60,000 claims in 1.2 seconds. Class action lawsuits are proceeding. Congressional hearings are happening. CMS proposed new rules requiring audit trails and stricter timelines.

On the other side, providers are finding real ROI in AI that patients never see:

- Ambient AI for clinical documentation: Abridge reported 80-86% reductions in note-taking time and 11-14% wRVU increases after deployment

- RCM and denial prevention: Citius Tech users achieved 30% ROI and up to 50% reduction in turnaround time

- Contact center automation: Agentic AI is handling routine calls for benefits verification, scheduling, and basic billing issues

The AMA’s formal guidance on AI draws a clear line: require human override for AI-assisted denials, publicly disclose model training data, ensure physician accountability for final determinations, and prohibit AI from being used solely to justify care denials. This isn’t anti-AI. It’s pro-accountability.

More and more in 2026 and beyond, you’re going to hear this phrase: “WHERE does the human belong in the loop?”

Providers don’t have an “AI problem.” They have a who-controls-the-AI problem. Ambient and admin AI are quietly winning because patients never see them. AI-driven algorithmic denials are under insane pressure because patients feel it immediately – which is why prior auth is such a pressing issue right now. Payors are discovering that opaque denial algorithms are a reputational landmine.

Theme 2: Contract Disputes Are a Symptom, Not the Disease

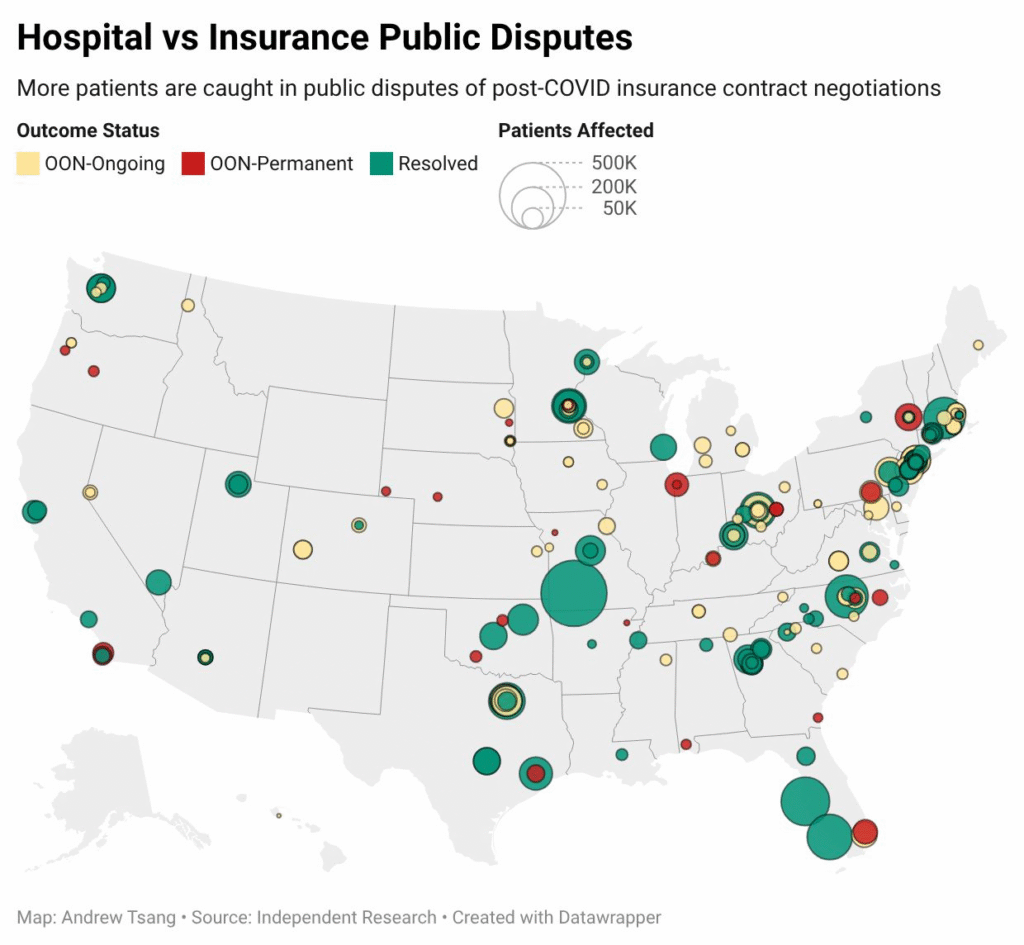

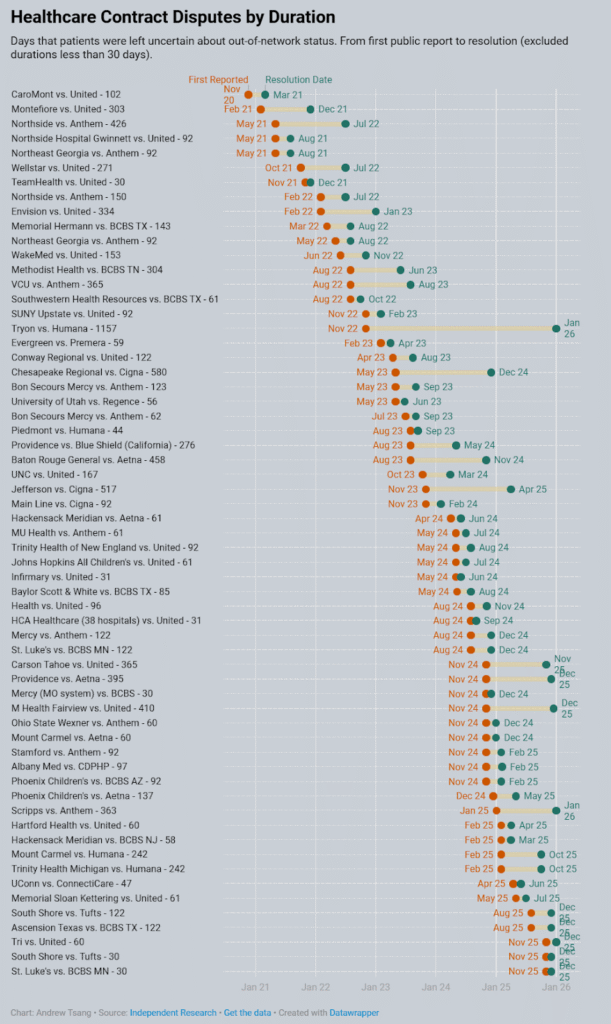

Provider-payor disputes more than doubled from 51 in 2022 to 133 in 2024. There were 26 in Q1 2025 alone. These aren’t rate fights anymore. They’re governance fights. Who controls access, authorization, documentation, and reimbursement?

Here’s what payors forget: patients don’t parse coverage bulletins or follow press releases. They feel change at the front desk, in the call center queue, and in the pit of their stomach when they’re told their doctor is no longer in-network. The level of frustration and anger over lack of control felt at a payor when an oncologist, or child allergist, or any specialist is no longer covered is felt, empathized with, and compounded throughout America.

And so these disputes, combined with other factors, result in the erosion of trust in healthcare:

- 51% of consumers told PwC they feel the healthcare system is fundamentally broken

- Trust in the honesty and ethics of doctors has dropped 14% since 2021

- More than a third of insured adults postponed or skipped care because they feared the cost or didn’t trust their insurance would cover what their doctor ordered

And the current administration is piling on, unveiling a healthcare plan focused on “holding big insurance companies accountable.” Pressure on managed care isn’t ceasing any time soon.

These fights stopped being about percentages a long time ago. They’re about who gets to define “appropriate care.” Health systems that don’t prepare their data, narrative, and community messaging before contracts blow up will lose, even if they’re right. The side that wins isn’t the loudest. It’s the one with the clearest, data-backed story that resonates with patients and employers.

Theme 3: Vertical Integration Aims to Own the Front Door (Until Patients Can’t Get Through It)

Vertical integration sounds great in theory. Let’s emulate the integrated Kaiser model, right? The business model innovation was sold as a way to “coordinate patient experiences.” In reality entering 2026, the industry finally admitted what many providers already knew: this model was built to financially engineer results, move money, and steer patients and providers.

A Brown/UC Berkeley analysis published last year confirmed what many physicians suspected: UnitedHealthcare paid its Optum physicians about 17% more than independent physicians for the same services, with gaps climbing as high as 61% in markets where UnitedHealthcare dominates. Why does this matter? It forces independent practices into financial distress, making them consider acquisition by the very organizations starving them. And health systems with large practices must publicly demand more money just to keep their physicians employed.

Patients felt the shift. In New York’s Hudson Valley, after Optum acquired CareMount and Crystal Run, Congressman Pat Ryan surveyed constituents and found:

- 41% said care quality worsened

- 49% reported problems getting appointments

- 37% reported longer wait times

- 33% said it’s harder to see their preferred doctor

Ryan forwarded the data to DOJ, HHS, and the FTC. Many physicians who worked at those practices have now left or exited medicine entirely. Nobody won here. Not even Optum. The company purchased an “asset” in a multispecialty practice, but many of the resources then left.

It’s called vertical integration, but there isn’t really much integration actually happening, which you would think would be the case. Where’s the shared tech, better, standardized clinical standards? Better data infrastructure, connectivity, consumer experience among owned and affiliated provider groups?

“Own the front door” sounds great until patients can’t get through it. Payors spent years building closed walled garden ecosystems riding the coattails of abundant margin and member growth in MA. Now they’re discovering that access, clinician morale, and public tolerance have limits as regulators push back HARD. The markets that push too far will trigger regulatory and employer backlash, and MA players are reeling.

The Patient Loses

Weaving through all of this is a simple truth: the patient loses.

Financial opacity now delays care more effectively than any prior auth form. 75% of uninsured adults under 65 put off needed care due to cost. More than 90% of consumers have delayed or cancelled care recommended by their physician due to prior auth delays. Preventive screenings dropped sharply in 2025, while emergent ED visits increased 6% YoY. Patients are arriving sicker, later, and with fewer options.

Health systems that treat financial conversations as part of care, not collections, will win loyalty in a brutal market. Financial clarity has joined quality and safety as a formal metric. Systems that integrate clear language, proactive counseling, and transparent billing into the care experience will gain not only collections but credibility.

The Path Forward

Payors are signaling their 2026 strategy: more precision, tighter networks and cost models, and firmer control of economics. They’re protecting margins in ways that increasingly depend on provider concessions and patient tolerance. When revenue outpaces margin, payors look to control what they can, starting with tighter utilization oversight, more aggressive prior auth, and stricter adherence to plan policies. That administrative pressure doesn’t live at the plan. It lands on the provider.

The organizations that win will:

- Build a cost story rooted in quantifiable value: lower total cost, better outcomes, stronger access

- Align that story to plan priorities and member impact, not just internal benchmarks

- Deploy those messages consistently at the negotiating table and in the patient experience and know what levers they can press

- Focus on what consumer audiences care about: access, denials, prior auth, and roadblocks to care

The next era of managed care won’t be won through better contracts alone. It will be won through clarity in messaging, in operations, and in how systems show up when patients are caught in the crossfire.

These trends were just some of the themes discussed in Unlock Health’s full report. You can go even deeper into their original research to read more about the above arenas but also others including Medicare Advantage dynamics and affordability. I really enjoyed reading the piece to get caught up on all things managed care.

For the full analysis, data, and predictions, download Unlock Health’s Managed Care Trends and Predictions: What to Expect in 2026!