Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.

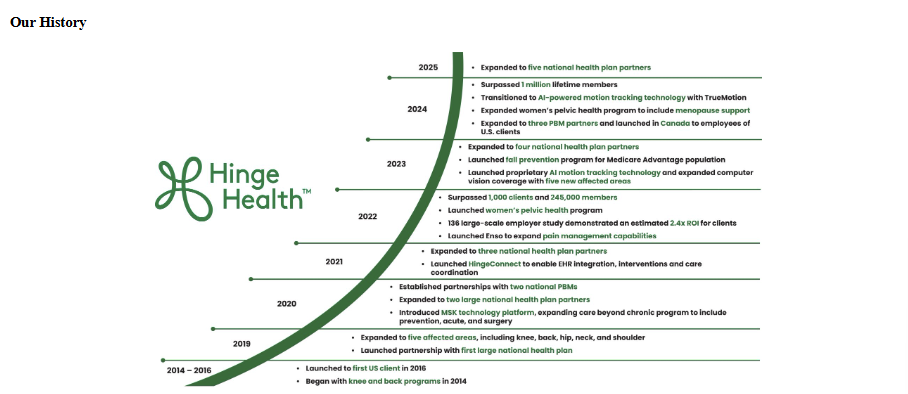

Ladies and gentlemen, we have our latest digital health IPO after a long hiatus. It’s Hinge Health, a tech-enabled provider of virtual musculoskeletal care serving self-insured employers and payors. I couldn’t help myself and spent most of my day yesterday reading the S-1 and doing some analysis on the first tech-enabled services company to go public in a hot minute.

So, without further ado, here’s the Hinge Health thesis.

The TL;DR on Hinge Health

AI introduces a massive opportunity to solve the access and cost problem in physical therapy services related to MSK Care and beyond.

- Hinge Health S-1 Link Here

- You should also read the letter from the CEO and Co-Founder, Dan Perez, starting on Page 129. Kinda buried but whatever.

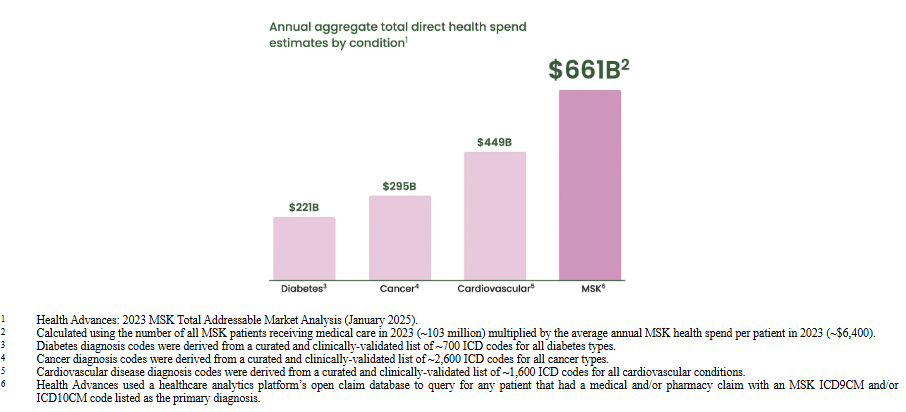

- The MSK market is massive and pain management is a huge black box rampant with literal witch doctors who just inject your back with God-knows-what.

- MSK Market Size: $661B in MSK spend overall. $624B in ‘indirect’ costs, so $1.3T total. 40% of adults suffer from an MSK disorder as of 2021. PT is $70B of MSK spend and growing.

- Preventive and proactive services, AKA in-person physical therapy, isn’t convenient and costs a decent amount out of pocket under traditional insurance models.

- Virtual MSK has emerged as a potential fix to this pain management problem.

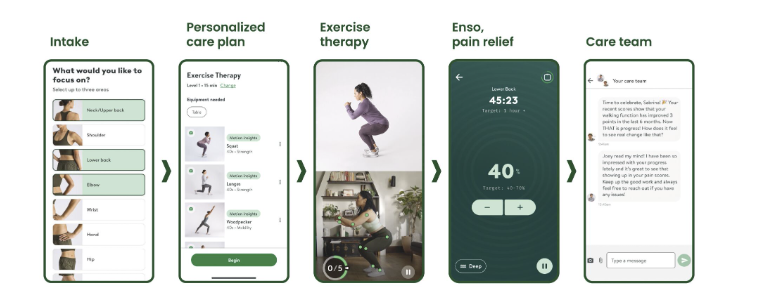

- Hinge is a virtual MSK company. It provides AI-enabled, virtual MSK services to employers and payors, offering 24/7 services to their members for zero out of pocket costs and saving them money on the back end through decreased utilization of downstream services.

- Virtual PT claims to offer similar to better clinical outcomes, as patients adhere to personalized programs better and are equally or more satisfied.

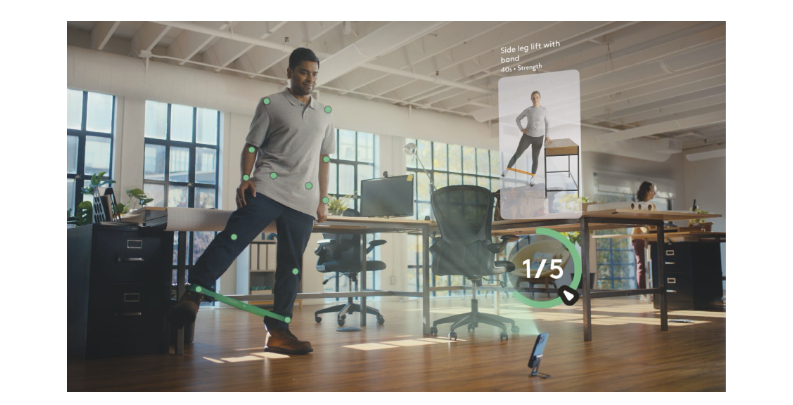

- Hinge claims to have reduced human hours associated with traditional PT by 95%, or 20x more efficient/productive than in-person clinical PT – seemingly proving out the tech-enabled services thesis.

- (Side note: we really should all be exercising but I digress)

This is AI!! Look at it!! The future!! Behold!!

Intro to Hinge and Virtual MSK

Here’s the Hinge Health thesis:

- Pain sucks. Lots of people have pain.

- Starting with musculoskeletal conditions, we can use software and AI combined with care teams to deliver a drastically better physical therapy experience, at scale, at a cheaper cost. Better PT = less pain, better outcomes.

- We’ll prove our model saves money, then contract with employers and payors to help them save money, making money in the process.

- We’ll expand into other conditions and services over time to help more people and make more money.

The TAM and the Problem:

The Musculoskeletal (MSK) space has received an unbelievable amount of investment across healthcare, and for good reason. In general MSK is a rampant cost and access issue in the U.S. – people are in pain and want to fix that pain, quickly. Elderly falls lead to 3.6 million emergency room visits per year and cost over $80B. My grandma fell and broke her hip. My other grandma fell and was hospitalized for several days. Both received PT and rehab services. I should know!!

Pain management is a massive pain point (ha!) and MSK is one of the largest specialties in the U.S. Treating musculoskeletal (MSK) conditions, especially chronic ones, is costly and inefficient – often even unnecessary or preventable for many patients dealing with constant pain. Having broken my tibia and fibula as a senior in high school, I can personally speak to how so much pain over time affects an individual. It’s heartbreaking and debilitating. Soul sapping.

But despite all of the pain and surgeries prevalent in the U.S., preventive and proactive care has fallen behind.

Physical therapists do a damn fine job. But the experience could improve. For instance, in-person physical therapy (PT) is hard to access given clinician availability, patient time / childcare coordination, and need to travel to a physical clinic location. It can also be expensive. And we want people to receive PT, just like we want people seeing their PCP. When patients adhere to PT more consistently and see through programs to completion, follow-up surgeries or complications typically reduce dramatically. Outcomes improve. Livelihoods are restored.

So one answer to our MSK pain problem is to…deliver therapy patients actually stick to, in a convenient and cost-efficient manner. And this challenge is what Hinge – and other virtual / AI care companies – have set out to solve.

Hinge’s Value Prop.

Hinge wants to deliver high quality physical therapy for MSK conditions at scale. They claim to have done just that, asserting their model automates 95% of care delivery through leveraging technology like virtual care and artificial intelligence.

Based on external reports and internally conducted Hinge studies, the Hinge model provides similar clinical outcomes to in-person PT. AI-enabled virtual care also saves their customers, employers and payors, money – on average, $2.4k or so. To address the out of pocket cost problem, Hinge doesn’t charge any out of pocket costs to members. A single app delivers personalized care plans to members and connects patients with PTs or other care team personnel 24/7.

Hinge’s Customers and TAM.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

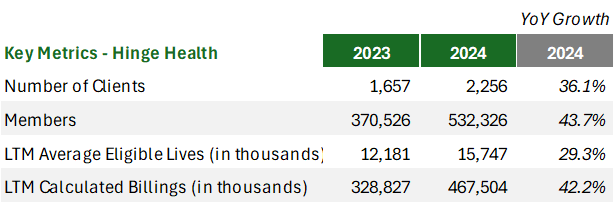

Hinge sells an annual subscription to its customers, and those customers only pay for members who engage with Hinge programming. In 2024, 3.4% of Hinge’s member base engaged with Hinge. This dynamic makes Hinge’s annual business predictable given advance bookings and deferred revenue, assuming Hinge can properly engage members.

Hinge works mostly with self-insured employers, fully insured payors, MA, Medicare, Medicaid, and international markets. Currently Hinge works with 2,250 clients with access to 20 million contracted lives (not all of which are eligible or engage in Hinge services), comprising 42% of Fortune 500 companies (err…so 210 companies? Can’t we just say that next time guys?) Hinge claims its current covered lives represents 5% of its TAM, so that implies a covered lives TAM of ~400M folks unless my algebra skills are softening.

- Self insured TAM: $10B

- Fully-insured, MA, federal insurance plans TAM: $8B (this segment is an area Hinge is actively looking to diversify its revenue into)

- Medicare and Medicaid: $9B

- International market: undefined (the limit does not exist)

So Hinge and others in the space are reimagining physical therapy, and increasing the scalability of PTs to improve access while reducing MSK utilization. Reducing utilization saves customers money and makes Hinge money.

The redefined experience – for all stakeholders – looks something like this:

- “I have to go get PT in person,” → “I can access PT whenever I want, 24/7.”

- “PT costs a ton,” → “PT is free for me.”

- “I have to get another surgery for my back,” → “I stuck with my PT program and feel much better without surgery.”

- “My employees are missing work and it’s costing me double – once for their absence, and once in my pocketbook,” → “My employees are less likely to be in pain, miss work for surgeries or PT, and I’m saving money.”

- “I struggle to get through my daily caseload of patients” → “I have a care team and technology to help me scale my services beyond what I thought was possible.”

Does Hinge’s model – virtual MSK – work and provide appropriate clinical outcomes?

Hinge says yes:

- Substantial outcomes: The research related to our programs spans 19 peer-reviewed research articles and studies and outcomes analyses. In 2020, we published a 10,000 member cohort study evaluating the efficacy of our platform for participants with chronic knee and back pain. Participants reported a 68% average improvement in pain and a 58% reduction in depression and anxiety after 12 weeks.

Other notable parts of the Hinge platform include its HingeConnect care coordination, data analytics, and patient personalization and stratification / risk platform to identify potential users and members with high needs, along with TrueMotion, which is Hinge’s AI-powered motion tracking technology, and finally Enso, which is Hinge’s FDA-approved wearable device. All are synergistic and add value to the Hinge Health offering.

- Our proprietary AI-driven database, HingeConnect, helps us identify and target the cost-driving individuals by leveraging a vast array of data, including demographics, comorbidities, exercise forms, and pain scores, as well as EHR data with daily claims feeds across over 750,000 providers

Brief Overview of Hinge’s Programs.

The full list and description of these programs is on page 149, but here’s a brief summary:

- Chronic: A comprehensive program for long-term musculoskeletal conditions, offering AI-powered exercise therapy, robust education, and multidisciplinary care team support across multiple body areas.

- Women’s Pelvic Health: specialized component of the chronic program focused on common pelvic disorders during pregnancy, postpartum, and menopause

- Acute: short-term program addressing one-time or acute musculoskeletal injuries, providing tailored exercise therapy and care team support

- Surgery / High Risk Member: identify and support members at high risk for surgery, offering education and interventions to help reduce unnecessary procedures

- Pre/post Surgery: guiding members before and after surgery with targeted exercise therapy, education, and recovery support

- Fall prevention: for adults 65 and older that combines exercise, education, and care team guidance to reduce the risk of falling. Launched in 2023

- General prevention: no-cost wellness program offering exercise routines and lifestyle education for members without pressing MSK issues

- Global / International: launched in 2024. Worldwide, hardware-free MSK care program using AI-driven exercise tracking and localized content, aiming to reach more members at a lower cost without dedicated care team support

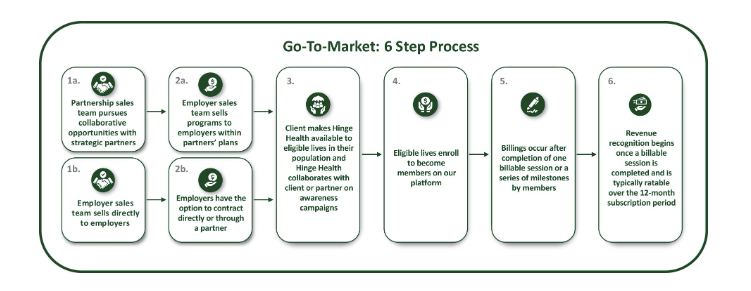

Go to Market and Revenue / Pricing Model.

Hinge’s pricing model and offering to employers is attractive too, leading to shorter sales cycles – 5 months, and up to 12 months for larger enterprise customers. As mentioned customers pay for engaged members – not all covered lives, and virtual MSK in general has moved to a contingency, at-risk pricing model on a portion of Hinge’s fees – akin to ‘downside’ risk. This approach works to close the deal faster, but also could work against Hinge:

- The majority of our clients enter into contracts with us through our relationships with health plans. Most of our agreements with health plans are three-year contracts; however, health plans can generally unilaterally terminate their relationship with us pursuant to the terms of their agreements with us or can seek to renegotiate their agreements prior to the end of the contract term. Additionally, our client contracts often include a performance guarantee, which may include engagement thresholds, member reported outcomes, and client return on investment, and, if we are unable to achieve these performance guarantees on a consistent basis, our business, results of operations, and financial condition could be materially adversely affected.

Importantly, because Hinge typically bills through a customer’s health plan, Hinge’s costs are embedded into the employer’s medical spend and NOT a separate wellness / discretionary budget. This billing dynamic alone makes Hinge’s relationship stickier and leads to easier collection of payment (assuming the payor cooperates). The dynamic also speeds up the implementation process with a new customer after entering into a new contract. Simple implementations and getting paid on time are key.

- In 2023, the vast majority of our contracts were completed via our partners, negating the need for many clients to contract directly with us since many clients can leverage existing contracts through our partners. This is a significant strategic advantage for us as it enables implementation and launch of our platform as quickly as a few weeks after entering into a contract. As a result, most implementations are completed in a 40–100 day period.

Hinge Health S-1: Financial and Operations Breakdown

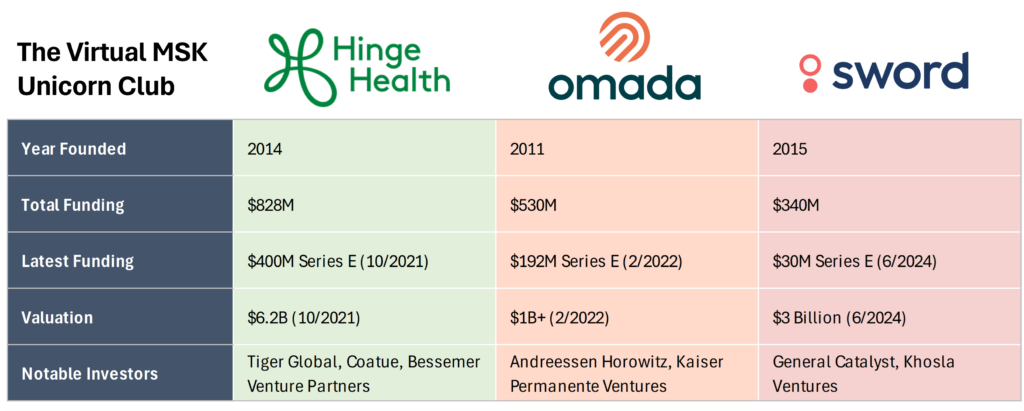

We can’t forget Hinge Health (Hinge) was last valued at $6.2B (granted – back in 2021 when money was free). Valuation is an important factor in all of this and determines Hinge’s ultimate invest ability. But also…over $1B raised to date (Hinge has $500M+ on the balance sheet in Cash + equivalents). Keep that in mind as you review these financials.

So what does a ‘$6.2B’ health tech company look like? (Note: probably not a $6.2B company for much longer – can’t imagine public investors stomaching a 16x trailing multiple in the current market bloodbath conditions)

Annual Income Statement.

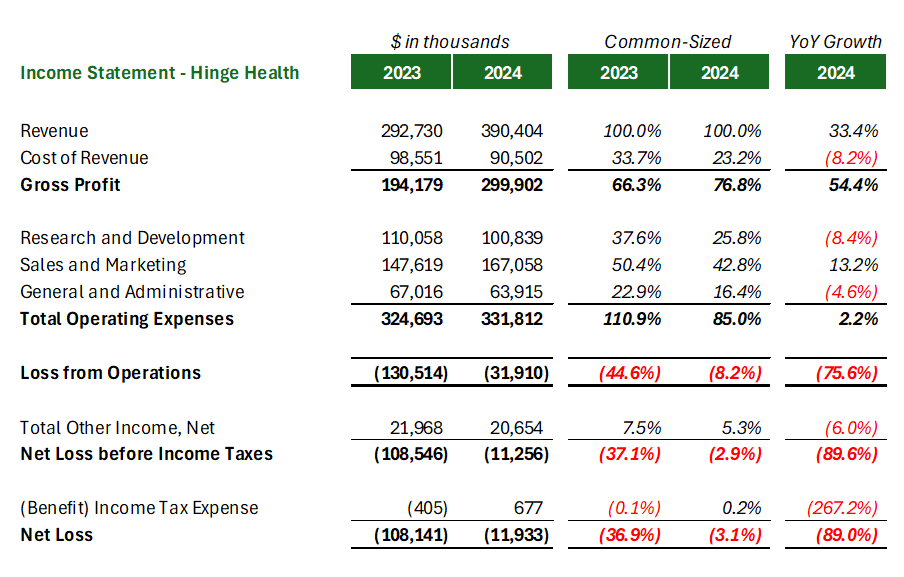

In 2024, Hinge generated $390M in revenue and hit gross margins of 77%. Year over year, Hinge grew revenues by over 33% while improving gross margin, operating margin, and net loss significantly. It’s trending toward profitability in the foreseeable future – a believable story investors can probably get behind:

At face value, Hinge’s financials are solid when comparing 2023 and 2024, the two years provided in the analysis.

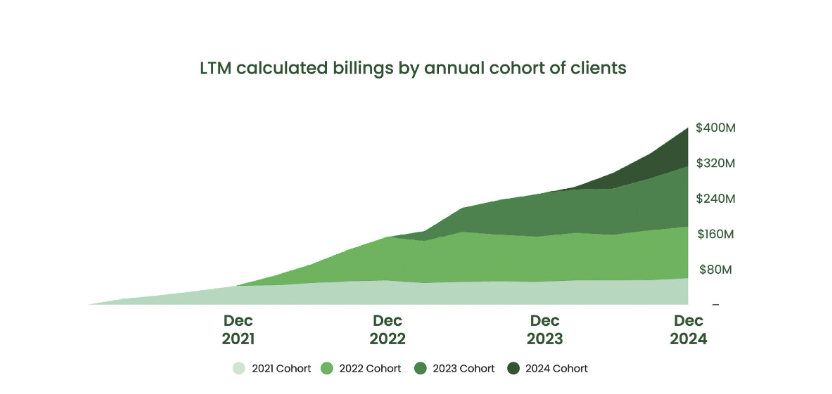

Along with net revenue, Hinge wants you to understand another key metric: $468M in calculated billings, which they state is a better way to understand the health of the business given some seasonality and accounting issues around revenue recognition and annual bookings. Calculated billings grew by over 40%, above the 33% revenue figure.

Operating Metrics and Footprint.

Hinge didn’t offer much in terms of operating metrics, but what they did share was impressive. Along with 1,437 total employees at year end, Hinge saw a 36% increase in clients, 44% increase in membership (note: 532k members out of 20 million covered lives – is that good, health tech analysts?):

Hinge’s overall footprint is impressive. They work with 50+ payor and PBM partners, all 5 national health plans, and are relatively insulated from customer concentration risk. Hinge lists this concentration as a risk but I’m not so sure. What do you guys think? Health Care Services Corp comprised 17% of Hinge’s revenue in 2024 while Elevance was 14% and Aetna hit 11.6%. Still, it’s noted several times throughout the S-1 that these contracts are not exclusive and while they’re signed for 3 year terms, the payor can terminate them for convenience at any time with notice. That’s a pretty notable caveat.

Quarterly Income Statement Analysis.

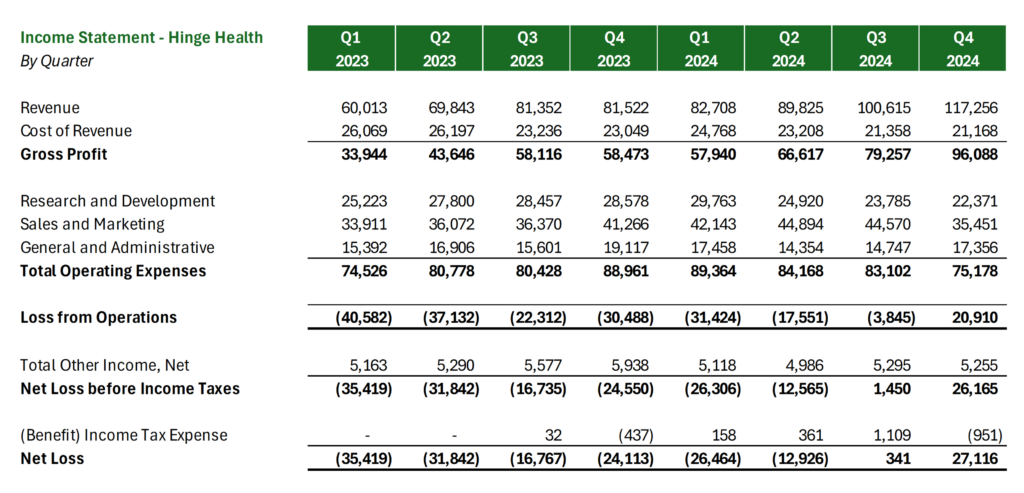

Hinge also provided us with 8 quarters of data (the aforementioned 2 years). Here’s a few different ways I sliced the data, first looking at a sequential income statement:

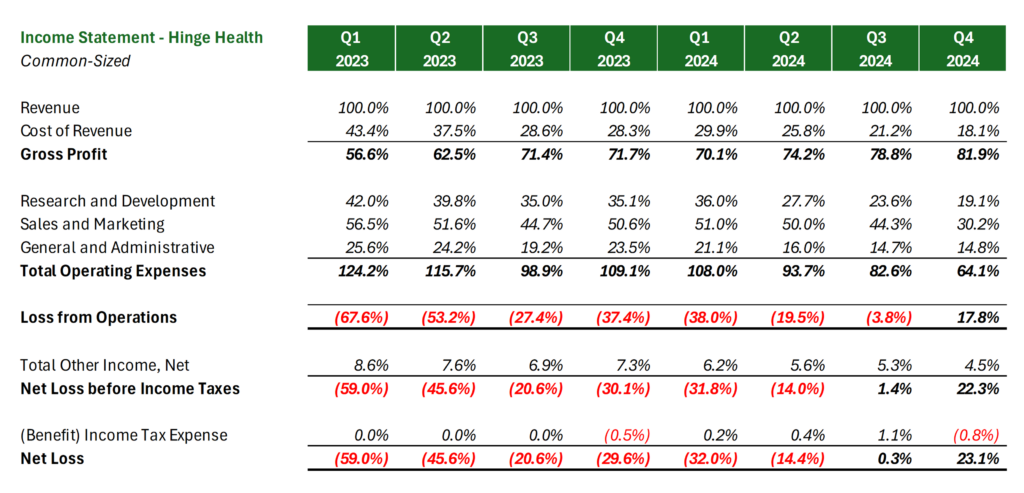

Here’s that same view, but common-sized (everything expressed as a percentage of total net revenue). Here you can pretty clearly see the trend toward profitability but also what levers Hinge pulled to reach it – namely, cutting sales & marketing spend, R&D then some COGS. Still, a good point made on X was around Hinge’s level of sales & marketing spend (50%+ in many quarters) relative to its overall revenue growth. Is that level of spend efficient / sustainable?:

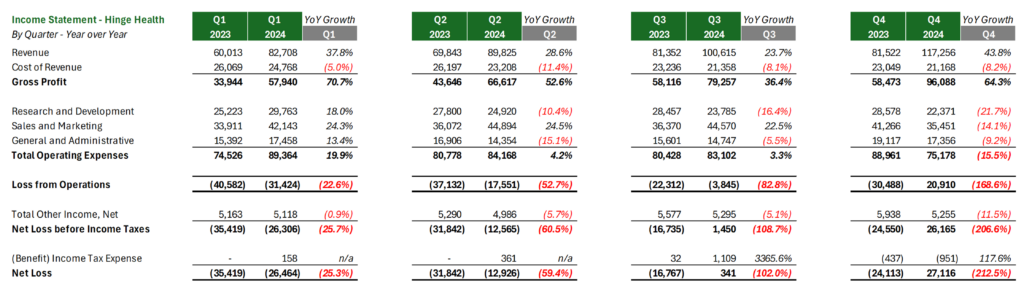

Here are growth rates quarter-over-quarter. From Q2 ‘24 to Q4 ‘24, Hinge grew revenues 15%+:

And finally, here’s the year-over-year view. Probably the best one to look at change over time when observing comparable periods. Look at all that red in Q4 on the expense side, prepping for this IPO!! That’s some serious expense lever pulling to essentially get Hinge to breakeven:

On the cash flow front, Hinge generated $49M in operating cash flow and holds over $466M in cash and marketable securities. So…the financials are…in a pretty good spot fam. And I mean, this is health tech we’re talking about too.

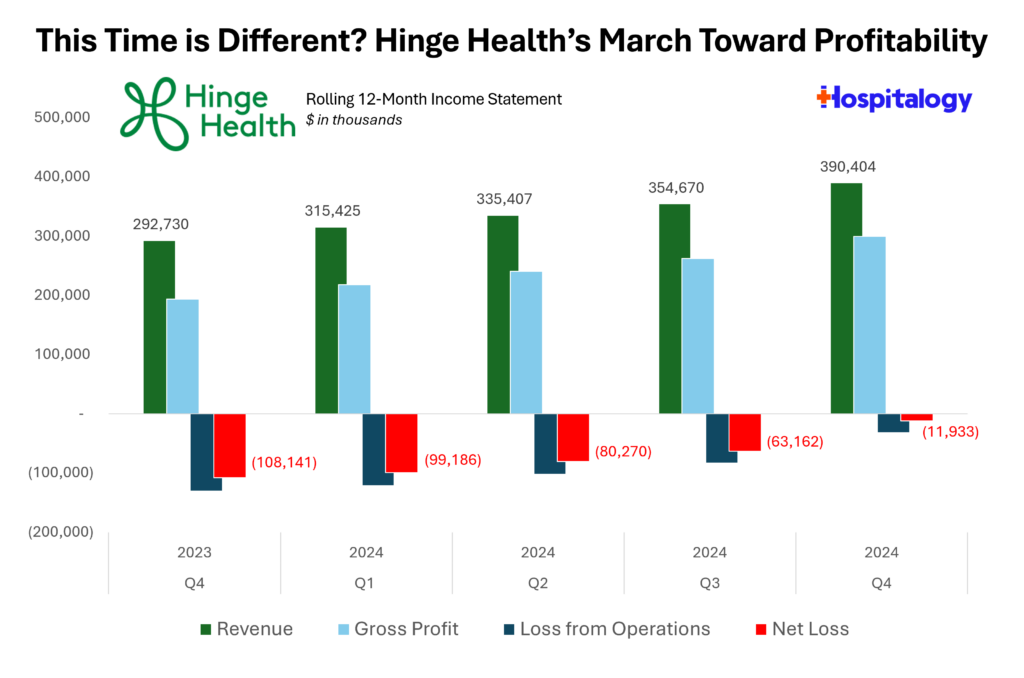

Here’s a better visual of that improving profitability trend. Look at that step-wise function up and to the right when you analyze the 12-month rolling income statement (i.e., adding and subtracting one quarter at a time):

My only problem – and what I imagine will be THE problem when it comes to IPO and near-term success is…valuation. What will public markets value Hinge at? What level will Hinge try to price its IPO at? Let’s at least TRY to be reasonable.

My Questions + Open-ended Thoughts on Hinge’s S-1

What’s in the tech?

One of the biggest points of emphasis I personally have, and one thesis I have yet to see play out at scale, is that ‘tech-enabled’ = superior margins to traditional healthcare delivery counterparts. Maybe Hinge is the first time that the VC-driven thesis plays out. For all of our sakes – I hope so!

Hinge also mentions its AI-powered motion tracking tech, TrueMotion reduces human PT and care team hours by 95%. And here’s the math backing into that, from a footnote on the bottom of page 134. I found the math absolutely fascinating:

- We estimate the reduction in human care team hours enabled by our platform by assuming an average of 11 outpatient orthopedic patients are treated with in-person physical therapy per eight-hour day. Assuming in-person physical therapy is delivered eight hours a day, five days a week and 48 weeks a year, each physical therapist can deliver approximately 2,640 sessions per year. Our platform delivered approximately 25 million activity sessions in 2024, which were facilitated by 438 care team employees on staff for an average of approximately 57,750 activity sessions per year per care team employee.

From 2,640 sessions per year to 57,750 sessions per year! That’s a 20x + boost in productivity if the activity sessions are apples to apples.

Behavioral Health savings note is interesting.

It’s notable for Hinge to highlight the behavioral health benefit of their offering.

In their case study section, Hinge notes a 50% reduction in depression among members. Since behavioral health massively exacerbates medical spend and utilization in populations, this datapoint is probably a nice ‘bonus’ for payors to see.

Does Virtual MSK …Work?

I’d be remiss to mention the Peterson Health Technology Institute report on virtual MSK solutions, which tried to provide an objective vetting of the various companies in the space – Hinge obviously being one of them. Any potential qualms about methodologies beside, PHTI found that physical therapist-guided solutions (Hinge, Omada, Sword, Vori, RecoveryOne) “can be an effective alternative to in-person PT and have the potential to reduce healthcare spending.” Stated differently, they are comparable to in-person PT. Which, if ultimately true, is huge for scalability and access to PT for the rest of us.

All of the above being said, I have been met with some skepticism related to the comprehensive role / scope of virtual MSK care. Can it truly replace, or are there elements of cherry picking? As one subscriber commented, “are we poking inside the cage with a very long stick, or are we actually solving the PT access problem?”

Hinge Health: Bull or Bear?

Bull Case:

- Employers, now more than ever, are looking for ways to reduce healthcare costs. We’re seeing a larger appetite for employers to engage in more ‘creative’ ways to save money and reduce premium spend.

- I’ve heard the leadership team are absolute killers and it’s hard to bet against driven, passionate people like that!

- According to NPS and customer data published, Hinge customers and end users are satisfied with the products and services offered. I’ve never used it so I can’t speak to it personally.

- MSK is a massive, growing market – orthopedics is, and will continue to be, a top growing service line at hospitals and ASCs nationwide. Chronic pain from MSK is rampant in the U.S.

- AI-enabled care teams can supercharge physical therapists to be much more productive, proving out the tech-enabled services thesis and introducing automation into the care team model. Over time, agentic AI could, conceivably, create true SaaS models and companies like Hinge would be in prime position to capitalize on that trend.

- Contingency-based pricing – downside risk – is attractive for employers and payors, and there’s plenty of frothiness / savings available in the commercial market given over-utilization of pain management services (injections, unnecessary surgeries).

- At its current financial trajectory, there is a road to profitability, and Hinge was profitable in Q4 with an 82% gross margin.

- Opportunity to move into additional segments and service lines as sophistication of platform / offering advances.

Bear Case:

- VALUATION FAM. VALUATION. It’s not worth $6.2B today – its last private valuation back in 2021. I liked Grant Hesser’s perspective here – and consensus seems to have spoken for the current value maxing out at $3B (and even this is generous). It’s unfortunate this point has less to do with Hinge’s actual business and more to do with the investor motivations happening behind the scenes. If we do the smart thing here, Hinge should have a successful debut. But the market environment has deteriorated…timing around the IPO isn’t great with current market conditions and recession fears. Wouldn’t surprise me if Hinge pulls the IPO altogether to wait for a sunny day.

- Questions abound around whether virtual PT can truly replace in-person PT or holds a more niche offering. Further questions around whether employers and payors on virtual MSK solutions see one short-term cost savings pop but struggle to see long-term downstream savings materialize. It’s also reasonable to question Hinge’s clinical evidence and cost savings studies / analysis.

- Replicability / copycats. Is Hinge’s product, technology, data moat, and overall offering superior / differentiated enough to provide it with a sustainable competitive edge, or will payors and other providers be able to copy it with ease? Will we see a race to the bottom over time as centers of excellence develop their own solutions?

- Long-term sustainability of profits – are we seeing a short-term juicing of the books to make things look better than they actually are? Does Hinge have a reliance on employers / workers comp for profitability, and how will movement into other segments affect profitability?

- Long-term effect of GLP-1s on utilization of MSK services and chronic conditions (very existential, I know)

Verdict: Would I Invest?

Alright, so none of this is financial advice. Just take a quick peek at my portfolio to know you shouldn’t listen to me.

That being said, would I invest in Hinge Health given what I’ve seen today?

I like the virtual MSK / ‘AI care’ space, and it’s an area with plenty of opportunity for growth particularly as these companies potentially move into other segments. And on top of this thought, I’d like to invest in a new company taking a crack at the public markets.

But for me, it’s ALL valuation dependent. I’m guessing Hinge will try to over value itself. So I’ll say a contingent no, but I’d like to reiterate this business is one of the better tech-enabled services firms we’ve seen economics-wise in hitting the public markets. If you’re paying 15x trailing revenue for it though you’re crazy. Just my opinion.

I mean, it’s also possible Hinge is just the ‘Yahoo’ of virtual MSK / AI care companies.

Would YOU invest in Hinge? What are your thoughts on the virtual MSK space, the bull/bear cases outlined above, and everything in between?